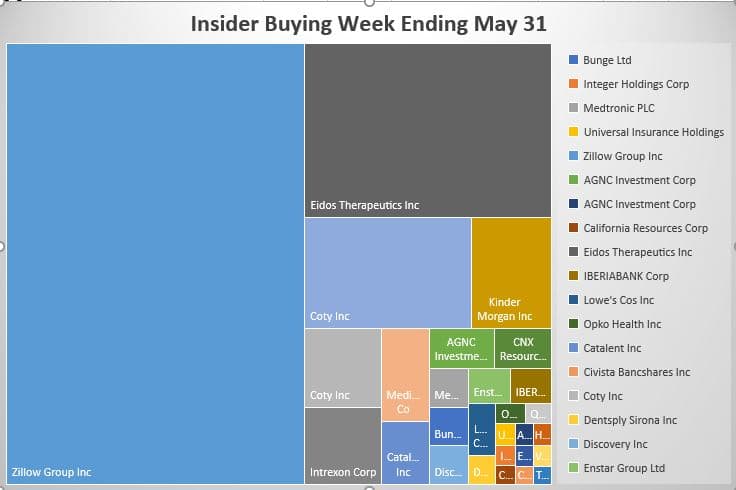

Insider Buying Week Ending May 31, 2019

Jay Hoag of Zillow Goes All In

Trump rocks market with trade wars on multiple fronts. Impromptu tweet on Friday about tariffs on Mexico linked to immigration enforcement cap off a month that most investors would like to forget. Monday’s action is likely not to be any better for FANGS with the news that the Justice Department is opening up an anti-trust investigation on Google aka Alphabet. S&P 500 Wipes Out $4 Trillion in Its Second-Worst May Since the ‘60s. Insiders are nibbling at a few names but in the short term are losing money like everyone else.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. As a standard, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. We generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and not the SMART money we are trying to go to school on. Although this info is available for free from the SEC’s Web site, Edgar, we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.To learn more about our strategy, visit our website here. We welcome your comments on our analysis.

THE INSIDERS FUND is a long-short equity fund. We invest in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is “inside information”. The SEC mandates that officers, directors and 10% shareholders file a Form 4 detailing buying and selling in their company’s stock within 48 hours. The SEC makes this info public immediately upon receiving it. This is as close to “insider information” that an ordinary investor is likely to see. We may own positions, long or short, in any of these names and are under no obligation to disclose that.

If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.