Curious how well insiders are doing with their buys? Click on this link or image above to scroll the significant buys of the last year.

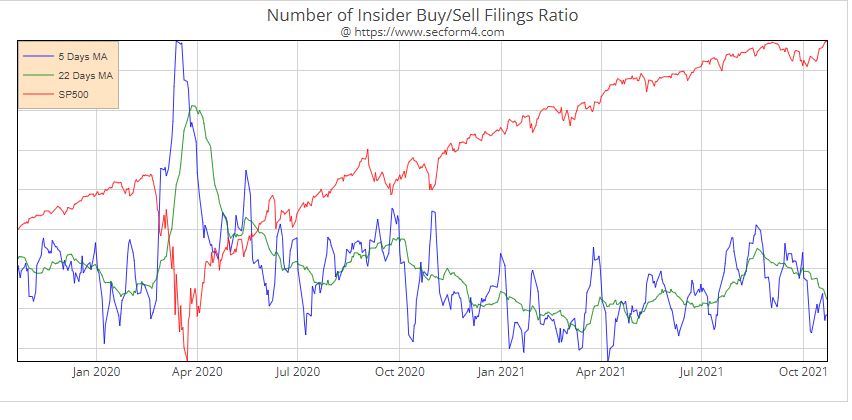

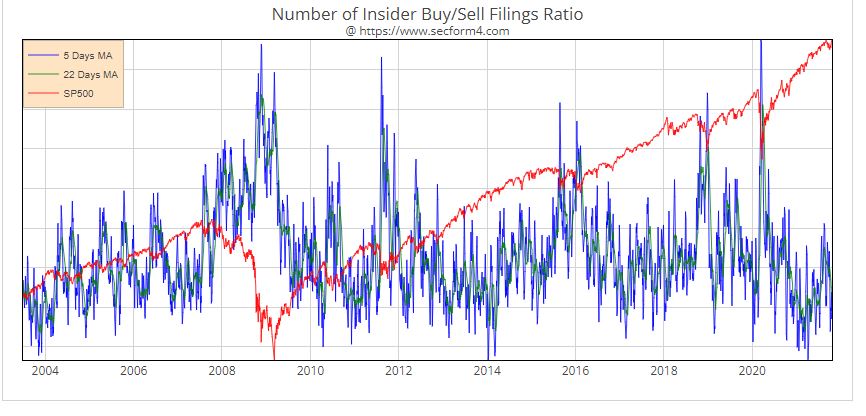

You think there can’t get any less insider buying but it gets worse week by week. Check out this ratio of insider buying/selling charted against the S&P 500. March 2020 insiders rushed to play the game. Now they are in full retreat knowing that we are just one move away from getting their head blown off. The stock market is starting to resemble Netflix’s dystopian hit, The Squid Game. Asset prices are at record highs, insiders are on strike, but money managers must play the game- they have no choice. The rest of us know that we will never have enough money to retire and must hustle and scrape by the best way we can. The stock market is our squid game. As much as I want to believe it’s all earnings blackout related, I know it’s not. There are damn few compelling reasons to buy most stocks at these valuations and insiders know it. Insiders as a group are value buyers, not index chasers or performance mongers.

Yet at the end of the day, we all know we need to keep coming back to the game. Sitting on cash, if you’re fortunate enough to have it, is a depreciating asset. None other than Warren Buffett has proclaimed cash as a sure-fire loser. With inflation now out of the bottle and showing no signs of retreating, there is increased urgency to win the game. With Federal Reserve interest rates at near zero, what choice do we have to play?

The modest decline of September has been completely released by the relief rally of the last three weeks now that a budget calamity is off the table. Historically the last quarter of the year is the best time to be invested in the market. This year might be different. The budget games Congress is playing may throw a monkey wrench into this seasonality. Common sense would tell you that they will come up with a way to pay the Country’s debt and avoid a first-ever default of the U.S. Government. The division and enmity of each side of the aisle though are at extreme levels. I head Dr. Shiller, a great economic historian, put it simply- “both sides think the other side is lying.”

Name: Fairhead Rona Alison

Position: Director

Transaction Date: 2021-10-14 Shares Bought: 2,277 Average Price Paid: $96.02 Cost: $218,640

Company: Oracle Corp. (ORCL)

Oracle Corporation provides products and services that address enterprise information technology environments worldwide. Its Oracle cloud software as a service offering includes various cloud software applications, including Oracle Fusion cloud enterprise resource planning (ERP), Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain and manufacturing management, Oracle Fusion cloud human capital management, Oracle Fusion cloud advertising, and customer experience, and NetSuite applications suite. The company also offers cloud-based industry solutions for various industries; Oracle application licenses; and Oracle license support services. In addition, it provides cloud and licenses business infrastructure technologies, such as the Oracle Database, an enterprise database; Java, a software development language; and middleware, including development tools and others. The company’s cloud and license business’ infrastructure technologies also comprise cloud-based compute, storage, and networking capabilities through its Oracle cloud infrastructure as a service offering. Further, it offers infrastructure offerings comprising Oracle autonomous data warehouse cloud service, Oracle autonomous transaction processing cloud service, Internet-of-Things, digital assistant, and blockchain. Additionally, the company provides hardware products and other hardware-related software offerings, including Oracle, engineered systems, enterprise servers, storage solutions, industry-specific hardware, virtualization software, operating systems, management software, and related hardware services; and consulting services. The company markets and sells its cloud, license, hardware, support, and services offerings directly to businesses in various industries, government agencies, and educational institutions, as well as through indirect channels. Oracle Corporation was founded in 1977 and is headquartered in Austin, Texas.

Rona A. Fairhead most recently served as Minister of State for Trade and Export Promotion for the United Kingdom Department for International Trade from September 2017 to May 2019. Previously, Fairhead served as chair of the British Broadcasting Corporation Trust (BBC) from 2014 to 2017. From 2006 to 2013, she was chair and chief executive officer of the Financial Times Group Limited, which was a division of Pearson plc, and, prior to that, she served as Pearson’s chief financial officer. Before joining Pearson, Fairhead held a variety of leadership positions at Bombardier Inc. and Imperial Chemical Industries plc. Fairhead serves as a director of Electrocomponents plc. She has previously served as a director of HSBC Holdings plc and PepsiCo, Inc. She is a member of the UK House of Lords.

Opinion: Oracle has had its best run-up in price in decades literally. Oracle is up 56% YTD. You have to go back to 1999, the height of the last tech stock mania to find a better year. We all know what happened shortly after that. Oracle appears to be the legitimate 3rd player in the great movement to the cloud. There is Amazon AWS, Microsoft Azure, and Oracle with its much-hyped hybrid cloud solution. It appears to be working. This is Director Fairhead’s third purchase since becoming a director in July 2019. Her largest purchase was 10242 shares on 3-16-2020 at $67.27 per share.

According to Fly on the Wall, Goldman Sachs analyst Kash Rangan raised the firm’s price target on Oracle to $66 from $60 and keeps a Sell rating on the shares following last night’s fiscal Q1 results. The company’s total revenue growth at 2% in constant currency, a deceleration from 4% in Q4, Rangan tells investors in a research note. The analyst wants to see a “sustained inflection” in the non-ERP software-as-a-service business and autonomous database “beginning to move the needle” before getting more positive on the shares. I find that opinion interesting and rather bold but worthless since even at the time of making it ORCL was 30% higher in price. Analysts may have a great understanding about the industry they cover and the company’s fundamentals but they are just as clueless as the next person as to where the stock market will price something making me question the value of their efforts and the worthwhileness of their endeavor. As you know I prefer insider buying than analysts’ opinions.

Name: ISTAR Inc

Position: 10% Owner

Transaction Date: 2021-10-19 Shares Bought: 13,164 Average Price Paid: $75.96 Cost: $999,937

Name: ISTAR Inc

Position: 10% Owner

Transaction Date: 2021-10-18 Shares Bought: 13,358 Average Price Paid: $74.86 Cost: $999,980

Name: ISTAR Inc

Position: 10% Owner

Transaction Date: 2021-10-20 Shares Bought: 13,185 Average Price Paid: $75.84 Cost: $999,950

Company: Safehold Inc. (SAFE)

Safehold Inc. (NYSE: SAFE) is revolutionizing real estate ownership by providing a new and better way for owners to unlock the value of the land beneath their buildings. Through its modern ground lease capital solution, Safehold helps owners of high-quality multifamily, office, industrial, hospitality and mixed-use properties in major markets throughout the United States generate higher returns with less risk. The Company, which is taxed as a real estate investment trust (REIT) and is managed by its largest shareholder, iStar Inc., seeks to deliver safe, growing income and long-term capital appreciation to its shareholders.

iStar Inc. (NYSE: STAR) is focused on reinventing the ground lease sector, unlocking value for real estate owners throughout the country by providing modern, more efficient ground leases on all types of properties. As the founder, investment manager, and largest shareholder of Safehold Inc. (NYSE: SAFE), the first publicly traded company to focus on modern ground leases, iStar is helping create a logical new approach to the way real estate is owned and continues to use its historic strengths in finance and net lease to expand this unique platform. Recognized as a consistent innovator in the real estate markets, iStar specializes in identifying and scaling newly discovered opportunities and has completed more than $40 billion of transactions over the past two decades.

Opinion: I mentioned I didn’t get it before. I haven’t had an epiphany. I am going to need better revenue growth and profitability before I can sanction running up $1.6 billion in debt to support a 59 P.E. and 3 times book value ratio. Operating margins of 82% though are great but let’s face it, this is a business built on cheap debt in a market where office space is being rationalized post-pandemic.

Name: Rogers William H Jr

Position: CEO

Transaction Date: 2021-10-18 Shares Bought: 67,000 Average Price Paid: $61.85 Cost: $4,143,950

Company: Truist Financial Corp. (TFC)

Truist Financial Corporation, a holding company, provides banking and trust services in the Southeastern and Mid-Atlantic United States. The company operates through three segments: Consumer Banking and Wealth, Corporate and Commercial Banking, and Insurance Holdings. Its deposit products include non-interest-bearing checking, interest-bearing checking, savings, and money market deposit accounts, as well as certificates of deposit and individual retirement accounts. The company also provides funding; asset management; automobile lending; bankcard lending; consumer finance; home equity and mortgage lending; insurance, such as property and casualty, life, health, employee benefits, workers compensation and professional liability, surety coverage, title, and other insurance products; investment brokerage; mobile/online banking; and payment, lease financing, small business lending, and wealth management/private banking services. In addition, it offers association, capital market, institutional trust, insurance premium and commercial finance, international banking, leasing, merchant, commercial deposit and treasury, government finance, commercial middle market lending, small business and student lending, floor plan, and commercial mortgage lending, mortgage warehouse lending, private equity investment, real estate lending, and supply chain financing services. Further, the company provides corporate and investment banking, retail and wholesale brokerage, securities underwriting, and investment advisory services. As of December 31, 2020, the company operated through 2,781 banking offices. The company was formerly known as BB&T Corporation and changed its name to Truist Financial Corporation in December 2019. Truist Financial Corporation was founded in 1872 and is headquartered in Charlotte, North Carolina.

William H. “Bill” Rogers Jr. is chief executive officer of Truist Financial Corporation, a purpose-driven financial services organization committed to inspiring and building better lives and communities. Rogers served as president and chief operating officer of Truist between December 2019 and September 2021, following the closing of the merger of equals between BB&T Corporation and SunTrust Banks Inc. Prior to the merger of equals, Rogers served as Truist predecessor SunTrust Bank’s chairman and CEO since January 2012, after having been appointed CEO in June 2011. Rogers held increasingly senior positions in corporate and commercial banking, corporate finance, retail banking, private wealth management, and mortgage after joining SunTrust’s commercial banking division in 1980.

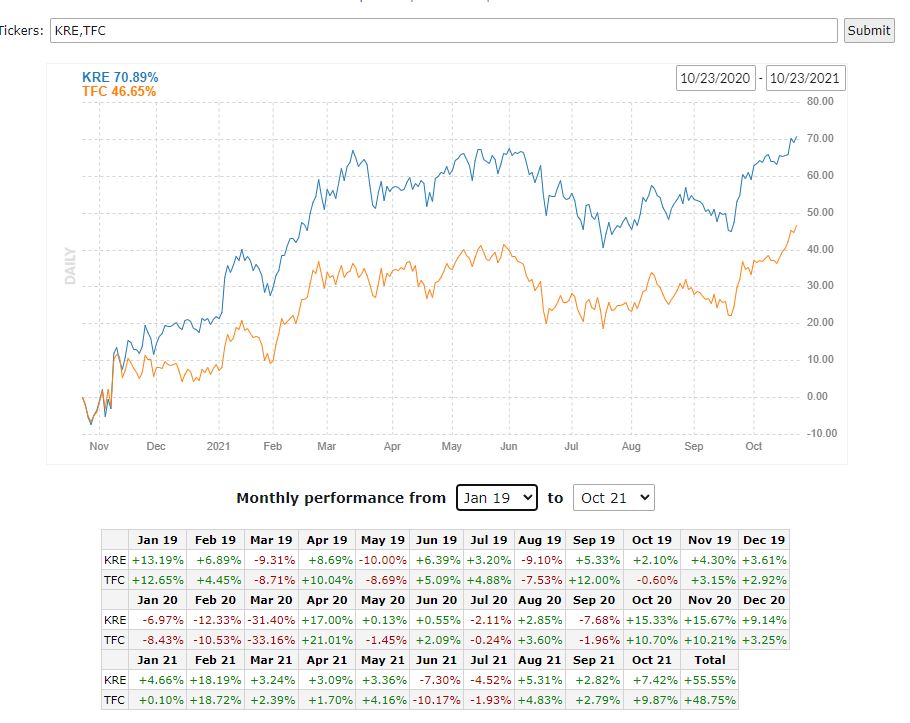

Opinion: Truist has performed in line with its peers since the name change as seen in this comparison chart between the bank and the Regional Bank ETF, KRE. This large purchase by Rogers is his first at the bank since the merger and the first at either bank as far back as SECform4 records go to 2016. Something might be looking better to him. If you like regionals banks, this is the one to play right now.

Name: Niblock Robert A

Position: Director

Transaction Date: 2021-10-20 Shares Bought: 2,500 Average Price Paid: $56.40 Cost: $141,000

Company: Lamb Weston Holdings Inc. (LW)

Lamb Weston Holdings, Inc. produces, distributes, and markets value-added frozen potato products worldwide. It operates through four segments: Global, Foodservice, Retail, and Other. The company offers frozen potatoes, commercial ingredients, and appetizers under the Lamb Weston brand and various customer labels. The company also offers its products under its owned or licensed brands, such as Grown in Idaho and Alexia, and other licensed brands, as well as under retailers’ brands. In addition, it engages in the vegetable and dairy businesses. The company serves retail and foodservice customers, grocery, mass, club, specialty retailers, businesses, independent restaurants, regional chain restaurants, convenience stores, and educational institutions. Lamb Weston Holdings, Inc. was founded in 1950 and is headquartered in Eagle, Idaho. The Foodservice segment comprises branded and private label frozen potato products sold throughout the United States and Canada. The Retail segment consists of consumer-facing retail branded and private label frozen potato products sold primarily to grocery, mass merchants, club, and specialty retailers—the Other segment is composed of vegetable and dairy businesses. The company was founded on July 5, 2016, and is headquartered in Eagle, ID.

Robert A. Niblock serves as Lead Independent Director of the Company. Mr. Niblock served as Chairman of the Board and Chief Executive Officer of Lowe’s Companies, Inc. from January 2005 until July 2018 and as President of Lowe’s from 2011 until July 2018, after having served in that role from 2003 to 2006. Mr. Niblock became a member of the board of directors of Lowe’s when he was named Chairman- and CEO-elect in 2004. Mr. Niblock joined Lowe’s in 1993 and during his career with the company, he also served as Vice President and Treasurer, Senior Vice President, and Executive Vice President and CFO. Before joining Lowe’s, Mr. Niblock had a nine-year career with accounting firm Ernst & Young.

Opinion: French fries dont’ cut it for me. Although great to eat, they don’t take long to make my body repel. Its funny the chart kind of represents how my body feels about fries.

Name: Gladstein Gary S

Position: Director

Transaction Date: 2021-10-21 Shares Bought: 11,399 Average Price Paid: $47.71 Cost: $543,846

Company: Mueller Industries Inc. (MLI)

Mueller Industries (NYSE: MLI) is an American manufacturing company that was started in 1917. It was included on the Fortune 1000 list in 2012. The head office of the Company is located in Memphis, Tennessee. Mueller Industries, Inc. is a multi-billion dollar revenue company that is publicly traded. The Company has operations throughout the United States, Canada, Mexico, China, South Korea, and Great Britain. The 2009 appointed CEO of the Company is Gregory L. Christopher. Mueller Industries, Inc. is a manufacturer of copper, brass, aluminum, and plastic products. The Company operates through three segments: Piping Systems, Industrial Metals, and Climate. The Piping Systems segment consists of Domestic Piping Systems Group, Great Lakes Copper, Pexcor Manufacturing Company and Heatlink Group Inc., Die-Mold Tool Limited, European Operations, Trading Group, and Jungwoo Metal Ind. Co., LTD. The Domestic Piping Systems Group manufactures and distributes copper tubes, fittings, line sets, pipe nipples, and resells steel pipe, brass and plastic plumbing valves, malleable iron fittings, and faucets, and plumbing specialties. The Industrial Metals segment consists of Brass Rod & Copper Bar Products, Impacts & Micro Gauge, and Brass Value-Added Products. The Climate segment consists of Refrigeration Products, Fabricated Tube Products, Westermeyer Industries Inc., Turbotec Products Inc., ATCO Rubber Products, Inc., Linesets Inc., and Shoals Tubular, Inc.

Gary S. Gladstein serves as Independent Director of the Company. Mr. Gladstein served as Chairman of the Company’s Board of Directors from 2013 to 2015 and was previously a director of the Company from 1990 to 1994. Mr. Gladstein is currently an independent investor and consultant. From the beginning of 2000 to August 31, 2004, Mr. Gladstein was a Senior Consultant at Soros Fund Management. He was a partner and Chief Operating Officer at Soros Fund Management from 1985 until his retirement in 1999. During the past five years, Mr. Gladstein also served as a director of Inversiones y Representaciones Sociedad Anónima, Darien Rowayton Bank, and several private companies.

Opinion: Copper, copper everywhere from cars to solar panels to the electricity grid and new home subdivisions. It’s kind of the global age of copper and Mueller is a global player in it. Gladstein knows this Company and has been buying modest amounts for years. The significant rally in copper prices created a “potentially major” tailwind for Mueller Industries’ revenue and EPS in 2021 given that many of its products are priced at a contractual spread to copper. Whether than become a tailwind or headwind in 2022 is a matter of conjecture and may hold the answer to Mueller.

Name: Hantman Peter

Position: COO

Transaction Date: 2021-10-20 Shares Bought: 6,280 Average Price Paid: $11.95 Cost: $75,040

Name: Farlekas Michael

Position: CEO

Transaction Date: 2021-10-20 Shares Bought: 20,000 Average Price Paid: $11.89 Cost: $237,706

Name: Farlekas Michael

Position: CEO

Transaction Date: 2021-10-19 Shares Bought: 20,000 Average Price Paid: $11.76 Cost: $235,200

Name: Farlekas Michael

Position: CEO

Transaction Date: 2021-10-19 Shares Bought: 20,000 Average Price Paid: $11.51 Cost: $230,104

Name: Janik Jarett

Position: CEO

Transaction Date: 2021-10-20 Shares Bought: 2,000 Average Price Paid: $11.84 Cost: $23,680

Name: Janik Jarett

Position: CEO

Transaction Date: 2021-10-19 Shares Bought: 6,000 Average Price Paid: $11.49 Cost: $68,935

Company: E2open Parent Holdings Inc. (ETWO)

E2open Parent Holdings, Inc. provides cloud-based and end-to-end supply chain management SaaS platforms in the Americas, Europe, and the Asia Pacific. The company’s software solutions orchestrate supply chains and realize the value and return on investment for its blue-chip customers. Its software combines networks, data, and applications to provide a platform that allows customers to optimize their supply chain across channel shaping, demand sensing, business planning, global trade management, transportation and logistics, collaborative manufacturing, and supply management. The company serves technology, consumer, industrial, transportation, and other industries. E2open Parent Holdings, Inc. was incorporated in 2020 and is headquartered in Austin, Texas.

Peter Hantman joined E2open in 2011 as VP and General Manager, leading sales and customer relationships in North America. He later became SVP, Customer Solutions where he led the company’s global Professional Services, Global Support, Customer Success, and Cloud Data Center operations. Most recently Peter served as CFO, leading the company’s finance and acquisition integration functions. In his current role as COO & EVP, Global Business Units, Peter oversees E2open’s strategic business units. Prior to taking a position at E2open, Peter served as SVP of Global Service Delivery at IQNavigator, Inc., a Software-as-a-Service (SaaS) leader in contingent workforce and services spend management. Peter also served as CEO of Bankers Title and COO of Alpine Access, Inc. In addition, Peter has held senior financial and operational management positions at Ryder Truck Rental, Budget Truck Group, and Harima USA.

Michael Farlekas joined E2open in 2015 as CEO. In this role, he is responsible for leading the company’s overall operations, with direct oversight of sales, marketing, professional services, research and development, and strategy. Michael brings to E2open more than 20 years of sales, marketing, and leadership experience in supply chain management and enterprise software. Prior to joining E2open, Michael was the VP and General Manager at Roadnet Technologies (now Omnitracs), the leading provider of last-mile routing and mobility solutions to Fortune® 50 clients. Previously, Michael spent 11 years at RedPrairie (now JDA Software) in roles that included SVP and General Manager, Industrial Business Unit, and VP, Industrial Sales. He also has held senior leadership roles at GATX Terminal Corp (now Kinder Morgan), an operator of petroleum and chemical distribution terminals worldwide, and CSX Transportation, a rail transportation provider offering comprehensive supply chain services.

Jarett Janik joined E2open in 2018 as CFO. In this role, he leads E2open’s finance, IT, acquisition, and business integration functions. Jarett brings to E2open more than 24 years of progressive senior leadership experience building dynamic global teams and transforming performance and process across finance and other areas to attain business objectives and foster profitable growth. Before joining E2open, Jarett was CFO at Forterro, a group of European software companies delivering enterprise resource planning (ERP) solutions. Allegro, an enterprise risk management and trading solutions provider for the energy industry. He also held executive and senior finance positions at Infor, Certegy, and Netzee, Inc.

Opinion: This one has a complicated capital structure and history. E2open, LLC is the girl you bring to a wedding party and the guests whisper to one another how happy they are to see her and how she’s certainly been around the block. The company was founded in 2000 as a joint project of 8 major companies. In July 2012, E2open went public on the NASDAQ. Insight Venture Partners took them private in 2015. Since then they’ve acquired at least 8 companies and their software offerings and now they’re public again last February via a SPAC deal valued at $2.57 billion with CC Neuberger Principal Holdings

Michael Farlekas, who has served as CEO of E2open since 2015, will continue to lead the business post-transaction. The transaction includes a total equity investment raise of $1.1 billion, and includes $520 million fully committed common stock PIPE at $10 per share.

Cluster buying spells confidence. Supply chain management is all you hear about in the news. Hot sector insider buying, this one has lots of potential but it is a sector with entrenched players, just to name a few; Microsoft, Oracle, SAP, NetSuite, Infor, Intacct but Gartner gives them high marks. Apparently, the company competes in a narrower subset of this universe that Gartner defines as MESCBN.

Multienterprise supply chain business networks support a community of trading partners that need to coordinate and execute on business processes that extend across multiple enterprises. Supply chain technology leaders should use this research to understand the MESCBN marketplace. The Company believes it can compete as it delivers solutions for some of the largest brand owners and manufacturers globally, and we estimate more than 125 of our customers have annual revenues of over $10 billion. They state they are mission-critical to their customers’ operations, as evidenced by their gross retention. The Company’s S1 stated they possess a diverse customer base consisting of more than 1,200 clients that span a broad spectrum of industries, including the technology, industrial, consumer and transportation sectors, among others

Multienterprise supply chain business networks support a community of trading partners that need to coordinate and execute on business processes that extend across multiple enterprises. Supply chain technology leaders should use this research to understand the MESCBN marketplace. The Company believes it can compete as it delivers solutions for some of the largest brand owners and manufacturers globally, and we estimate more than 125 of our customers have annual revenues of over $10 billion. They state they are mission-critical to their customers’ operations, as evidenced by their gross retention. The Company’s S1 stated they possess a diverse customer base consisting of more than 1,200 clients that span a broad spectrum of industries, including the technology, industrial, consumer and transportation sectors, among others

There is a lot of overhang of sellers here and as the wedding guests snickered, this girl has been around the block. That doesn’t mean ETWO can’t get up and pony but there will be a lot of sellers with lots of stock left to sell along the way. Some of that might be cleared out for now and insiders know things like this. We generally avoid complicated capital structures like this and it will take a lot more insider buying to change my tune.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer-friendly and responsive I’ve used.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019

[…] the stock market does nothing but power higher. The performance race to the finish we highlighted two weeks ago is game on. We’ve got a few names to analyze this week and some names with high confidence […]