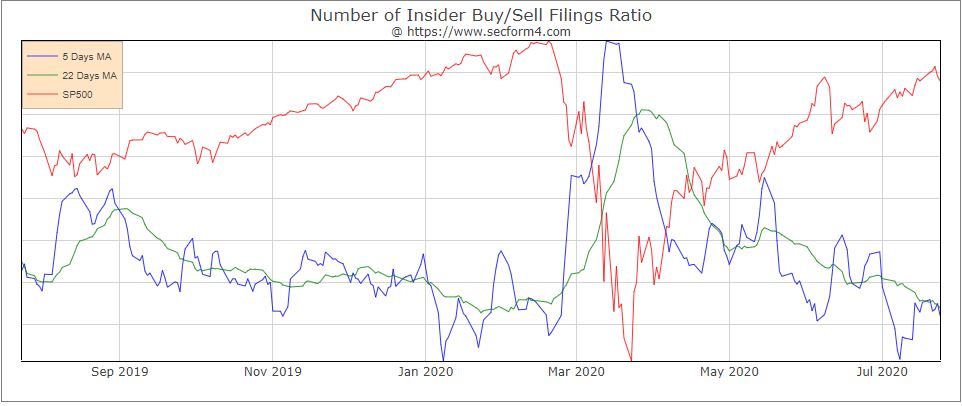

According to Bloomberg, as U.S. stocks climb to their most expensive levels in two decades, the executives in charge of the companies benefiting from the rally are showing signs of anxiety.Corporate insiders, whose buying correctly signaled the bottom in March, are now mostly sellers. Almost 1,000 corporate executives and officers have unloaded shares of their own companies this month, outpacing insider buyers by a ratio of 5-to-1, data compiled by the Washington Service showed. Only twice in the past three decades has the sell-buy ratio been higher than now.

Source: Insiders Who Nailed Market Bottom Are Starting to Sell Stocks – Bloomberg

As you can see from this chart, courtesy of SECform4 insiders are largely sellers into the rally. This is not normally the best setup for prolonged strong rallies as we’ve seen since the March low. Of course any investor in their right mind would be selling into a market that is completely divorced from fundamentals. I say with the exception that remarkably low interest rates have driven up the value of all income streams but this isn’t what’s driving the market at all. In fact the most reliable steady stream of income, the utility stocks have under performed most groups. It’s clearly a liquidity and speculative frenzy rally. We intend to make as much money as we can in this environment with our foot resting lightly on the brake, ready to reverse course near instantly.

There are obvious winners, the stay at home economy, but finding obvious winners that haven’t already made huge price moves is a challenge. This weeks insider buys reflect a couple of new ideas.

First, FEDEX Director Marvin Ellison bought 2200 shares at $164.53. FEDEX and UPS are both huge beneficiaries of the shop from home trend. UPS had a sizable insider buy back on 5-29 when the CEO bought 10,100 shares at $99.33. Since then he is up 19.15% on the purchase. We’d be adding to both UPS and FDX on any pullbacks. They have both been perceived to be at the mercy of Amazon which is moving heavily into shipping. It now seems that fear is overblown as EVERYONE is now shipping more.

Someone needs to tell Warren Buffett that he is all washed up, his brand of value investing has come and gone, and its now time to forget fundamentals and hop on the momentum bandwagon. Why else would he buy $813 Million of Bank of America BAC at $23.99? Doesn’t he know that the banking sector is just about the worst sector after hospitality, airlines, travel, and oil and gas? Oh yea, they say Buffett is over the hill but I for one would not bet on that. BAC at $23.99 is a moderate buy if we don’t have a major depression or the second coming of the Great Depression.

GES Guess Inc hope springs eternal for this out of favor fashion wear icon. CEO Carlos Alberini bought 100,000 shares at $10.17. His last purchase was on June 12, 2019 at $14.32. I don’t think anyone can call this a track record as Covid gives a lot of people a mulligan, Alberini included. I don’t feel sympathetic though as Alberini is on the board at Restoration Hardware and has done quite nicely there.

Follow us on Twitter for real time insider buying alerts at https://twitter.com/theinsidersfund

Insiders sell stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer friendly and responsive I’ve used. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believe they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001, when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019