For trade, details click on this link to the trades.

For trade, details click on this link to the trades.

Sorry about the last post. It got out before I could review obvious errors. It’s the Summer and everyone wants to get out of town on a hot Friday afternoon. The S&P was up 1.96% for the week. New index highs are the norm but there was scant insider buying. Corporate officers and directors brazenly unloaded hundreds of $millions dollars worth of company stock during the earnings blackout period, shielded by the loophole that 10b5-1 provides. This post will examine the few hardy souls that stepped up and bought their company’s stock.

Name: Staglin Garen K

Position: Director

Shares Bought: 2,500, Average Price Paid: $108.79 Cost: $271,975

Company: ExlService Holdings Inc. (EXLS)

EXL Service is an American multinational professional services company mainly involved in operations management and analytics. EXL offers insurance, banking, financial services, utilities, healthcare, travel, transportation, and logistics services. The Company is headquartered in New York and has more than 31,000 professionals in locations throughout the United States, Europe, Asia, Latin America, Australia, and South Africa. ExlService Holdings Inc. (EXL) is a leading operations management and analytics company that helps its clients build and grow sustainable businesses. By orchestrating its domain expertise, data, analytics, and digital technology, EXL looks deeper to design and manage agile, customer-centric operating models to improve global operations, drive profitability, enhance customer satisfaction, increase data-driven insights, and manage risk and compliance. Headquartered in New York, EXL has approximately 31,900 professionals in locations throughout the United States, the United Kingdom, Europe, India, the Philippines, Colombia, Canada, Australia, and South Africa. EXL serves customers in multiple industries, including insurance, healthcare, banking, financial services, utilities, travel, transportation and logistics, media, and retail.

Garen K. Staglin serves as Independent Chairman of the Board of the Company. Mr. Staglin has over 40 years of experience in the financial services and technology industries. Based in part on Mr. Staglin’s expertise in the financial services and technology industries and his experience as a member of public company boards of directors, the Company has concluded that Mr. Staglin should serve as a director. Mr. Staglin is an investor in several private companies and hedge funds and is a Special Limited Partner for FT Ventures, a $600 million equity firm headquartered in San Francisco, California. FT Ventures is an investor in EXL Service.

Opinion: I’m on vacation this week but buying speaks for itself more often than not.

Name: Furman William A

Position: CEO Chairman

Shares Bought: 100,000, Average Price Paid: $43.08, Cost: $4,307,659

Company: The Greenbrier Companies. (GBX)

Greenbrier, headquartered in Lake Oswego, Oregon, is a leading international supplier of equipment and services to global freight transportation markets. Greenbrier designs build and market freight railcars and marine barges in North America. Greenbrier Europe is an end-to-end freight railcar manufacturing, engineering, and repair business with Poland, Romania, and Turkey that serves customers across Europe and in other geographies as opportunities arise. Greenbrier builds freight railcars and rail castings in Brazil through two different strategic partnerships.

The Greenbrier Companies is a leading supplier of marine and rail transportation equipment and services, powering the movement of products worldwide. Greenbrier’s innovation and engineering expertise pairs with its capacity to build and repair transportation equipment. It allows them to provide an unrivaled level of service to their customers across the Americas, Europe, and the GCC countries. With a railcar lease fleet of over 10,300 railcars, Greenbrier also provides asset management services for nearly 400,000 railcars. Their unique railcar leasing syndication platform brings them into contact with the world’s leading fixed asset investors. They have delivered over 21,000 railcars in a single year and maintain the capacity to produce over 35,000 railcars annually.

William A. Furman serves as Chairman of the Board, Chief Executive Officer of the Company. Mr. Furman has served as a member of the Board since 1981 and as the Company’s Chief Executive Officer since 1994. He has served as the Chairman of the Board of Directors since January 2014. As a founder, Mr. Furman has been associated with the Company and its predecessor companies since 1974. He has led the Company through incredible growth over the last decade, including international expansion and significantly increased market share in North America. He is highly experienced in the cycles of our business and uniquely qualified to lead the Company.

Opinion: I’m on vacation this week but buying speaks for itself more often than not.

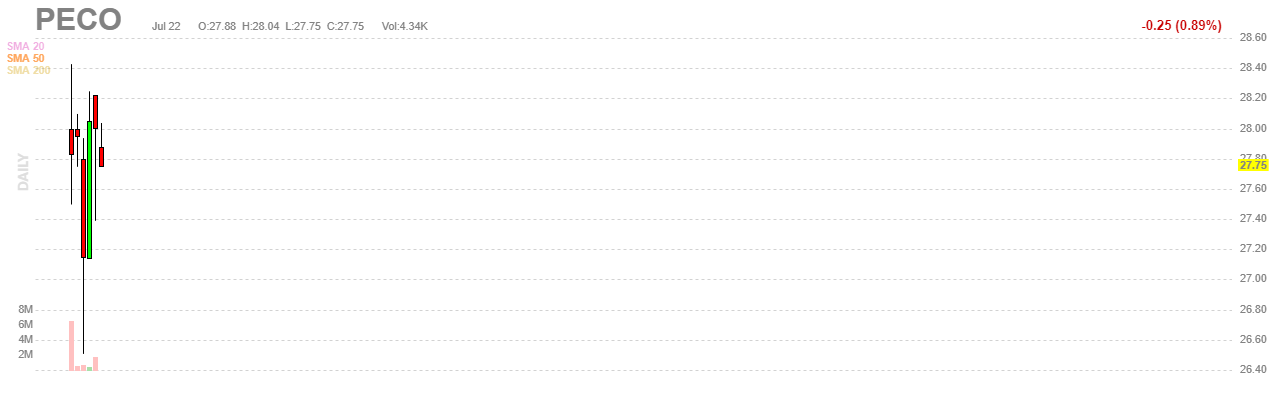

Name: Edison Jeffrey

Position: CEO Chairman

Shares Bought: 50,000, Average Price Paid: $28.00, Cost: $1,400,000

Name: Chao Leslie

Position: Director

Shares Bought: 7,000, Average Price Paid: $28.00, Cost: $196,000

Company: Phillips Edison & Company Inc.(PECO)

Since 1991, Phillips Edison & Company has focused on the grocery-anchored shopping center sector. The company has a fully integrated in-house operating platform built on market-leading expertise designed to optimize property value and consistently deliver a great shopping experience. Led by a veteran management team, Phillips Edison’s operating platform provides retail services, including acquisition, redevelopment, leasing, and management of grocery-anchored retail centers. The company’s portfolio currently includes a national footprint of retail properties. The company has corporate offices in Cincinnati, Park City, and Atlanta. Phillips Edison & Company is an American owner, operator, acquirer, and developer of shopping centers throughout the US. Founded in 1991, the Company is headquartered in Cincinnati, Ohio, and has offices in Salt Lake City, Utah, New York City, New York, and Atlanta, Georgia. Phillips Edison & Company, Inc. (“PECO”) is one of the nation’s largest owners and operators of grocery-anchored shopping centers. PECO’s diversified portfolio of well-occupied neighborhood shopping centers features a mix of national and regional retailers selling necessity-based goods and services in fundamentally strong markets throughout the United States. The Company manages a portfolio of 300 shopping centers through its vertically integrated operating platform, including 278 wholly-owned centers comprising approximately 31.3 million square feet across 31 states (as of March 31, 2021)

Mr. Chao has served as a director since July 2010 and as a lead independent director since November 2017. He retired in 2008 as Chief Executive Officer of Chelsea Property Group, Inc., an NYSE-listed shopping center REIT with operations in the United States, Asia, and Mexico (now part of Simon Property Group, NYSE: SPG), previously serving as President and Chief Financial Officer.

Jeff Edison co-founded Phillips Edison & Company and has served as a principal since 1995. He currently serves as Chairman and CEO. From 1991 to 1995, he was employed by NationsBank’s South Charles Realty Corporation, serving as a Senior Vice President from 1993 until 1995 and as a Vice President from 1991 until 1993. Jeff was employed by Morgan Stanley Realty Incorporated from 1987 until 1990 and The Taubman Company from 1984 until 1987.

Opinion: I’m on vacation this week but buying speaks for itself more often than not.

Name: Edelman Harriet

Position: Director

Shares Bought: 11,000, Average Price Paid: $27.47, Cost: $302,153

Company: Bed Bath & Beyond Inc (BBBY)

Bed Bath & Beyond’s culture is customer-centric. Significant investments support their commitment to customer service to strengthen their company’s foundation for future growth. Today, their eCommerce businesses are rapidly growing to meet their customer’s ever-evolving needs. They strive to better engage with their customers wherever, whenever, and express their life interests, and travel through their life stages. As a company, they also recognize that we are people-powered and continuously strive to foster a culture that supports diversity and equity of all types. They are listening and constantly evolving, with concrete goals set to create an ever more equitable, inclusive work environment where all their people feel at home and can thrive. Bed Bath & Beyond’s family of companies has contributed to their evolution. As they continue to expand, differentiating themselves across all channels, brands, and locations in which they operate, they are better able to serve their customers.

Harriet Edelman serves as Independent Director of the Company. Ms. Edelman has served since 2010 as vice chairman of Emigrant Savings Bank, a privately held community bank, where she leads the finance, information technology, and credit administration operations. She joined the bank in 2008 as a special advisor to the chairman. Ms. Edelman spent 29 years at Avon Products Inc., rising to chief information officer and senior vice president of global supply chain and business transformation. She has prior public company board experience during the past 17 years with UCB, a global biopharmaceutical company, software company Ariba Inc., The Hershey Company, and Blair Corporation.

Opinion: I’m on vacation this week but buying speaks for itself more often than not.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund.

[custom-twitter-feeds]

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried many vendors, and SECForm4 is one of the most customer-friendly and responsive I’ve used.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial, so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization, and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years, and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 are horrendously poor. Also, planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001, when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019, 4th Best in November 2020, 4th Best in January 2021 (I kid you not)