As the earnings blackout period ends, there are a ton of interesting insider buys. We are going to analyze ALL of them that seem interesting, particularly the ones that look like they may have a good chart setup for profitable trades. Read on and find out what insiders are investing in.

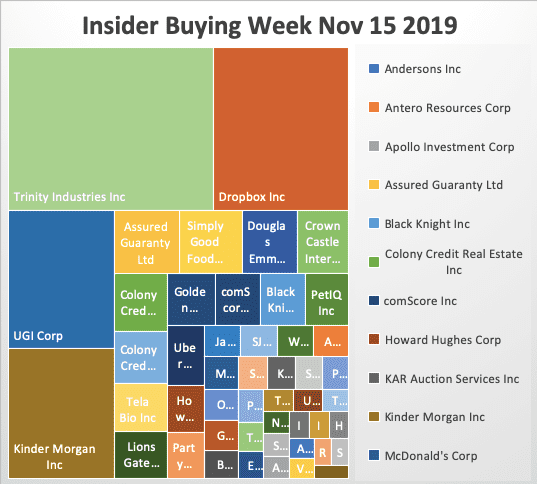

Hope springs in the oil patch. Antero Resources Corp Director bought 178,000 shares at $2.79 for $496k substantially increasing his holdings by 266%. Just about all the E&P companies are making new lows and I’d prefer to buy OXY with its outsized dividend. The irony here is that the energy guys are one of Trump’s most loyal followers and he has been absolutely terrible for their shareholder as the Chinese are sourcing their oil and gas from Iran, Saudia Arabia, Russia and bypassing the most logical way to reduce the trade imbalance by boycotting American producers.Several insiders bought shares in Anderson Inc, an ag trading company. The largest being the CEO’s 10,000 share purchase at $21.50. It’s hard to say if this stock is bumping off the bottom, but there are in tough businesses. Trade war is killing farmers, Trump’s ethanol policy aint helping either. I’m selling some puts here as the stock has bounced a good amount after these buys. It’s hard to imagine how the news could be worse and its probably a good contrarian play. Both Bunge and Archer Daniels Midland have rallied from their lows.

Apollo Investment Corp., a mezzanine portfolio lending company, CEO bought $247k worth of stock at $16.47. AINV offers a 10.9% dividend! Quite incredible considering where interest rates are but then Apollo made some bad bets on the energy sector. Another investment company, Colony Credit dropped on announced losses in their real estate portfolio. Several insiders bought stock on the pullback. Colony yields 9.46%. Income investors should strongly consider both of these names.

Black Knight CEO bought $1 million worth of stock on 12% on lowered earnings guidance. The stock bounced sharply after the CEO bought stock. Insider trades often add confidence to other investors and it’s not uncommon for an immediate 5% bounce over the following days. The stocks usually base for a while after that and even pull back slightly so one has to exercise discipline on following the insiders.

comScore has been absolutely crushed this year. The new CEO Livek bought $1 million at $3.24, down from $23. comScore has been involved in messy litigation with the SEC and its former CEO over-inflated audience measure metrics. New CEOs often buy significant amounts of stock on their appointments.

Howard Hughes Corp CEO and a director bought a combined $750,000 worth of this real estate development company. Business is booming in Las Vegas and with legalized pot and an NFL team starting next year, it’s hard to imagine how it cannot get even better. Their New York development of Seaport District is another story, losing $4.2 million in the first quarter of this year. The stock dropped 17% last month on the news that their strategic review (putting the company up for sale) did not yield any results. The Company changed out CEOs and announced a strategic change in direction. Bill Ackman, a major shareholder who made is fame by investing in HHC has been selling stock unloading $200 million on November 8th. This one is a head-scratcher.

Kar Auction Services Director bought $397k worth of stock when the company lowered its earnings guidance. Janna Partners, a very successful activist hedge fund has recently gotten three directors appointed to this company. You can be assured they are agitating for change.

Kinder Morgan, Chairman, and founder, Richard Kinder continues to buy large amounts of his company’s stock. The most recent buy was $18 million. I don’t believe he has ever sold a share of stock.

McDonald’s insiders continue to nibble at their company’s stock, the most recent buy from Chairman Hernandez with 2500 shares at $193.83. We like McDonald’s and would buy it here.

Occidental Petroleum director Klesse ads to his losing position with another $471k worth of stock. We like OXY but are losing money here. I believe the dividend is safe but the outsized yield of 8.11% indicates not everyone shares this view. Buffet’s Berkshire Hathaway recently reported buying some stock as well as the preferred they own.

Crown Castle Chairman Landis loves his stock, buying another $1.42 million at $130.61. He is a steady buyer and the company doesn’t disappoint. With 5G on the horizon and low-interest rates, it’s hard to see how you lose money in this cell tower leader. My largest complaint is the dividend yield of 3.56% seems paltry.

REIT Douglas Emmit Director bought $1.51 million at $43.23. DEI pays a paltry 2.37% dividend and trading at a 52 week high. Insiders usually buy when their stock is depressed. That’s certainly not the case here and that is very bullish.

Dropbox Chairman, Co-founder and CEO Andrew Houston bought 500,000 shares for $9.568 million. This one looks very interesting to us and we are buyers.

PetIQ CFO Newland bought 44,000 shares dropping a cool $980320 on this pet supply company. PetIQ has been bumping against a 52 week low. I think this is worth a shot as CFO’s are a very good C-class officer to follow and he has been the CFO since 2014. This looks like his first every open market purchase.

Teradata insiders nibble at some stock after 3rd quarter earnings fell flat. Insiders have been wrong on this name but at these prices, they may have a shot at making money.

Uber Technologies Chairman Ronald Sugar bought 35,000 shares at $27.20. Uber’s IPO lock-up is over and the real appetite for owning Uber is about to be seen. I have a hard time buying Uber with a market cap greater than Delta’s. It’s hard to fathom how they lose money but they have done it to historic levels. I’m waiting for the company to abandon all of their bets, fire most of their employee and start printing money. Until then I will take a pass.

Golden Entertainment Director bought $451k worth of stock. This is a pretty thinly traded stock and we are passing even though its a sizeable buy in this 2nd tier gaming operator.

Lions Gate Entertainment insiders continue to buy as the stock makes new lows. Director Crawford bought $1.08 million at $8.87. The obvious buyer is Apple in my mind as their original programming so far on Apple TV is a bust and Lions Gate at least knows how to make movies. This is worth a stake at these depressed prices.

UGI Corp Director Hermance increases his holdings by 60% with this $6.4 million dollar buy at $42.70. UGI is a natural gas and electric utility company serving 700,000 companies in Pennsylvania and one county in Maryland. UGI recently dropped 10% on weak 4Q earnings. With a 3% dividend yield and enough natural gas for 200 years, its’ hard to get excited about this name.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, unintuitive as it may seem, insiders can also be wrong about their Company’s prospects, they can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website.

If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar

#theinsidersfund #alphawealthfunds #insomnicahedgefundguy #stock #market #money #bitcoin #business #forex #marketing #binaryoptions #wallstreet #cryptocurrency #forextrader #trading #binary #luxurylifestyle #entrepreneur #stockmarket #realestate #billionaire #investor #food #investing #success #iqoption #forexsignals #binaryoptionsignals #usa #invest #workfromhome #forexlifestyle #trader #investment #wealthmanagement