Not much happened in the world of insider buying last week. The vast majority of insiders are blacked out from buying or selling their stock during the period immediately before the release of 4th quarter earnings. The few that did make buys were hardly noticeable or worthy of exploring.

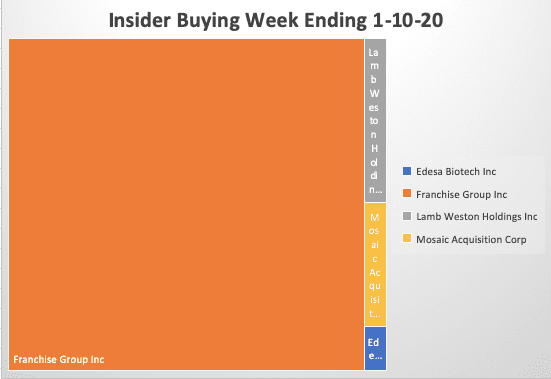

The largest buyer last week was the CEO of Franchise Group Inc. FRG is the old Liberty Tax now focused on the evaluation and acquisition of franchise-oriented or complementary businesses. I spent some time researching this. It’s basically at this point a private equity company with a public stock they can do deals with. Perhaps it’s a good investment, CEO Kahn plunked down $54 million to buy stock at $12, but we don’t really buy private equity, hedge funds other than our own, and blank check companies like Mosaic Acquisition Corp.

We are also scratching our head a bit on the Lamb Weston purchase. A director bought $1.6 million of LW at $92.01 after the stock climbed 11% on a good 2nd quarter earnings report. Aggressive buying on good news with a stock making new recent highs usually signifies that business is good and getting better. We don’t like the fact that the CFO and other insiders sold considerable amounts of stock on this news as well.

Edesa Biotech looks interesting, especially in the light of how hot the biotech sector is at the moment. EDSA is an early stage biotech company with a non steroid product for contact dermatitis. This is a large market but EDSA just entered phase 2 and will need a lot of money to push it further. EDSA just raised $4.3 million and 10% owner Van Der Velden purchased an additional $450k at $3.20.

Insider buying will be taking a back seat to earnings as this coming week marks the start of 4th quarter earnings results. We will be looking closely at Delta which reports before the open Tuesday. We have a large stake in this laggard and think the market is grossly undervaluing Delta as well as United, and American Airlines.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course insiders can also be wrong about their Company’s prospects. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax