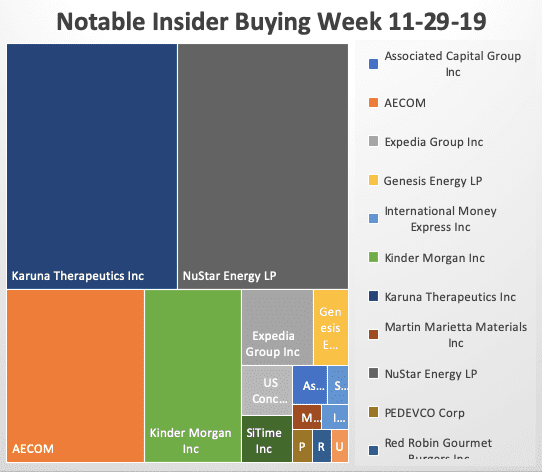

Shares of Karuna Therapeutics Inc. KRTX, more than tripled (up 254%) November 19th in active trading to an intraday high of $123.99 after a phase 2 trial of its schizophrenia treatment met its primary endpoint. Karuna and its underwriters, led by Goldman Sachs et al, wasted no time rushing out a sport secondary at $96 raising $250 million. At Friday’s close of $71.88, people lost serious money in this secondary, including biotech VC and hedge fund Sofinnova Venture Partners which upped their position by$15 million. No tears shed as they are early investors, buying $15 million on the IPO at $16 last June in addition to the million or so shares they already owned at pre-IPO prices. Normally we don’t report on OPM (other people’s money) investors but these guys are very smart and it is worth paying attention. After spending most of 2019 in the doldrums, biotech has mounted a frontal charge and was the hottest sector in November.

Starboard Value bought more AECOM. This was a small addition to a sizeable holding of Starboard. They have a great track record and its’ always worth paying attention to them. It’s hard to see how this investment works though without some movement in politics as all major infrastructure initiatives seem to be stalled in this polarized political environment.

Normally we discount new director purchases as they are expected to own some stock in the companies on which they hold a board seat. Not this time, though, as Sam Altman’s $2 million dollar buy at $98.83 is more than window dressing. This time it might be a smart insider buy as Expedia dropped 40% from a high of $139.37 to as low as $93.48 because of last quarter’s dramatic earnings miss and lowered forecast.

Three insiders made large purchases in the beleaguered oil and gas midstream infrastructure businesses. Richard Kinder has been steadily buying his namesake’s company stock, Kinder Morgan. NuStar Energy Chairman Greehey added $15 million worth to his giant stake.NS yields a giant 8.5% at Friday’s close. This pales in comparison to Genesis Energy’s 11.57% yield Director Jastrow picked up with his purchase of 50,000 shares at $18.96. According to GEL, through their offshore pipeline transportation, chemicals, onshore facilities and transportation, and marine transportation, they provide an integrated suite of services to integrated oil companies, large independent oil and gas or refinery companies and large industrial and commercial enterprises. There are several high yielding midstream plays with insider buying that are stagnant or down considerably this year as oil and gas is the worst-performing sector in the market.

Two insiders bought over a combined $1 million worth of US Concrete at a depressed price of $39.92 after its worse than expected Q3 EBITDA and revenue. Peer play Granite Construction also saw some insider buying after plunging 30% on disappointing Q3 results although GVA’s problem seems to be more contract dispute related. Also, the insider buying was small compared to USCR.Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, unintuitive as it may seem, insiders can also be wrong about their Company’s prospects, they can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar

#insomnicahedgefundguy #stock #market #money #bitcoin #business #forex #marketing #binaryoptions #wallstreet #cryptocurrency #forextrader #trading #binary #luxurylifestyle #entrepreneur #stockmarket #realestate #billionaire #investor #food #investing #success #iqoption #forexsignals #binaryoptionsignals #usa #invest #workfromhome #forexlifestyle #trader #investment #wealthmanagement