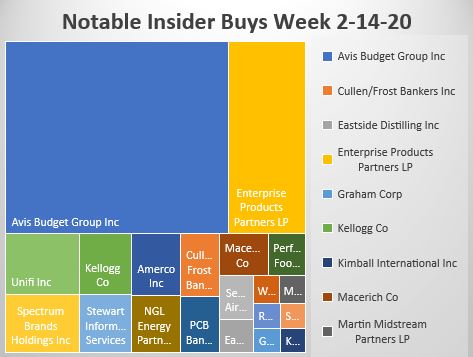

Avis got a new Chairman of the Board and he bought a lot of stock. Bernardo Hees, CEO of Kraft Heinz, bought 430,169 of CAR at $34.87. That was his first purchase and it was a big one, $15 million. It’s hard to say what the future is for the car rental companies with the gig economy, ride sharing, and autonomous vehicles. It’s not one we want to participate in, though.

Chairman of the Board, Duncan, continues to amass significant shares of Enterprise Products Partners. Taken into perspective, this $5 million EPD buy represents a pittance of his vast holdings, over 700 million shares.

Unifi insider and Home Depot founder, Kenneth Langone continues to buy this recycled textile manufacturer. As far as I can tell Mr. Langone hasn’t made any money buying UFI since 2014 but he has stepped up his buying in recent months.

CEO and Chairman of the Board of Kellogg, Peter Cahilane may be just another insider buying a percentage of his salary at K as part of ownership requirements, rather than an opportunistic purchase. There is no way of knowing this short of asking Mr. Cahilane himself. My guess is not.

The new CEO at Stewart Information Services has been accumulating stock. This may also be part of ownership requirements but I think not exactly. I think CEO Eppinger is a savvy operator and we are putting our money on him. He recently bought $1.1 million worth of STC at $39.89. This was his second buy in recent months. Housing has strong demographic tailwinds and the Fed is going to persist with easy money, at least through the Presidential elections, else risking the ire of Donald Trump or considered meddling in election year politics. We are confident this is a money maker although a modest one. Stewart was planning on a merger with Fidelity National but the government caboshed it for anti trust reasons about creating a title insurance monopoly.

Two insiders bought Spectrum Brands, SBI at prices , the largest being Chairman Maura’s $1 million purchase at $59.84. We are still smarting from our spanking from Black and Decker’s last earnings report. SBI has a lacklustre list of household brands. The CFO also purchased $497 thousand dollars worth at $60.17. This is exactly the kind of staid, boring stock no one is interested in owning but CFO buys are my favorite kind of insider buying.

I was reassured to see insiders buy more stock in Macerich after the Simon property’s buy of competing mall operator, Taubman centers. After rallying sharply on the news that Simon was paying a 53% premium for TCO, Malls located in good urban markets are not going anywhere. Hudson Pacific Properties, Inc. (NYSE: HPP) and Macerich (NYSE: MAC) today announced last January, that Google, Inc. has leased the entirety of their One Westside redevelopment, a planned 584,000-square-foot Class A creative office campus that was formerly part of the Westside Pavilion shopping mall in West Los Angeles. For god sake’s MAC is yielding 13%.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course insiders can also be wrong about their Company’s prospects. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax