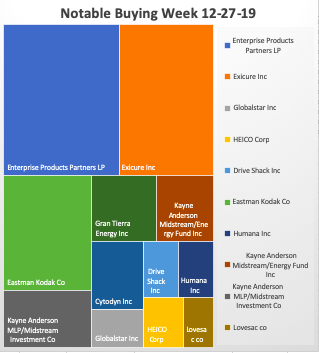

This was a holiday shortened week but insiders still managed to report a few buys. William Duncan continues to buy MLP Enterprise Products Partners, spending $2.4 million at #27.88

Continuing along this theme of buying scorned midstream energy infrastructure assets, President Baker bought both KMF and KYN both Kayne Anderson Midstream Investment Funds. We like this idea and would be buyers of this diversified ETF play on the entire sector. KMF is a closed-end energy fund investing in the midstream energy sector, including midstream MLPs and other energy companies. As of Friday’s close the current yield is 8.3%. KYN invests in stocks of companies operating in the energy sector. The fund primarily invests in energy-related master limited partnerships and yields 10.01%

Exicure Inc a clinical-stage biotechnology company, develops gene regulatory and immuno-oncology therapeutics based on spherical nucleic acid (SNA) technology. It has 3 early stage phase 1 trials and a partnership with Purdue Pharmaceuticals( the Oxycontin maker flirting with bankruptcy). This was a secondary offering so we don’t look very closely at these buys although they can be profitable trades, there are just too many undercurrents and may not reflect the true insider animal spirits we look for.

Heico looks interesting to me. The CFO bought $270,000 of HEI.A at $91.21 Corporation, through its subsidiaries, designs, manufactures, and sells aerospace, defense, and electronic related products and services in the United States and internationally. We are a buyer here.

Humana and officer bought $276k at $386.40 Humana has run up a lot in the last quarter as political pressure on the sector seems to have abated some. We are passing here.

Globalstar James Monroe continues to buy this satellite cell phone and messaging company. We noted another buy last week. Normally this would pique our attention but Monroe’s track record is dismal.

Eastman Kodak Chairman of the Board Continenza bought 400,000 shares at $2.50. You can completely ignore this buy as it was below the market and shares bought from another large seller.

Cytodyne Inc I wouldn’t normally mention this penny stock but the director Welch did buy $500,ooo worth at $.031 share. This is an early stage biotech with a very checkered past and present. They recently announced an inflated press release touting an $87.5 million financing deal with with Vyera. Upon further analysis, the deal was really only selling $4 million worth of registered stock to Vyera and the $87.5 million was contingent upon milestone achievements which in my opinion are complete pie in the sky. Why?

- VYERA is a Martin Shkreli controlled company. Shkreli, better known as “pharma bro” is currently serving a 7 years prison sentence for securities fraud.

- CYDY has been a listed stock a long time and has lost a cumulative $245 million and has never made a dime.

- The company has financed itself with PIPES and death spiral preferred stock sales.

- Nearly half of the board members left in May of this year.

- They are suing their largest individual shareholder and past board member and he is suing them.

- These are just a few of the red flags.