Three Insiders buy Over $7 Million: Value Buyers with Conviction.

In this week’s report we present five significant buys and three significant sells. As the third quarter begins insiders make moves to capitalize on their companies share price with big value buys and bigger conviction. This report covers a wide variety of sectors on both the buy and the sell side.

In this report, we examine stocks that C-level officers and directors bought and sold throughout the week ending August 10, 2018.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. As a standard, we only look at material amounts of money, $100 thousand or more, as anything less could just be window dressing.

The bar is different with selling, because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52 week lows.

Another red flag are large planned sale programs that start without warning. We generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and not the SMART money we are trying to go to school on. We also exempt IPOs and secondaries for a variety of reasons from not being available to the public or more nefarious reasons like trying to provide support for additional fund raising.

Although this info is available for free from the SEC’s Website , Edgar, we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data. Charts display one month of data from the date of our analysis at one day intervals. Credit for charts goes to yahoo.com

To learn more about our strategy, visit our website at The Insiders Fund. We welcome your comments on our analysis.

NOTE: We may own positions, long or short, in any of these names and are under no obligation to disclose that.

Significant Insider Buys

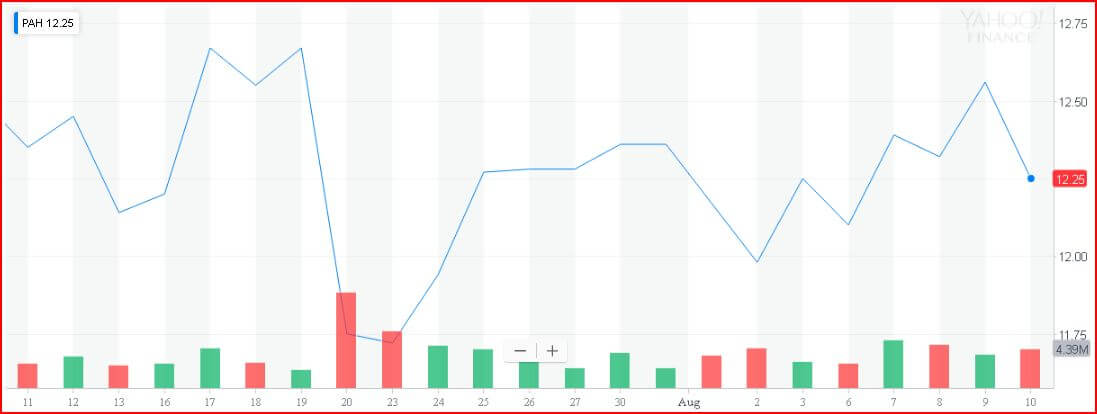

Platform Specialty Products Corporation (PAH)

The Inside Trade: Martin Franklin, Director at Platform Specialty Products, purchased 357,000 shares at an average price of $12.25. This purchase took place Tuesday, Aug. 7, held a market value of $4.59 million and increased his ownership by 2.8%.

This buy took place just two days after their second quarter results were released. The price was $11.98 the days the filings went public and led to a rise in price. Martin purchased his shares on Tuesday for in instant value because they closed the day at $12.39.

About PAH: Platform Specialty Products Corporation produces and sells specialty chemical products worldwide. It operates through two segments, Performance Solutions and Agricultural Solutions.

DowDuPont Inc. (DWDP)

The Inside Trade: CEO Edward Breen purchased 29,580 shares at an average price of $67.61. This purchase held a market value of $1.99 million, increased his ownership by 8.8% and took place on Wednesday August 8th.

DowDuPonts price dropped $2.33 per share leading up to their second quarter earnings report that was released on August 2nd. Their price rebounded rather quickly when it closed Thursday the 9th out at $69.02; just one day after their CEO purchased nearly $2 million in stock.

About DWDP: DowDuPont Inc. operates as a holding company. The Company, through its subsidiaries, produces agricultural chemicals, material science, and specialty chemical products. DowDuPont serves clients globally.

Crown Castle International Corp (CCI)

The Inside Trade: Landis Martin, the Chairman of Crown Castle, purchased 9,900 shares at $110.14. This purchase held a market value of $1.09 million, increased his ownership by 9.4% and took place between Tuesday, August 7th and Wednesday, August 8th.

Landis made six total purchases during this two day time period. Each day he purchased the majority of his shares for his direct ownership. The other four purchases were for two of his children, he purchased 1,400 shares total, and two of his grandchildren for which he purchased 400 shares total. The remaining 8,100 shares were purchased directly for himself.

CCI’s second quarter results were reported on July 18th and the quarterly dividend was declared on August 2nd. After the report came out, their price dropped to a low of $107.99 & rose to $112.49 after their quarterly dividend of $1.05 per share was released. That leads to just over $10 thousand in dividend payments for the shares that Landis purchased alone.

About CCI: Crown Castle International Corp. operates as a real estate investment trust. The Company owns, operates, and leases towers and other infrastructure for wireless communications. Crown Castle manages and offers wireless communication coverage and infrastructure sites in the United States and Australia.

Aon plc (AON)

The Inside Trade: Jeffery Campbell, a Director at Aon plc, purchased 5,500 shares at an average price of $143.84. This purchase held a market value of $798.29 thousand, increased his ownership by 361.8% and took place on Monday, August 6th.

Upon releasing their second quarter results on July 27th, Aon’s share price dropped $3.69 in one day. The price continued down to hit a one month low of $ $141.40 on August 2nd. This was also just days after they extended the ex-dividend date for their second quarter earnings of $0.40 per share. Share prices then rose slightly before dropping back down and closing the week out at $141.76 per share. This is $2.08 below the price that Jeffrey paid on the sixth. The extension of the dividend payment may have contributed to the slight increase in price and his buy. The moved the record date for the payable dividend from August 1st to August 10th. Additionally this could explain the drop in price at the end of the week after the shares began trading ex-dividend.

In addition to being on the board at Aon plc, Jeffery Campbell is currently the Executive Vice President and CFO at American Express. He was chosen to be on the Board of Directors for Aon due to his background as a CFO for financial service corporations that are publicly traded and multinational.

About AON: Aon plc provides risk management services, insurance and reinsurance brokerage, and human resource consulting and outsourcing services worldwide. The company operates through two segments, Risk Solutions and HR Solutions.

Flexion Therapeutics, Inc. (FLXN)

The Inside Trade: Two high level insiders combined to purchase 14,000 shares at an average price of $22.88. The purchases had a market value of $316.98 thousand.

The President and CEO, Michael Clayman, purchased 10,000 shares on Wednesday, August 8th to increase his ownership by 1.3%. CFO David Arkowitz followed suite by purchasing 4,000 shares on Thursday, August 8th to increase his ownership by 9.9%.

Flexion released their second quarter earnings report on August 7th, one day prior to the insider buys. This led to an increase in price of $0.65 per share the following day, just to see it turn around and drop by $1.37 on the 9th. The stock closed the week out at $22.95.

The earnings report highlighted the continued launch of their new product ZILRETTA, with a 73% increase in sales. However, the report soon followed to show a net loss of $43.9 million in the second quarter.

About FLXN: Flexion Therapeutics, Inc., a biopharmaceutical company, focuses on the development and commercialization of anti-inflammatory and analgesic therapies for the treatment of patients with musculoskeletal conditions.

Significant Insider Sells

Microsoft Corp (MSFT)

The Inside Trade: CEO Satya Nadella sold 328,000 shares at an average price of $109.44. This sale had a market value of $35.89 million and took place on August 10.

About MSFT: Microsoft Corporation develops, licenses, and supports software, services, devices, and solutions worldwide. The company operates through Productivity and Business Processes, Intelligent Cloud, and More Personal Computing segments.

WEX Inc. (WEX)

The Inside Trade: Six high level insiders at WEX sold a combined 28,885 shares at an average price of $187.73. These trades, combined, represent a market value of $5.46 million. The trades occurred between August 6 and August 8.

The highest valued trade came from their Chief Portfolio Risk Officer, Kenneth Janosick, who sold 10,550 shares and decreased his holdings by 55.7%. Their CEO and President, Melissa Smith, sold 5,000 shares and decreased her ownership by 6.5%. The CFO of WEX, Roberto Simon, sold 4,137 shares to decrease his holdings by 29.4%. WEX’s Chief Legal Officer, Hilary Rapkin, sold 3,723 shares to reduce her ownership by 22.9%. Two Directors, Regina Sommer and Jack VanWoerkom, sold 1,099 and 4,376 shares which reduced their holdings by 7.9% and 36.2% respectively.

About WEX: WEX Inc. provides corporate card payment solutions in North and South America, the Asia Pacific, and Europe. It operates through three segments: Fleet Solutions, Travel and Corporate Solutions, and Health and Employee Benefit Solutions.

Insperity Inc. (NSP)

The Inside Trade: Five insiders sold a combined 110,165 shares at an average price of $106.72. These trades combined for a market value of $11.69 million and all took place between August 6 and August 9.

The Chairman and CEO, Paul Sarvadi, and a Director, Richard Rawson, sold 45,000 shares each. These were the two highest trades having values over $4.7 million apiece. These sells reduced their ownership by 1.7% and 10.1% respectively. The EVP of Client Services and COO, Arthur Azripe, sold 15,000 shares and decreased his holdings by 9.8%. WES’s Finance SVP, CFO and Treasurer, Douglas Sharp, sold 2,165 shares to reduce his ownership by 9.0%. Finally, the EVP of Sales and Marketing, Jay Mincks, sold 3,000 shares to reduce his holdings by 4.6%.

About NSP: Insperity, Inc. provides human resources (HR) and business solutions to enhance business performance for small and medium-sized businesses in the United States. The company offers its HR services through its Workforce Optimization and Workforce Synchronization solutions.