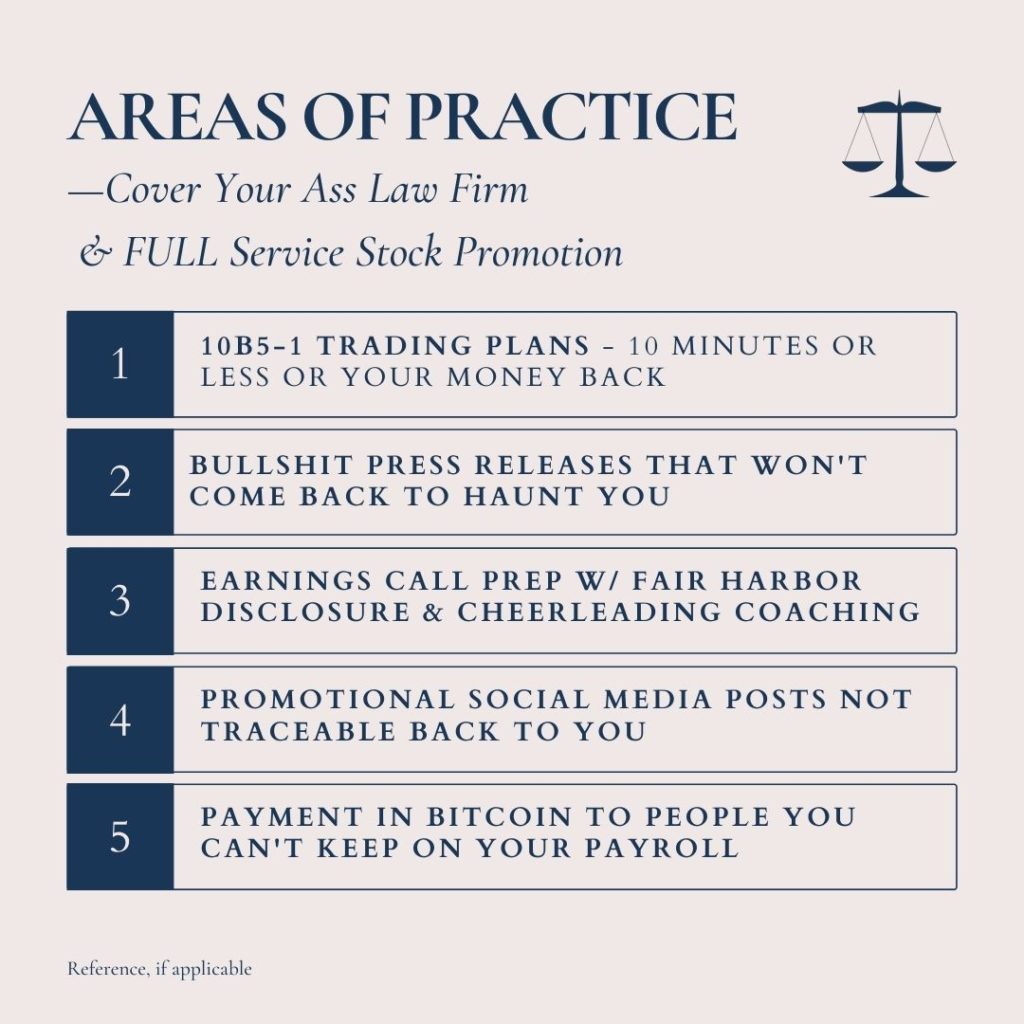

Let’s hope it comes about. I’ve been talking about this for years. Insiders have rigorous disclosure mechanisms when they buy stock but little to none with these “canned ready-to-go trading plans” known as Rule 10b5-1. They are an abomination. It’s about time someone does something to level the playing field for the public.

https://www.reuters.com/business/us-secs-gensler-says-has-asked-staff-consider-new-rules-company-trading-plans-2021-06-07/

WASHINGTON, June 7 (Reuters) – The head of the U.S. Securities and Exchange Commission (SEC) said on Monday he has asked staff to tighten up a legal safe-harbor that allows corporate executives to buy or sell company stock without running afoul of insider trading laws.

The “Rule 10b5-1” trading plans allow insiders to execute trades in the company’s stock on a pre-determined future date, providing legal protection against potential allegations of insider trading on material nonpublic information.

Progressive Democrats and consumer advocates have long complained the rules for adopting, amending, or canceling trades are far too lax, allowing insiders to game the system and reap windfalls at the expense of ordinary investors.

SEC Chair Gary Gensler said on Monday that SEC staff should consider tougher restrictions on such changes and increased transparency.