The old adage is you make money when you wait to buy when there is blood on the streets. There is certainly some blood on the streets in Denver at this year’s Entercom, an annual event where oil and gas companies pitch their investment prospects to institutions, individuals, and especially to their bankers so they will extend the lifeline. After years of building and growing reserves, now the mantra is debt-adjusted cash flow growth. There may be blood but hope springs eternal in the blood of the oil wildcatter. Here are my day one observations:

- Surging US supply coupled with tepid global demand is crushing share prices.

- Perception about growth has changed the investor psychology to believe the industry is in secular decline.

- Energy companies perceived as a poor steward of capital. Pursuing growth for growth stake.

- Rise of ESG (environmental social governance )investing has seen institutional money fleeing the sector.

- Free cash flow is the buzzword of the Conference.

- Occidental CFO delivers a blockbuster keynote.

I found the Occidental presentation fascinating. I’ve attached it here, Occidental.pdf. I hope I don’t get disinvited by the folks at Entercom for doing this.

- The dividend is sacrosanct at OXY. That’s the word they used to describe their attitude, sacrosanct. Occidental has no intention of cutting the 6.7% dividend.

- They plan on rapidly selling some assets, notably the African acreage, reducing debt.

- They explained the Anadarko deal in detail with an interesting timeline. They’ve been eyeing them for a couple of years. Warren Buffett financing was key as he took a subordinate position with the 8% preferred enabling OXY to maintain investment grade with the rating agencies. Their weighted average loan rate on the debt part of the deal was 4.6%. You don’t hear Carl Icahn explaining that.

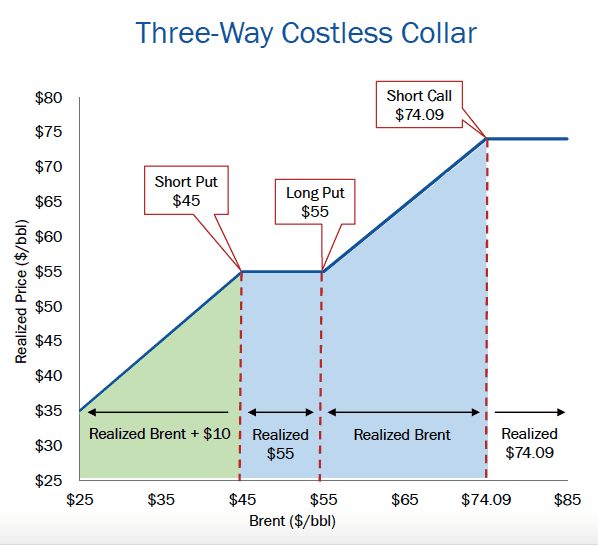

- Oxy has put a gigantic derivative collar in protecting their cash flow to $40 WTI barrel of oil. As long as WTI doesn’t go below $40 dividend is secure.

Other presenters interested me but I’d have to do more work before I would buy any of them. I’m buying OXY but not backing up the truck or anything. I like the fact that there has been massive insider buying and the stock has been trashed by the rout in the sector and Icahn bad-mouthing the CEO. Fact is I don’t think he’s sold any stock either.

Cabot is a natural gas exploration company working 100% in the Marcellus. Said you will see the lowest prices for gas is in October. COG has free cash flow even in the worst year,2016. I think they are the only company that presented today that does have free cash flow although everyone is aspiring to or projecting it. The unit cost of gas is $1 less than in 2016. I asked the CEO about paying back ALL of their debt and he said with gas at $2.50 they could be debt-free in 2/12 years if they suspended the dividend and buybacks. That won’t happen of course. I’ll probably buy some COG but may wait for October when gas bottoms.

Vermilion Energy, a Canadian E&P company with a 13%yield has no intent to cut the dividend and would cut CAPEX first. They sell a lot of product overseas where they realize higher prices. Say they are cash flow positive but the payout ratio is 100% pretty much like OXY now but somehow I trust Occidental more on this.

High Point HPR mostly hedge production should ben cash flow positive 2nd half. They have lots of insider buying. Drilling all in Colorado rural counties very friendly to oil and gas. I learned that Colorado voted on fracking and agreed they would legislate on a county by county level. No fracking in Denver county but the rural counties where they drill like the frackers and the money they pour into the economy.

Lonestar Resources, a driller in the Eagleford says they are free cash flow positive in 2020. Who has that long?

SM Energy should be free cash flow 2nd half 2019 debt-adjusted cash flow share growth. I learned a new buzz word phrase, debt-adjusted cash flow growth. I’m still wrapping my aging brain around that.

WTI Offshore CEO believes they have 100 billion barrels of oil in the Gulf of Mexico yet to be proved, 1.4 billion in cash flow not fully appreciated by the market. He just bought $1million of stock at $4.63 per share. We bought a little of this and might be a little more. The GOM is getting more respect as the depletion rates in the oil shales are far worse than the long-lived assets in the GOM>

Wells Fargo economist doesn’t believe Trump gets a trade deal with China before the Presidential election. He believes oil is $50-$55 for the foreseeable future.