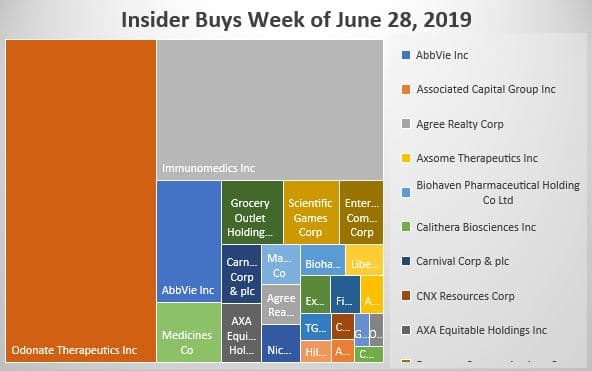

Odonate ODT’s Chairman and CEO Kevin Tang has made open market purchases of more than $36 million in so far this June, including $10 million on the spot secondary at the highest price his paid all year. This is a bet the farm investment but seems to be validated by the market as ODT stock has more than tripled this year.

Three insiders buy AbbVie after Wall Street choked on their purchase of Allergan. Do two out of favor big pharma companies add up to 4? Wall Street certainly doesn’t think so.

Carnival Cruise CEO Donald Arnold bought just under a $1 million of stock after the company issued reduced financial guidance and stock flirted with a new 52 week low. In “Carnival Stock Is Headed for Smoother Sailing,” Andrew Bary says Carnival Corp (NYSE: CCL) now looks like a bargain, after hitting the rocks on reduced 2019 financial guidance. Plus, it has the best balance sheet in the cruise-line operator industry.

Click here -to receive the complete report and analysis.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. We generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and not the SMART money we are trying to go to school on. Although this info is available for free from the SEC’s Web site, Edgar, we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data. To learn more about our strategy, visit our website. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

If you would like to hear more about how you can get involved with the Insiders Fund, please fill out contact info here

#stock #money #bitcoin #forex #binaryoptions #wallstreet #forextrader #trading #binary #luxurylifestyle #stockmarket #billionaire #cryptocurrency #investing #iqoption #forexsignals #binaryoptionsignals #usa #workfromhome #trader #makemoneyonline #success #entrepreneur #binaryoptionstrading #binarytrigger #billionaireboysclub #iqoptionstrategy #dubai #binaryoptionstrader #bitcoins, I’m using @tagsfinder_com