Big Insider Trades Return as Earnings Season Slows: GE director buys 2.5 million of stock.

In this week’s report, we present six significant buys and four significant sells, a notable increase in activity from last week as the earnings season end is in sight. The increase of activity has a direct correlation to each company’s second quarter results. These results may also give insight into the dramatic increase in pre-planned insider sales from powerhouse companies.

Here is your insider trade rundown.

In this report, we examine stocks that C-level officers and directors bought and sold throughout the week ending July 27, 2018.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. As a standard, we only look at material amounts of money, $100 thousand or more, as anything less could just be window dressing.

The bar is different with selling, because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52 week lows.

Another red flag are large planned sale programs that start without warning. We generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and not the SMART money we are trying to go to school on. We also exempt IPOs and secondaries for a variety of reasons from not being available to the public or more nefarious reasons like trying to provide support for additional fund raising.

Although this info is available for free from the SEC’s Website , Edgar, we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data. Charts display one month of data from the date of our analysis at one day intervals. Credit for charts goes to yahoo.com

To learn more about our strategy, visit our website at The Insiders Fund. We welcome your comments on our analysis.

NOTE: We may own positions, long or short, in any of these names and are under no obligation to disclose that.

Significant Insider Buys

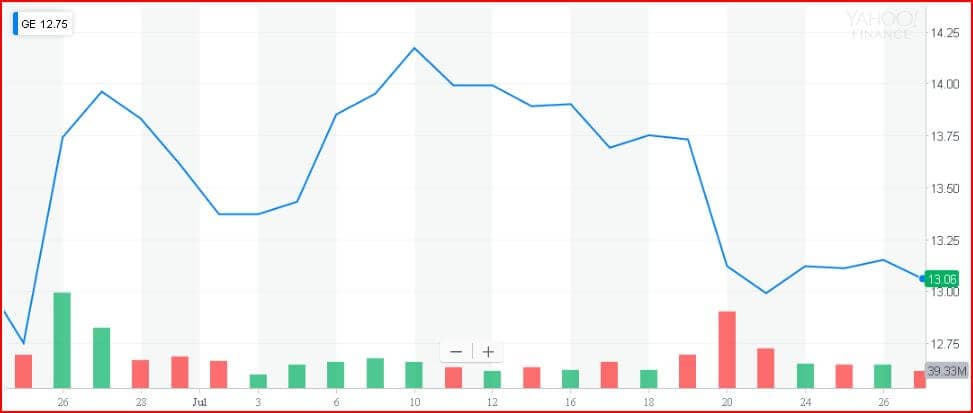

General Electric Company (GE)

The Inside Trade: General Electric’s new Lead Independent Director Henry Lawrence Culp Jr. grew his holdings by nearly 105% last week with a 191,000 share purchase. This purchase holds a market value of $2.5 million and increased his ownership to an estimated 373,400 shares in total.

Over the past year, General Electric’s share price has been on a steady decline, dropping over $12. The shares that Culp purchased were at an average price of $13.04 while the stock closed on Friday at $13.07 which is a nominal immediate impact, but then again, he has just started as a Director. Culp’s impressive resume led him to the role of Director for GE at the beginning of this year. This comes after retiring from the Danaher Corporation in 2014, the same year that he was ranked the 38th best CEO.

About GE: General Electric Company operates as a digital industrial company worldwide. It operates through Power, Renewable Energy, Oil & Gas, Aviation, Healthcare, Transportation, Lighting, and Capital segments.

PolarityTE Inc. (COOL)

The Inside Trade: Peter Cohen joined the Board of Directors for PolarityTE at the beginning of July this year but he increased his holdings by 13.6% last week. His 6,000 share purchase at $23.20 led to a market value addition of $139.2 thousand to his portfolio.

This trade took place on the same day that they issued a press release with an update on their commercial progress. They announced they are a month into stage two of their commercialization of their first product into major metropolitan areas.

On Tuesday COOL closed at $18.65, but jumped to 24.32 by Wednesday morning, the same day of the press release. The trend did not continue for the week though, as it finished the week at $21.57.

About COOL: PolarityTE, Inc., a translational regenerative medicine company, develops functionally polarized human tissues to improve clinical medicine and biomedical research. It offers PolarityTE, a technology platform that simplifies regeneration and allows cells to function naturally; and used to induce cell and tissue polarity.

AT&T (T)

The Inside Trade: Five Directors, Michael McCallister, Scott Ford, Beth Mooney, Geoffrey Yang and Matthew Rose made a combined purchase of 149,000 shares for a market value of nearly $4.57 million. Four of the five purchases came on the 25th, one day after their second quarter report came out with the fifth coming on the 26th.

These five insider buys topped off AT&T’s big week, with the organization’s 2018 second quarter report coming out and the planned acquisitions of Time Warner Cable, AppNexus and AlienVault.

The buys have made improvements during their short period of time with T closing the week out climbing back up at $31.09 per share.

AT&T and these directors are no strangers to making the most of their insider buys. In 2017 they were named the Top Dividend Stock With Insider Buying in both January and October. The two insiders mentioned in both of these articles were Geoffrey Yang in January with a 4.67% yield and Matthew Rose with a 5.77% yield. This most recent insider purchase increased Yang’s ownership by 40.60% while Rose increased his stake by a massive 200.9%. Beth Mooney increased her position by 127.8%.

About the planned AT&T Acquisitions:

The acquisition of Time Warner cable represents significant changes to AT&T’s products , financials and media abilities. With companies like HBO and TNT increasing both subscriptions and in-house series, they are a strong addition.

AppNexus describes itself as the world’s largest independent digital ad exchange.

AlienVault advertises itself as a unified security management & threat intelligence system that simplifies security in the cloud and on-premises areas.

The combination of one of the largest telecommunications networks with an entertainment and subscription powerhouse is significant, and has even received a negative backing by the President of the United States. New services coupled with a digital ad company and cloud security company represent big changes for the company. It is thought that AT&T is making a move to challenge companies like Facebook and Google in the realm of tracking consumer preferences, data and ad content.

About T: AT&T Corporation offers telecommunications and networking products and services. The Company provides a range of networking solutions, including business continuity, security, virtual private networking, and voice over IP. AT&T offers local, regional, long distance, and international telecommunications services to businesses, government entities, and consumers.

Eli Lilly & Co (LLY)

The Inside Trade: Tia Jackson, a Director at Eli Lilly and Co purchased 2,168 shares just two days after the company’s second quarter results were released. The buy was executed at an average price of $95.22 for a market value of $206.4 thousand. This represents a 4.2% increase in her holdings as the share price rose from $91.06 to $96.61 between the day the second quarter results were released and Friday’s close.

Her past purchases have turned out very well, with only one of the six previous not showing a positive return of over 4% and an average one year return of 16.7% to date.

The highlights for Eli Lilly this quarter was a decrease in EPS of 0.25% with revenue up 9%. The positive results were primarily due to the business’ rapidly expanding pharmaceutical side. New products were responsible for a 10% increase in revenue during second quarter and have increased the volume growth of the company by 12%.

About LLY: Eli Lilly and Company discovers, develops, manufactures, and markets pharmaceutical products worldwide. The company operates through two segments, Human Pharmaceutical Products and Animal Health Products.

Roper Technologies, Inc. (ROP)

The Inside Trade: Director Wallman purchased 500 shares at an average price of $299.50 representing a value of $149.8 thousand on the 27th, just one day after ROP’s report went public.

This is Wallman’s 4th insider buy since his Roper career started in 2013, with three of the buys all occurring as of March 12th of this year.

Roper Technologies released another record setting quarter press release on the 26th. This release helped cause the share price to jump $5.80 overnight and close the week out at $298.92 per share, up $10.32 since release.

Roper’s release was highlighted with an organic revenue increase of 9%, adjusted revenue increase of 13%, EBITDA increase of 14% and second quarter GAAP revenue increase of 14%. In addition to the strong numbers, the company acquired PowerPlan, which is an application software company that aids in financial, compliance and operation optimization.

About ROP: Roper Technologies, Inc. designs and develops software, and engineered products and solutions. It operates in four segments: RF Technology; Medical & Scientific Imaging; Industrial Technology; and Energy Systems & Controls.

Whirlpool Corporation (WHR)

The Inside Trade: Director Diane Dietz purchased 1,600 shares on the 26th at an average price of $124.26 per share. This buy increased her holdings by 23.7% and represents a value of $198.8 thousand at time of trade.

The Whirlpool Corporation released their second quarter result on the 23rd after the market closed while their share price closed at a strong $150.74 per share. Following the report after the market closed, the stock opened on Tuesday the 24th at $135.37 per share, down $15.37 per share.

With revenue, net income, diluted EPS and many other key financials all down 3.87% or higher from a year over year standpoint, the drop in price is not surprising. The company stated that they plan for their full year statistics to be positive and to have their operating cash flow to $1.5 billion by the end of the year. Whirlpool also used their anticipated proceeds from selling a compressor business to repurchase $1 billion of common stock with plans to repurchase more though the end of the year.

About WHR: Whirlpool Corporation manufactures and markets home appliances and related products. It operates through four segments: North America; Europe, Middle East and Africa; Latin America; and Asia.

Significant Insider Sells

Carbonite, Inc. (CARB)

The Inside Trade: Carbonite has been on a slight decline since July 20th following a press release that they will have a public offering of 4.7 million shares at a price of $37.50. Additionally there will 698,080 more shares offered by the co-founder and Director David Friend. This led to a reported sale on the 23rd from Director David Friend of 698,080 shares sold at $37.50 for a market value of $26.2 million. This decreased his holdings in the company by 52.1%.

Liberty Tax, Inc. (TAX)

The Inside Trade: The Chairman of the Board for Liberty Tax, John Hewitt, is also the company’s founder and former CEO. On the 19th he entered into an agreement to sell all shares of Class A and Class B common stock, bringing his holdings to 0%. The sale of 1,946,665 shares at an average of $8.70 had a market value of $16.9 million.

The shares were sold to Vintage Tributum LP, a third party with no affiliation. Additionally, at the closing of the sale, Hewitt gave his resignation which was followed by the resignations of four other board members that he elected. This all stems from the fact that the company failed to file its Annual Report on time. This resulted in the receipt of a NASDAQ letter of delinquency which jeopardizes the companies listing on the exchange. The shares saw a sharp increase in value on the 23rd that led to a closing price of $10.40.

Twitter, Inc. (TWTR)

The Inside Trade: Matthew Derella emerged this year on the insider sale list. He made three pre-planned sales and two 144 Sales this year for a market value of just over $1.7 million. This doesn’t seem that noteworthy until you take into account that Derella started at Twitter in 2012 and did not make an insider sale until April 4th of this year.

His five insider sales took place between April 4th and July 5th; all after the second quarter began and before their results became public.

Twitter’s quarterly report scared many and led to a 21% drop in price. This happened despite the company beating projections for a third straight quarter and increasing revenue by 24% year over year. The red flag that sent everyone running was their negative user growth from the company removing fake accounts. Unfortunately for Twitter, this may continue through the year as they continue to clean out the accounts that should not be there in the first place.

Netflix, Inc. (NFLX)

The Inside Trade: The list of planned insider sales from Netflix is usually long and repetitive, but there has been some notable changes.

Netflix released second quarter results that fell below their projections. Since their report was made public the share price has fallen $45.27 per share. Main areas of concern were falling subscription numbers that would have been noticeable by insiders long before the report was issued. New to note about these sales are the increase in size and value of the trades.

This holds true for their Chairman who, through his planned sales, sold over $100 million last week. Additionally, two officers who have increased their selling to the highest personal levels since 2013.

David Wells has made four sales in the past three months alone, prior to that he had only made six sells total between 2014 and 2018. During that same four year period Theodore Sarandos made four sales in total. So far this year the Officer has completed two for a market value of $83.2 million.

As Netflix’s second quarter report was the first to show its true subscription numbers were far less than the projections, it led to being the first to fall. Additionally the recurring theme of lowered projections for the next few quarters was realized for the entertainment giant. Netflix has not stopped though; they are projected to spend eight billion on original series and movies this year alone.