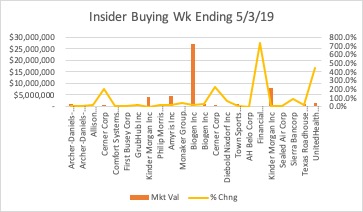

Several new buys this week signaled a return to animal spirits. We are particularly excited about Biogen. Biogen (BIIB) had a double whammy over the last two weeks. Two insiders bought material amounts of stock Biogen when the stock lost more than a quarter of its value during premarket trading Thursday morning after the company announced it would discontinue trials of its Alzheimer’s disease drug. CEO Vounatsos increased his holdings by 21.6% purchasing 4,351 shares at $231.48. Longtime board member and biotech guru hedge fund manager, Alexander Denner laid down a cool $27.2 million increasing his holdings by 22.1%.

Anxiety about both Democratic and Presidential railings about high drug prices first reaped havoc on the whole group of biotech and pharmaceutical companies share prices. Then to top it off, Biogen canceled their long-running trials on potential blockbuster Alzheimer’s drug, aducanumab. Mr. Market seems to be ignoring that Biogen increased revenues 11.2% last year and first-quarter earnings rose over 15% without any contribution from the failed Alzheimers drug. Biogen trades a stunningly low forward multiple of 7.5% The Company announced a $5 billion stock buyback days after the failed trial.

BIOGEN IS A TABLE THUMPING BUY

In this report, we examined open market purchases from employees and directors. Insiders sell stock for many reasons, but they generally buy for just one – to make money. As a standard, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. We generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and not the SMART money we are trying to go to school on. Although this info is available for free from the SEC’s Web site, Edgar, we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

To learn more about our strategy, visit our website here. We welcome your comments on our analysis.

THE INSIDERS FUND is a long-short equity fund. We invest in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is “inside information”. The SEC mandates that officers, directors and 10% shareholders file a Form 4 detailing buying and selling in their company’s stock within 48 hours. The SEC makes this info public immediately upon receiving it. This is as close to “insider information” that an ordinary investor is likely to see. Our Fund provides complete liquidity with no lock-ups. We only invest in transparent and liquid Level 1 securities. This strategy involves taking long positions in stocks that are expected to increase in value and short positions in stocks that are expected to decrease in value We may own positions, long or short, in any of these names and are under no obligation to disclose that.

If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.