Icahn buys EGN but sells LNG. This & more significant insider trades.

In this report, we are deep into the blackout period. Expect another two weeks of tepid insider buying before we see if insiders have any game for this market. The most interesting behavior, however, is corporate insiders with 105-1 plans that allow them to sell at will.

While trading remains slow, significant trades are still being made. Here is your insider trade rundown.

$EGN, $NS, $ETM, $GRBK, $TRTC, $DSPG, $AEO, $ROST, $LGN, $SFIX

In this report, we examine stocks that C-level officers and directors bought and sold throughout the week ending June 29, 2018.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. As a standard, we only look at material amounts of money, $100 thousand or more, as anything less could just be window dressing.

The bar is different with selling, because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52 week lows.

Another red flag are large planned sale programs that start without warning. We generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and not the SMART money we are trying to go to school on. We also exempt IPOs and secondaries for a variety of reasons from not being available to the public or more nefarious reasons like trying to provide support for additional fund raising.

Although this info is available for free from the SEC’s Website , Edgar, we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data. Charts display one month of data from date of post at one day intervals. Credit for charts goes to yahoo.com

To learn more about our strategy, visit our website at The Insiders Fund. We welcome your comments on our analysis.

NOTE: We may own positions, long or short, in any of these names and are under no obligation to disclose that.

Significant Insider Buys

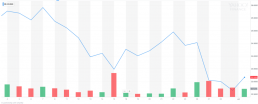

Energen (EGN)

The Inside Trade: Legendary investor, Carl Icahn, bought $117.9 million worth of stock at an average price of $69.50.

One always has to take note of Icahn’s purchases. He is a patient, long term investor but also not one that is passive. Energen Corporation, through its subsidiary, Energen Resources Corporation, engages in the exploration, development, and production of oil, natural gas liquids, and natural gas. The company has operations within the Midland Basin, the Delaware Basin, and the Central Basin Platform areas of the Permian Basin in west Texas and New Mexico.

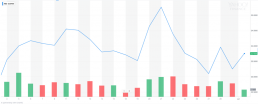

NuStar Energy LP (NS)

The Inside Trade: Chairman of the Board and billionaire William Greehey bought $10 million of stock at an average price of $24.17.

NuStar Energy L.P. engages in the terminalling, storage, and marketing of petroleum products in Texas. The company also engages in the transportation of petroleum products and anhydrous ammonia. It operates through three segments: Pipeline, Storage, and Fuels Marketing. The Pipeline segment transports refined petroleum products, crude oil, and anhydrous ammonia. The Storage segment owns terminal and storage facilities, which offer storage, handling, and other services for petroleum products, crude oil, specialty chemicals, and other liquids.

NS yields a plump 10.60%. Back in April, NS blew past quarterly estimates and raised EBITDA view by $20 million.

Entercom (ETM)

The Inside Trade: Director Joseph Field bought another $2.9 million of stock at an average price of $7.79.

Field has been a steady buyer of this local radio behemoth. It has steadily declined in price.

Green Brick Partners, Inc (GRBK)

The Inside Trade: Five insiders bought $577.2k worth of this homebuilder after it dropped 25% on news of a large secondary offering by stockholders.

The Company received none of the proceeds. Apparently insiders view this as an overreaction.

Terra Tech (TRTC)

The Inside Trade: Two insiders bought a combined $149.7k worth of stock in this small cap vertically integrated cannabis-focused agriculture company.

Marijuana has been hot on Wall Street, but these are small buys and may amount to nothing more than window dressing. For example the Chairman of the Board, Peterson has sold nearly $3 million worth of stock for prices between $0.23 to $0.33 and after this small $43.2k buy, he owns 649,782 shares, so this could be just a “pump and dump” move.

The company operates in two segments, Herbs and Produce Products; and Cannabis Dispensary, Cultivation and Production. The Herbs and Produce Products segment offers hydroponic herbs, produce, and floral products. The Cannabis Dispensary, Cultivation and Production segment operates medical marijuana retail and adult use dispensaries under the name Blüm, which provides a selection of medical and adult use cannabis products, such as flowers, concentrates, and edibles; and produces and sells a line of medical and adult use cannabis flowers, as well as a line of medical and adult use cannabis-extracted products comprising concentrates, cartridges, vape pens, and wax products in California and Nevada.

DSP Group (DSPG)

The Inside Trade: Director Cynthia Paul purchased 105,871 of this fabless semiconductor manufacturer at an average price of $11.78.

Significant Insider Sells

American Eagle Outfitters (AEO)

The Inside Trade:Chairman Schottenstein goes from buyer to seller, unloading $21.4 million of teen clothier, American Eagle.

Selling has picked up across the board here with directors selling numerous shares at prices from $24.40- $25.42. Technical indicators are flashing red, so this timing may be opportune.

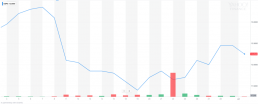

Ross Stores (ROST)

The Inside Trade: President Fasio sold $15.2 million of this discount clothing chain decreasing his holdings by 23.8%.

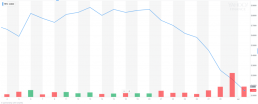

Cheniere Energy (LNG)

The Inside Trade: Icahn unload $584.4 million of this LNG pioneer representing 27.5% of his holdings.

Stitch Fix Inc. (SFIX)

The Inside Trade: Three insiders sell $8 million worth of this online clothing retailer.

SFIX is pioneering a new fashion concept where a combination of personal designers and AI pick out clothes for customers, send them on a regular schedule, and allow customers to keep what they like & return the rest.

Amazon has been rumored as interested in acquiring them, but that doesn’t seem to stop insiders from unloading stock.