Financial &Commodities Lead The List as the Insider Buy Volume Rockets.

In this week’s report the insider buying rockets. It is back and big again. We present sixteen significant buys and four significant sells, showing a continued, notable increase in insider activity. As earnings season comes to an end, the stocks are still feeling the effects as they settling in. Financial institutions and commodities dominate the report this week as over half of the buys come from these areas.

In this report, we examine stocks that C-level officers and directors bought and sold throughout the week ending August 3, 2018.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. As a standard, we only look at material amounts of money, $100 thousand or more, as anything less could just be window dressing.

The bar is different with selling, because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52 week lows.

Another red flag are large planned sale programs that start without warning. We generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and not the SMART money we are trying to go to school on. We also exempt IPOs and secondaries for a variety of reasons from not being available to the public or more nefarious reasons like trying to provide support for additional fund raising.

Although this info is available for free from the SEC’s Website , Edgar, we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data. Charts display one month of data from the date of our analysis at one day intervals. Credit for charts goes to yahoo.com

To learn more about our strategy, visit our website at The Insiders Fund. We welcome your comments on our analysis.

NOTE: We may own positions, long or short, in any of these names and are under no obligation to disclose that.

Significant Insider Buys

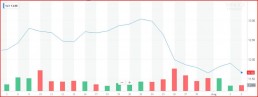

Las Vegas Sands Company (LVS)

The Inside Trade: Robert Goldstein, President of Las Vegas Sands Corp., purchased 10,000 shares at an average price of $71.13 for a market value of $711 thousand, increasing his ownership by 7.9%.

LVS’ share price dropped nearly $4, from $75.12, after their earnings report came out on the 25th. The price continued down to $0.73 above their one year low, until the company announced the pricing of $5.5 billion in senior unsecured notes two days after their President made his purchase.

About LVS: Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Asia and the United States.

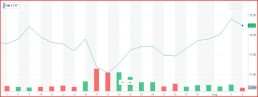

Reinsurance Group of America (RGA)

The Inside Trade: A Director at the Reinsurance Group of America, John Gauthier, purchased 1,000 shares at an average price of $140.19. This trade increased his ownership by 100% and represented a market value of $140 thousand.

Reinsurance Group’s shares dropped $4.02 per share after their second quarter earnings were reported, from $140.92 to $136.90. They have since been on a steady rise ending the week at $142.28. This could be a result of their increased dividends by 20% as they began trading ex-dividend today.

About RGA: Reinsurance Group of America, Incorporated engages in reinsurance business. It offers individual and group life and health insurance products

Valley National Bancorp (VLY)

The Insider Trade: Vice President Janis Ronald increased her ownership by 26.3%. She purchased 10,000 shares at an average price of $11.64 for a market value of $116 thousand.

Valley National Bancorp’s shares began a steady decline three days before their earnings report was released on the 26th. The shares were at $13.06 on the 23rd and ended last week at $11.66, down $1.40 per share since the decline started.

About VLY: Valley National Bancorp is the holding company for Valley National Bank and The Merchants Bank of New York. The Banks provide personal and commercial banking products and services to individuals and businesses through branches located in northern New Jersey, and Manhattan, New York. Valley’s other subsidiaries include mortgage servicing and investment companies.

Synchrony Financial (SYF)

The Inside Trade: Directors Roy Guthrie, Will Graylin and Jeffrey Naylor purchased a combined 25,000 shares, representing a market value of $738 thousand, increasing their ownership by 11.6%, 16.5% and 38.5% respectively.

Synchrony Financial’s share price dropped $3.44 on the day of their earnings release when it was confirmed their contract with Walmart would end at the end of July. Their Walmart portfolio is estimated at $10.5 billion, the option to sell it with the year’s end could add $2.5 billion in free capital to the company. SYF’s other option would be to retain the portfolio and move associated cardholders to one of their general purpose credit cards.

Synchrony also made moves on the acquisition side of things as well. They completed the acquisition of the U.S. PayPal Credit financing program, added new partners, like Furniture Row and Ashley Furniture and acquired the e-gifting platform Loop Commerce. The insiders purchased their shares the day before the price hit its year to date low of, $28.94.

Synchrony’s share price had a slow rise to close the week out at $29.85.

About SYF: Synchrony Financial operates as a consumer financial services company in the United States.

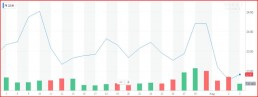

First Horizon National Corp (FHN)

The Inside Trade: First Horizon National Corp had two large insider trades, one by Chairman Bryan Jordan and one by Director Scott Niswonger. Together, they purchased 125,000 shares for a market value of $2.26 million. The Chairman increased his ownership by 3.0% and the Director by 18.5%.

After their earnings report came out on the 17th, the share price for First Horizon dropped to $17.03. The stock has since been steadily increasing to a one month high of $18.40 on the 2nd before closing the week out at $18.23.

About FHN: First Horizon National Corporation operates as the bank holding company for First Tennessee Bank National Association that provides various financial services. It operates through four segments: Regional Banking, Fixed Income, Corporate, and Non-Strategic.

Federated Investors Inc. (FII)

The Inside Trade:

Michael Ferrell, Director at Federated Investors Inc, purchased 65,000 shares to increase his ownership by 88.6%. They were purchased at an average price of $24.12 for a market value of nearly $1.57 million.

Federated Investors share price rose to $24.21 two days after their earnings report was released. This was short lived though as their share price dropped, closing the week out at $22.91, losing $1.30 per share in four days.

About FII: Federated Investors, Inc. is a publicly owned asset management holding company.

Live Oak Bancshares Inc. (LOB)

The Inside Trade: Chairman James Mahan and Director William Williams purchased 75,200 shares for a combined market value of $2.17 million. The shares increased their ownership for the Chairman by 0.7% and the Director by 2.7%.

After their share price dropped $3.60 from the announcement of their second quarter earnings, it began to rise. They announced on the 31st that they added three new and accomplished lenders to their Small Business Administration Lending Team. Their share price closed at $29.70, up from the low of $28.25 after their earnings report.

About LOB: Live Oak Bancshares Inc. provides small business lending. The Company offers loans to the veterinary, pharmacy, investment advisory, beverages, funeral homes, entertainment centers, agricultural, and healthcare sectors. Live Oak Bancshares serves customers in the United States.

Martin Marietta Materials Inc. (MLM)

The Inside Trade: Director Stephen Zelnak increased his ownership by 19% with a purchase of 3,500 shares at$202.87. This purchase held a market value of $1.18 million.

After an earnings report that showed record revenues, profits and diluted earnings per share, Martin Marietta Material’s stock dropped $16.10 per share. It continued to drop to a low of $199.41, which was one day after the insider purchase. The share price closed the week out at $206.96, giving their Director a profit in just a few days.

About MLM: Martin Marietta Materials, Inc., is a natural-resource-based building materials company, supplies aggregates and heavy building materials to the construction industry in the United States and internationally.

BlackRock, Inc. (BLK)

The Inside Trade: Director William Ford made another purchase this week at a market value of $467 thousand. The 5,400 shares were purchased at $467.92 and increased his ownership by 22.7%.

This is Ford’s third purchase of the year, with the first one coming in May. The trade this month held the smallest market value coming in at a hefty $467 thousand. On the year he has purchased 3,000 shares at a combined value of $1.5 million. Ford purchased these shares one day after their press release that BlackRock has completed the acquisition of Tennenbaum Capital Partners, LLC (TCP). Their company press release states that this is “bolstering BlackRock’s position as a leading global credit manager and enhancing its ability to provide clients with private credit solutions across a range of risk level, liquidity and geography.”

About BLK: BlackRock, Inc. is a publicly owned investment manager. The firm primarily provides its services to institutional, intermediary, and individual investors.

Visteon Corp. (VC)

The Inside Trade: Director James Wilson increased his ownership by 100% with a purchase of 2,500 shares. They were purchased at $116.71 and held a market value of $291 thousand.

When their quarter earnings came out, Visteon’s share price dropped $10.06 per share to a low of $114.17. It has risen to $117.42 after it was announced that they will participate in the J.P. Morgan Annual Auto Conference on August 8th. This trade was Wilson’s first since 2012 and it doubled his ownership.

About VC: Visteon is a global technology company that designs, engineers and manufactures innovative cockpit electronics products and connected car solutions for most of the world’s major vehicle manufacturers.

Pershing Gold Corp. (PGLC)

The Inside Trade: Director and 10% shareholder Barry Honig purchased 125,000 shares at $2.00. This increased his ownership by 1.5% and had a market value $250 thousand.

Honig is no stranger to insider buying, he has made seven this year alone and his buying history extends to 2012. These continued purchases have seemed a little puzzling given the fact that the shares have been on a constant decline for the last year with a high of $3.18 per share to closing out last week at $1.41.

About PGLC: Pershing Gold Corporation is an emerging Nevada gold producer that is reopening the Relief Canyon Mine.

Mohawk Industries, Inc. (MHK)

The Inside Trade: Flip Balcaen, a Director, increased his ownership by 5.3% with a purchase of 75,000 shares. They were purchased at an average price of $183.16 and had a market value of $13.7 million.

This was by far the largest insider buy of the week, taking place between July 26th and August 3rd. There haven’t been any company press releases since their earnings report was released and the shares dropped $38.06 to a low of $183.06. Their price hadn’t been in this area since October of 2016. This led to a large buy opportunity for Balcaen as the shares rose slightly to close the week out at $186.61.

About MHK: Mohawk Industries, Inc. designs, manufactures, sources, distributes, and markets flooring products for remodeling and new constructions of residential and commercial spaces worldwide.

Basic Energy Services, Inc. (BAS)

The Inside Trade: Director Kerns purchased 14,000 shares for a market value of $106.5 thousand.

When Basic Energy Services released their quarterly report on the 31st, their shares dropped over $3. This led to an opportunistic insider purchase as the shares closed out the week at $7.75.

About BAS: Basic Energy Services, Inc. provides well site services to oil and natural gas drilling and producing companies in the United States.

US Foods Holdings Corp. (USFD)

The Inside Trade: Director Anthony Lederer purchased 25,000 shares at $33.50 for a market value of $837.5 thousand. This trade increased his ownership by 24.5%.

On the July 30th, US Foods Holdings announced their earnings and the plan to acquire SGA’s food group of companies for $1.8 billion. This was also the day that the shares dropped $7.09 per share and Lederer increased his ownership.

About USFD: US Foods Holding Corp. operates as a holding company. The Company, through its subsidiaries, provides catering services. US Foods Holding serves healthcare, hospitality, educational, government facilities, and other sectors in the United States.

Virtu Financial, Inc. (VIRT)

The Inside Trade: Director John Nixon purchased 5,000 shares at $20.15 to increase his ownership by 25.1%. This trade held a market value of $100 thousand.

Virtu Financial released their quarterly earnings on Friday the 27th and saw their share price drop to $21.40 from a previous close of $25.65. Nixon waited until the first of the month when the price dropped even further to purchase his additional 5,000 shares.

About VIRT: Virtu Financial, Inc., together with its subsidiaries, provides market making and liquidity services through its proprietary, multi-asset, and multi-currency technology platform to the financial markets worldwide.

Fortive Corp (FTV)

The Inside Trade: Alan Spoon, the Chairman of Fortive Corp, purchased 18,000 shares which increased his ownership by 59.5%. The shares were purchased at $80.80 for a market value of $1.45 million.

Leading up to its second quarter results Fortive Corp showed a healthy jump from $76.18 on the 23rd to $81.21 on the 26th, the day of their earnings release. Since then, Fortive has also announced their acquisition of the facilities and asset management software company Accruent as well as their quarterly dividend.

About FTV: Fortive Corporation operates as a diversified industrial growth company. The Company focuses on professional instrumentation, automation, sensing, and transportation technologies. Fortive serves customers worldwide.

Significant Insider Sells

World Wrestling Entertainment, Inc. (WWE)

The Inside Trade: An Officer joined the Co-President of WWE this week in making a large sale. Their combined sells reached a market value of $19.11 million. The Officer, Kevin Dunn, sold 100,000 shares at a market value of $7.91 million, decreasing his ownership by 31.8%. The Co-President, Michelle Wilson, sold 140,000 shares at a market value of $11.2 million and decreased her ownership by 38.5%.

About WWE: World Wrestling Entertainment, Inc., an integrated media and entertainment company, engages in the sports entertainment business in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Pfizer Inc. (PFE)

The Inside Trade: Three insiders at Pfizer made sales this week for a combined 66,954 shares at a market value of $2.7 million. Michael Goettler, the Group President, sold 19,198 shares worth $762 thousand and decreased his ownership by 61.7%. Kirsten Lund-Jurgensen, the Executive Vice President, sold 20,942 shares worth $838 thousand and decreased her ownership by 81.9%. Loretta Cangialosi, the Senior Vice President, led with the largest sales with 26,814 shares worth $1.1 million and decreased her ownership by 23.8%.

About PFE: Pfizer Inc. discovers, develops, manufactures, and sells healthcare products worldwide. It operates in two segments, Pfizer Innovative Health (IH) and Pfizer Essential Health (EH).

Logitech International S.A. (LOGI)

The Inside Trade: CEO Darrell Bracken, decreased his ownership by 13.7% last week. His trade was for 100,000 shares at a price of $45.66 and a market value of $4.56 million.

About LOGI: Logitech International S.A., through its subsidiaries, designs, manufactures, and markets products that allow people to connect through music, gaming, video, computing, and other digital platforms worldwide.

Avery Dennison Corporation (AVY)

The Inside Trade: The President of Label and Graphic Materials for AVY, Georges Gravanis, decreased his ownership by 52.2%. He sold 13,000 shares at $112.67 for a market value of $1.46 million.

About AVY: Avery Dennison Corporation produces and sells pressure-sensitive materials worldwide.