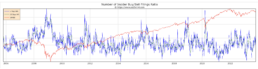

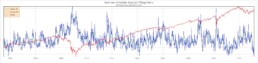

Insider Buying 02-14-25 Buyers Coming Back as Blackout Abates and Uncertainty Rocks Stocks

As Q4 earnings announcements start to wind down, we would expect to see a pickup in insider activity. We are seeing that, particularly in sectors that have sold off in anticipation of possible Trump…

Insider Buying Week 06-28-24 The Emperor has no Clothes

In addition to the lack of insider buying, there was a Presidential debate last week between a sitting President with a blank stare and an ex-President who has shown us he will stop at nothing to…

Insider Buying Week 06-21-24

It's that familiar time of year again when insiders are blocked from transacting in their own stock due to pending 2nd quarter earnings. At least two of the notable buys were stocks The Insiders Fund…

Fathers Day Insider Buying Week 06-14-24

The post took a backseat to Father's Day last week. Looking closely, you can see me with DJI FPV goggles next to my son at Tunnel Park. In the background, the sun sets over Antelope Island in the…

Insider Buying Week 02-09-24 Is it the Super Bowl or the Ripping AI Bandwagon?

Finally, there is some work to do in analyzing insider buying. It's not much, but it's better than the last three weeks of nonexistent purchases. Still, the lazy move, and perhaps the best move, is…

Insider Buying Week 12-15-23 Glad to See some Big Names and Big Dollars Returning to the Insider Buying Game

While some stocks like the Magnificent Seven have had a phenomenal comeback year, many, many companies are depressed in value. We have no shortage of compelling investment ideas, but getting people…

You Really Want to Know What's Wrong with this Market? Insider Buying Week 10-27-23

$OXYLast week, I had two conversations with astute market watchers, one a long-time successful UBS financial wealth manager and the other, a close personal friend who bought the second charity lunch…

Bank Execs Picking over the Carcasses Insider Buying Picks Up-Week 3-17-23

Insiders are the ultimate value buyer. It's rare they buy at the top of the price chart but instead prefer to plumb the depths for the prize. They are buying the banks you never heard of while…

Federal Reserve Chairman Powell is a Dangerous man

I wrote to clients in the February update that Federal Reserve Chairman Powell is a dangerous fellow. Last week he proved that causing a run on the banking system. Ironically if the creation of a…

One way this is not like 2008, Insiders are NOT Buying -Insider Buying Week 3-10-23

This is LIKE 2008, contrary to what you may have heard about the recent Silicon Valley Bank failure. Banks either don't want to pay competitive deposit rates or can't. Competing with Fed Chairman…