Three weeks have passed with little notable insider buying. Insiders continue to cash out. Amazon founder Jeffrey Bezos sold $1 billion, which should help with his much-panned wedding. Larry Fink of BlackRock unloaded $30 million, the Etsy CEO sold ~$9 million, the Penumbra CEO took ~$3.7 million out, Carvana founder Ernest Garcia unloaded $80 million, and Goldman Sachs executives blew out close to $100 million, and I haven’t even finished the reporting week. I could spend the next few hours analyzing insider selling, but it’s not a productive task in an of itself. Perhaps run an AI prompt on unusual selling, but why bother? I already know what I can learn from this. Warren Buffett, the Oracle of Omaha –has already run the prompt. We already know the output: “Be greedy when others are fearful, and fearful when others are greedy.” Ironically, the underperformer in the S&P 500 is none other than Berkshire Hathaway.

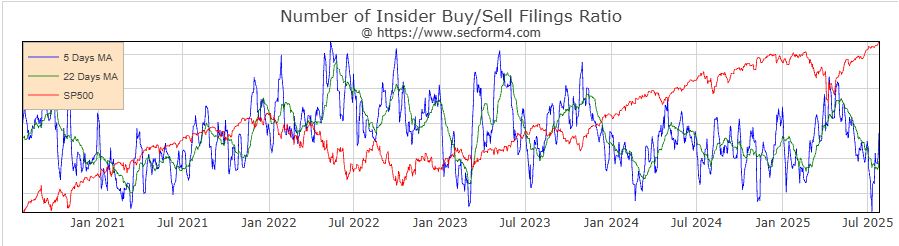

This market presents a paradoxical mix of fear and greed. The spread between the S&P 500 and MA of insider buy/sell ratio is clearly the largest in five years. The most profitable periods are when the exact opposite is the pattern. Note in the chart above the “Liberation Day’ sell off and commensurate step up in the ratio. While concerns about the deficit are prevalent, the government’s revenue surge from tariffs and insider stock sales could fuel further market enthusiasm. In effect a positive feedback loop reminiscent of other market booms like the productivity boost of the Internet, the exuberant atmosphere of 1999. It’s also reminiscent of the roaring twenties, except its the 2020s.

Name: Yogesh K. Gupta

Position: Chief Executive Officer

Transaction Date: 07-23-2025 Shares Bought: 2,100 shares an Average Price Paid of $49.14 for Cost: $103,194

Name: David Krall

Position: Director

Transaction Date: 07-23-2025 Shares Bought: 5,125 shares an Average Price Paid of $48.90 for Cost: $250,613

Company: Progress Software Corp (PRGS):

Progress Software Corporation is a global provider of AI-powered application development and digital experience solutions. Its product portfolio includes Chef for DevOps and DevSecOps automation, Corticon for decision automation, and DataDirect for secure data connectivity across diverse sources. The company also offers developer tools for .NET and JavaScript, AI components, reporting solutions, and automated testing tools. Additional offerings include Flowmon for network security and visibility, and Kemp LoadMaster for application delivery and security. Founded in 1981, Progress Software is headquartered in Burlington, Massachusetts.

Yogesh K. Gupta has served as President, Chief Executive Officer, and Director of Progress Software Corporation since October 2016. Since joining the company, he has led its strategic growth through innovative product launches, targeted acquisitions, and operational enhancements. Mr. Gupta holds a Bachelor of Science in Electronics and Electrical Engineering from the Indian Institute of Technology, Madras, and a Master of Science in Computer Science from the University of Wisconsin–Madison.

David A. Krall has served as a Director of Progress Software Corporation since March 2008 and currently chairs the Compensation Committee. He brings over 25 years of leadership experience in the software and digital media industries, having held executive roles including President and COO of Roku Inc., CEO of Avid Technology, and CEO of QSecure. Mr. Krall holds both a Bachelor of Science and a Master of Science in Electrical Engineering from the Massachusetts Institute of Technology (MIT), as well as an MBA with distinction from Harvard Business School.

Opinion: Progress Software stock went into free fall after Q2 earnings. Analyzing multiple Chatbots seem to bring up disappointing growth in recurring revenues and gross margins in spite of revenue and earnings beats. PRGS has made six acquisitions during the last five years. Organic revenue growth is preferable to growing by acquisitions yet DCF models from ChatGPT and Claude show a DCF value closer to $65. This strong and consistent free cash flow generation is one of the reasons why DCF models show Progress Software trading below its intrinsic value – the company is generating substantial cash that can be returned to shareholders or used for debt reduction and strategic investments.

Name: Geoff E. Tanner

Position: President and CEO

Transaction Date: 07-23-2025 Shares Bought: 6,050 shares an Average Price Paid of $33.11 for Cost: $200,297

Company: Simply Good Foods Co (SMPL):

Simply Good Foods is a consumer packaged food and beverage company committed to leading the healthful snacking movement. Its product portfolio includes protein bars, ready-to-drink shakes, sweet and salty snacks, and confectionery items marketed under the Quest, Atkins, and OWYN brands. The company emphasizes convenient, innovative, and better-for-you offerings that align with modern wellness trends. With a strong foundation in health and nutrition, Simply Good Foods seeks to expand its presence in the nutritious snacking category through product innovation, organic growth, and strategic acquisitions.

Geoff E. Tanner has served as President and Chief Executive Officer of Simply Good Foods Co. since July 2023, after initially joining the company in April 2023 as President, Chief Operating Officer, and CEO-elect. He holds a Bachelor of Commerce and a Bachelor of Arts in Political Science and Government from Victoria University of Wellington in New Zealand, and an MBA from Duke University’s Fuqua School of Business.

Opinion: Based on the most recent DCF analysis I found, Simply Good Foods (SMPL) has an estimated DCF value of $33.64 per share -$50 per share. The average annual growth rate has been slowing, with just `7% in 2024. I think I’d skip my Atkin bar here.

Follow us on Twitter for real-time commentary and insider buying alerts at https://twitter.com/theinsidersfund

If you are a QUALIFIED INVESTOR and are interested in learning how you can be part of the Insiders Fund, schedule some time with me here.

This blog is solely for educational purposes and the author’s own amusement. IT IS NOT INVESTMENT ADVICE. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

The Insiders Fund and its blogs and posts are not affiliated with, endorsed by, or sponsored by any of the companies mentioned herein. All company names, logos, and trademarks belong to their respective owners. The use of company logos is solely for descriptive and illustrative purposes under fair use. Any information provided is based on publicly available data and should not be considered financial, investment, or legal advice. Readers should conduct their own research or consult with a professional before making any investment decisions.

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data, so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified as soon as practically possible. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does. When I have time, over the weekend, I’ll add some preliminary analysis to the Opinion at the end. Sometimes I won’t update this for a couple of weeks or more. A good way to use this blog is as I do, it’s a reference point and filing cabinet for various stocks with notable insider buying. It’s one of many tools I use. I regularly live on Chat GPT and Microsoft Copilot now. I find the footnotes research very helpful in eliminating errors from AI hallucinations.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,