Please read the last paragraph before you invest. Following insiders, although childishly simple and obvious of an idea, is fraught with danger. You can lose money. There are a lot of nuances to interpreting. For example, the significance of a billionaire buying $300,000 worth of stock is like the average person tippling the valet $5. It doesn’t mean much. We try to grab the essence of an interesting buy with as few words as possible.

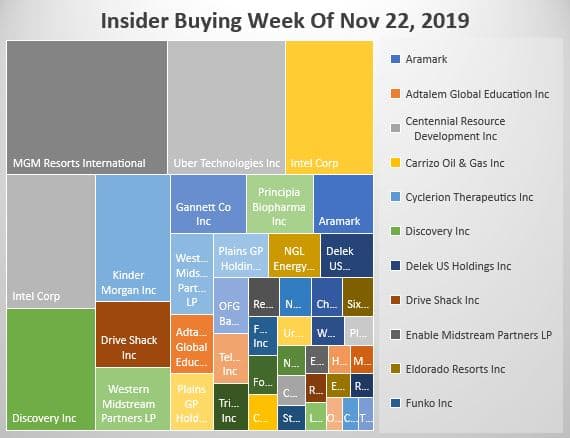

Why does Aramark CEO buy $1.49 million of stock at $42.68? Perhaps he is jealous of seeing his Chairman of the Board make $1,000,000, 30% on his $3 million buy 11 months ago. There is not much growth in revenues. It does seem they are getting more out of the dollars though with net profit per share rising far in excess of revenue growth. A paltry 1% dividend is embarrassingly low. The CEO said they planned to accelerate revenue growth. I guess that begets the question, why haven’t they done it already. None the less these are large buys from C-Level officers and they may be more to appearances like a takeover offer tucked away in the cobwebs. I like the chart and we’re nibbling until we understand the catalyst.

Adtalem Global Education company has been on a steady decline since 2016 so it’s very interesting why someone like the CFO drops a cool $1.079 million at $33.73 on this pig in a poke. This is the old Devry Education Company. n March 2016, the Veterans Administration reprimanded DeVry over allegations of deceptive marketing practices made by the Federal Trade Commission and suspended DeVry University from its “Principles of Excellence” status under the G.I. Bill. This is a new job for the CFO and that explains the buy.

Discovery Inc. Insiders seem, confidant, they are buying a money-making business. I wouldn’t be so sure. The streaming video landscape is the most brutally competitive market I’ve ever seen. I don’ t like a business where your competitors are willing to lose billions to get a toehold. Perhaps Apple will buy Discovery or Lions Gate as their new Apple TV streaming product is horrendously bad. John Mallone, a legend in the industry just bought $75 million more of stock. He’s certainly smarter than me so take this with a grain of salt.

At some point, E&P companies will have a rip your face off rallies. I would have thought the attack on the Saudi oil and gas infrastructure would do it but nothing happened except stock prices got cheaper. The long and short of it, is I am staying away for oil and gas exploration companies with the exception of Occidental Petroleum. There is just way too much insider buying and an 8% dividend that is sacrosanct. Instead, I’m investing in pipelines and infrastructure like NGL Energy Partners LP with its 15% dividend yield or Plains GP Holdings, LP. Carizzo makes money, quite a bit of it but they are involved in a merger with Callon so I’m on hold here.

Fossil group executive bought McKelvey bought almost $500,000 worth of stock. Fossil has been investing heavily in the smartwatch category. Google just bought Fitbit. I’d short Fossil, not buy it. There’s zero chance of successfully competing now.

Funko toys are growing in popularity but one has to wonder how long novelty items can be hits. This is a notoriously faddish industry. Business by the numbers looks good except stock performance is generally horrible. It jumped 8.83% Friday when the filing became public that a director bought nearly $500,000.

Normally we discount the new director buys. After all, you’re expected to own some stock for attending four board meetings per year and getting paid hundreds of thousands in dollars and options for the time commitment. But no one expects you to buy $9 million worth of stock, even if you are a billionaire, like James Goetz, the new Intel director. I like Intel but even a $9 million dollar buy won’t move a mega-cap stock.

Tricida CEO Parker has been a steady buyer of his stock and so have we. We’ve made some good money on it but unfortunately did not own when this latest buy was revealed, $686,016 and it sent the stock up to new heights. Biotech is on fire right now and only expect it to heat up further with the news this weekend that Novartis is paying $7 billion for the Medicine Company. See our twitter post about that!

UroGen Pharma CEO scoops up 15,000 shares of URGN at $28, a depressed price. This is development-stage biotech. Oppenheimer analyst Gershwell lowered his target to $62 from $70 on November 13th. Are you kidding me? This is the first meaningful insider buy in the history of the company.

The carnage just doesn’t end with Occidental’s ill-timed purchase of Anadarko Petroleum. Western Midstream Partners WES has lost half its value trading Friday at a 13.79% dividend yield. WES is a midstream asset gathering and transmission business owned by Anadarko, now a part of Occidental. Director Crane must feel its overdone when he bought $1.5 million worth of stock. Recent dividend coverage was 1.08 and during the most recent earnings conference call, CEO Michael Ure said that they intend to continue increasing the dividend as they have done for the past 27 quarters taking into consideration their desire to decrease leverage and increase the coverage ratio. Oxy’s ownership and questions about their future ownership in WES are weighing on the stock. It was reported they are shopping a majority stake to private equity firms.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

Of course, unintuitive as it may seem, insiders can also be wrong about their Company’s prospects, they can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. Some of them will work out spectacularly well and some won’t. They will fail miserably. We have and we curse aloud, what were they thinking! Why did they throw good money after bad? Sometimes patience is required, a lot of it. Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website.

If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar

#alphawealthfunds #theinsidersfund #insomnicahedgefundguy #stockmarket # #trader #investment #wealthmanagement #insidertrading