CASSAVA SCIENCES INC up 28.59%

CORPORATE OFFICE PROPERTIES TRUST up 2.57%

GOLUB CAPITAL BDC Inc. up 0.54%

HARTFORD FINANCIAL SERVICES GROUP Inc down 0.50%

BROADCOM INC down -1.29%

Casssava was up 28.59% on the week while the S&P notched its 4th consecutive week in decline, down 0.52%. There is an old adage on Wall Street, Sell Rosh Hashana buy Yom Kippur. Historically it does show some uncanny consistency but perhaps it’s more from the fact the Jewish Holiday routinely falls toward quarter end when insiders are blacked out from buying their own stock than observant Jews absent from the trading desk.

SAVA is a developmental stage biotech pioneering an entirely new approach to tackling Alzheimer’s. There have been so many high profile costly failures that any glimmer of hope is rewarded with astounding price movement. Cassava is an early state biotech working on a novel approach to Alzheimer’s. Two buys, one particularly large by the 94 year old director Sanford Robertson ignited the stock. Director Roberston bought 1,491,759 shares at $6.98 after the news of positive phase 2 results. We have been following SAVA since the first insider buys by Robertson last December in the $2 range. This week in the aftermath of Phase 2 trials, Robertson and its’s CEO came back to the buying board. Robertson is the lead Independent Director, salesforce.com, inc. and a founder of Robertson Stephens & Co. and Francisco Partners Management LP,

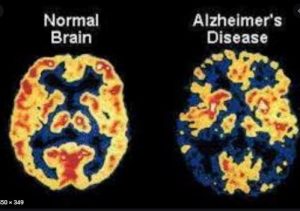

Alzheimer’s disease is a progressive disorder that causes brain cells to waste away (degenerate) and die. Alzheimer’s disease is the most common cause of dementia — a continuous decline in thinking, behavioral and social skills that disrupts a person’s ability to function independently. It’s fatal and takes a horrible toll on the victim as well as their family. Alzheimer’s is the third. leading cause of death in the United States, and the only top-10 deadly disease not to have a treatment or cure. It is is the golden fleece of the biotech world. Next to a cure for cancer, there is no bigger prize in the pharmaceutical market.

SAVA is a battle ground stock as the first results from their trial in Phase 2b was disappointing and the stock plunged as low as $1.63. The Company thought there was something wrong with the independent analysis of their results. It’s been fighting its way back and the company stated that it would re-examine this Phas2b results and when they did this, they found a different conclusion.

If you don’t like the results you get the first time, try again?

This small trial was largely funded by the NIH. Cassava Sciences with $25 million in the bank, isn’t capitalized or staffed enough to run a pivotal AD trial with thousands of patients and dozens of study locations that would be needed to advance their patented molecule, sumifiliam.

Insiders know how the game is played in biotech. SAVA will need hundreds of millions of dollars to bring an AD drug to market. A small sub $100k buy by its CEO could be nothing more than window dressing in the efforts to get the price and volume up to a point where the Company can float more stock in a secondary. Robertson, himself a multimillionaire approaching 89, probably has more than a financial interest in Alzheimer’s as its a disease that inflects the elderly. Not that there is anything ethically wrong with this but you don’t want to be caught on the front side of the secondary and find 10 million shares for sale 15% less than what you paid.

Bottom line on SAVA. Do your own research. This is probably an all or nothing investment. If the path Cassava has chosen ends in a dead end, investors will lose all their investment. If by chance and genius, they are successful, the modest $274 Million market cap (24.9 million shares outstanding) could easily soar to a modest $56 Billion if they show efficacy in a phase III trial. Peter Lynch used to talk about 10 baggers. SAVA could be a 200 Bagger. We are buying on any dips.

To hear the latest web presentation from the company, click here

Corporate Offices Trust Director Taylor bought 10,000 shares of this office property REIT at $22.16. That’s what I call buying straw hats in the winter time. Normally I would be drawn to this kind of contrarian value buy but office property is in a secular downtrend. I think major corporations will be rationalizing their office requirements for years to come. Corporate Office’s focus on the defense sector provides some insulation against work-from-home risks that will overhang the office business. I don’t think OFC dividend yield of 4.7% is enough to insulate the investor from vacancy risks.

Golub Capital CEO and Chairman Golub have been steadily buying back shares in their namesake company for years now, buying about $500k more last week at an average prices of $12.87 to $13.33. Golub has a strong dividend history with an estimated yield of 9.0%. State Retirement Fund of Ohio is another larger institutional buyer of shares.

GBDC’s middle market Lending business caters private equity sponsors and their portfolio companies. They invest equity in their deals as well. Lawrence Golub, the CEO, is Harvard MBA and Law School graduate and billionaire. He is married to Karen Finerman, of CNBC fame. Karen runs a hedge fund and was married to Jim Cramer, CNBC star personality, for 20 years. It’s hard to go wrong following this much smarts but still one has to note that GBDC has stock price has done nothing since the initial listing in 2012. Be prepared to collect a dividend and perhaps not much else. GBCD has been paying a dividend since June 2010. They have reduced the quarterly dividend from $.33 to $.29 in the 2nd and 3rd quarter of this year. It’s no slam dunk how this lender’s share price will perform when all of the banking stocks are in the toilet.

GBDC share price has gone nowhere since its inception in 2010 in spite of massive share buybacks by the principals.On April 13th, 2020, the firm pre-announced a 2QFY20 drop in NAV from $16.66 to a range of $14.43 to $14.67, owing mostly to a decline in the fair value. The problems as I see it with this investment and other BDC and middle market lenders is that no one believes their marks. If GDBC could assure investors of the value underlying the collateral, I’d be all over this outsized yield. It’s the same problem with P.E. firms and GBDC is basically a lender partner to private equity. Let’s see a portfolio company make a grand exit at a big multiple. Golub needs a strategic exit.

Hartford Financial Services Group CEO Swift bought 6.975 shares of this property casualty insurer at $35.98. Insurance stocks have been pummeled by the pandemic and the Fed’s policy of maintaining rates at historically low levels. Hartford’s actual Covid-19 losses are quite small-The company estimates second quarter 2020 incurred losses related to COVID-19 of $251 million, before tax, or $198 million, after tax. It’s the lack of yield for fixed income and poorer returns on limited partnerships and alternative investments that are depressing its stock price. Nonetheless HIG is a solid dividend payer with an above average S&P 500 yield of 3.68%. Based on the chart, I’d say buy this Monday and make a few points, perhaps even hold until the November dividend is paid. Longer term investors might be comforted by buying an iconic blue chip less than its $46.59 book value.

I am a bit confused by this purchase from Henry Samuel, one of the founders of Broadcom, Inc. He gifted away169,912 shares and simultaneously bought 101,740 shares at $361.45 for a total purchase of $36,773,924. I guess the rich or different than you and I, they have tax strategies that we can only dream of. This looks like a way to take a charitable tax donation while at the same time, keeping your current level of ownership about the same. Considering Samuel owns at least 2.83 million shares according to this filing, he must really like the stock. Broadcom is perhaps best known for its attempt to buy Qualcomm a few years back. Broadcom is integral to the iPhone and most everything else that makes up modern digital society.

AVGO (Broadcom acquired Avago, a few years back) insider buying picture becomes even more clouded as there are numerous insider sales at or near this same price Samuel paid to buy stock. That is not surprising since tech companies give out options to their executives as a major form of compensation and they are always exercising and selling. It would be more comforting to lowly investors like ourselves, though, if the CEO would keep some of the stock that he exercised rather than flipping all of it. Perhaps other investors feel the same as most stocks now are popping big on an insider buys anywhere near the magnitude of Samuel’s purchase. AVGO is a solid longer term play on the health of the semiconductor industry but we would need to some more insider buying and less selling before we thought it was a compelling for our members.

[…] excess return was attributable to Cassava Sciences, SAVA. We first blogged about Cassava in our September 29th, 2020 post on The Insiders Report where we identified it as a possible 200 bagger. Peter Lynch first popularized the expression […]

[…] don’t really believe in the underlying value of their marks. We have written on this in previous posts. GBDC is an externally managed, closed-end, non-diversified management investment company […]