Simply Good Foods’s SMPL Director Brian Ratzan bought 10,000 shares at $22.98. The newly capitalized Atkins brands has found what seems to be permanent shelf space in grocery stores and drug store chains. Insiders have had a steady diet of SMPL shares, the largest being the Chairman of the Board’s purchase of $1.7 million at back in November 2019 at $24.62 . Atkins bars might be causing me indigestion, I had a followed his lead. The stock is down 17% on concerns over missing consensus growth expectations According to Fly on the Wall –“Goldman Sachs analyst Jason English added Simply Good Foods (SMPL) to Goldman’s Americas Conviction List while keeping a Buy rating on the shares with a $34 price target. Since the company reported earnings on January 9, English tells investors in a research note. However, the selloff is overdone as the miss was not a sign of reduced demand but rather improved inventory management at key retailer, contends the analyst. “

We don’t see the growth runway here and passed back in November and still taking a pass.

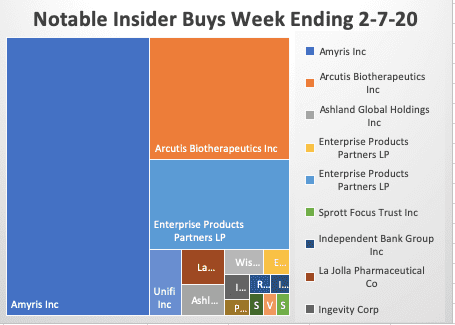

William Duncan continues to amass sizable amounts of mid-stream infrastructure, Enterprise Products Partners, EPD. Yes, it’s got a great dividend yield at 6.9% with a better leverage profile than most but let’s face it, these pipeline plays are not going anywhere. ESG investing headwinds and the possible elimination of the internal combustion engine due to electric vehicles (EV) are making this sector a painful place to play in spite of the Trump Administration embrace of the oil and gas industry. I personally think the time to buy oil and gas is if the Democrats gain control and put restrictions on hydrocarbon production, likely driving the commodity price up faster than green alternative energy can keep pace. For now, we have modest exposure to the sector.

Which brings us to Amyris, AMRS. John Doer, legendary Chairman of Kleiner Perkins is keeping this bioengineering play alive. He just added $30.15 million to their coffers by converting into stock at $2.87 per share. It’s either going to be a 10 bagger as Pete Lynch coined, or a bust. I have no way of knowing. I did order a basket of their bioengineered beauty products for my fiancé to try out and give me an opinion. There is a lot written on Seeking Alpha and elsewhere about this mysterious company. Amyris said it has closed a deal potentially worth $300 million with biotech startup Lavvan to research and develop synthetic cannabinoids. According to their web site, LAVVAN is led by one of the most influential, respected and pioneering teams in the global cannabis industry. After the $2.5 billion purchase of MedReleaf Corp. – a company that from 2014 to 2018 was one of the largest legal producers of cannabinoids in the world the team dedicated itself to once again revolutionizing the industry that it helped to birth, by bringing to it a level of quality, reliability and sustainability that global brands, manufacturers and suppliers can depend on.

Ingevity NGVT– two insiders bought stock in this specialty chemical manufacturer at a multiyear low price. The CEO Michael Wilson bought 7,500 at $64.44. CFO Forston bought 2,290 at $65.50. Tell me he isn’t watching the stock price. Fortson sold 36,000 share a year ago at nearly twice the price. One thing I’ve learned about studying insiders over the year, is that C-level officers always have one eye on the stock ticker and have a good instinctual feel for the way their stock trades. We are going to nibble here. Hate the sector though. Buying a good house in a bad neighborhood is not shooting fish in a barrel but in a market as picked clean of value as this one, you have to take what you can get.

Unifi UFI– there are some stocks insiders buy for years without making any money. Unifi is one of them. Kenneth Langone may not be smarter than me, but he is certainly richer. Maybe he just doesn’t need the money. Well, we know that for a fact. He just awarded tuition free med school to NYU students. Don’t buy the stock if you need to make money.

That’s it for this week. Hope you caught the ride on Anthem. It was our pick of the week last week and we rode it for a quick pop and have just a tail now. Gee, Barron’s just wrote it up Saturday. Glad we kept a tail. I wish I had known they were going to tout it. I guess that’s why you want to pay attention insider buying.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course insiders can also be wrong about their Company’s prospects. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax