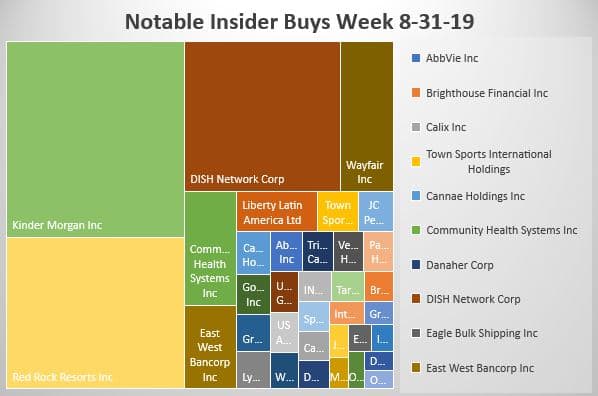

You have to love investors that put their money where their shareholders are. None are better than this than Richard Kinder, pipeline magnate. He bought almost $8 million of his namesake company, Kinder Morgan. The 5% dividend yield looks both juicy and secure.

Las Vegas Station Casino owner continues to pile into Red Rock Resorts. Maybe he hasn’t heard that a recession is on the way.

Dish shareholders continue to bet the farm on the license spectrum and their highly risky and leveraged 5G buildout. 5G cellular is supposed to change everything and no doubt it will change Dish.

Wayfair director Kumin continues to bet big on this as of yet unprofitable but fast-growth online household furniture and lifestyle company, Wayfair. We are passing on this as it looks like a big VC firm, other people’s money.

GOGO – don’t ask me to explain this insiders’ fascination with losing money on in-flight WIFI company GOGO.

CEO of chemical giant LyondellBasell bought $500k. If this is bottom fishing and taking one for the team, it might be a good contrarian bet as LYB is now yielding 5.4%.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, unintuitive as it may seem, insiders can also be wrong about their Company’s prospects, they can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website.

If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar

#stock #market #money #bitcoin #business #forex #marketing #binaryoptions #wallstreet #cryptocurrency #forextrader #trading #binary #luxurylifestyle #entrepreneur #stockmarket #realestate #billionaire #investor #food #investing #success #iqoption #forexsignals #binaryoptionsignals #usa #invest #workfromhome #forexlifestyle #trader