Curious how well insiders are doing with their buys? Scroll through the significant buys of the last year.

It was an ugly two-day close to the week that marked 4 consecutive weeks of selling. Friday’s 900-point Dow collapse was either a capitulation of sorts or the beginning of something more ominous. There was literally nowhere to hide. Pretty much anything sold short worked as seen in this red, red heat map of the market. The narrative was hawkish Fed talk had finally pushed the market over the edge.

There is another narrative that I prefer is that no one wanted to be long over the weekend with the Russian army amassing its invasion force in the Eastern part of Ukraine. That made more sense to me as we have an enormous put position in the TLT and are short tons of FXI and neither did much to hedge our long exposure. In fact, the Chinese market as represented by the FXI was up slightly. The only green that made some sense was the two pure-play giant US defense contractors, Lockheed Martin and Northrup Grumman. I expect the defense sector which has been consolidating after a sharp runup to pick up some steam again after Sunday’s visit of the Secretary of Defense and State to Ukraine. I’d take a look at AVAV Aeroenvironment, the only public pureplay drone maker and the manufacturer of the Switchblade drones sent to Ukraine. It has a nice pullback and it’s pretty obvious by now that the military drone business is going to go through the roof.

We are in heart of earnings season and there was no insider buying to lift the animal spirits either. The few buys that attracted our attention are outlined below.

Name: Ford William E

Position: Director

Transaction Date: 2022-04-14 Shares Bought: 3,000 Average Price Paid: $687.96 Cost: $2,063,880.00

Company: BlackRock Inc. (BLK)

BlackRock, Inc. is a financial services firm that specializes in asset management. Institutional and retail clients can use the company’s investing and risk management services. The Company can create investment outcomes and asset allocation solutions for clients thanks to its extensive platform of active (alpha) and index investing methods across asset classes. Single- and multi-asset portfolios that invest in stocks, fixed income, alternatives, and money market instruments are among the Company’s product offerings. Its products are available in a variety of vehicles, including open-end and closed-end mutual funds, iShares exchange-traded funds (ETFs), separate accounts, collective investment funds, and other pooled investment vehicles, both directly and through intermediaries. The company also provides technical services, such as Aladdin, Aladdin Wealth, eFront, and Cachematrix, an investment and risk management technology platform, as well as advisory services and solutions.

Mr. Ford has been the Chairman of General Atlantic and its Chief Executive Officer since 2007. Mr. Ford is a member of The Council on Foreign Relations and serves on the Executive Committee of the Partnership for New York City, the board of directors of the National Committee on United States-China Relations, and the Executive Committee of the Partnership for New York City. He is also a member of the CEO Action for Diversity and Inclusion initiative’s Steering Committee. Mr. Ford served on the boards of First Republic Bank, NYSE Euronext, E*Trade, Priceline, NYMEX Holdings, and Computershare in the past.

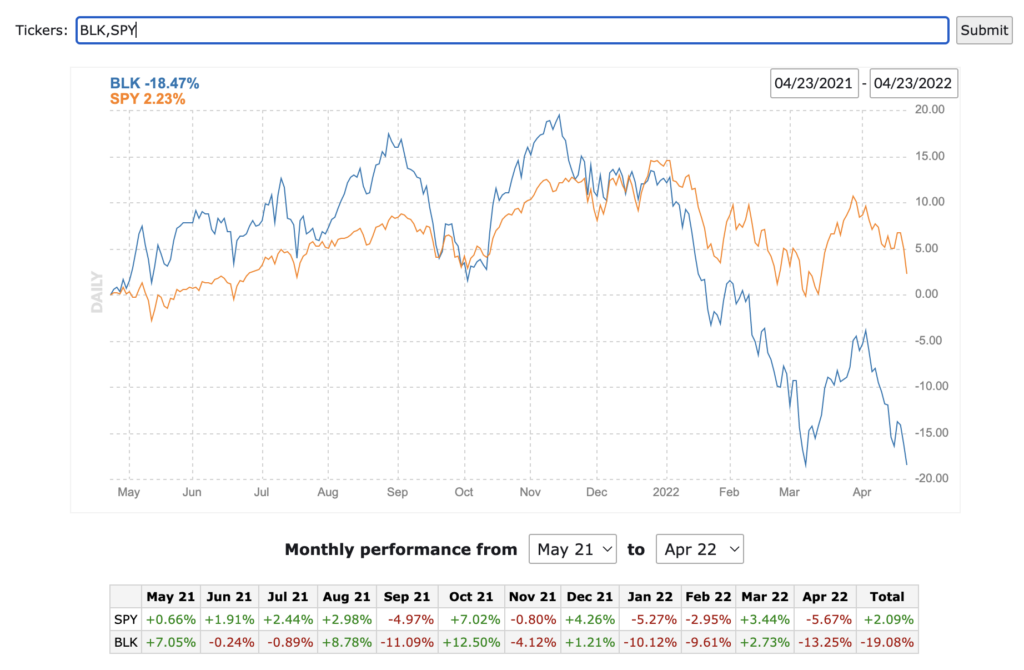

Opinion: This is a relatively small purchase in the scheme of things for Mr. Ford but he is an astute investor and BlackRock is a money machine that will make money as long as people are investing in the stock and bond markets. The stock is in the doldrums and at this level, BlackRock is a decent bet. BLK has grossly underperformed the market and that makes little sense to me.

Name: Amin Snehal

Position: 10% Owner

Transaction Date: 2022-04-14 Shares Bought: 7,116,000 Average Price Paid: $27.35 Cost: $194,622,600.00

Company: Nielsen Holdings plc (NLSN)

Nielsen Holdings plc is a global data analytics and audience measurement corporation. The company’s main business is the audience and advertising measurement and analytics for television, radio, web, and mobile platforms. One Measurement Solutions (Measurement) and Impact Marketing Solutions/Gracenote Content Solutions are the company’s two product categories. For linear television, streaming, internet, and listening platforms, the company primarily delivers viewership and listening measurement data and analytics to media publishers and marketers as well as their advertising agencies. About 55 nations are served by the company. AGB America S.A., Gracenote Argentina S.R.L., The Nielsen Company Pty Ltd, Nielsen Television Audience Measurement Pty Ltd, NetRatings Australia Pty Limited, H W W Pty Limited.

Snehal Amin is the founder of WindAcre Partnership and their website is a one-page web poster with no description. It’s the perfect if you have to ask, you can’t afford it response. Houston-based WindAcre was started by Snehal Amin, who was a co-founder of London-based activist firm TCI, which is run by Chris Hohn.

Opinion: Nielsen Holdings (NLSN.N) agreed on March 29th to go private for $10.06 billion in a sweetened deal with private equity firms led by Elliott Management and Brookfield Asset Management, days after the TV rating firm rejected a bid from the group. Including debt, The deal is valued at $16 billion. The transaction is expected to close in the second half of 2022.

BOOM in comes WindAcre. Approximately one week later, The WindAcre Partnership, a Houston-based hedge fund, disclosed that it owned a 9.6% stake in Nielsen and that it planned to acquire more stock in an attempt to block the take-private transaction. It has since been acquiring stock at a breathtaking pace, recently blowing through 27% ownership in the company.

Incredibly enough WindAcre puts an extraordinary amount of money behind its protests, $1.5 billion from April 6 through April 13 for a total of 31.6 million Nielsen shares (ticker: NLSN), at an average price of $27.47, according to Securities and Exchange Commission filings. WindAcre now owns 91 million Nielsen shares, giving it a stake of 25.3%. The purchases make WindAcre the largest holder of Nielsen shares, topping Vanguard Group, which has 44.6 million, according to S&P Capital IQ.WindAcre contends that Nielsen is worth “well in excess of $40 per share.”

Who the heck is WindAcre? Who is Snehal Amin? What are they up to? Fortune magazine says it’s greenmail. Bloomberg broke an article that said WindAcre wanted to get paid the equivalent of $40 per share in equity in the deal If it is greenmail, it just seems so unlikely to succeed. Since the Bloomberg article, Amin has said that they feel the Elliott and Brookfield offer undervalues the company. Brookfield and Elliott have publicly spurned the greenmail offer if it did exist in the first place.

I really don’t know but it’s one of the strangest things I’ve seen in some time. It’s not likely that WindAcre which has $7 Billion in AUM is going to thwart Elliott and Brookfield. Is it a David vs. Goliath story or just 1980’s old-fashioned greenmail? I just don’t see WindAcre going away so easily. First of all, there is the relationship with TCI which is a $27 billion dollar hedge fund that Amin co-founded in the U.K. Bloomberg ran another article on Friday, the 22nd that the U.K is investigating if WindAcre’s stake should have been filed in the UK since it has 500 employees there, something Bloomberg’s prior story committed. Even as recently as 4-14 WindAcre purchased $194 million worth of stock at $27.35. That’s considerably after the April 7th Blomberg piece stating that Elliott and Brookfield turned down the greenmail offer.

Name: Farner Jay

Position: CEO

Transaction Date: 2022-04-14 Shares Bought: 42,600 Average Price Paid: $9.37 Cost: $399,300.00

Transaction Date: 2022-04-14 Shares Bought: 42,800 Average Price Paid: $9.34 Cost: $399,538.00

Company: Rocket Companies Inc (RKT)

Rocket Companies, Inc. is a holding company with interests in real estate, mortgage lending, and eCommerce. Rocket Platform is a service provided by the company. Direct to Consumer and Partner Network are two of its segments. Performance marketing and direct engagement through its Rocket Mortgage application are part of its Direct to Consumer strategy. Clients in the Direct-to-Consumer segment can connect with the Rocket Mortgage application or the Rocket Cloud Force, which consists of sales team members spread over the platform. Its Partner Network is a collaboration with leading consumer-focused businesses, brokers, and mortgage specialists who use its platform and scale to offer mortgage solutions to their customers. The Rocket Professional platform helps the company’s Partner Network, which uses its client service and well-known brand to create marketing and influencer relationships, as well as its mortgage broker alliances through Rocket Pro third-party origination (TPO).

Rocket Companies’ Chief Executive Officer and Director is Jay Farner. Since 1996, he has worked for Quicken Loans and has held senior leadership positions since 1999. Jay was President and Chief Marketing Officer before being promoted to CEO in 2017. He is also the Chief Executive Officer and Director of RHI and its subsidiaries. Jay sits on the boards of Detroit Labs, LLC, Community Solutions, StockX, Bedrock Manufacturing, the Metropolitan Detroit YMCA, Bizdom Fund, and Rocket Giving Fund, among others.

Opinion: RKT has been a disaster of a public offering but it’s still the gorilla in the home mortgage business. One might look at these repeated buys by CEO Farner as a here’s the bottom moment but these are 10b5-1 purchases. It has to be discounted as it’s a prearranged purchasing plan to buy up to $36 Million of the stock. I still think, though, it’s significant because Farner didn’t start buying the stock until the end of February. He’s not buying near the IPO price but instead at a near 70% discount. The news is so universally bearish with rising rates, the drop in refinancing, and the lackluster performance of homebuilder stocks, that this is probably a bottoming moment.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data so I like people that eat what they kill.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health. It’s just one piece of the investor’s due diligence. The Insiders Fund blog informs you of the purchases that count. As a rule, we only look at material amounts of money as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong about, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have and we curse aloud, what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019