What did you do with your $20 million last week?

Otto spent it, but Mark made it.

Low volumes of trades are common during the blackout periods of every quarter. Insiders cannot trade during their own blackouts, so buying volume is normally low. However, there is still a way to sell. We keep a eye on all trades during blackout season. No one sector stuck out to us, but important individual trades were made.

Here are the significant insider trades that mattered most.

$DDR, $DSPG, $FLNT, $WMT, $FB, $SFIX, $BRKS

METHODOLGY

In this report, we examine stocks that C-level officers and directors bought and sold throughout the week ending June 22, 2018.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. As a standard, we only look at material amounts of money, $100 thousand or more, as anything less could just be window dressing.

The bar is different with selling, because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52 week lows.

Another red flag are large planned sale programs that start without warning. We generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and not the SMART money we are trying to go to school on. We also exempt IPOs and secondaries for a variety of reasons from not being available to the public or more nefarious reasons like trying to provide support for additional fund raising.

Although this info is available for free from the SEC’s Website , Edgar, we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data. Charts display one month of data from date of post at one day intervals. Credit for charts goes to yahoo.com

To learn more about our strategy, visit our website at The Insiders Fund. We welcome your comments on our analysis.

NOTE: We may own positions, long or short, in any of these names and are under no obligation to disclose that.

Significant Insider Buys

The summer doldrums continue. Market volatility and the earnings blackout period contribute to slack activity as the quarter nears an end.

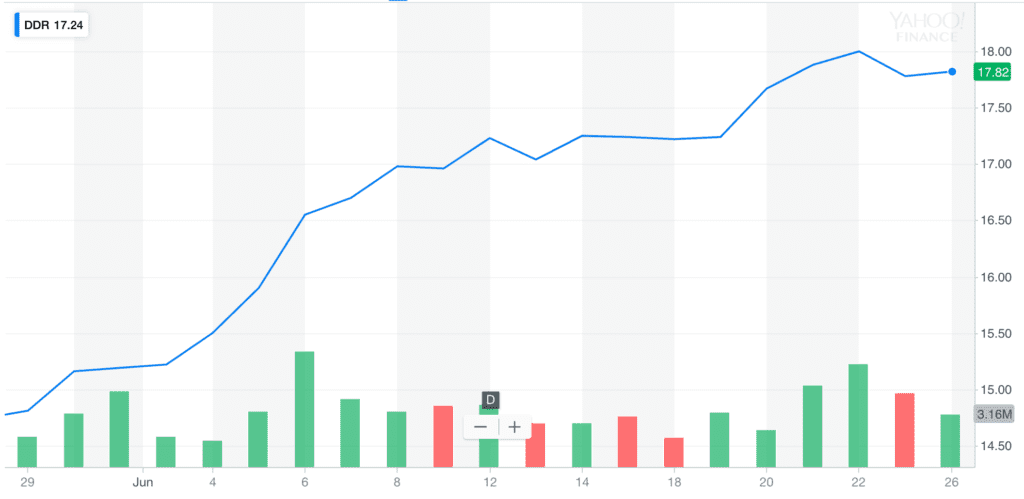

DDR Corp (DDR)

The Inside Trade: Otto Alexander is at it again buying $20.8 million at an average price of $17.87.

Normally we omit a 10% holder like Otto, but he is persistent, consistent and the yield curve is flattening. Maybe he’s got something on this low yielding REIT.

DSP Group, Inc. (DSPG)

The Inside Trade: Director Paul bought $1.2 million at an average price of $11.81.

Fluent Inc (FLNT)

The Inside Trade: Ryan Schulke, CEO, bought 600,000 shares at $2.75 of this micro cap company valued at $218 million.

Significant Insider Sells

Even though buyers are held on the sidelines during quarterly earnings blackout periods, sellers manage to find a way to continue unloading their stock through the use of planned sales, aka SEC Rule 10b5-1, a regulation enacted by the United States Securities and Exchange Commission (SEC) in 2000.

Walmart (WMT)

The Inside Trade: The founder’s relative and director, Walton Robson, unloads 29.4% of his holdings at $103 per share.

Facebook (FB)

The Inside Trade: Founder & CEO Zuckerberg continues to dribble out his vast holdings, selling $19.425 million worth at an average price of $194.25.

Stich Fix, Inc (SFIX)

The Inside Trade: Four insiders sold $7.6 million worth of stock at prices ranging between $26.27 & $27.48.

This rent versus buy clothing vendor and high flyer momentum stock sees sellers. Insiders perhaps don’t buy the related Amazon, Oprah rumors. Personally, we think this idea will not work but momentum stocks are tough to short.

Brooks Automation (BRKS)

The Inside Trade: Four insiders sold $1.2 million worth of stock at prices between $34 & $35.10 per share.

Although not big actual numbers, we feel it is notable to point out that insiders at Brooks Automation have picked up their selling.