Insiders Know When to Buy & It Shows

… according to many of today’s charts at least.

We believe insiders know their business better than most. We also believe they buy for one main reason – to make money. Last week’s insider buys compared to todays charts appear to support our believes. Are you a believer too?

$QTS, $DISH, $VSAR, $UAL, $YUMC, $GOGO, $HWKN, $LCII, $DLTR, $WR, $CARG, $LOGM, $NYT

METHODOLGY

In this report, we examine stocks that C-level officers and directors bought and sold throughout the week ending June 8,2018.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. As a standard, we only look at material amounts of money, $100 thousand or more, as anything less could just be window dressing.

The bar is different with selling, because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52 week lows.

Another red flag are large planned sale programs that start without warning. We generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and not the SMART money we are trying to go to school on. We also exempt IPOs and secondaries for a variety of reasons from not being available to the public or more nefarious reasons like trying to provide support for additional fund raising.

Although this info is available for free from the SEC’s Website , Edgar, we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data. Credit for charts goes to yahoo.com

To learn more about our strategy, visit our website at The Insiders Fund. We welcome your comments on our analysis.

NOTE: We may own positions, long or short, in any of these names and are under no obligation to disclose that.

This Week's Buys

As we get into the blackout period, it is normal to expect less and less buying. Selling, on the other hand, since corporate insiders with 105-1 plans can sell at will.

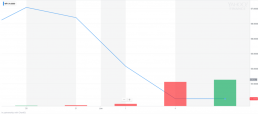

QTR Realty Trust (QTS)

The Inside Trade: Chairman of the Board, Williams purchased $5.1 million worth of low yielding (1.64%) QTS at prices averaging $35.74 capping of a slew of insiders scooping up QTS depressed stock.

As usual, the sectors that are the most out of favor in the market attract insider interest. Nothing baits an insider as much as a sinking stock price. Rising rates have depressed the REIT sector as they are primarily a haven for income investors. Higher interest rates generally mean lower prices for REITs, utilities, bond funds, and other income plays. REITs, though, have a little more insulation from a rise in interest rates due to improving business conditions as they can often raise their rental rates as the economy improves. QTS Realty Trust, Inc. (NYSE: QTS) is a leading provider of secure, compliant data center solutions, hybrid cloud and fully managed services.

Candidly, we don’t see the attraction to a dividend this low. Data centers are growing, no doubt but many of the largest players build and run their own like Apple, Amazon, Google, Facebook, etc. This is not a business we would want to be in.

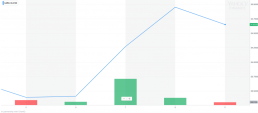

United Continental Holdings, Inc (UAL)

The Inside Trade: Director Shapiro added to his stake with another $1.7 million purchase at an average price of $69.15.

Rising oil prices have begun to take a toll on airline profit margins. Delta recently said price hikes are coming due to fuel inflation. Maybe this will hike the moribund stock prices of the group.

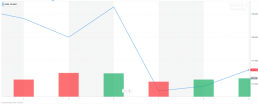

Dish Network (DISH)

The Inside Trade: Founder, Chairman and controlling shareholder, Charlie Ergen, casts a vote when few others venture. Ergen purchased 100,000 shares at $29.37, just above the 52 wk low price of $28.80.

It would be no surprise to us if that marked the floor in the stock as this kind of large insider purchase often does put a bottom in, restoring some modicum of confidence and helping put the short sellers at bay.

We don’t know enough about the dynamics of this, but I would research on DISH’s reportedly valuable bandwidth. Is this a potential 5G play? We plan on doing more work on this name but it interests us. This is first open market purchase of any size in the Company’s history. We will initiate a small position that could rise to a major one based on our analysis.

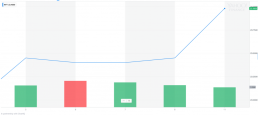

LCI Industries (LCII)

The Inside Trade: CEO Lippert and President Merness bought $503 thousand and $340 thousand at $83.83 and $85.00 respectively.

LCII is in the recreational vehicle business. The fear of rising rates and gasoline prices has crushed the sector.

We made a lot of money last week on Camping World Holdings but it was diminished by our play on Rev Group REVG earnings which caused the stock to plummet 20% in spite of heavy insider buying. This is a tough group to make money in and we prefer Camping World, CWH, which we have recently reported on.

Versartis Inc (VSAR)

The Inside Trade: Director Akkaraju bought $1.9 million of this biotech at $1.81.

Shares of Versartis Inc. soared 24% in active premarket trade Monday after the biopharmaceutical company announced a deal to merge with privately-held Aravive Biologics Inc. to create a company focused on developing cancer treatments.

Aravive’s lead development candidate AVB-S6-500 is in a phase 1 trial for the treatment of ovarian cancer. After the deal closes, the company will operate under the Aravive Inc. name, and will continue to trade on Nasdaq, but under a new ticker symbol to be determined at a later date.

Yum China Holdings, INC (YUMC)

The Inside Trade: CEO Wat took a big bite of YUM by buying 24,400 shares at $40.97 for $1 million.

Ms. Joey Wat has been the Chief Executive Officer of Yum! China Holding, Inc since March 1, 2018 and has served as its President and Chief Operating Officer from February 7, 2017 until February 2018. Ms. Wat has been a Director of Yum! China Holding, Inc since July 2017.

Ms. Wat served as Chief Executive Officer, KFC from October 2016 to February 2017, a position she held at Yum! Restaurants China from August 2015 to October 2016.

Gogo Inc (GOGO)

The Inside Trade: CEO Thorne spends another $745.5 thousand on what to date has been a losing investment.

Gogo Inc. is in a race against the onslaught of technological obsolescence. As it ramps up its broadband speed on the the fleets of airplanes using its products, Gogo faces new challenges on many fronts.

For example, Elon Musk, amongst others, has said that Space X plans to launch hundreds of low cost satellites to offer ubiquitous global internet connectivity.

Hawkins Inc (HWKN)

The Inside Trade: CEO Hawkings bought $731 thousand of this specialty chemical manufacturer.

The 52 week low is $32.50 so it seems this is a case of bottom fishing. It’s a large buy from an obvious founder so we are paying attention to it.

Dollar Tree Inc (DLTR)

The Inside Trade: Two insiders took advantage of plunging prices after 2nd quarter earnings last week. Directors Lewis and Navlor bought $201.1 thousand and $246.2 thousand at prices of $80.44 and $82.08 respectively.

This Week's Sells

LogMeIn Inc. (LOGM)

The Inside Trade: Six insiders unloaded $10.8 million of stock.

This highly acquisitive company may have hit a temporary wall with their latest acquisition of Utah-based Jive Communications. The highly competitive unified messaging business is a stretch from the gotomeeting roots.

However, if they pull it off, it will catapult renewed growth. If they don’t, well this is a good short as its valuation is stretched.

We are doing more research on this name.

New York Times (NYT)

The Inside Trade: Carlos Slim continues to lessen his ownership in the New York Times, selling another $24 million worth of stock, decreasing his ownership by another 8.9%.

Combined with the previous week, this marks a 32.9% overall decrease of his ownership in the stock.

Westar Energy, Inc. (WR)

The Inside Trade: Selling has picked up here with 8 insiders unloading millions of dollars worth of options. We are doing more research here.

Car Gurus (CARG)

The Inside Trade: Six insiders unloaded $165.3 million.

This week continues a notable inside selling string of the online car vendor.

[…] this report card, we show the performance of insider trades we deemed as significant in our report from the week ending June 8, 2018. Here is how the trades have done so […]