- The first every buy from Exxon Mobil XOM controller Patrick Mulva steps up and purchases $1 million at $89 on 3/13/13. We are all over this one. There are plenty of catalysts. Exxon is a major player in the U.S. domestic gas market via its ill timed purchase of XO Energy. Natural gas usage is picking up momentum. We’ve been blogging about this over the last two days and have done very well with our purchase of Dresser Rand. Also the refinery business is very lucrative for XOM. They are the world’s largest refinery. Have you noticed the price action of Valero, Holly Frontier, and even Phillips 66 which has doubled since spun off from Connoco Phillips. How about CVRR? We tweeted about this, up 14% in three days since. Follow us on Twitter. XOM could be the monster trade we are waiting for. Let’s see if any other insiders step up to the plate.

- Akamai Technologies AKAM steps up and buys $1 million more after his large buy in February. No one seems to care though as the stock sold off even on this news Friday. We bought this one last month and made a lot of money on it and we’re glad we got out. Now we’re back again at an average price of $35.25. It closed Friday at $34.70. General angst over Amazon, Google and other encroaching into web services. Great balance sheet, large international telecom partners. Grandaddy of the space, continual massive insider support.

- Five insiders buy $1.5 million of troubled Allscripts Healthcare Solution, Inc. (MDRX). This one we traded in and out of for a profits. On 3/12/13, five insiders appeared to show confidence in the clinical software developer’s growth by purchasing an aggregate $1.5 million. They bought right after earnings blackout period with an average cost of $12.70. Don’t know what to think of this one. Where were they just a few months ago when the stock was much lower?

- Three insiders buy $1.5 million of TETRA Technologies TTI near 52 week high. Don’t know exactly what they are doing here. Attended their presentation last year at Intercom. TTI drew very little interest from the investing public. Insiders are swarming all over this company. Possibly a water recycling frac play as they just got a patent in the space but they don’t talk this up that much. We are going to listen to their web presentations more this weekend and read some analyst’s take on this company.

Insider Selling (Warning.. insider selling is nowhere as predictive as buying. We pay particular attention to cluster selling particularly when the insiders have a good history of calling the top or when the stock has been trending down, akin to rats fleeing the ship)

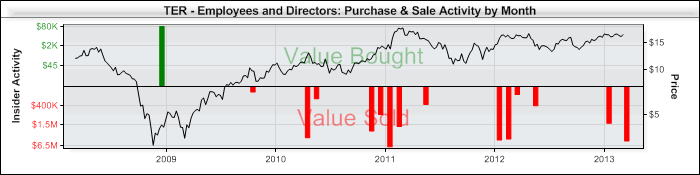

- Teradyne TER CFO and CEO sell $4.5 million between 3-5 and 3-6-13. According to the Company’s recently filed 10K, “we design, develop, manufacture and sell automatic test systems and solutions used to test semiconductors, wireless products, hard disk drives and circuit boards in the consumer electronics, wireless, automotive, industrial, computing, communications and aerospace and defense industries.” 68% of the business revenues is semiconductor test equipment. The remainder is wireless testing (17%) and systems test (15%) Apple is the largest customer in wireless about 10%. 86% of sales are outside the U.S. CFO Beecher On 3/5,exercised 67,424 options which were not due to expire for just over three years, and sold the resulting shares. He then disposed of an additional 58,000 shares. The aggregate $2.2 million sale was Beecher’s fifth and largest at the company, and decreased his holdings by 42.3%.Beecher has been successful timing prior sales before decreases in price at TER, making his recent sale worth noting. In the nine months following his first four sales, the stock slid an average of 20.7%, earning him the The Washington Service’s highest Insider Rating for the time period. In the last quarter, Agilent’s Electronic Measurement segment revenue declined both sequentially and year over year for the third straight quarter. Agilent is named as a competitor in the 10-k. According to Yahoo finance, 14 analysts follow TER and the consensus is a 41.6% drop in Q2 revenues.

. . |

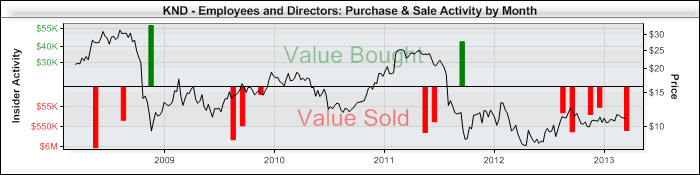

- Why are they dumping Kindred Healthcare, Inc..(KND) On 3-8-13, three insiders at Kindred Healthcare (KND) sold a total of 75,367 shares. This involved the largest number of insiders selling since May 2011. From their 10K, “We are a healthcare services company that through our subsidiaries operates TC hospitals, IRFs, nursing and rehabilitation centers, assisted living facilities, a contract rehabilitation services business and a home health and hospice business across the United States. At December 31, 2012, our hospital division operated 116 TC hospitals (8,382 licensed beds) and six IRFs (259 licensed beds) in 26 states. Our nursing center division operated 223 nursing and rehabilitation centers (27,142 licensed beds) and six assisted living facilities (341 licensed beds) in 27 states. Our rehabilitation division provided rehabilitation services primarily in hospitals and long-term care settings. Our home health and hospice division provided home health, hospice and private duty services from 101 locations in ten states.” There are a few things besides insider selling to be concerned about. Medicare was 59% of the business last year. Sequestration could pressure reimbursement rates. Kindred is a serial acquirer and has grown by acquisition.

Fleetcor (FLT) insiders can’t sell this IBD 50 company fast enough. Eleven insiders have sold a combined $321.6 million of stock in the last 30 days alone. I can see why insiders might want to sell some of their stock when the share price has doubled over the past 12 months but what about the big upside left – if any? Another red flag is the declining cash flow. Net earnings grew by 49.4% from 2011 to 2012 yet cash flow declined by 51.5%. Insiders don’t have a good record of profitable selling at FLT. Momentum stocks like FLT can be painful to short.

Cliffs Natural Resources Inc. (CLF) Things don’t appear to be looking up anytime soon or at least the 5 insiders selling $586.5 thousand dollars worth of stock aren’t sending that message. The CFO sold 19.5% of his holdings at $24.o4. That’s a far cry from the $70 per share it reached a year ago. Normally insiders buy on weakness and sell on strength. Insiders selling at these low levels is not confidence inspiring for the bulls.