For trade details click on this link to the trades

Are we the only ones talking about how insiders have taken their chips off the board? This is the smallest amount of insider buying we have seen since 2016. Just looking back at my records, the S&P 500 was up 11.96% that year. Consider the S&P 500 is already up 12%, which doesn’t auger well for the remainder of the year. It’s hard not to get enthusiastic about a market making new highs, low-interest rates, the most dovish Fed Chairman in history, the 2nd most dovish at the Treasury, and a government determined to stimulate money to the economy. What I’d really like to know is where are all these insiders are not so enthusiastic. In particular, I’d like to know where they are putting all this money they are taking out of the market? Bitcoin, maybe? Certainly waterfront homes in Florida, second homes in ski resort areas, and well, your guess is as good as mine. This week the buying was pathetic but here it is none the less here it is. Remember you only need one good idea and not a lot of bad ones.

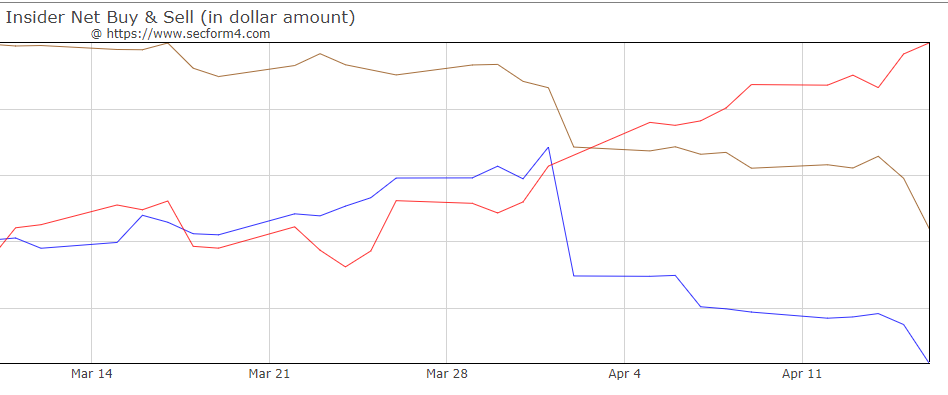

Blueline 5 days moving average of the ratio of buying to selling. It is plummeting. Brown line is 22-day ratio. Redline is the S&P 500. The market goes steadily higher without insiders buying into it.

Spark Networks LOV seems to have one group of hedge funds selling out and another buying, the definition of a true battleground stock. Spark Networks SE is a global dating company with a portfolio of brands designed for singles seeking serious relationships. These online dating brands include Zoosk, SilverSingles, EliteSingles, Jdate, Christian Mingle, eDarling, JSwipe, AdventistSingles, LDSSingles, and Attractive World. Spark Networks SE (“Spark Networks” or “the Company”) is domiciled in Germany and is a leading global operator of premium online dating sites and mobile applications. The Company targets the 40+ age demographic and religious-minded singles looking for serious relationships in North America and other international markets. The Company’s brands are tailored to quality dating with real users looking for love and companionship in a safe and comfortable environment.

They are traded as ADS, American Depository Receipts as this is a German company listed on our exchange.

I can’t make much out of the small amount of insider buying from Osmium Partners as there is an equally small amount of selling by 10% shareholder Canaan Partners. Where this is some related party transaction or not is beyond the time we have today to figure out. Spark recently announced expected revenue of $238-$234 million. This is not a small business. Cannacord analyst Austin Moldow raised his target price from $$0-$10 based on the company’s recent change to be domestic filer. He feels more transparency will increase the share price. Transparency is always a good thing. In the case of LOV, they could use plenty more. Effective January 1, 2021, we no longer qualify as a foreign private issuer under the Exchange Act and began reporting as a domestic registrant on January 1, 2021. Furthermore, we are now required under SEC rules to prepare our financial statements in accordance with U.S. GAAP, rather than International Financial Reporting Standards (“IFRS”). Therefore, our consolidated financial statements for fiscal years 2020 and 2019 included in this Annual Report on Form 10-K were prepared in accordance with U.S. GAAP. In addition, the reporting currency used in the consolidated financial statements has changed from the euro to U.S. dollars. The change in reporting currency has been applied retrospectively in the consolidated financial statements.

From their 10k-For the year ended December 31, 2016, the Company had 178,407 average paying subscribers, representing a decrease of 12.4% from the year ended December 31, 2015. Paying subscribers are defined as individuals who have paid a monthly fee for access to communication and website features beyond those provided to our non-paying members. Average paying subscribers for each month are calculated as the sum of the paying subscribers at the beginning and end of the month, divided by two. Average paying subscribers for periods longer than one month are calculated as the sum of the average paying subscribers for each month, divided by the number of months in such period.

For the year ended December 31, 2016, we had 142,372 period-ending subscribers, representing a decrease of 28.8% from the year ended December 31, 2015. Period ending subscribers are defined as the paying subscriber count as of the last day of the period.

Bottom line traffic is shrinking. Not a good thing.

In August 2016, they entered into a purchase agreement with PEAK6 Investments, L.P. (“PEAK6”), pursuant to which they issued and sold to PEAK6 an aggregate of 5,000,000 shares of common stock of the Company at a purchase price of $1.55 per share. They also issued a warrant to PEAK6 to purchase up to 7,500,000 shares of common stock of the Company at an exercise price of $1.74 per share pursuant to the terms of a warrant agreement.

In connection with the execution of the purchase agreement, the Company entered into a Management Services Agreement dated as of August 9, 2016 with PEAK6, pursuant to which PEAK6 provides certain marketing, technology, strategy, development and other services to the Company over a five-year term, for a cash fee of $1.5 million per year (the “Management Fee”), which will be paid on a quarterly basis in an amount of $375,000 per quarter. The Management Fee excludes reimbursement of marketing costs as described below, which are costs in addition to the Management Fee.

For the year ended December 31, 2016, the Company has expensed $259,000 for sales and marketing services performed by PEAK6. The Management Services Agreement may be terminated by the Company at its convenience upon at least 60 days prior written notice at any time after August 9, 2019, and may be terminated for cause at any time by PEAK6 or the Company upon the occurrence of certain events as set forth in the Management Services Agreement.

Between the three years 2016 to 2019, subscribers must have grown rapidly through organic and acquisition. In the latest 10k dated December 2020, average paying subscribers increased by 26.9% to 927,951 during the year ended December 31, 2020, compared to 731,088 during the year ended December 31, 2019. The increase was due to the addition of Zoosk.

During the half-year and full year ended December 31, 2020, average paying subscribers for Zoosk were 529,902 and 525,871, respectively, compared to 601,652 during the half-year ended December 31, 2019. The 11.9%, or 71,750 decrease in average paying subscribers for Zoosk in the second half of 2020 compared to the second half of 2019 was primarily due to lower direct marketing expenses for the Zoosk brand. Average paying subscribers for non-Zoosk brands decreased by 6.6% year over year also due primarily to lower direct marketing investment.

Bottom line LOV is in an attractive online business staking out solid niches on the periphery of the broader dating market. If they can prove they can run these niches profitably and cohesively, the stock could work and work big. For the time being, we are going to watch it for signs of top and bottom-line growth, the true determiner of any stock price.

Mack Cali Realty Corp CLI Director Katz bought 240,000 shares at $15.67. CLI is one of the country’s leading real estate investment trusts (REITs), Mack-Cali Realty Corporation is an owner, manager and developer of premier office and multifamily properties in select waterfront and transit-oriented markets throughout the Northeast. Mack-Cali is headquartered in Jersey City, New Jersey, and is the visionary behind the city’s flourishing waterfront, where the company is leading development, improvement and place-making initiatives for Harborside, a master-planned destination comprised of class A office, luxury apartments, diverse retail and restaurants, and public spaces.

Katz has a lot of conviction. He purchased 442,000 shares at $14.51 on 3/5/21 and then again 345,963 shares on 3/25 for $15.52 and his latest purchase at $15.67 This is all the more interesting as it is happening on the eve of the company suspending their dividend for the remainder of 2021 as they reposition their portfolios, unloading several office properties.

The CFO of Bed Bath and Beyond purchased 20,000 shares of BBBY at $25.45 on 4/16. We liked this purchase and bought shares ourselves but you have to keep this purchase in perspective. Gustavo Arnal is a new CFO and he is expected to buy stock. Bed Bath & Beyond Thursday named Gustavo Arnal as executive vice president and chief financial officer, effective May 4 so the fact that he waited until now might be meaningful. He will replace outgoing CFO and Treasurer Robyn D’Elia, who served as CFO since 2018.BBBY is undergoing a transformation, closing some stores, beefing up its online presence, and making the right moves to be a hybrid retailer, using online and bricks and mortar to its strength. With housing demographics as a tailwind, BBBY should be a conservative winner in the market over the next year. I just wish we would have loaded up on $7.80 and last July when Director Gove bought 34,000 shares at $7.89. I’m sure the CFO Arnal must be kicking himself in the butt too for waiting. What took him so long is a valid question? Director Shechter purchased 3000 shares at $25.45 helping support the turnaround thesis.

Ironically enough, we sold our house in Park City and are building in sleepy, bejeweled Midway. While waiting out the builder we moved into an apartment in downtown Salt Lake City, very close to where the above photo must have been taken. I can tell you first-hand train traffic is booming as we feel it night and day. Major railroads are all reporting 20% plus improvements in traffic. Greenbrier Companies has been a much better way to play this than Union Pacific or CSX

Greenbrier Companies CEO William Furman bought 50,000 shares of GBX at $43.85 on 4/21. He also bought 50,000 shares at $43,87 on 2-9-21. The Greenbrier Company is an American publicly traded transportation manufacturing corporation based in Lake Oswego, Oregon, United States. Greenbrier specializes in transportation services, notably barge and railroad car manufacturing, railroad car refurbishment, and railroad car leasing/management services. Wikipedia

Furman has steel balls. He last bought his stock at 5-15-20 with 100,000 shares at $16.52. when oil was trading near zero and railcars we being parked so as not to deliver any more oil as there was no more storage. Railroad traffic is booming now and it would be wise to follow Furman as he headed to a better place now. On April 6, Furman noted Our near-term outlook is becoming increasingly optimistic as rail fundamentals improve. Rail loadings are up year-to-date, driven by increased traffic in grain, intermodal, and other categories. Railroad velocity has slowed by nearly two miles per hour. Railcars in storage have decreased by more than 148,000 units from the 2020 peak storage level. Proposed environmental and other regulations in both North America and Europe should support secular demand for rail as a growing mode for freight transport. Fiscal stimulus and proposed infrastructure legislation are expected to further add to demand.”

Furman is one of those CEOs that trades his stock pretty heavily and decisively. Between April 25th and November 17th, 2017 Furman sold 950,000 shares for proceeds of $39,699,348. Those looked like smart trades as the stock got as low as $16.52. Curiously though the price he is paying now to buy some of those shares back is not very different than what he sold them for. The lifting of Covid manufacturing slow down will be very good for Greenbriar. A manufacturing renaissance in America will be even better should it come about. American manufacturing moves on rails.

Follow us on Twitter for real time insider buying alerts at https://twitter.com/theinsidersfund

[custom-twitter-feeds]

Insiders sell stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer-friendly and responsive I’ve used.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019, 4th Best in November 2020, 4th Best in January 2021 (I kid you not)