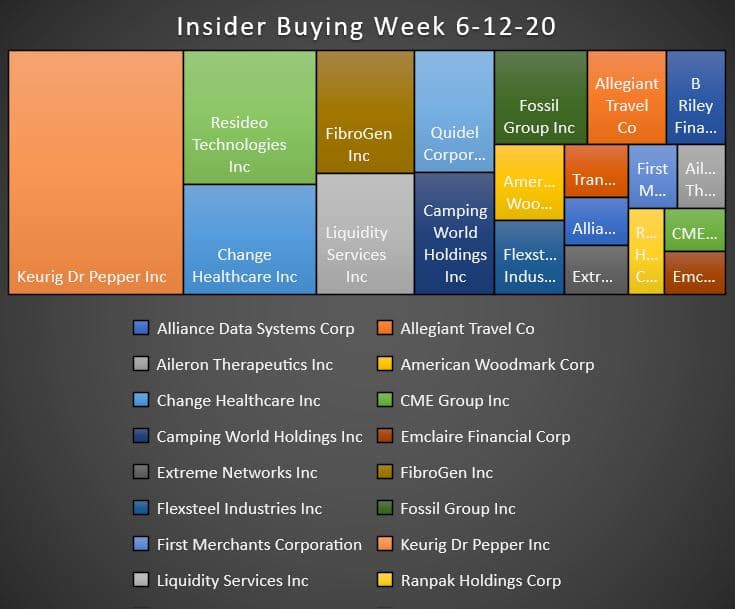

Fibrogen CEO Conterno bought 27,800 shares at $35.47. After last year’s unexpected passing of founder and long-time helmsman Thomas Neff, FibroGen needed a permanent successor—and with its big roxadustat launch looming, that new CEO would ideally know the ropes in kidney and metabolic diseases. Conterno, who came from Lilly six months ago as its U.S. business chief and worldwide diabetes lead, became FibroGen’s new CEO, in January. This is his first open market purchase. Here is a link to a recent Goldman Sachs investor presentation

According to their website, FGEN is dedicated to creating innovative, first-in-class medicines for the treatment of chronic and life-threatening or debilitating conditions such as anemia in chronic kidney disease (CKD), anemia in myelodysplastic syndromes (MDS), idiopathic pulmonary fibrosis (IPF), pancreatic cancer, and Duchenne muscular dystrophy (DMD). FGEN has a newly approved drug in China and Japan, roxadystat, for the treatment of anemia in adult patients with chronic kidney disease. It is in final phase 3 trials in the U.S. and Europe with partners AstraZeneca and Astellas . AstroFibroGen announced the planned initiation of two additional randomized, double-blind, placebo-controlled Phase 2 studies investigating the efficacy and safety of pamrevlumab versus standard of care in patients with severe COVID-19 infection in the United States. The second planned U.S. trial, under discussion with the FDA, is expected to assess the longer term efficacy and safety of pamrevlumab in patients who recovered or are recovering from COVID-19 infection with evidence of interstitial lung disease. A treatment for Covid-19 might be considered a bonus indication, Fibrogen looks like a de-risked bet, rich in cash and likely to get Roxadystat approved. Get your lotto ticket at FGEN.

Camping World Holdings CWH CEO Marcus Lemonis buys 13,975 shares at $21.48 and 23,500 a $21.27. CWH has been struggling with its January 2018 disastrous purchase of Gander Mountain out of bankruptcy. Wall Street gave the acquisition a bronx cheer as competing against online juggernaut Amazon and Dicks Sporting Goods, bankrupted Sports Authority. Turn the clock forward and now a global pandemic; people are flocking to the outdoors and camping and RVs are a prime beneficiary. This begets the question is Lemonis buying at the top? Or is the camping and RV lifestyle a secular growth industry? Lemonis bought stock while it was in the $8 range so buying at the top is unusual and very bullish. We would buy this camping juggernaut on dips.

Alliance Data Systems ADS is getting booted from the S&P 500 for Teledyne. Director Gerspach bought shares at $51.51. ADS manages loyalty card programs. ADS was up $5.21 or 10.95% Friday, the 12th. The only news I can find is this first time buy from newly elected director which we generally discount.

American Woodmark Corp Director Tang bought 6,000 shares of this cabinet maker at $72.08. The single family housing market is surprising on the upside as city dwellers are heading to the suburbs to get to less densely virus prone communities. Record low rates also should contribute to favorable housing trends. AMWD was upgraded to buy from hold at Loop Capital on June 11th. This is the first insider buy since December 2018 and is a 40% increase in Tang’s holdings. The last stock Tang bought was March 2018 at $97.55.

CFO Eliasson bought 100,000 shares of Change Healthcare at $12 spending $1.2 Million to increase his holdings by 174.5% the same day CHNG lost Priority Health deal to Inovalon. Both healthcare IT companies have insider buying but Change is more heavily levered. It seems inevitable and logical to us that as a nation we need to spend more money on healthcare informatics. I’m more in to Inovalon than Change.

Allegiant Travel Co President bought 5,000 shares of this budget airline at $122.89. This is the 2nd insider to buy into the airline as a director has been accumulating shares. This would all be significant if the Chairman of the Board of ALGT hadn’t sold over $40 million of stock during the same time period.

Quidel Corporation has been on a tear, doubling in price this year as it’s rapid Covid-19 has propelled investor sentiment. It’s all the more unusual seeing an insider, the CEO Bryant, purchase $801,670 worth of QDEL at $160.33 per share. It’s hard figuring intent here. In the scheme of things, $800K is a lot of money but Bryant sold millions of dollars worth of QDEL last year for half the price. It’s hard to ascribe motives here.

No mention of insider buying would be incomplete without mentioning the President of Keurig Dr Pepper’s $3.5 million purchase of $28.47. KDP has been hovering in this price range for two years. We can’t see the catalyst unless JAB Holdings, the company’s largest shareholoder plans on taking the company private. We went down this path with Cody and got spanked hard. JAB Holdings is not my favorite whale to follow.

Two insiders at Honeywell home-automation spin-off Resideo Technologies bought stock at $8.51 and $9.08. Director Teich bought $1.5 million worth of stock the previous week. REZI has a bright future in the stay at home world. We would be a buyer on dips. Spin-offs were one of Peter Lynch’s core strategies in the classic One Up on Wall Street.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer friendly and responsive I’ve used.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course insiders can also be wrong about their Company’s prospects. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax