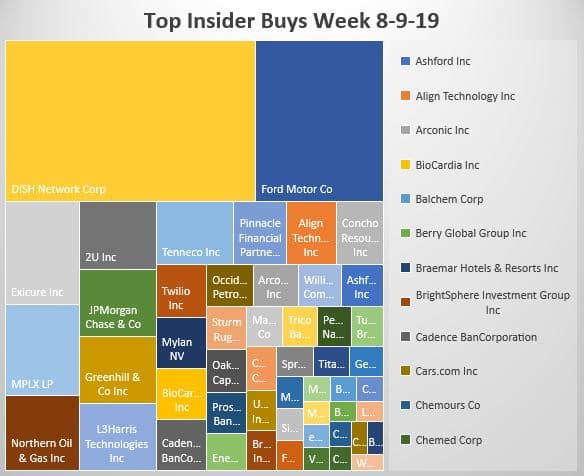

After weeks of dull action, insider buying has finally picked up. Part of it is the end of 2nd Quarter earnings blackout and part of it is the market sell-off. The highlights:

Charlie Egren, the founder of Dish, is making a massive bet on 5G, buying assets in the pending TMobile Sprint network and committing billions to buy more bandwidth. Its a bet the farm expensive gamble on a player late to the game. But if the competing networks are slow in getting 5G rolled out, Dish might be able to lumber in and get a piece of the future without the steep prices others have paid.

Chairman of the Board, William Clay Ford, bought $7.9 million worth of his namesake. God only knows why. Ford has been dead money for years and we don’t see a reason for that to change. Perhaps Ford is getting a handle on the unprofitable operations. The 6% dividend is attractive, especially if they can show some growth in earnings.

Several insiders bought Marathon Petroleum midstream spinoff, MPLX. This one looks like money in the bank to us; 9.7% yield, interest rates headed lower, and trading at a 5 year low. Oil and Gas looks like an investment wasteland, the worst-performing sector YTD. That’s exactly why insiders are buying this sector. Investments in Occidental, Northern Oil and Gas, and Williams Co all showed up on our screens this week. We like Occidental, it’s 6% dividend and Carl Icann agitating. We also like Williams which has a 6.3% dividend yield with a stable natural gas pipeline business.

The next worst-performing sector is the banking group. Standout JP Morgan has been attracting million dollar insider buys all year. It’s proved to be good trading but until interest rates show some signs of rising, don’t expect much more than a trading range and a 3.28% dividend which isn’t all that bad considering the 10 yr is yielding 1.75%.

Insiders come back to the well at online education company, 2U Inc, with million-dollar purchases. 2U Inc had a disastrous 2nd quarter losing 80% of its market cap. One of the things we look at is the winning percentages that particular insiders have. The guys at 2U Inc don’t inspire confidence.

Here’s a hail mary pass. Two insiders buy almost $2 million of Tenneco, an auto and truck parts company. Ten is trading at 27 year low.

Mylan’s Chairman, Robert Coury, bought $1 million worth of the generic drug manufacturer. Mylan is in part depressed in price due to litigation threats from opioid lawsuits. We despise Coury as this is the man that turned down $70 plus offer for the company from Mylan. We don’t like management who has other agendas than shareholder’s best financial interests.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, unintuitive as it may seem, insiders can also be wrong about their Company’s prospects, they can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website.

If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar

#stock #market #money #bitcoin #business #forex #marketing #binaryoptions #wallstreet #cryptocurrency #forextrader #trading #binary #luxurylifestyle #entrepreneur #stockmarket #realestate #billionaire #investor #food #investing #success #iqoption #forexsignals #binaryoptionsignals #usa #invest #workfromhome #forexlifestyle #trader