For trade details click on this link to the trades

insider-trading/723612.htm”>AVIS BUDGET GROUP Inc up 21.08%

American Assets Trust Inc. up 5.36%

CHEVRON CORP up 5.03%

Sonos Inc up 4.26%

NU SKIN ENTERPRISES Inc up 3.41%

INCYTE CORP up 1.67%

AGREE REALTY CORP up 1.46%

GREENHILL & CO INC up 1.21%

DuPont de Nemours Inc. up 0.54%

Sensei Biotherapeutics Inc. up 0.12%

Royalty Pharma plc down -0.56

QUIDEL CORP down -0.63%

Macy’s Inc. down -1.36%

CERNER Corp down -1.83%

ABBOTT LABORATORIES down -2.22%

Zoetis Inc. down -5.73%

Longeveron Inc. down -20%

The market genuflected like the herd following creature it is on the mere whiff of rates rising. It seems that the relentless speculation and money-sucking SPACs have finally caught up with investor appetite although the stalwarts, Microsoft, Amazon, Facebook, Apple nudged higher on a day making the tape on Friday look a lot better than it really was. The difference between losing and winning investors is often a matter of having confidence and conviction. Nothing engenders that like knowing insiders are buying when the herd is selling. Incyte is our Pick of the Week.

The worst performing insider buy, Longeveron LGVN, ironically holds the most potential upside. We blogged on it considerably so we won’t go there again, other than to note that octogenarian and Miami billionaire businessman and founder of the Fountainbleu and Turnberry Isle bought $1 million more of LGVN. I can’t ascribe motives here other than to say his interest might be more humanitarian than monetary. Longeveron is the brainchild of Joshua Hare, MD, founding director of the Interdisciplinary Stem Cell Institute at the University of Miami’s Miller School of Medicine. Although we have nothing against getting rich, it’s clear to us Dr. Hare’s motives are far from just making a buck. Improving the human condition is at the core of his quest. Stem cells have intrigued many brilliant minds and may unlock the greatest scientific discovery in centuries. LGVN is a moonshot we want to take.

Strangely enough, AVIS, a company many would have given up for dead, was the biggest winner. CFO Choi purchased 23,735 shares of CAR at $45.88 and was rewarded with a 21% gain for the efforts. You have to wonder if he wouldn’t sell after such a rapid rise in price but he can’t because of the short swing rule. We would but he can’t. That’s one of the advantages the everyday investor has over insiders with special knowledge.

Avis is an American car rental company headquartered in Parsippany, New Jersey, United States. Avis, Budget Rent a Car, Budget Truck Rental and Zipcar are all units of Avis Budget Group. Avis Budget Group operates the Avis brand in South Africa, North America, South America, India, Australia, and New Zealand. Wikipedia

I have to admit I don’t understand the merits or see the benefits of investing in a company that is declining in revenues and shrinking its cost structure to profitability. BofA’s Smith initiated coverage of Avis on January 21 with a buy rating and stock price target of $50. She said Avis is the third-largest car rental car company but effectively the only investable name in that market, as No. 1 Enterprise is privately held and No. 2 Hertz Global Holdings Inc. HTZGQ, -2.25% is bankrupt.

CEO Rady purchased 117,998 shares of American Asset Trusts at $29.50. AAT is a full-service, vertically integrated, and self-administered real estate investment trust, or REIT. Frankly, a 3% dividend yield is nothing close to the return I would need to be compensated for the rising yield environment and the fundamental shift in the valuation of office and retail space. If you want a REIT, I think Crown Castle CCI with its global network of cell towers and 5G rollout is a safer real estate play.

Chevron CVX Director bought 3200 shares at $95.21. It’s no surprise to us the price of the underlying commodity is on the rise. When the Government makes drilling for oil more costly because of the necessary focus on renewables, there is going to be a gap between aspiration and reality. That gap is going to manifest itself in rising prices. We will have hydrocarbons in the energy equation for as long as I am alive and the investment consensus is that Chevron is the best way to play it.

Director Volpi purchased 54,666 shares of Sonus at $37.35. SONO Sonos is an American developer and manufacturer of wireless home audio products, including smart speakers. Wikipedia.

Director Campbell bought another block of Nu Skin Enterprises with a purchase of 10,100 shares of this Utah-based MLM skin care and nutraceutical company. NUS is a cash cow and we bought shares after the latest earnings rout following the insiders into the stock. Putting things into perspective, Steve Lund bought $1 million worth last week. After selling the stock for the last five years, he turned into a buyer. Hello, folks- that’s a wake-up call. Nu Skin is that ‘fat pitch’ Buffet likes to swing at.

Incyte Corp CEO and Chairman Hoppentot bought 12,925 shares at $77.37, a convenient call your broker, buy me a $ million dollars worth of stock. Incyte Corp is an American pharmaceutical company based in Alapocas, Delaware. The company was founded in Palo Alto, California in 1991 and went public in 1993. I was personally involved with Incyte’s original IPO during my brief tenure with David Blech, the disgraced once the king of biotech.

Today Incyte is a giant with FY revenues of $2.67 billion (+24% y/y); total FY product and royalty revenues increased 18% to $2.46 billion. INCY ended 4Q with $1.8B in cash. INCY had three new FDA approvals in 2020. Jakafi®(ruxolitinib) FY revenue increased to $1.94 billion (+15% y/y); The company provided Jakafi® guidance range of $2.125 to $2.20 billion for 2021 Successful launches of Monjuvi®(tafasitamab-cxix) and Pemazyre® (pemigatinib) in the U.S.

The Company at its last earnings call talked about opportunities for additional growth provided by a broad late-stage pipeline, with the potential approval of ruxolitinib cream for atopic dermatitis in the U.S. and six other regulatory approval decisions expected across the U.S., EU, and Japan during 2021. This is rich in catalysts. We are buyers here. Lisen to last quarter earnings report.

Director Rakolta made a large buy at Agree Realty with 19,525 shares at $63.63. Agree Realty is a $5B+ industry leader in the acquisition & development of properties net leased to retailers in the US. 3.9% yield is not enough to compensate me in this disruptive environment for retailers. We are passing on ADC.

CEO Scot Bok purchased 33,095 shares of Greenhill & Co. at $14.91. GHL is a leading independent investment bank focused on providing financial advice on significant mergers, acquisitions, restructurings, financings, and capital raising to corporations, partnerships, institutions, and governments.

They were established in 1996 by Robert F. Greenhill, the former President of Morgan Stanley and former Chairman and Chief Executive Officer of Smith Barney. In 2004 we were the first of several independent advisory firms to complete an initial public offering and list on the New York Stock Exchange (ticker GHL).

Director Curtin bought 7500 shares of Dupont at $69.94. DuPont de Nemours, Inc., commonly known as DuPont, is an American company formed by the merger of Dow Chemical and E. I. du Pont de Nemours and Company on August 31, 2017, and the subsequent spinoffs of Dow Inc. and Corteva. Prior to the spinoffs, it was the world’s largest chemical company in terms of sales. Wikipedia

I’m not sure what to make of Dupont with all the mergers and spin-offs, but with all stocks rallying the way they have it only stands to reason that DD will not be far behind. Taking this from their last quarterly earnings release, it’s hard to understand why it hasn’t already but then the separation of its Nutrition and Bioscience s business and the sale of its clean technology business for $510 million in cash have coincided with decreased investor enthusiasm.

“For 2021, we expect net sales between $15.4 and $15.6 billion, an increase of 8 percent at the mid-point versus 2020 net sales of $14.3 billion and operating EBITDA between $3.83 and $3.93 billion, an increase of 13 percent at the mid-point versus 2020 operating EBITDA of $3.4 billion, reflecting anticipated solid top line growth and robust operating EBITDA margin expansion,” said Lori Koch, Chief Financial Officer of DuPont. “Our outlook for full year adjusted EPS is in the range of $3.30 to $3.45 per share, an increase of 68 percent at the mid-point versus 2020 adjusted EPS of $2.01 per share, reflecting the improvement in operating EBITDA, lower interest expense and the benefit of a lower share count.”

“We also expect a strong first quarter of 2021 with net sales between $3.75 and $3.85 billion, an increase of 4 percent at the mid-point versus 1Q 2020 net sales of $3.7 billion, operating EBITDA between $950 and $970 million, an increase of 6 percent at the mid-point versus 1Q 2020 operating EBITDA of $907 million, and adjusted EPS in the range of $0.75 to $0.77 per share, an increase of 58 percent at the mid-point versus 1Q 2020 adjusted EPS of $0.48 per share,” Koch stated.

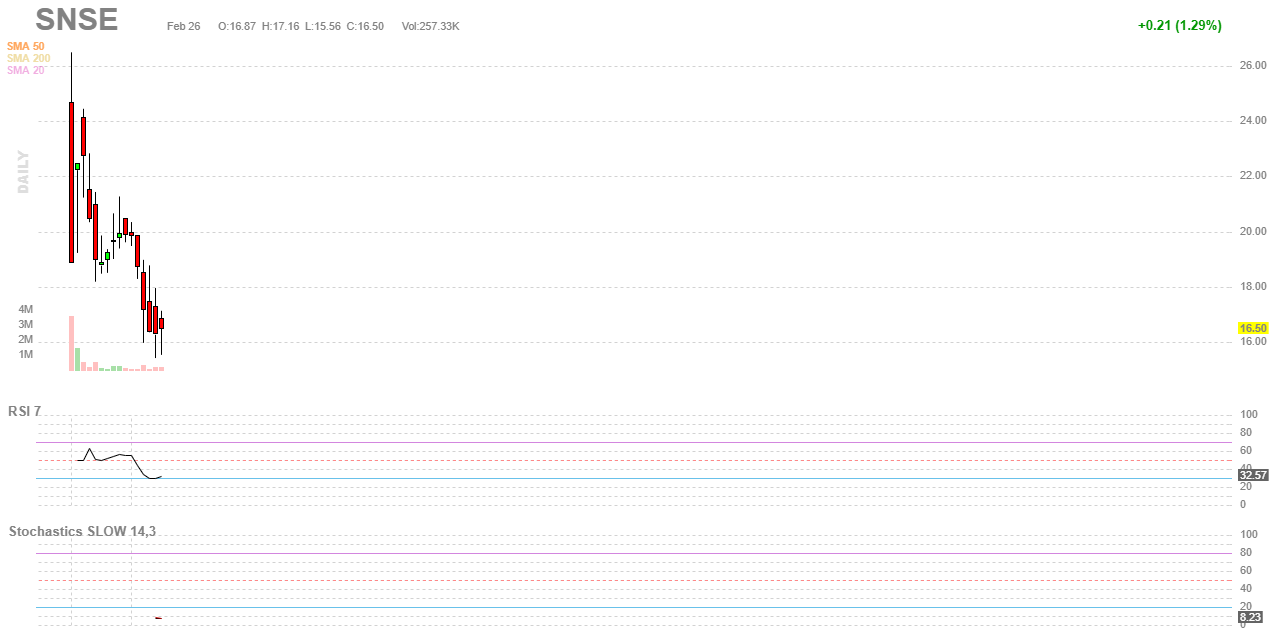

Director James Peyer and his hedge fund, Cambrian BioPharma bought 31,000 shares of Sensei Biotherapeutics last week at $16.48. They have been buying it all week in smaller quantities. Sensei Biotherapeutics is a clinical-stage biopharmaceutical company developing immunotherapies for cancers and infectious disease. SNSE is another money vacuum machine that just sold over $7 million of its share to the public on February 21st at $19.00 per share.

It is engaged in the discovery and development of next-generation therapies with an initial focus on cancer treatments. The companies ImmunoPhage platform is a powerful, self-adjuvanted and highly differentiated immunotherapy approach that is designed to utilize bacteriophage to induce a robust, focused and coordinated innate and adaptive immune response. They’ve been at this since 1999 and I wouldn’t expect any home runs soon.

Director Fernandez must really know something about Royalty Pharma plunking down $1.2 Million to buy 25,700 shares at $46.83 while Royalty went public just last June at $28 per share.

RPRX is the largest buyer of biopharmaceutical royalties and a leading funder of innovation across the biopharmaceutical industry. They have assembled a portfolio of royalties that entitles them to payments based directly on the top-line sales of many of the industry’s leading therapies, including Imbruvica, Januvia, Kalydeco, Trikafta, Truvada, Tysabri, and Xtandi.

They partner with companies to co-fund late-stage clinical trials and new product launches in exchange for future royalties, and indirectly when they acquire existing royalties from the original innovators.

CEO Doug Bryant purchased 5000 shares of Quidel Corp at $165.30. Bryant seems to be a buyer of QDEL whenever the stock gets into this range. Unfortunately for long-term holders of QDEL, it seems to spend a lot of time trading in a range. I really like the common sense manner of the CEO Bryant and his enthusiasm for his company’s future. QDEL has virtually no debt and has $489 million in cash. The enormous run up in price because of Covid may be overdone and Bryant may be underestimating the market’s enthusiasm for the future.

Quidel Corporation is a major American manufacturer of diagnostic healthcare products that are sold worldwide. On May 8, 2020, the U.S. Food and Drug Administration has issued the first emergency use authorization for a COVID-19 antigen test, a new category of tests for use in the ongoing pandemic. Wikipedia

Quidel rightfully or wrongly is inextricably associated with the first approved Covid-19 test. Covid will end eventually and revenue for this test will inevitably go down. The market is very leary of this. What will not go down is that the realization that we may know how many gallons of gas is sold at the pump each week or what the total credit card transactions at any point in time; what we don’t know is an accurate measurement of the general population health. This glaring omission may forever alter the demand for measuring instruments in the public health care sector. Quidel is a market leader in testing and diagnostics.

Director Varga purchased 33,135 shares of Macy’s Inc at $15 per share. I don’t get it but then he’s the director, I’m not. M is an American luxury department store chain founded in 1858 by Rowland Hussey Macy. It became a division of the Cincinnati-based Federated Department Stores in 1994, through which it is affiliated with Bloomingdale’s department store chain; the holding company was renamed Macy’s, Inc. in 2007. Wikipedia

CFO Erceq bought 10,655 shares of CERN at $70.43. Cerner Corporation is an American supplier of health information technology services, devices, and hardware. As of February 2018, its products were in use at more than 27,000 facilities around the world. The company had more than 28,000 employees globally, with over 13,000 in Kansas City, Missouri. Wikipedia

If we had to pick a corporate officer to follow it would be the CFO. It’s our experience that the CFO buying in size is a strong indicator of future success. There’s an exception to this rule, though, and that’s when the CFO just joins the company. That’s exactly the case here as Mr. Erceg just joined Cerner in February. It’s pretty normal and not exceptional for a multimillion-dollar prominent hire to buy a slug of stock when he starts. We still love the business and the position CRN holds but we are not jumping up and down because of this buy.

Director Kumbier bought 2020 shares of Abbot Laboratories at $122.50. This is not a large buy and will not impact the stock price. I do think it’s notable because Kumbier has been on the board of Abbot since 2018. This seems to be her first open market purchase. ABT is a solid buy but this buy at this price is not a catalyst for me.

Director Scully purchased 7,590 shares of Zoetis Inc at $164.68. You might remember from last week that Scully purchased $1.25 million of KKR last week. Scully is the former Co-President of Morgan Stanley and looks like a professional board member to me, serving on KKR, Chubb, and Zoetis. This is great work if you can get it and Scully can. Does that make him a reliable insider? The record is imperfect He unloaded a ton of KKR at $14.22 only to buy some back at $48. We all make mistakes but this looks like a big one.

Zoetis Inc. is An American drug company, the world’s largest producer of medicine and vaccinations for pets and livestock. The company was a subsidiary of Pfizer, the world’s largest drug maker, but with Pfizer’s spinoff of its 83% interest in the firm it is now a completely independent company. Wikipedia

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

[custom-twitter-feeds]

Insiders sell stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer-friendly and responsive I’ve used.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 are horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the U.S in 2019