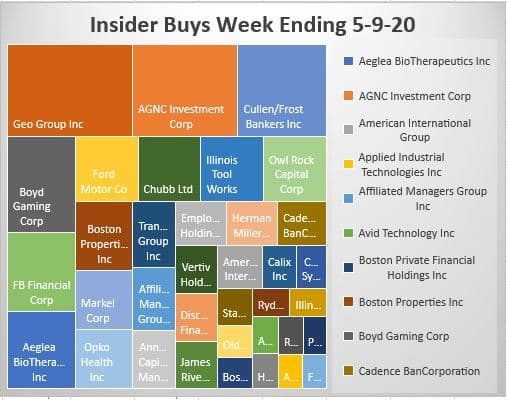

Private prison operator GEO Geo Group CEO Anthony Quinn continues to buy stock in this out of favor REIT play yielding an astounding 16.7% on Friday’s close. In the most recent 10Q the Company stated that Covid-19 pandemic adds a material concern to the financials. I think the stock reflects that with its yield. On March 24th they were rewarded with a five year 90-100,000 participant contract with U.S. immigration services. This $2.8 million purchase at $11.31 is the latest in large buys. He bought $1.2 Million on 3/12 at $11.65 and $8.5 million at $16.58 on 2-24-20. The stock continues to bump along the bottom while the market rallies. Longer term GEO has a problem with investor flows as private prisons seem to be a political and ESG issue but in the short term, the only real risk I see is the uncertainty of the liability associated with the spread of Covid-19 throughout the prison system. Is the liability there any different than the workplace at large? I doubt it.

William Boyd, Chairman of the Board, Boyd Gaming bought 100,000 shares at $16.07. Barron’s wrote this weekend, “… casino operators aren’t all created equal. For investors looking to bet on a recovery in gambling in the age of Covid-19, there may be an opportunity: regional casinos. Boyd Gaming (ticker: BYD), in particular, appears to be well positioned for investors who are willing to be patient. It faces the same near-term hurdles as most gambling companies, but Boyd is helped by a geographically diversified portfolio of 29 properties across 10 states and sufficient financial flexibility. Barron’s is not the only casino operator to buy their own stock.

I’m having a hard time, though, imagining how people will flock back to the crowded spaces of ANY casinos in the immediate future. Online gaming is definitely a growth industry but for the time being that is being expressed in the stock market.

AGNC Investment Corp AGNC is leverage REI investing predominately in agency residential mortgage-backed securities on a leveraged basis, financed primarily through collateralized borrowings structured as repurchase agreements. CEO Kain bought 189,1888 shares at $12.60. The Government has backstopped agency paper so there is little risk of default but small fluctuations in rates and assumptions can have outsized impacts on leveraged offerings. We’d stay away from this one.

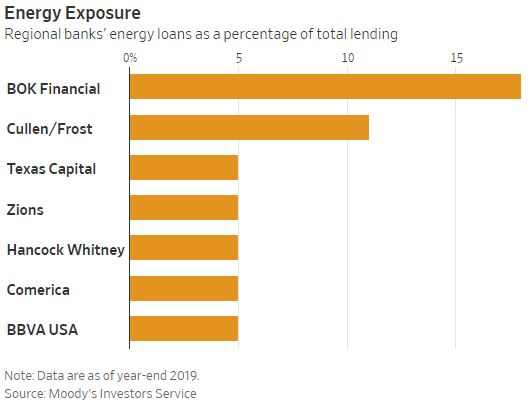

Cullen/Frost Bankers CFR has it all going against it. Low rates, compressed spreads, worsening credit profile and home to significant oil and gas loans. With up to 11% of it’s loan book out to energy companies, that didn’t stop Director Weston from buying 29,400 shares at $68.00. Another director, Chris Avery bought 7000 shares at $81.62 on 2/37/30-3/4/20 and 5000 shares at $94.70. If he liked it at those prices, I’d expect to see another buy soon. CFR yields a little over 4% and is trading at 1.35 x tangible book

Chubb Ltd, CB There have been several insider buys in insurance stocks. The latest buy was Director Scully purchase of 9,7450 shares at $102.4 for $1 Million. Director Shasta bought 4,000 shares at 3/13/20-3/17/20. Chubb is the world’s largest publicly traded P&C insurance company and the largest commercial insurer in the U.S. Insurance companies have multiple challenges invoked by the pandemic. In Chubb’s case there is some risk associated with business interruption but I consider that moderate. Mitch McConnell is big on getting liability waivers for business and it will be critical to getting people back to work. Chubb’s CEO Greenberg is the only insurance executive on President Trump’s economic task force, with the executive having reiterated his opposition to government attempts that would force insurers to pay claims retroactively on uncovered pandemic-related business interruption. Greater challenges result from the long term drop in interest rates as insurance companies make money on re- investing premium income.

AIG American International Director Jurgensen bought 20,000 shares at $24.10. AIG provides a wide range of property casualty insurance, life insurance, retirement solutions, and other financial services to customers in more than 80 countries and jurisdictions. is trading at .40% of tangible book and with a dividend of 4.6%. The life insurance challenges from Covid seem to be disproportionately weighted toward older people with commodities. This is a challenge insurers can handle and adjust to. There is anecdotal evidence that the demand for life insurance and annuities has increased but low rates and recessionary conditions are significant challenge for reinvesting premiums.

Illinois Tool Work ITW Director Lenny bought 1,575 shares at $159.19 and the Chairman of the Board, Santi, bought just under $1 million dollars worth, 6300 shares at $158.42. That’s encouraging for investors as both buys were made just after reporting quarterly earnings. ITW is diversified manufacturing partner and is a deeply cyclical play. Although they suspended guidance, insiders are showing confidence in an economic recovery. If the move to manufacture in the USA picks up steam, ITW could be a real beneficiary.

Ford Motor F Director Farley bought $1 Million of Ford Motor stock at $5.13 per share. Pickup sales have been strong but with factories around the worlds shut and people just now coming out of quarantine, auto sales are projected to be down. Ford has a completely designed Mustang debuting as an EV in the Fall. A real challenge to Tesla and proof that they can deliver, could see big returns for patient investors.

Boston Properties BXP New Director Bruce Duncan bought 11,000 shares at $89.14. We generally discount new director purchases as it’s almost free money considering the fees paid for serving on the Company’s board but this is a $1 Million dollar purchase. I heard Eric Schmidt today on the talk shows saying that contrary to conventional wisdom, businesses will need to increase office space to account for infectious disease social distancing needs. If that turns out to be true, BXP is one I would take a look at. Boston Properties, Inc. a self-administered and self-managed real estate investment trust (REIT), is one of the largest owners, managers, and developers of first-class office properties in the United States, with significant presence in five markets: Boston, Los Angeles, New York, San Francisco and Washington, DC. Conventional wisdom would question the logic of adding to this office REIT.

TransDigm Group TDG Director bought 2000 shares at $346.45. TDG is a leading global producer, designer and supplier of highly engineered aerospace components, systems and subsystems for use on nearly all commercial and military aircraft in service today. We expect the commercial side to be a victim of the pandemic for an extended period of time.

Employers Holdings EIG CEO Dirks bought 25,000 shares at $29.38. Three other insiders bought smaller amounts of this workers’ compensation insurance company that sells to small businesses in low to medium hazard industries.

Herman Miller, MLHR officer furniture company saw a little insider buying when Michael Volkema bought 25,000 shares at $21.94.

Chairman Abram bought 15,384 at James River Group Holdings JRVR at $31.86. Through its insurance subsidiaries, the Company provides workers’ compensation insurance coverage to select, small businesses in low to medium hazard industries.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer friendly and responsive I’ve used.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course insiders can also be wrong about their Company’s prospects. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax