Curious how well insiders are doing with their buys? Scroll through the significant buys of the last year.

I sound like a broken record. The market seems like it’s stabilizing, up over 2% last week. Behind the scenes, the war in Europe is the 800-pound gorilla. Is the grain deal Turkey brokered in negotiation with Russia and Ukraine the beginning of the end? Interest rates have stopped rising despite all the tough talk from the Fed. We’ll see this week if they have the stomach for a full point increase in the Fed’s funds rate or will they wimp out at 1/2 point. Friday’s week PMI seems to favor slow as we go.

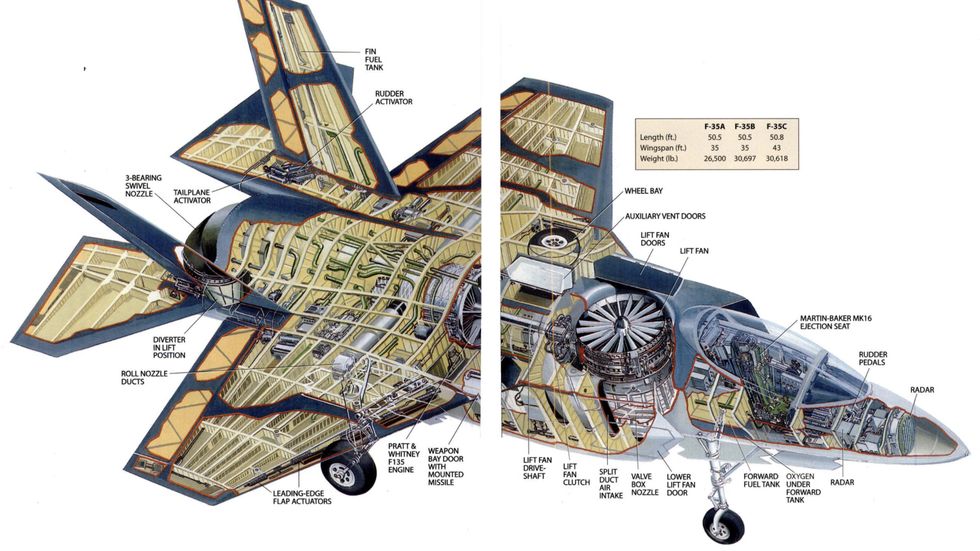

At least the long part of the yield curve is stable, although many economists and market pundits say that’s because the curve is inverting, sending classic recessionary signals. There’s no question that consumers are slowing down their spending binge but a recession? I don’t see it, and for now, I’m in the soft landing camp. Two sure-fire signs signal the end of the bear market, massive insider buying, and stocks stop going down on bad earnings news. Lockheed Martin missed earnings estimates badly due to supply chain issues. Can anyone reasonably doubt the global demand building for weapons? Director Donovan scooped in a bought some shares in the dominant defense contractor. The world is becoming a more dangerous place.

Name: Donovan John

Position: Director

Transaction Date: 2022-07-21 Shares Bought: 632 Average Price Paid: $396.16 Cost: $250,373.00

Company: Lockheed Martin Corp (LMT)

A security and aerospace corporation, Lockheed Martin Corporation conducts research, designs, develops, manufactures, integrates, and maintains technological systems, products, and services on a global scale. Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space make up its four operating segments. Offering unmanned air vehicles, combat and air mobility aircraft, and associated technology. The manned and unmanned ground vehicles, tactical missiles, air-to-ground precision strike weapon systems, logistics, fire control systems, mission operations support, readiness, engineering support, and integration services, as well as energy management solutions, are all offered by the Missiles and Fire Control segment.Military and commercial helicopters, surface ships, missile defense systems for the sea and land, radar systems, mission and combat systems for the air and sea, command and control mission solutions, cyber solutions, and simulation and training options are all provided by the Rotary and Mission Systems segment.

Prior to his retirement in October 2019, Donovan worked as CEO of AT&T Communications, LLC, a fully owned subsidiary of AT&T Inc., from August 2017. From April 2008 until January 2012, he served as AT&T Inc.’s chief technology officer. From January 2012 to August 2017, he served as AT&T Technology and Operations’ chief strategy officer and group president. Donovan formerly served as VeriSign Inc.’s executive vice president of product, sales, marketing, and operations before joining AT&T. Additionally. He served as the chairman and CEO of inCode Telecom Group Inc., where he assisted cellular carriers throughout the world in developing their strategies, and as a partner with Deloitte Consulting, where he oversaw America’s telecom practice. Donovan is the chair of the President’s National Security Telecommunications Advisory Committee, a director of the international cybersecurity firm Palo Alto Networks, and the author of several publications on advanced networking and organizational leadership.

Opinion: Although not a particularly large buy, it was a purchase nonetheless, and we’ve been chomping at the bit to get invested in defense stocks. We actually bought on the initial first reaction drop after releasing earnings. The stock closed up on the day, and this vote of confidence from Donovan would have lit a match under the stock, except Friday was a distribution day. There are not a lot of pure-play defense stocks. The ETFs under this category are all intermingled with aerospace names. Based on the chart and the scarcity, LMT looks like the best play for now.

Wells Fargo analyst Matthew Akers lowered the firm’s price target on Lockheed Martin to $406 from $496 and keeps an Equal Weight rating on the shares. The analyst thinks Lockheed Martin will struggle to outgrow its defense peers with large F-35 exposure where sales are flattish from here. The next upcoming catalyst is the Future Vertical Lift FLRAA contract award, expected in September. What the Wells Fargo analyst doesn’t seem to appreciate is countries will be lining up to buy F35s, the finest attack aircraft money can buy. The world looks like an increasingly dangerous place just in the last six months.

Name: Troendle August J

Position: CEO 10% Owner

Transaction Date: 2022-07-14 Shares Bought: 22,290 Average Price Paid: $144.59 Cost: $3,222,911.00

Company: Medpace Holdings Inc (MEDP)

The Company’s drug development services concentrate on full-service Phase I–IV clinical development services, and they also include project management, regulatory affairs, clinical monitoring, data management and analysis, pharmacovigilance, new drug application submissions, and post-marketing clinical support. Additionally, it offers clinical human pharmacology, imaging services, bioanalytical laboratory services, and support for interpreting electrocardiograms for clinical trials. The Company’s drug development services concentrate on full-service Phase I–IV clinical development services, and they also include project management, regulatory affairs, clinical monitoring, data management and analysis, pharmacovigilance, new drug application submissions, and post-marketing clinical support. Additionally, it offers clinical human pharmacology, imaging services, bioanalytical laboratory services, and support for interpreting electrocardiograms for clinical trials.

Since he established the business in July 1992, Dr. Troendle has served as Medpace’s CEO and chairman of the board of directors. Through July 31, 2021, Dr. Troendle served as president of Medpace as well. Dr. Troendle worked with Sandoz (Novartis) from 1987 to 1992 as an assistant director, associate director, and senior associate director, where he was in charge of the clinical development of lipid-altering drugs before starting Medpace. Dr. Troendle served as a medical review officer for the FDA’s Division of Metabolic and Endocrine Drug Products between 1986 and 1987. Dr. Troendle has extensive experience serving as a director for a variety of public and private companies, including Coherus BioSciences, Inc. from 2012 to February 2018, Xenon Pharmaceuticals Inc. from 2007 to 2008, LIB Therapeutics, LLC since 2015, CinCor Pharma, Inc. from March 2018 to November 2021, and CinRx Pharma, LLC since 2015.

Opinion: Medspace was our insider buying winner of the week, up 11% on the CEO’s purchase of $3.2Million worth of stock at $144.59. Medspace focuses on contract services for the sector of the biotech market known as pre-revenue. This segment also creates more volatility as these companies are constantly on the hunt for new money to fund drug trials. The last year has been one of the most vicious bear markets in memory for small-cap biotechs. Many have not been able to raise money for further trials without punishing dilution for their shareholders.

Name: Buffett Warren E

Position: 10% Owner

Transaction Date: 2022-07-14 Shares Bought: 1,942,900 Average Price Paid: $57.70 Cost: $112,113,273.00

Company: Occidental Petroleum Corp (OXY)

Occidental Petroleum Corporation is an energy company. The Company conducts oil and gas exploration and production activities in the United States, the Middle East, and Africa. Within the United States, it has operations in Texas, New Mexico, and Colorado, as well as offshore operations in the Gulf of Mexico. The Company’s business segments include Oil and Gas, chemicals, Midstream, and Marketing. The Oil and Gas segment explores, develops, and produces oil and condensate, natural gas liquids (NGL), and natural gas. The Chemical segment manufactures and markets basic chemicals and vinyls. The Midstream and Marketing segment purchases, markets, gathers, processes, transports, and stores oil, condensate, NGL, natural gas, carbon dioxide (CO2), and power. It also trades around its assets, including transportation and storage capacity, and invests in entities that conduct similar activities. The Midstream and Marketing segment purchases, markets, gathers, processes, transports, and stores oil, condensate, NGL, natural gas, carbon dioxide (CO2), and power. It also trades around its assets, including transportation and storage capacity, and invests in entities that conduct similar activities.

Warren Buffett, the full name Warren Edward Buffett, is an American businessman and philanthropist who was born on August 30, 1930, in Omaha, Nebraska, United States. He is widely regarded as the most successful investor of the twentieth and early twenty-first centuries, having defied prevailing investment trends to amass a personal fortune. Buffett, also known as the “Oracle of Omaha,” was the son of Nebraska Congressman Howard Homan Buffett. He studied with Benjamin Graham at the Columbia University School of Business after graduating from the University of Nebraska with a B.S. in 1950. (M.S., 1951). Buffett returned to Omaha in 1956 and, in 1965, acquired a majority stake in textile maker Berkshire Hathaway Inc., which he used as his primary investment vehicle.

Opinion: The whole fish or just a big piece. No one seems to know, and maybe Buffett himself is trying to figure it out. Why else would he continue to nibble at this massive rate? According to the latest filing, Berkshire Hathaway has purchased 265,643,640 shares of OXY, giving the company a 28% ownership stake based on 919 million outstanding shares. With the equity method of accounting, a business reports the initial cost of stock investment in the assets section of its balance sheet. Because you have significant influence over the investee company, your proportionate share of its profits increases your profit on your income statement and increases the value of the investment on your balance sheet. Buffett is long past the 20% threshold. Current market conditions are allowing him to seemingly buy as much as he wants without having to pay a premium price.

Name: Milikin Maurice Anthony

Position: Chief Supply Chain Officer

Transaction Date: 2022-07-18 Shares Bought: 12,979 Average Price Paid: $36.36 Cost: $471,916.00

Company: Keurig Dr Pepper Inc. (KDP)

With annual revenue is a leading beverage company in North America. KDP is a market leader in soft drinks, specialty coffee and tea, water, juice, juice drinks, and mixers, as well as the #1 single-serve coffee brewing machine in the United States and Canada. Keurig®, Dr. Pepper®, Green Mountain Coffee Roasters®, Canada Dry®, Snapple®, Bai®, Mott’s®, CORE®, and The Original Donut Shop® are among the Company’s more than 125 owned, licensed, and partner brands, which are designed to meet almost any customer demand, at any moment. KDP can bring its line of hot and cold beverages to practically every point of purchase for consumers, thanks to its extensive sales and distribution network. The Company is committed to sourcing, producing, and distributing its beverages responsibly through its Drink Well. The company, formerly Dr. Pepper Snapple Group, is one of North America’s largest beverage companies, with more than 125 owned, licensed, and partner brands. It owns the top single-serve coffee system in the US (Keurig) and is one of the US’s leading soft drinks.

With more than 30 years of experience in supply chain management, Milikin joins KDP. He most recently served as Anheuser-Busch InBev’s Chief Procurement, Sustainability, and Circular Ventures Officer. In that role, he was responsible for overseeing 70 manufacturing facilities, a significant environmental agenda, and the global procurement budget for one of the biggest brewers in the world.

Opinion: This stock has grown shareholder value by about 8% per annum over the last three years, not including dividends of 2% per year. Throw that in, and you have a 10% a year return, and that’s about all you’re going to get here, and that’s about as good as it’s likely to get.

Name: Brannon Richard D

Position: Director

Transaction Date: 2022-07-14 Shares Bought: 137,680 Average Price Paid: $9.69 Cost: $1,334,660.00

Company: Energy Transfer LP. (ET)

Energy Transfer is a Texas-based company that began in 1995 as a small intrastate natural gas pipeline operator and is now one of the largest and most diversified investment grade master limited partnerships in the United States—growing from roughly 200 miles of natural gas pipelines in 2002 to more than 86,000 miles of natural gas, natural gas liquids (NGLs), refined products, and crude oil pipelines. Today, there are three publicly traded partnerships in the Energy Transfer Family. (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with a strategic footprint in all major domestic production basins. ET is a publicly-traded limited partnership with core operations that include complementary natural gas midstream, intrastate, and interstate transportation and storage assets, crude oil, natural gas liquids (NGL), refined product transportation, and terminalling assets; NGL fractionation; and various purchase and marketing assets.

Businessman Richard D. Brannon formed CH4 Energy II LLC and has held executive positions in 9 different organisations. Mr. Brannon holds the positions of President & Director of CH4 Energy Six LLC, CEO of CH4 Energy II LLC, CEO of CH4 Energy III LLC, CEO of CH4 Energy-Finley Utah LLC, CEO of CH4 Energy IV LLC, and CEO of CH4 Energy V LLC. He also serves as CEO of CH4 Energy-Finley Utah LLC. Richard D. Brannon serves on the boards of LE GP LLC, Energy Transfer LP, and Susser Petroleum Partners GP LLC, in addition to being a member of the Independent Petroleum Association of America, the Society of Petroleum Engineers, Inc., and the Fort Worth Wildcatters. Before joining the Texas Alliance of Energy Producers, Richard D. Brannon held the positions of Chairman and Chief Executive Officer of Esquisto Resources II LLC, President of CH4 Energy Corp., and President for Brannon Oil & Gas Inc.

Opinion: This is really a no-brainer. With Europe and Asia desperate for US LNG, the one big hold-up is pipelines moving the vast natural gas reserves to the coasts where it can be gasified and shipped as LNG. The war in Europe has brought home the importance of having energy independence or, if you have dependence, do it with friendly nations. Massive insider buying and a 7.8% dividend make me wonder what I’m missing. This stock is too cheap.

Name: Michel Gerard J

Position: CEO

Transaction Date: 2022-07-21 Shares Bought: 62,814 Average Price Paid: $3.98 Cost: $250,000.00

Company: Delcath Systems Inc (DCTH)

In the US and Europe, Delcath Systems, Inc., an interventional oncology business, specializes in the treatment of primary and metastatic liver tumors. HEPZATO KIT, melphalan hydrochloride for injection/hepatic delivery system to provide high-dose chemotherapy to the liver while limiting systemic exposure and associated adverse effects, is the company’s leading product candidate. The FOCUS clinical study for patients with hepatic dominant ocular melanoma is its clinical development program for HEPZATO, which examines the objective response rate in metastatic ocular melanoma. The business also offers HEPZATO as a standalone medical device for sale to medical facilities in Europe to treat a variety of liver malignancies under the brand name CHEMOSAT Hepatic Delivery System for Melphalan. The corporate headquarters of Delcath Systems, Inc. are located in New York, New York.

Before joining the company, Mr. Michel served as Chief Financial Officer of Vericel Corp., a biopharmaceutical company, since June 2014. During this time, he played a significant role in the management team’s integration of a game-changing acquisition and revision of the company’s business model from one that focused on research to one that is fully integrated and profitable. At Biodel Inc., Mr. Michel also held the positions of vice president of corporate development and chief financial officer. From August 2002 to November 2007, he served as the Chief Financial Officer and Vice President of Corporate Development of NPS Pharmaceuticals Inc., a specialty biopharmaceutical company specialising in the treatment of diabetes, and from November 2007 to May 2014, he served as the company’s Vice President of Corporate Development. Prior to that, Mr. Michel had a number of commercial positions at Lederle Labs and Wyeth Labs in addition to his position as a principal at Booz Allen Hamilton Inc. Mr. Michel is a graduate of the University of Rochester’s School of Medicine with an M.S. in microbiology, an M.B.A. from the Simon School of Business, and a B.S. in both biology and geology.

Opinion: This is not a large buy for a CEO of beleaguered biotech. I’ll need more proof before I can commit.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

[custom-twitter-feeds]

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data so I like people that eat what they kill.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have and we curse aloud, what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019