Learn How You Can Become an Insider Too – Click Here

The reality of significantly richer returns on risk-free assets like U.S. Treasuries has taken hold of investors’ psyches. The marginal excess returns that the stock market is likely to provide over the 10 Year Treasury are still mildly attractive. Considering the historic return of the stock market is 7.5%-8%, is the 3.7% to 4.18% risk premium above yesterday’s 3.82% 10 Year Treasury Yield worth it? For some retired investors losing sleep over the market’s gut-wrenching volatility- the answer is clearly no. Years of financial repression are over for the moment. Bonds once again look attractive, particularly on the short end.

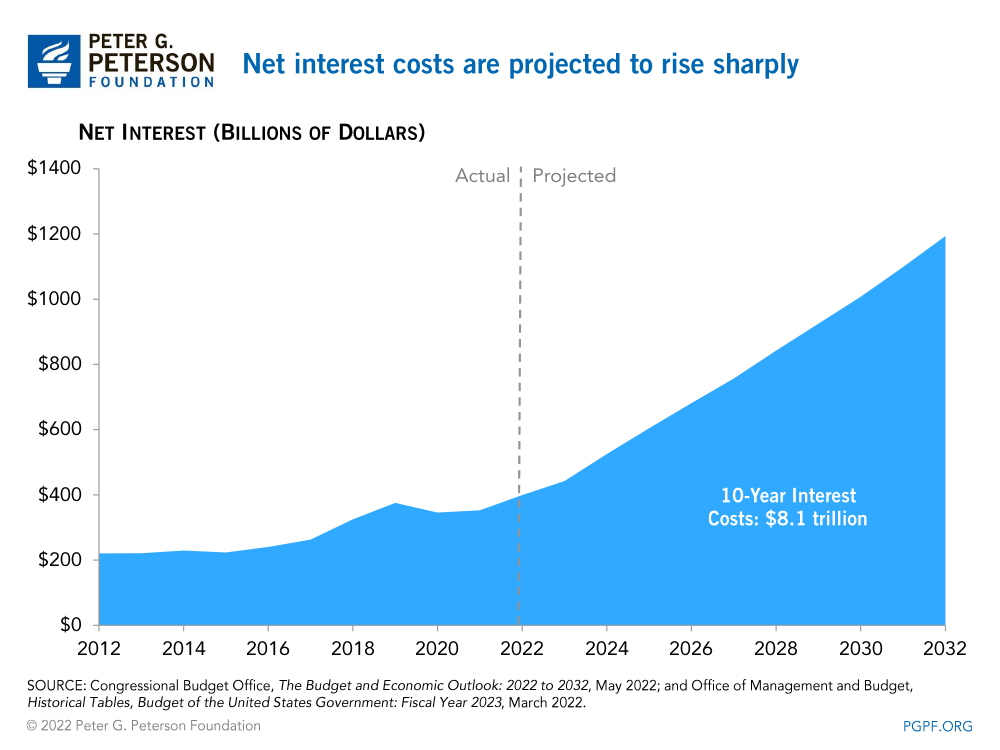

When I sit back and look at who suffers the most from this sharp Fed-induced rate shock, the victims are clearly the debtors and the negative cash flow operators. The largest of both is the U.S. Government. It wouldn’t surprise me at all if the U.S. debt got downgraded to AA by the remaining rating agency; Moody’s has it ranked at AAA. You should recall that during one of the self-induced budget debacles, one of the world’s leading credit rating agencies, Standard & Poor’s, downgraded the United States top-notch AAA rating for the first time ever by one notch to AA+ with a negative outlook, citing concerns about budget deficits.

The growth in interest costs presents a significant challenge in the long term as well. According to CBO’s projections, interest payments would total around $66 trillion over the next 30 years and would take up nearly 40 percent of all federal revenues by 2052. Interest costs would also become the largest “program” over the next few decades — surpassing defense spending in 2029, Medicare in 2046, and Social Security in 2049.

Name: Joe E Kiani

Position: CEO/Chairman

Transaction Date: 2022-11-11 Shares Bought: 7,784 Average Price Paid: $129.27 Cost: $1,006,255.00

Transaction Date: 2022-11-14 Shares Bought: 31,994 Average Price Paid: $123.99 Cost: $3,967,010.00

Company: Masimo Corp. (MASI)

Masimo is a multinational medical technology provider that creates, produces, and sells a range of noninvasive monitoring systems and hospital automation solutions. The company’s goal is to decrease the price of medical care while improving patient outcomes. Patient monitoring solutions typically include a monitor or circuit board, specialized single-patient use, or reusable sensors, software, and cables. Through its direct sales force, distributors, and partners with original equipment manufacturers, the company offers its products to hospitals, emergency medical service providers, home care providers, long-term care facilities, doctor’s offices, veterinary clinics, and consumers. In May 1989, the company was incorporated in California; in May 1996, it was reincorporated in Delaware. Measure-through Motion and Low PerfusionTM pulse oximetry, also known as Masimo Signal Extraction Technology® pulse oximetry, is the company’s main line of business.

Joe established the Masimo Foundation for Ethics, Innovation, and Competition in Healthcare. To provide access to high-quality healthcare and enhance lives worldwide, this charity collaborates closely with institutions, including the Carter Center, Smile Train, and United4Oxygen. Soon after, he was named the co-inventor of “modern pulse oximetry,” as it is currently known. His invention altered how doctors utilize the “fifth vital sign” by reducing false alarms in pulse oximetry by 95%. He expanded the company from a “garage start-up” to a prosperous publicly listed enterprise that employs more than 5,000 people globally and tracks more than 200 million individuals annually. He and his team currently hold over 600 patents, including the creation of measure-through-motion pulse oximetry, and they have contributed to the solution of many “unsolvable” clinical problems.

Opinion: Masi has lost its glean as one of the great growth stocks of the decades and now faces consumer products companies like Apple ripping off their IP. This is the largest buy by the founder in the last five years, probably the largest ever. Kiani has over 2.9M shares and has sold off hundreds of millions of dollars. He’s rich and doesn’t need any more stock. So what’s the motivation? What’s the catalyst?

Masimo sued Apple in 2020, claiming the iPhone maker had stolen its trade secrets and infringed its patents, including for measuring heart rate and blood-oxygen levels. Apple did more than infringe; it raided his company, luring over the Chief Medical Officer and 20 some employees from Ceracur, a subsidiary. Masimo knows CEO Tim Cook was personally involved in the raid. This lawsuit is deeply personal. Last year, it also asked the US government to halt imports of Apple Watches that violate its patents.

Apple recently countersued when Masimo came out with a consumer watch product similar to the Apple iWatch. The chief legal counsel for Masimo purchased 1000 shares in April 2021 at $231.62. My guess is that Masimo will win its day in court just like it successfully sued Phillips for patent infringement and collected a $600 million judgment. Apple has a long history of patent infringement only to settle and pay up; think Qualcomm. When will this happen? Taking a note from the most recent 10Q, it’s imminent, no later than Monday, December 19, 2022, to be precise.

“On June 30, 2021, the Company filed a complaint with the U.S. International Trade Commission (ITC) against Apple for infringement of a number of other patents. The Company filed an amended complaint on July 12, 2021. On August 13, 2021, the ITC issued a Notice of Institution of Investigation on the asserted patents. From June 6, 2022 to June 10, 2022, the ITC conducted an evidentiary hearing. The current target date for completion of the ITC investigation is April 19, 2023, with an initial determination due December 19, 2022. The Company is seeking an exclusion order and a permanent cease and desist order. Apple filed petitions for IPR of the asserted patents in the PTO and the Company has responded and will continue to respond to each of the petitions before the PTO determines whether to institute IPRs.”

Apple is now suing MASI for infringement of its highly successful watch product. Such is life- the lawyers win in the end. Masi will win this ITC round with Apple. Apple will settle, and MASI stock will go up. Longer term, I don’t have a feel as the stock is pretty fair to overly valued unless their consumer products business takes off.

Name: Mitchell P Rales

Position: Director

Transaction Date: 2022-11-16 Shares Bought: 500,000 Average Price Paid: $40.00 Cost: $20,000,000.00

Company: Esab Corp (ESAB)

The ESAB Corporation formulates, develops, produces, and supplies gas control equipment, consumables, and tools for automated welding, joining, and cutting. The company offers various cutting consumables, such as electrodes, nozzles, shields, and tips, as well as cored and solid wires, fluxes, and electrodes made from various specialty and other materials. The company’s inventory includes small, mobile welding machines to massive, specially made automated cutting and welding systems. Additionally, it provides software and electronic solutions to help its clients work more productively, monitor their welding processes from a distance, and digitize their records. Under the ESAB brand, the firm distributes its goods to various end sectors, including general industry, building, infrastructure, transportation, energy, renewable energy, and the medical and life sciences.

Mr. Rales is one of Colfax’s co-founders and has held that position as a director since the company’s creation in 1995. Currently serving as the chairman of the Colfax board of directors, he will also preside over the boards of ESAB and Enovis after the Separation. In addition to being a co-founder and serving on the board of directors of the international science and technology company Danaher Corporation since 1983, Mr. Rales also served as chairman of the executive committee of Danaher from 1984 to 1986 and served on the board of directors of Fortive Corporation, a diversified industrial growth company that was spun off from Danaher in 2016, from 2016 to June 2021. He has over 25 years of experience as a principal in several private business entities with stakes in manufacturing firms and publicly traded securities.

Opinion: Monster purchase by a billionaire. Put that into perspective.

Name: Lip-Bu Tan

Position: Director

Transaction Date: 2022-11-16 Shares Bought: 50,000 Average Price Paid: $29.49 Cost: $1,474,365.00

Company: Intel Corp (INTC)

Intel and its employees, for more than 50 years, have had a significant impact on the globe, advancing commerce and society by inventing breakthrough innovations that fundamentally alter how the company lives. Intel is now using its reach, scale, and resources to help its clients fully use digital technology’s potential. Release what CEO Pat Gelsinger refers to as the four superpowers: Al, pervasive connectivity, cloud to the edge, and ubiquitous computing by integrating intelligence into the cloud, network, edge, and every computing device. The four astonishing technology advancements driving the digitization of everything are now significant commercial factors. They will significantly change how companies interact and experience technology, including PCs, linked gadgets, houses, and automobiles. The COVID-19 epidemic has merely sped up this transformation.

Tan, 62, has been Cadence’s board member and executive chairman since 2004. Cadence is a computational software provider of solutions used to design and manufacture complicated semiconductor circuits and electrical systems. He presided at Cadence as president from 2009 to 2017 and a chief executive officer from 2009 to 2021. The Massachusetts Institute of Technology awarded him a Master of Science in nuclear engineering, and the University of San Francisco awarded him an MBA. He graduated with a Bachelor of Science in physics from Nanyang Technological University in Singapore.

Opinion: At first I thought this was just a typical board member purchasing the mandatory amount of stock. Now I don’t know. It looks like Tan is a believer. There are very few left in this former national champion.

Name: Scott B Helm

Position: Director

Transaction Date: 2022-11-15 Shares Bought: 10,000 Average Price Paid: $23.39 Cost: $233,900.00

Company: Vistra Corp. (VST)

Vistra is a holding corporation that primarily serves regions across the United States with integrated retail and electric power-generating operations. Through its subsidiaries, the Company engages in competitive energy operations such as producing electricity, selling and acquiring energy at wholesale prices, managing commodity risk, and selling electricity and natural gas to end users. Delaware legislation was used to create the Company in 2016. To set itself apart from businesses engaged in the exploration, production, refining, or transportation of fossil fuels as well as to more accurately reflect its integrated business model, which combines a retail electricity and natural gas business devoted to providing its customers with cutting-edge products and services with an electric power generation business operating at the forefront of the industry, Company changed the name of Vistra Energy Corp. to Vistra Corp. as of July 2, 2020. The sustainable energy transition through the Vistra Zero portfolio while providing secure, dependable, and reasonably priced electricity to the people served.

Scott Helm is a Private investor located in Baltimore. He now serves as the Board of Directors Chair for Vistra Energy. Helm previously served as a founding partner of Energy Capital Partners, a private equity company that specialized in making investments in the energy infrastructure of North America. He worked for Orion Power Holdings, Inc., a publicly traded firm that owned and ran power plants, as executive vice president and chief financial officer before joining Energy Capital Partners. Before that, he served as a consultant to the private equity group in charge of Texas Genco’s acquisition. Helm started his career at Goldman Sachs & Co., initially working in the fixed-income department before switching to the investment banking department. He graduated from Washington University with a bachelor’s degree in business administration. Helm holds the position of treasurer on the Chesapeake Shakespeare Company’s board.

Opinion: We like electric utilities. Vista is one of the ones we would own.

Name: David Angelo Jr. Daglio

Position: Director

Transaction Date: 2022-11-14 Shares Bought: 35,000 Average Price Paid: $23.31 Cost: $815,735.00

Company: Alkermes plc. (ALKS)

As a fully integrated, international biopharmaceutical firm, Alkermes plc conducts research, develops, and commercializes pharmaceutical medicines to meet patients’ unmet medical needs in significant therapeutic areas, both with partners and independently. Alkermes has a pipeline of pharmaceutical candidates being developed for cancer and neurological diseases, as well as a portfolio of patented commercial medications targeted at alcoholism, opioid dependency, schizophrenia, and bipolar I disorder. Alkermes, which has its main office in Dublin, Ireland, also has a research and development facility in Waltham, Massachusetts, a manufacturing facility in Wilmington, Ohio, and an R&D and manufacturing facility in Athlone, Ireland.

Mr. Daglio worked as a non-executive director of Mellon Investments Corporation from January 2020 to 2019 and as executive vice president, chief investment officer, and director of Mellon from 2017 to 2019. Additionally, he oversaw Mellon’s Opportunistic Value Strategies division. Since joining Mellon in 1998, Mr. Daglio has played a key role in creating the 12th biggest U.S. Asset Manager, as well as designing, implementing, and managing an innovative equities investment strategy. In these capacities, Mr. Daglio oversaw many investors, worked with institutional customers and boards worldwide, and increased portfolio assets by more than five times. Mr. Daglio worked as an engineer for The Dannon Company and a management consultant at Deloitte before starting his investing career.

Opinion: This looks like an informed buyer. Beyond that Alkermes just raised guidance. They are planning a spinoff which might be a catalyst. According to Post on the Fly Piper Sandler analyst David Amsellem upgraded Alkermes to Overweight from Neutral with a price target of $30, up from $26, after management announced that it is planning to separate its oncology segment in part as a means of maximizing the profitability of what will eventually be a pure-play neuropsychiatry company. The analyst says his new price target reflects the “leaner” cost structure that would support the neuropsychiatry business. Per his analyses, Alkermes shares could be worth $30 as a “leaner, pureplay neuropsychiatry company.”

Name: Eric E Burrough

Position: Director

Transaction Date: 2022-11-15 Shares Bought: 10,000 Average Price Paid: $22.53 Cost: $225,300.00

Company: Choiceone Financial Services Inc. (COFS)

ChoiceOne is a financial holding company authorized by the Bank Holding Company Act of 1956, as amended. On February 24, 1986, the Company was set up as a Michigan corporation. The Company was established as a bank holding company to acquire the entire capital stock of ChoiceOne Bank, which on April 6, 1987, became a wholly owned subsidiary of the Company. On November 1, 2006, the Company merged with Valley Ridge Financial Corp., a single-bank holding company for Valley Ridge Bank. ChoiceOne Bank combined with VRB in December 2006. The County, a single-bank holding company for Lakestone Bank & Trust, merged with and became a part of the Company on October 1, 2019. The Company’s activity is mostly centered in the banking sector of one industry. ChoiceOne Bank is a full-service financial institution that provides consumers with a range of deposit, payment, credit, and other financial services.

Eric E. Burrough has been a director of ChoiceOne since October 2019. Since 2009, Mr. Burrough has held a position as a director of County Bank Corp., the parent company of Lakestone Bank & Trust. Mr. Burrough served on the loan, nominating, risk, mergers and acquisitions, trust, and compensation committees while a director of County Bank Corp. Having offices in Davisburg, Michigan, and Greenville, Michigan, Mr. Burrough has been the owner and president of Michigan Web Press since 1990. He has also served as the owner and president of JAMS Media/View Newspaper Group, which has published 19 community papers in Michigan since the company’s founding in 2003. Mr. Burrough has been a devoted supporter of the Lapeer community via volunteerism, advocacy, in-kind gifts, and monetary sponsorship of regional groups and events, both personally and through his enterprises.

Name: Michael Stubblefield

Position: CEO

Transaction Date: 2022-11-16 Shares Bought: 15,000 Average Price Paid: $20.95 Cost: $314,250.00

Company: Avantor Inc. (AVTR)

Name: Thomas A Szlosek

Position: CFO

Transaction Date: 2022-11-16 Shares Bought: 12,500 Average Price Paid: $20.71 Cost: $258,850.00

Company: Avantor Inc. (AVTR)

Avantor Inc. is a top provider of mission-critical goods and services in the biopharma, healthcare, education & government, and advanced technologies & applied materials sectors worldwide. Avantor is integrated into almost every stage of the most significant research, scale-up, and production operations in the company of the sector served. The foundation of the business model is assisting clients from breakthrough discovery to rapid delivery. The company acts as a one-stop shop for all research supplies, including materials and consumables, tools and instruments, and services and specialist procurement. The company uses extensive offerings and access to early-stage research to find content and solutions that ultimately become defined into clients’ authorized production platforms. The customer-centric innovation methodology enables solutions for some of the most demanding applications.

Michael Stubblefield has served as the organization’s president and CEO since May 2014. In the years leading up to his current role, Mr. Stubblefield worked for McKinsey & Company as a Senior Expert for the Chemicals Practice. From 1994 through 2012, Mr. Stubblefield worked for Celanese Corporation in several positions, including Vice President, General Manager of Advanced Engineered Materials, and Chief Marketing Officer. At the moment, Mr. Stubblefield is a director of Ingersoll Rand Inc. He received an MBA from Texas A&M University-Corpus Christi and a bachelor’s degree in chemical engineering from the University of Utah.

Thomas A. Szlosek is the executive vice president and CFO of Avantor. As CFO, Mr. Szlosek is responsible for managing Avantor’s accounting, business support, financial planning and analysis, Treasury, M&A, investor relations, internal audit, and tax functions. He spent 14 years at Honeywell, the last five of which were as Chief Financial Officer, before joining Avantor in December 2018. Additionally, Mr. Szlosek worked for GE Corporation for eight years, serving as CFO for two years at GE Consumer Finance in Ireland and three at GE Medical Systems in Asia. He obtained his certification as a public accountant from The State University of New York at Geneseo.

Opinion: CEO and CFO buying some stock, not a huge amount on depressed performance looks a bit like cheerleading. Don’t know the answer to this riddle.

Name: Martin E Franklin

Position: Director

Transaction Date: 2022-11-11 Shares Bought: 902,000 Average Price Paid: $19.07 Cost: $17,202,420.00

Company: Element Solutions Inc. (ESI)

The Delaware-based firm Element Solutions was founded in January 2014 and are a market leader in specialty chemicals. Its companies offer a wide range of solutions that improve the functionality of items that people use daily. These cutting-edge solutions, which were created through multi-step technological processes, support customers’ manufacturing processes in several important sectors, including offshore energy, communications and data storage infrastructure, semiconductor fabrication, consumer electronics, power electronics, automotive systems, industrial surface finishing, and consumer packaging. The companies sell goods almost always consumed by customers as a part of their manufacturing process, giving steady and dependable income streams as long as the items are replaced to continue manufacturing.

Martin founded Element Solutions in 2013 and held the position of Chairman of the Board until he was appointed Executive Chairman in January 2019. Martin has a remarkable track record of founding and growing long-term profitable enterprises. Martin is the co-founder and co-Chairman of Nomad Foods Limited, a leading European frozen foods company, a director of Restaurant Brands International Inc., one of the world’s largest quick-service restaurant companies, and a founder and co-Chairman of API Group Corporation. He is the principal and executive of Mariposa Capital LLC, a Miami-based family investment firm. He is also the chairman and controlling shareholder of Royal Oak Enterprises, LLC.

Opinion: Large purchase, high conviction buy from its former leader.

Name: David L Wenner

Position: Director

Transaction Date: 2022-11-14 Shares Bought: 20,000 Average Price Paid: $14.01 Cost: $280,294.00

Company: B&G Foods Inc. (BGS)

B&G Foods produces, markets, and distributes a wide range of branded, premium, frozen, shelf-stable, and home goods in the United States, Canada, and Puerto Rico. Numerous branded items command significant regional or global market shares. In general, the company’s product strategy is to appeal to customers who want a high-quality item at a fair price. Retail sales of branded products are complemented by the corporation’s institutional, restaurant, and private label sales. B&G Foods has been operating for over 125 years, encompassing its predecessors and subsidiaries. On November 25, 1996, the business was formed in Delaware as B Companies Holdings Corp. Company changed its name to B&G Foods Holdings Corp. on August 11, 1997.

Director David Wenner has been in the industry since August 1997. From March 1993 to December 2014, Mr. Wenner was B&G Foods’ president and CEO. From November 2020 to June 2021, he served as the company’s interim president and CEO. As Assistant to the President, Mr. Wenner began working at B&G Foods in 1989. He was in charge of the business’s Bloch & Guggenheimer and distribution departments. He was given the vice presidential title in 1991. He took over management of the entire business and distribution, which he remained in charge of. Mr. Wenner spent 13 years with Johnson & Johnson in management and supervision roles, where he was in charge of production, upkeep, and buying. Mr. Wenner has participated in industry trade groups and has held a position on the Grocery Manufacturers Association’s Chairman’s Advisory Council.

Name: Daniel D. Burton

Position: CEO

Transaction Date: 2022-11-11 Shares Bought: 197,078 Average Price Paid: $10.14 Cost: $1,998,213.00

Company: Health Catalyst Inc. (HCAT)

Health Catalyst Inc is the leading data and analytics technology and service supplier to the healthcare industry. A cloud-based data platform, analytics tools, and professional services knowledge make up the Company Solution. Customers, who are primary healthcare providers, use the Solution to manage their data, gain analytical insights to run their businesses, and create quantifiable improvements in the areas of operations, finances, and clinical outcomes. All healthcare choices in the future, according to the company, will be based on data. By using the Health Catalyst Flywheel, also known as the Flywheel, the company achieves its goals with each client. Delivering on the three Solution components—the data platform, the analytics apps, and the services expertise—that together provide demonstrable gains is part of this approach.

Daniel D. Burton, the founder of HB Ventures LLC, was previously a senior director and head of the strategy group at Micron Technology, Inc., an associate consultant at The Boston Consulting Group, Inc., and a managing partner at HB Ventures LLC. A marketing manager and senior strategist at HP, Inc., Mr. Burton earned his undergraduate degree from Brigham Young University and his MBA from Harvard University.

Opinion: Enthusiastic CEO buying stock is always welcome, but I’m not sure I understand the value proposition. We are dabbling a bit.

Name: Richard N Massey

Position: Director

Transaction Date: 2022-11-14 Shares Bought: 100,000 Average Price Paid: $8.41 Cost: $840,500.00

Company: Alight Inc. / Delaware (ALIT)

Alight Inc is one of the top cloud-based providers of business and integrated digital human capital solutions. The company is unwavering in its conviction that its success begins with its employees, and the solutions link technological advancements with human insights. To support Alight’s business process as a service model, the Alight Worklife employee engagement platform combines content with artificial intelligence and data analytics to offer a seamless customer experience. Mission-critical business solutions help employees improve their health, wealth, and well-being, assisting global organizations in developing a high-performance culture. Several forces are at play now that affect how corporations might prosper. The complexity of healthcare and retirement for employees is growing, and employers now bear more financial responsibility for rising healthcare expenses.

Richard N. Massey has served as Chairman of FTAC since April 2021, has served as Chief Executive Officer of FTAC since March 2020, and has served as a member of the FTAC Board since May 2020. In addition, he serves as a Senior Managing Director of Trasimene Capital Management LLC and has served as Chief Executive Officer of Cannae Holdings since November 2019. Since January 2021, Mr. Massey has served as the Chief Executive Officer of Austerlitz Acquisition Corp. I and Austerlitz Acquisition Corp. II, as well as a director of both companies. From July 2020 until March 2021, Mr. Massey served as the Chief Executive Officer of Foley Trasimene Acquisition Corp. II and a director of Foley Trasimene Acquisition Corp. II.

Opinion: A dubious HR proposition in a recessionary climate is not something I’m taking a shot at.

Name: Farner Jay

Position: CEO

Transaction Date: 2022-11-15 Shares Bought: 49,500 Average Price Paid: $8.09 Cost: $400,312.00

Company: Rocket Companies Inc. (RKT)

The Detroit-based FinTech company Rocket Companies Inc. operates tech-driven real estate, mortgage, and financial services businesses. The business uses technology, analytics, and a highly skilled Rocket Cloud Force to provide customers assurance throughout life’s most complicated transactions and aid them in realizing the American dream. The business is dedicated to offering clients a platform-powered customer experience that leads the industry. The business thinks the well-known “Rocket” name is linked with offering straightforward, dependable digital solutions for complex transactions. The company’s founder and chairman, Dan Gilbert, deliberately established a solid cultural foundation of guiding principles, or “ISMs,” to serve as a framework for team members’ decision-making.

Jay Farner serves as the chairman and CEO of Rocket Companies. He began working with Quicken Loans in 1996, and since 1999, he has held positions of responsibility. Jay held the positions of President and Chief Marketing Officer until becoming CEO in 2017. In addition, he serves as the company’s CEO and director for a few of RHI’s subsidiaries. Jay serves on the boards of the Metropolitan Detroit YMCA, Bedrock Manufacturing, StockX, Community Solutions, Bizdom Fund, and Rocket Giving Fund. Jay earned a bachelor’s degree in finance from Michigan State University.

Opinion: The mortgage business is at a 40-year low. If there was blood on the streets, this is it. Rocket is the largest player If they can survive the meltdown, coming out on the other side could be huge.

Name: John Andrew Sr Morris

Position: CEO

Transaction Date: 2022-11-11 Shares Bought: 15,000 Average Price Paid: $6.87 Cost: $103,050.00

Company: Repay Holdings Corp (RPAY)

Name: Shaler Alias

Position: President

Transaction Date: 2022-11-11 Shares Bought: 75,000 Average Price Paid: $6.87 Cost: $515,250.00

Company: Repay Holdings Corp (RPAY)

Name: Timothy John Murphy

Position: CFO

Transaction Date: 2022-11-11 Shares Bought: 26,000 Average Price Paid: $6.87 Cost: $178,620.00

Company: Repay Holdings Corp (RPAY)

In connection with the closure of a transaction in which Thunder Bridge Acquisition Ltd., a special purpose acquisition company constituted under the laws of the Cayman Islands, participated, Repay Holdings Corporation was established as a Delaware corporation on July 11, 2019. Card payment volume is a crucial operating statistic used to assess the business since a sizeable amount of the income is obtained from volume-based payment processing fees on card transactions. The firm is a world leader in payments technology, offering integrated payment processing solutions to vertical markets focused on industries where enterprises have unique and specialized transaction processing requirements. The business is a payment industry pioneer and stands out for its integrated, proprietary payment technology platform and capacity to make electronic payments for businesses less complicated.

John Morris is the Company’s CEO, Co-Founder, and Director. He is the Chief Executive Officer of REPAY LLC, which he co-founded in 2010. Between 2006 and 2008, Mr. Morris was President of REPAY LLC. Mr. Morris served on the Hawk Parent board of directors from the company’s inception in September 2016 through the Business Combination. Since its creation in September 2013, Mr. Morris has also served on the board of directors of Repay Holdings, LLC. Mr. Morris served as the Executive Vice President of Sales and Marketing for Payliance, a payment processing, risk management, and recovery solutions company, after it acquired Security Check Atlanta, a check processing and recovery solutions company, where he had served as President, before starting his role as Chief Executive Officer of REPAY LLC.

The President and co-founder of REPAY are Shaler Alias. As President, he is in charge of establishing and maintaining all business-critical third-party connections, such as REPAY’s alliances with the major card brands, its sponsored banks, and its front- and back-end processing technologies. He also manages the company’s strategic direction. He is a member of REPAY’s board of directors as well. Shaler brings over fifteen years of sales and management expertise in the transaction processing and debt collection sectors. Before REPAY, Shaler co-founded and held the position of director of sales and marketing for Capital Recovery Systems. This contingency-based debt collection company specializes in recovering receivables for the consumer financing sector.

Timothy J. Murphy holds the title of Chief Financial Officer for both M & A Ventures LLC and Repay Holdings Corp. (a subsidiary of Repay Holdings Corp.). On the Hawk, Parent Holdings LLC board is Mr. Murphy as well. He formerly worked as the director of finance for Cadillac Jack, Inc., a principal at BearingPoint, Inc., the director of corporate development for The Stars Group, Inc., and an investment banker for Credit Suisse First Boston Corp. Brown University awarded Mr. Murphy with his undergraduate degree, and Kenan-Flagler Business School awarded him with his MBA.

Opinion: According to Post on the Fly Stephens analyst Charles Nabhan initiated coverage of Repay Holdings with an Overweight rating and a $9 price target. He believes the current valuation overlooks secular tailwinds and stabilizing factors that should contribute to above-peer growth despite Repay’s exposure to economically sensitive verticals, Nabhan tells investors.

Name: Jeffrey Richart Geygan

Position: Director

Transaction Date: 2022-11-14 Shares Bought: 17,650 Average Price Paid: $6.75 Cost: $119,198.00

Transaction Date: 2022-11-08 Shares Bought: 29,022 Average Price Paid: $6.65 Cost: $192,939.00

Company: Rocky Mountain Chocolate Factory Inc. (RMCF)

Rocky Mountain Chocolate Factory, Inc., a Delaware corporation, and its operating subsidiary by the same name, Rocky Mountain Chocolate Factory, Inc., a Colorado corporation, are global franchisors, confectionery producers, and retail operators. The company was established in 1981 and had its headquarters in Durango, Colorado. It produces a wide variety of confectionery items, including premium chocolate candies. Self-serve frozen yogurt cafés are franchised and run by the wholly owned subsidiary U-Swirl International, Inc. Company franchised/licensed system of retail stores, which sell chocolate, frozen yogurt, and other confectionary items is the main source of the company’s revenues and profitability. The business also licenses the use of the name on specific consumer items and sells candies in a few locations outside of its network of retail outlets.

Mr. Geygan was appointed a director in August 2021. Since February 2018, Mr. Geygan has been a director of the Wayside Technology Group, Inc., and since May 2018, he has served as board chair. Since establishing Global Value Investment Corp. in 2007, which provides investment research and consulting services, Mr. Geygan has held the positions of Chief Executive Officer and President. Mr. Geygan worked as a Senior Portfolio Manager at UBS Financial Services before starting GVIC. At the College of Charleston, the University of Wisconsin – Milwaukee Lubar School of Business, and the IE University in Madrid, Spain, Mr. Geygan has taught undergraduate and graduate-level courses. He is a member of the University of Wisconsin – Madison Department of Economics Advisory Board.

Opinion: It’s not like this is a new, novel franchise concept.

Name: Gordon Crawford

Position: Director

Transaction Date: 2022-11-17 Shares Bought: 100,000 Average Price Paid: $6.35 Cost: $634,510.00

Company: Lions Gate Entertainment Corp. (LGF.B)

Lionsgate includes top-tier motion picture and television studio activities coordinated with the STARZ premium global subscription platform to provide customers worldwide with a distinctive and diverse portfolio of entertainment. The company’s 17,000-title library and rich collection of classic film and television properties support its film, television, subscription, and location-based entertainment operations. The company uses three reportable business sectors to manage and provide operating results: media networks, motion pictures, and television production. The production of film and television content and the domestic and international theatrical release of the company’s films both experienced delays. Even though most film and television production has resumed, the industry still experiences production interruptions depending on the local environment.

Mr. Gordon Crawford is a Lions Gate Entertainment Corporation independent director. Since February 7th, 2013, He has worked in several capacities for Capital Research and Management, a privately held investment management firm. Mr. Crawford left his position as Senior Vice President in December 2012. Mr. Crawford is now Chairman of the US Olympic and Paralympic Foundation’s Board of Trustees and a Life Trustee on the Board of Trustees of Southern California Public Radio. Mr. Crawford formerly served as Vice Chairman of the Paley Center for Media and Vice Chairman of The Nature Conservancy. Since 1971, Mr. Crawford has been one of the most powerful and successful investors in the media and entertainment sector.

Opinion: For the life of me, Gordy, tell me what you see here. You continue to throw good money after bad chasing Lions Gate. It’s not like you need anymore as a major shareholder in the company.

Name: Robert Carey

Position: Director

Transaction Date: 2022-11-16 Shares Bought: 50,000 Average Price Paid: $5.88 Cost: $294,000.00

Company: Beyond Air Inc. (XAIR)

The Beyond Air Inc., a commercial-stage medical device and biopharmaceutical company, “LungFit® platform” is a platform of nitric oxide (“NO”) generators and delivery devices. This platform can use the outside air to create. NO, and this platform can produce NO from the outside air. The Company thinks that the LungFit® platform has the potential to meet a significant unmet medical need for patients with specific severe lung infections. The FDA’s premarket reviews and approvals, as well as certification through the performance of a conformity assessment by a notified body in the EU for the product to bear the CE marking and equivalent foreign regulatory authorities, will apply to the Company’s current product candidates. The Company’s system will be marketed as a medical device in the United States.

Mr. Carey joined the Board of Directors of Beyond Air in February 2019. He has a long and successful career in the biopharmaceutical and healthcare investment banking industries. He’s worked on follow-on offerings, debt offerings, and private placements for biotech and specialty pharma companies. He has advised on mergers, acquisitions, and strategic partnership transactions. Mr. Carey co-founded and served as President and Chief Operating Officer of ACELYRIN, INC.; a biopharmaceutical company focused on investing in, developing, and commercializing life-changing medical therapies in 2020. Mr. Carey worked at JMP Securities for almost 11 years as the Managing Director and Head of the Life Sciences Investment Banking Group.

Opinion: Nitric oxide is not to be confused with nitrous oxide. If you could just spin up nitrous oxide from the air around you, can you imagine how much money one of those units could turn outside rock concert venues? The Grateful Dead shows alone could pay for it.

Name: Franklin M Berger

Position: Director

Transaction Date: 2022-11-08 Shares Bought: 42,881 Average Price Paid: $5.83 Cost: $249,996.00

Company: Rain Therapeutics Inc. (RAIN)

Rain Therapeutics Inc. is a late-stage precision oncology company developing oncogenic driver-targeting therapies with the ability to genetically select the patients who will most likely benefit from its therapies. In this method, patients are chosen based on the genetics of their tumors rather than the histology, using a tumor-agnostic approach. The company has in-licensed product candidates, each with a unique profile about the therapies currently on the market. The company plans to keep building the pipeline through targeted business development and internal research initiatives. Mouse double minute 2 is a small molecule oral inhibitor of the company’s lead product candidate, milademetan, which may be oncogenic in various cancers.

Franklin serves as managing director at FMB Research and a consultant to the biotechnology sector. He offers business development, strategic advisory, financing, partnering, and royalty acquisition advice to major biopharmaceutical companies, mid-capitalization biotechnology companies, specialized asset managers, and venture capital firms. Franklin has over 25 years of expertise in capital markets and economic research at Sectoral Asset Management, NEMO Fund, and J.P. Morgan Securities. He is also a biotechnology sector analyst. Franklin holds a BA in international relations from Johns Hopkins University, a MA in international economics from the same institution, and an MBA from Harvard Business School.

Name: Jonas Fajgenbaum

Position: Director

Transaction Date: 2022-11-10 Shares Bought: 29,250 Average Price Paid: $4.27 Cost: $124,880.00

Company: WW International Inc. (WW)

Name: Raymond Debbane

Position: Director

Transaction Date: 2022-11-10 Shares Bought: 75,000 Average Price Paid: $4.27 Cost: $320,055.00

Company: WW International Inc. (WW)

The world’s leading commercial weight control program and an award-winning digital subscription platform are the foundation of WW International Inc., a worldwide wellness firm. The business emphasized encouraging individuals to develop healthy lifestyle habits and aimed to democratize and provide wellness for everybody. The company is among the most recognizable and trusted brand names among customers concerned about their weight because of the nearly six decades of weight control experience, competence, and know-how. To help its customers form healthy habits and concentrate on their overall health and wellness, the company educates them and offers them support, advice, digital tools, and a motivating community. Workshops, consumer items, various events, and experiences, as well as digital offerings made available through apps and websites, all fall under the WW-branded services and goods category.

Mr. Fajgenbaum has been a director since Artal Luxembourg S.A. purchased the company. 1999 September Mr. Fajgenbaum joined The Invus Group, LLC in 1996 and is currently a Managing Director. Mr. Fajgenbaum worked as a consultant for McKinsey & Company in New York from 1994 to 1996 before joining The Invus Group, LLC. His degree was a B.S. and a B.A. from the University of Pennsylvania’s Wharton School in Economics with a focus on finance. From the University of Pennsylvania in Economics. Artal Group S.A. is one of the private companies that Mr. Fajgenbaum serves as a director. Or the L.P. Invus. are investors.

Mr. Raymond Debbane serves on the board of directors of Connecticut College. He is the chairman of Lexicon Pharmaceuticals, Inc., chairman of WW International, Inc., president, chief executive officer of Invus Public Equities Advisors LLC, president and chief executive officer of The Invus Group LLC, co-chairman of Action Against Hunger-USA, and president of Ulys LLC. Mr. Debbane previously held positions as Chief Executive Officer & Director at Artal Group SA, Manager at The Boston Consulting Group & Cie, Independent Director at Ceres, Inc. (California), Keebler Co., and Refresh Mental Health, Inc., as well as Chief Executive Officer & Manager at Blue Buffalo Pet Products, Inc. He graduated from the American University of Beirut with his undergraduate degree, the University of California, Davis with his graduate degree, and Stanford Graduate School of Business with his MBA.

Opinion:

Name: Chad C Deaton

Position: Director

Transaction Date: 2022-11-09 Shares Bought: 50,000 Average Price Paid: $4.07 Cost: $203,450.00

Company: Transocean Ltd. (RIG)

Transocean Ltd. is a top international provider of offshore contract drilling for oil and gas wells. A fleet of 37 mobile offshore drilling units, including 27 ultra-deepwater floaters and ten harsh environment floaters, was owned, operated, or had a portion of their own as of February 14, 2022, by the company. The company had two ultra-deepwater drillships under construction as of February 14, 2022. The company’s main line of business is contract drilling, which involves hiring mobile offshore drilling rigs, ancillary equipment, and work crews to drill oil and gas wells. The company specializes in technically challenging areas of the global offshore drilling industry with a focus on ultra-deepwater and harsh environment drilling services. The drilling fleet, which consists of drillships and semisubmersible floaters used to support offshore drilling activities and offshore support services globally, is one of the most adaptable fleets in the world.

Chadwick C. Deaton, 69, an American citizen, has been a company director since 2012 and the chair of the board of directors since 2019. Before that, from 2004 until 2012, Mr. Deaton held the positions of Chair and Chief Executive Officer of Baker Hughes Incorporated and Executive Chair. He started working at Schlumberger in 1976 and held several worldwide positions, such as Executive Vice President of Oilfield Services from 1998 to 1999 and Senior Advisor from 1999 to 2001. Mr. Deaton served as President, Chief Executive Officer, and Director of Hanover Compressor Company from 2002 until 2004. The University of Wyoming awarded Mr. Deaton a Bachelor of Science in Geology in 1976.

Opinion: Not for me. Revolutionary diet drugs coming onto the market are going to hurt WW.

Name: Wes Cummins

Position: Director

Transaction Date: 2022-11-09 Shares Bought: 107,100 Average Price Paid: $3.17 Cost: $339,666.00

Company: CalAmp Corp. (CAMP)

CalAmp Corp. is a linked intelligence business that uses an ecosystem of data-driven solutions to help individuals and businesses perform better. By offering solutions that track, monitor, and retrieve their essential assets, the company helps clients in the market verticals of transportation and logistics, business and government fleets, industrial equipment, and consumer cars handle complicated challenges. By enabling real-time visibility into a user’s vehicles, assets, drivers, and cargo, CalAmp solutions enable data and insights that help organizations better understand and manage their operations. Ultimately, these insights help organizations worldwide operate with visibility, safety, efficiency, maintenance, and sustainability. With roughly 10 million installed devices reporting to the cloud-based platform, CalAmp is currently producing data for a global customer portfolio.

Mr. Wesley C. Cummins is an Independent Director at Sequans Communications SA, an Independent Director at Vishay Precision Group, Inc., a Chairman & Chief Executive Officer at Applied Science Products, Inc., and a Founder & Chief Investment Officer at 272 Capital LP. He is on the Board of Directors at Sequans Communications SA and Vishay Precision Group, Inc. Mr. Cummins was previously employed as an Independent Director by TeleNav, Inc., a Research Analyst by Nokomis Capital LLC, an Analyst by Harvey Partners LLC, a Research Director & Head-Capital Markets by B. Riley & Co. LLC, a President by Riley Investment Management LLC, an Analyst by Needham & Co., Inc., and an Analyst by Kennedy Capital Management, Inc.

Opinion: They need to operate the business better. I’ll pass

Name: Matthew Neagle

Position: Chief Operating Officer

Transaction Date: 2022-11-10 Shares Bought: 315,000 Average Price Paid: $1.05 Cost: $329,553.00

Company: Porch Group Inc. (PRCH)

Porch, a vertical software for Over 24,000 organizations that provide home services, including house inspectors, mortgage lenders, title companies, movers, real estate firms, utility providers, roofers, and others, use this platform for the home. Porch supports these service providers in expanding their operations and enhancing consumer satisfaction. Porch assists homebuyers in making smarter selections concerning time-sensitive services, including insurance, warranties, moving, security, TV/Internet, and home maintenance and remodeling while saving them money. The porch can provide customers with its product for a few services, such as insurance and warranty. Porch’s Vertical Software segment earns SaaS fees and gains exclusive early access to homebuyers and homeowners by offering software and services to home service providers.

Matthew oversees business operations and leads initiatives to promote organic development for Porch’s software and service platform. He formerly held the positions of Vice President, Operations for Porch from 2014 to 2016, Chief Customer Officer for Porch from 2016 to 2017, and Chief Revenue Officer for Porch from 2017 to 2020. Before joining Porch, Matthew worked for Google and Amazon, where he oversaw teams that assisted small companies in acquiring and retaining consumers online using AdWords. At Amazon, he oversaw the introduction of the Kindle into shops in China, India, and Japan. The largest student organization in the world, AIESEC, has long had Matthew as a leader, sponsor, and alumnus. He graduated from the University of Michigan with a B.A., a B.S.E., and an M.B.A.

Opinion: Tough place to make money for a while with housing getting slammed by Fed policy.

Name: Manuel Kadre

Position: Director

Transaction Date: 2022-11-10 Shares Bought: 296,693 Average Price Paid: $0.99 Cost: $293,506.00

Company: Bright Health Group Inc. (BHG)

Bright Health Group, Inc. was established in 2015 to change healthcare. Making Healthcare Right is the company’s declared mission. The foundation of Together. It is the idea that by linking and coordinating the best local healthcare financing resources with the delivery of care, the business can improve consumer experiences, cut systemic waste, lower costs, and improve clinical results. The company thinks American healthcare has failed the consumer for far too long due to needless complexity, a lack of transparency, and rising costs. American healthcare was primarily created to serve employers and large institutions, and bright Health Group has made healthcare simple, individualized, and affordable.

Manuel is the board of directors of Bright Health Group, Inc.’s lead independent director. He has been Chairman and CEO of MBB Auto Organization since 2012, a premium luxury retail automobile group with several stores in the Northeast and Texas. Manny was the CEO of Gold Coast Caribbean Importers, LLC from July 2009 until 2014, before joining MBB Auto Group. From 1995 to July 2009, he worked for several automobiles, beverage, and consumer products companies in markets across the United States and the Caribbean, holding positions such as President, Vice President, General Counsel, and Secretary. Manny also serves as Chairman of the Board of Republic Services, Inc. and serves on the boards of directors of The Home Depot, Inc., Mednax Services, Inc., and as Vice Chairman of the Board of Trustees of the University of Miami.

Opinion: “There is a house in New Orleans, They call the Rising Sun. And it’s been the ruin of many a poor boy. And God I know I’m one” The House of the Rising Sun

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have and we curse aloud, what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

[…] Opinion: We have written about this in detail in the past, as this is Mr. Kiani’s second round of recent buying. Check out the blog on November 19th, Masi Apple Showdown coming soon to a Screen near You. […]