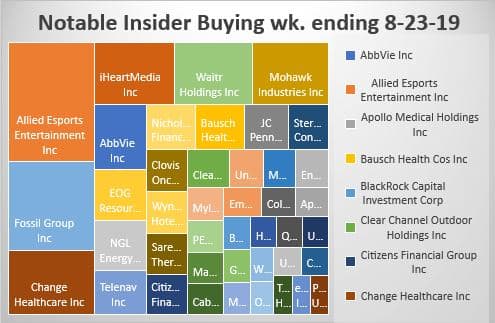

We are throwing out AESE as this wasn’t filed correctly and upon further review, it was deemed not to be an open market purchase

Fossil Group insiders bought $2.2 million worth of this watch and teen wear company. FOSL group is in a race down the down staircase with decreasing revenues and decreasing SGA.

Change Health Care is McKesson’s giant conglomerate of health tech companies recently gone public with Blackstone as their private equity investors. I haven’t had good luck with private equity IPOs, saddled with debt and selling institutional investors. This one doesn’t have any long term debt but it does have a $169 million tax liability with just $3.4 million in cash. With McKesson, Blackstone, and other P.E. guys waiting in the wings to unload, I’d have to do a lot more research on this one as there is a ton of stock coming to the market some time.

AbbVie VP bought $1million of stock. They must pay really well as a bunch of insiders have bought a lot of stock lately. We own this one. The risks in ABBV are well known and I don’t dislike AGN. It’s Humira that’s the problem and its a crapshoot how they manage the best selling drug in the world coming off patent.

Waitr Holdings is a microcap competing with Grubhub and Uber eats. Not a place I want to play. But low priced stocks can skyrocket on any good news. I just don’t see any coming.

Iheart Media owns Clear Channel and radio stations. Bad balance sheet and no growth businesses although they may be enduring and stable.

Mohawk billionaire director Balcaen bought a tiny bit more. He’s been a steady buyer of MWK. Mortgage rates are cratering and that ultimately is good for home purchasing and renovations. I’m researching this name more but I’m inclined to buy here. Wall Street is almost universally negative. This is a market that may undervalue value and overvalue growth. If we are headed into a cyclical downturn, the homebuilding industry might not be helped by low rates.

EOG Resources is a bet that Chevron comes back to the Permian oil basin with a mega buyout. Everyone hates oil now but I see no future where the ICE is replaced. Look at the prices of lithium producers, the essential ingredient in the electrification of the automobile fleet. We sold the $45 puts. That’s a lot lower than the mid $70’s the stock is currently at. Notice the sizeable number of oil and gas-related buyers. We own natural gas pipeline heavyweight, WMB, and Occidental. NGL Energy Partners, Cabot, Magellan, Patterson, and QEP Resources all had insiders buying. Hope springs eternal in the energy patch. Natural gas is essentially free or even has a negative carry as it’s a stranded byproduct of drilling for oil. Its all about the transportation of it to the end-use where it is an indispensable commodity. That’s why we prefer Williams and the midstream pipeline companies like MPLX.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

Of course, unintuitive as it may seem, insiders can also be wrong about their Company’s prospects, they can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website.

If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar

#stock #market #money #bitcoin #business #forex #marketing #binaryoptions #wallstreet #cryptocurrency #forextrader #trading #binary #luxurylifestyle #entrepreneur #stockmarket #realestate #billionaire #investor #food #investing #success #iqoption #forexsignals #binaryoptionsignals #usa #invest #workfromhome #forexlifestyle #trader