Curious how well insiders are doing with their buys? Click on this link or image above to scroll the significant buys of the last year.

Insiders mostly set out this historic runup in the last weeks of October. One buy we are fascinated with was the last-minute SEC filing of Marc Lore’s purchase of his startup Archer Aviation, $ACHR. We used this to provide our summary of the space, the incredible opportunity, and investment opportunities here with electric Vertical Take-Off and Landing vehicles. EVTOLs will be the next largest and most visible disruptive force in our economy. Not only will it decarbonize how we fly, but it will also change the very essence of transportation and urban living

Name: Stephens Kevin A

Position: Director

Transaction Date: 2021-10-27 Shares Bought: 1,110 Average Price Paid: $178.66 Cost:$198,310

Company: Crown Castle International Corp. (CCI)

Since 1994, Crown Castle has worked around the country to build and maintain the infrastructure behind the world’s most revolutionary technologies. This comprehensive portfolio of towers, small cells, and fiber gives people and communities access to essential data, technology, and wireless service and opens the door to countless opportunities and possibilities. We continue to work closely with wireless carriers, businesses, technology companies, governments, and communities to make sure these transformative ideas and innovations find their way to those who rely on them. Crown Castle owns, operates, and leases more than 40,000 cell towers and approximately 80,000 route miles of fiber supporting small cells and fiber solutions across every primary U.S. market. This nationwide portfolio of communications infrastructure connects cities and communities to essential data, technology, and wireless service – bringing information, ideas, and innovations to the people and businesses that need them.

Mr. Stephens most recently served as Executive Vice President and President, Business Services for Altice USA. In that role, he was responsible for $1.4 billion in annual revenue, providing high-speed data connectivity and cloud services to enterprise, wholesale, and small and medium business customers. Before his role with Altice, Mr. Stephens served as President, Commercial and Advertising Operations at Suddenlink Communications. Mr. Stephens previously held senior leadership positions at Fortune 500 and start-up firms, including Cox Communications, Choice One Communications, and Xerox Corporation, where he started his career.

Opinion: I wrote on 7-30-21 that investors should follow Director Landis when he bought stock. He’s underwater on this purchase. Director Stephens has had three previous purchases at CCI, his first on 2-1-1 with 2000 shares at $164.15.

The cellular tower leasing business has got strong secular winds at its back. 5g rollout is in the first innings and both Democrats and Republicans support 5G as part of the desire to have broadband internet everywhere.

You won’t get rich off the 3.26% dividend yield for this REIT but you don’t have to worry about the dividend and it will most likely increase in time moving the stock price higher with it. The two big risks to this investment thesis are rising interest rates dragging down all interest-rate sensitive sectors such as REITs. The other risk is technological obsolescence. Will Space X and Elon Musk’s global constellation of low orbit satellites be a competitive threat to 5G broadband internet? I’m sure it will be an option but I think the demand for broadband is insatiable for the next several years. Rates are likely to rise but at a very muted pace. CCI is a buy on any pullbacks and we are buyers on this one. You do have to be careful what you pay though as this is not going to be a runaway growth stock

So what’s really bugging Crown Castle? I tried comparing the performance of interest-rate sensitive entities such as bond ETFs but that doesn’t account for the marked underperformance since the end of August beginning of September. When I compare the charts of the utility ETF and CCI there is a striking similarity. Both CCI, utilities have underperformed the market and broad-based real estate ETFs. Why utilities have underperformed is another issue. I’d like to posit it is fear of rising rates but that’s not supported by facts. The true rate barometers like Government bond ETFs have barely budged. It’s very possible that the market is sniffing out higher rates but the Federal Reserve is holding rates down. Corporate bonds look quite different. Contrast the Vanguard Corporate Intermediate Bond ETF with Crown Castle above

Name: Helm Larry L

Position: Director

Transaction Date: 2021-10-22 Shares Bought: 5,000 Average Price Paid: $60.52 Cost: $302,600

Name: Stallings Robert W

Position: Director

Transaction Date: 2021-10-22 Shares Bought: 55,000 Average Price Paid: $60.46 Cost: $3,325,050

Name: Stallings Robert W

Position: Director

Transaction Date: 2021-10-27 Shares Bought: 5,000 Average Price Paid: $58.50 Cost:$292,500

Name: Anderson Julie L

Position: CFO

Transaction Date: 2021-10-25 Shares Bought: 4,000 Average Price Paid: $60.41 Cost: $241,640

Company: Texas Capital Bancshares Inc. (TCBI)

Texas Capital Bancshares, Inc. operates as the bank holding company for Texas Capital Bank, National Association that provides various banking products and services for commercial businesses, and professionals, and entrepreneurs. It offers business deposit products and services, including commercial checking accounts, lockbox accounts, and cash concentration accounts, as well as other treasury management services, including information services, wire transfer initiation, ACH initiation, account transfer, and service integration; and consumer deposit products, such as checking accounts, savings accounts, money market accounts, and certificates of deposit. The company also provides commercial loans for general corporate purposes comprising financing for working capital, internal growth, and acquisitions, as well as financing for business insurance premiums; real estate term and construction loans; mortgage warehouse lending; mortgage correspondent aggregation; equipment finance and leasing; treasury management services, including online banking and debit and credit card services; escrow services; and letters of credit. In addition, it offers personal wealth management and trust services; secured and unsecured loans; and online and mobile banking services. Further, the company provides American Airlines AAdvantage, an all-digital branch offering depositors. It operates in Austin, Fort Worth, Dallas, Houston, and the San Antonio metropolitan areas of Texas. Texas Capital Bancshares, Inc. was founded in 1996 and is headquartered in Dallas, Texas.

Larry L. Helm currently serves as Chairman of Texas Capital Bancshares, Inc. (NASDAQ®: TCBI). Helm has been chairman of the board of directors for Texas Capital Bancshares, Inc. since 2012, and has been a director since 2006 until his appointment as chairman. Helm served as a senior advisor at Accelerate Resources, a data-driven energy company engaged in the development and production of oil and gas assets, from 2016 to 2020. Before joining Accelerate Resources, he served as executive vice president of corporate affairs at Halcón Resources Corporation, now called Battalion Oil Corporation. Previously, Helm served as the chief administrative officer of Petrohawk Energy Corporation from 2004 until its sale to BHP Billiton in 2011. He served as vice president – transition with BHP Billiton before joining Halcón Resources.

Robert W. Stallings has served as a director since August 2001. He has also served as Chairman of the Board of Directors and Chief Executive Officer of Stallings Capital Group, an investment company, since March 2001. From 1991 to 2001, Mr. Stallings served as Chief Executive Officer of Pilgrim Capital Group, an investment company. He is currently Executive Chairman of the Board of GAINSCO, Inc.

Julie Anderson serves as the chief financial officer for Texas Capital Bank and its parent company, Texas Capital Bancshares, Inc. (NASDAQ®: TCBI). She is responsible for all accounting and financial reporting functions, as well as financial planning and analysis, capital planning, and funds management. She has oversight responsibility for operations and service, investor relations, corporate communications, strategic sourcing, and facilities. Anderson joined Texas Capital in February 1999, shortly after its formation in 1998, as the controller for both Texas Capital Bancshares, Inc. and Texas Capital Bank. She served as chief accounting officer from 2003 to 2018 and was named CFO of Texas Capital Bank in 2013.

Opinion: Regional bank stocks should be doing better in a strong economy with rising rates, assuming that’s what the consensus economic picture is forecasting. The regional bank ETFs KRE are beating the S&P 500 yet TCBI is clearly underperforming its peers. Why? That’s what the board is trying to figure out? New management was brought into the bank in January. They have begun the long process of resetting expectations and clearing the deck chairs. Analysts have gotten frustrated by the new management’s recalculation of time and effort for the turnaround. Based on this cluster buying, I think there is light at the end of the tunnel and we are buyers.

Name: Shulman Douglas H

Position: CEO

Transaction Date: 2021-10-26 Shares Bought: 2,250 Average Price Paid: $56.12 Cost: $126,274

Company: OneMain Holdings Inc. (OMF)

OneMain Financial is America’s largest personal installment loan company with 2.2 million customers. They are competing with a rash of newly started fintech companies.

Doug Shulman is Chairman and CEO of OneMain Financial. He leads the nation’s largest non-prime lender focused on improving the financial well-being of millions of hardworking Americans by providing responsible lending products. Doug has significant experience managing large, complex organizations at the intersection of financial services, data, and technology. He came to OneMain in 2018 from BNY Mellon, where he served as Senior Executive Vice President, Global Head of Client Service Delivery, and was a member of the Executive Committee. Before BNY Mellon, Doug was a Senior Advisor at McKinsey & Company. From 2008 to 2012, he served as the Commissioner of the Internal Revenue Service (IRS).

Opinion: I think this is just a CEO buying stock as expected in his employment contract. I wouldn’t put any emphasis on it. It’s a small buy and he purchased 8,575 shares back on 8-5-21. One Main Holding does pay a whopping 5.30% dividend yield. We are on the sidelines here.

Name: Gelsinger Patrick P

Position: CEO

Transaction Date: 2021-10-25 Shares Bought: 10,000 Average Price Paid: $49.94 Cost: $499,398

Name: Weisler Dion J

Position: Director

Transaction Date: 2021-10-25 Shares Bought: 5,015 Average Price Paid: $49.85 Cost: $249,998

Name: Goetz James J

Position: Director

Transaction Date: 2021-10-25 Shares Bought: 20,000 Average Price Paid: $49.76 Cost: $995,200

Name: Yeary Frank D

Position: Director

Transaction Date: 2021-10-25 Shares Bought: 10,000 Average Price Paid: $49.66 Cost: $496,595

Name: Lavizzo-Mourey Risa J

Position: Director

Transaction Date: 2021-10-25 Shares Bought: 5,000 Average Price Paid: $49.50 Cost: $247,500

Name: Weisler Dion J

Position: Director

Transaction Date: 2021-10-26 Shares Bought: 5,147 Average Price Paid: $48.57 Cost: $249,978

Company: Intel Corp. (INTC)

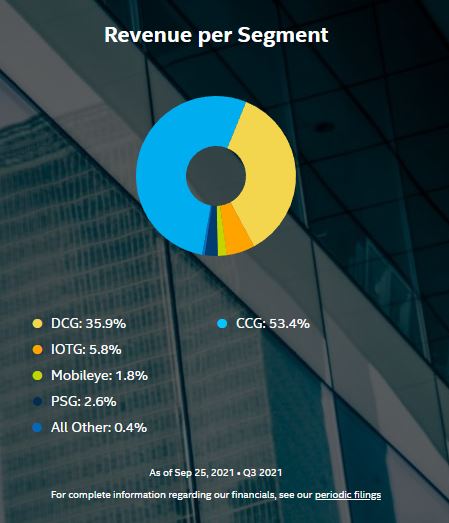

IIntel Corporation is an American multinational corporation and technology company headquartered in Santa Clara, California. It is the world’s largest semiconductor chip manufacturer by revenue and is the developer of the x86 series of microprocessors, the processors found in most personal computers (PCs). Incorporated in Delaware, Intel ranked No. 45 in the 2020 Fortune 500 list of the largest United States corporations by total revenue for nearly a decade, from 2007 to 2016 fiscal years. Intel Corporation designs manufacture and sells essential technologies for the cloud, smart, and connected devices for retail, industrial, and consumer uses worldwide. The company operates through DCG, IOTG, Mobileye, NSG, PSG, CCG, and All Other segments. It offers platform products, such as central processing units and chipsets, and system-on-chip and multi-chip packages; and non-platform or adjacent products comprising accelerators, boards and systems, connectivity products, and memory and storage products. The company also provides Internet of Things products, including high-performance compute solutions for targeted verticals and embedded applications; and computer vision and machine learning-based sensing, data analysis, localization, mapping, and driving policy technology. It serves original equipment manufacturers, original design manufacturers, and cloud service providers. Intel Corporation has a strategic partnership with MILA to develop and apply advances in artificial intelligence methods for enhancing the search in the space of drugs.

Patrick (Pat) Gelsinger is the chief executive officer of Intel Corporation and serves on its board of directors. On Feb. 15, 2021, Gelsinger returned to Intel, the company where he had spent the first 30 years of his career. Gelsinger began his career in 1979 at Intel, becoming its first chief technology officer, and also serving as senior vice president and the general manager of the Digital Enterprise Group. He managed the creation of key industry technologies such as USB and Wi-Fi. He was the architect of the original 80486 processor, led 14 microprocessor programs, and played key roles in the Intel® Core™ and Intel® Xeon® processor families, leading to Intel becoming the preeminent microprocessor supplier.

Dion Weisler was elected to Intel’s board of directors as an independent director in June 2020. Weisler is a member of the boards at Thermo Fisher Scientific Inc. and BHP. From 2015 to 2019, he served as president and chief executive officer of HP Inc., a computer, printer, and related supplies technology company. Weisler also served as a member of HP’s board of directors from 2015 to May 2020. His prior experience includes senior executive roles at HP and Lenovo Group Inc., where he was responsible for various operations in the Asia Pacific and globally. Weisler also served in management positions with Telstra Corp. Ltd., a telecommunications company, and Acer Inc.

James (Jim) J. Goetz was elected to Intel’s board of directors as an independent director in November 2019. He is a partner of Sequoia Capital, a venture capital firm. Goetz joined Sequoia Capital in June 2004. Prior to joining Sequoia, Goetz co-founded VitalSigns Software, where he assembled and led the team that pioneered end-user performance management. Prior to VitalSigns, he was vice president of Network Management for Bay Networks. Goetz currently serves on the boards of several privately held companies, and, since April 2005, on the board of Palo Alto Networks Inc., a network security solution company. Goetz previously served on the boards of directors of Barracuda Networks Inc., a data security and storage company from 2009 to 2017; Nimble Storage Inc., a data storage company, from 2007 to 2017; Jive Software Inc., a provider of social business software, from 2007 to 2015; and Ruckus Wireless Inc., a manufacturer of wireless (Wi-Fi) networking equipment, from 2012 to 2015, among others

Frank D. Yeary has served as a director of Intel since 2009. Yeary is the managing member at Darwin Capital Advisors LLC, a private investment firm, and was executive chairman of CamberView Partners LLC, a corporate advisory firm, until 2018. Prior to this time, Yeary was vice-chancellor of the University of California, Berkeley, and before that spent 25 years in the finance industry, including as global head of mergers and acquisitions and as a member of the management committee at Citigroup Investment Banking. Yeary also serves on the board of directors of PayPal Holdings and a number of private companies.

Dr. Lavizzo-Mourey was elected to Intel’s board of directors as an independent director in March 2018. Lavizzo-Mourey was the Robert Wood Johnson Foundation PIK Professor of Population Health and Health Equity at the University of Pennsylvania from 2018 to 2021. From 2003 to 2017, she was the president and chief executive officer of the Robert Wood Johnson Foundation, the largest U.S. philanthropy organization dedicated to health. Lavizzo-Mourey is a member of the boards of directors of General Electric Co. and Merck & Co. She previously served as a director at Genworth Financial Inc., Beckman Coulter Inc., and Hess Corp. She is also a member of the National Academy of Medicine, the American Academy of Arts and Sciences, The American Philosophical Society, and is on the board of regents of the Smithsonian Institution and on the board of trustees for the Howard Hughes Medical Institute.

Dion Weisler was elected to Intel’s board of directors as an independent director in June 2020. Weisler is a member of the boards at Thermo Fisher Scientific Inc. and BHP. From 2015 to 2019, he served as president and chief executive officer of HP Inc., a computer, printer, and related supplies technology company. Weisler also served as a member of HP’s board of directors from 2015 to May 2020. His prior experience includes senior executive roles at HP and Lenovo Group Inc., where he was responsible for various operations in the Asia Pacific and globally. Weisler also served in management positions with Telstra Corp. Ltd., a telecommunications company, and Acer Inc.

Opinion: Intel has truly become a battleground stock owned by deep value players and scorned by growth investors and technologists. Some would say that Intel has fallen so far behind its peers like Nvidia and Taiwan Semiconductor that there is no possibility of crawling out of the Jeffrey Moore chasm the chip giant has fallen into. Moore’s iconic book published in 1991 still holds powerful sway amongst marketers of technology. Once a lead and dominance have been established everyone falls in line and the die is cast. Game over.

Don’t try and tell that to the group of insiders ponying up money to buy shares of Intel. The analyst community seems to be in agreement with Goldman Sachs analyst Toshiya Hari who reiterated a Sell rating on the shares. Intel will have to forfeit short-term profits to regain process node parity/leadership. It will require higher levels of CAPEX. The consensus view is that management is doing the right thing but investors don’t need to buy the stock. This is setting up for a big buying opportunity but the catalysts could be a long way out. Why buy now? That’s the market response.

How does an investor play this? Buying the stock for its 2.8% dividend yield is one way but it could be a mistake as the dividend could be one of the first sacrifices to the CAPEX plan. Intel’s competitors like AMD pay no dividends and Nvidia a paltry one. One could sell far out of the money puts and collect premium but this ties up a lot of capital for the possibility of minimal gain.

I want to invest in semiconductors. It’s the digital heartbeat of the 21st-century economy. One could just buy the broad-based semiconductor ETF, SMH. That looks like a far safer bet than INTC for now. Don’t ignore the Black Swan event though. If China moves on Taiwan- Intel stock could soar as much of the world’s output is made on the island nation. Even that is far from certain as the entire market would likely collapse bringing INTC with it. For now, we have a small position. This much insider buying just forces our hand. Perhaps the insiders are closer to the truth than the analyst community?

Intell will have to diversify its revenue segments as today it is tied heavily to the PC and Data Center.

Name: Lore Marc E

Position: 10% Owner

Transaction Date: 2021-10-27 Shares Bought: 444,272 Average Price Paid: $5.64 Cost: $2,504,212

Company: Archer Aviation Inc. (ACHR)

Archer is an aerospace company building an all-electric vertical takeoff and landing aircraft focused on improving mobility in cities. The company’s mission is to advance the benefits of sustainable air mobility. Archer is designing, manufacturing, and operating a fully electric aircraft that can carry four passengers for 60 miles at speeds of up to 150mph while producing minimal noise. Archer’s team is based in the San Francisco Bay Area. Archer’s mission is to advance the benefits of sustainable air mobility. With headquarters in Palo Alto, California, Archer is creating the world’s first electric airline that moves people throughout cities in a quick, safe, sustainable, and cost-effective manner. As the world’s only vertically integrated airline company, Archer’s world-class team focuses on vertically integrating key enabling technologies, including aircraft design, electric powertrain, and flight control software to revolutionize air travel.

Marc Lore, the executive vice president, president and CEO of U.S. e-commerce for Walmart stepped down a little over four years after selling his e-commerce company Jet.com to the country’s largest retailer for $3 billion. Lore’s tenure at the company was a mixed bag. Walmart instituted several new technology initiatives under Lore’s tenure, but the Jet.com service was shuttered last May.

Marc was previously the Chief Operating Officer of Wizkids, Inc., a wholly-owned subsidiary of The Topps Company, Inc. (NASD: TOPP) and a leading game manufacturer. Before joining Wizkids, Marc was the co-founder and CEO of The Pit, Inc., an Internet market-making collectible company constructed as an alternative to eBay. The Pit, Inc. was successfully sold to the then publicly traded Topps Company in 2001. Lore is the lead investor in Archer Aviation, an electric vertical takeoff and landing (eVTOL) company focused on advancing the benefits of sustainable air mobility. In February 2021, Archer announced Lore would be investing an additional $10 million as the company announced their $1 billion purchase order from United Airlines and a SPAC.

Opinion: I believe that EVTOLs will be the next largest and most visible disruptive force in our economy. Not only will it decarbonize how we fly, but it will also change the very essence of transportation and urban living. Electric vertical takeoff aircraft will start to appear in major cities by 2024. The adoption could be swift and overwhelming. They will replace helicopters with astonishing speed.

The question, though, is can investors make money here? No doubt all the major aircraft manufacturers and airline companies are totally committed to embracing this zero-carbon future of short-haul transportation.

Toulouse, 21 September 2021 – Airbus has announced plans for a new CityAirbus at the Company’s first #AirbusSummit on “Pioneering Sustainable Aerospace” as the emerging Urban Air Mobility (UAM) market begins to firm up. Ushering in the next generation of CityAirbus, the fully electric vehicle is equipped with fixed wings, a V-shaped tail, and eight electrically powered propellers as part of its uniquely designed distributed propulsion system. It is designed to carry up to four passengers in a zero-emissions flight in multiple applications.

From new air vehicles to solar airplanes and unmanned helicopters, Boeing subsidiary Aurora Flight Sciences is building autonomous aircraft to reimagine the future of flight. Aurora Flight Sciences is part of Boeing NeXt, an organization that’s leading the safe and responsible introduction of next-generation air vehicles for urban, regional, and global mobility.

“As you can appreciate every one of the proposed manufacturers has been after Delta. We’ve heard from many of them,” Bastian said referring to eVTOL developers. “We’re studying this space and we will continue to get good smartness space. I think it’s at a very, very early stage right now and I think a lot of the plans that we see are a bit premature, candidly. But it’s not anything that we are unaware of and I guarantee every one of those manufacturers would love to have Delta colors on their plane. So hard to predict timing but we’re in the marketplace having lots of conversations.”

In a research note published Thursday, July 15th, 2001 Morgan Stanley analysts led by Adam Jonas claim that Tesla Aviation is not a question of if but when, predicting that the urban air mobility (UAM) market could be worth as much as $1,000 per share to the company.

There are several new entrants into this market. Lore’s company Archer Aviation is a leading one, as well as Joby Aviation which has Silicon Valley billionaire and Linkedin founder, Marc Hoffman as its prime investor. Toyota has invested $500 million into Archer. Archer bought Uber’s IP in regards to air taxi technology and will undoubtedly be a force to reckon with. Below is a list of public EVTOL companies. An investor could take the shotgun approach and invest a little bit in all of them, wait and see how their economic models payout or go all-in on a bet on the winner. The derivative plays on this revolution are also exciting. Real estate within 150 miles of major urban centers suddenly becomes accessible to affluent vacationers, office building rooftops have new leasing opportunities, short-haul airplane routes pop up all over the country, and so on.

Morgan Stanley estimates the eVTOL industry will reach $1.5 trillion as we explore urban air travel to reduce traffic and open up a brand new wave of intracity travel. Right now, investing in eVTOL stocks could be like buying Tesla in the early days

- Blade Air Mobility (BLDE) BLADE is a technology-powered, global urban air mobility platform committed to reducing travel friction by enabling cost-effective air transportation alternatives to some of the most congested ground routes in the U.S. and abroad. $657M market cap

- 2. Archer Aviation (ACHR) $1.37B market cap

- 3. Joby Aviation (JOBY) $5.24B market cap Investors Toyota partnership with Uber

- 4. eHang (EH) Guangzhou EHang Intelligent Technology Co. Ltd is a company based in Guangzhou, China that develops and manufactures autonomous aerial vehicles and passenger AAVs which have entered service in China for aerial cinematography, photography, emergency response, and survey missions. $1.3B market cap

- 5. Broadstone Acquisition Corp (NYSE: BSN) announced a deal to acquire Vertical Aerospace Group, LTD new ticker EVTL. Vertical also announced investments from American Airlines, Avolon, Honeywell, and Rolls-Royce, which have invested in the PIPE and are part of Vertical’s strategic partner ecosystem. Microsoft’s M12, 40 North, and Rocket Internet SE have also invested in the business. American has committed to preorder 250 aircraft. $2.2B market cap

- 6. Qell Acquisition Corp merged with Lillium LILM market cap $2.56B 7 seater electric jet with a radical design

- 7. VTOL eve Urban Air Mobility, LLC, an Embraer company, and Bristow Group Inc. (NYSE: VTOL), the global leader in vertical flight solutions, announced today a Memorandum of Understanding to work together to develop an Air Operator’s Certificate (AOC) for Eve’s electric vertical takeoff and landing (eVTOL) aircraft. The partnership will develop an Urban Air Mobility (UAM) operating model using Bristow’s experience in safely transporting passengers and cargo worldwide. In addition, Bristow has placed an order for up to 100 eVTOLs with deliveries expected to start in 2026. With over six decades of aviation solutions crossing the globe, Bristow is the world’s leading provider of helicopter transportation to oil and gas customers, search and rescue (SAR) and aircraft support solutions to government and civil organizations. Bristow offers the latest training and safety standards and includes a fleet of approximately 240 of the industry’s most modern aircraft, targeting the growing demand for reliable, integrated aviation solutions. This is my best idea in this group. With a market cap,$977M, just a fraction of the rest, although we bought ACHR after hours on Friday. If Bristow can transform itself from an offshore oil rig helicopter transportation system to a cutting edge urban air mobility play- watch out. We have a 10 bagger but I would wait for the big insider buy that confirms this possibility.

- ZNTE Zanite is targeting companies in the Aviation, Aerospace & Defense, Urban Mobility, and Emerging Technology sectors

with an Enterprise Value of $750M+ They announced June 10 confirmed that it is in negotiations relating to a potential business combination with Eve Urban Air Mobility Solutions, Inc., a subsidiary of Embraer S.A., a Brazilian corporation. There can be no assurance that a definitive agreement will be entered into or that the proposed transaction will be consummated

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer-friendly and responsive I’ve used.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019

[…] We wrote extensively on Archer Aviation last week, Marc Lore gets high on his own supply of Archer Aviation. We love the whole EVTOL space. It’s the next big thing but I have no idea how you will make […]