For trade, details click on this link to the trades.

For trade, details click on this link to the trades.

Name: Andrews Kirkland B

Position: CFO

Transaction Date: 2021-09-23 Shares Bought: 7,875 Average Price Paid: $63.67 Cost: $501,392

Name: Campbell David A

Position: CEO

Transaction Date: 2021-09-23 Shares Bought: 7,870 Average Price Paid: $63.66 Cost: $499,699

Company: Evergy Inc. (EVRG)

Evergy is an American investor-owned utility (IOU) with publicly traded stock headquarters in Topeka, Kansas, and in Kansas City, Missouri. The company was formed from a merger of Westar Energy of Topeka and Great Plains Energy of Kansas City, Missouri, the parent company of Kansas City Power & Light. Evergy is the largest electric company in Kansas, serving more than 1.6 million residential, commercial, and industrial customers in the state’s eastern half. Evergy has a generating capacity of 16,000-megawatt electricity from its over 40 power plants in Kansas and Missouri. Evergy service territory covers 28,130 square miles (72,900 km2) in eastern Kansas and western Missouri. Evergy owns more than 13,700 miles (22,000 km) of transmission lines and about 52,000 miles of distribution lines. Evergy is committed to delivering clean, safe, reliable energy sources today and well into the future. So they’re embracing alternative energy sources to generate more power with less impact on our environment and adopting new technologies that let their customers manage their energy use in ways that work for them. Whether it’s new ways to connect with them, electric vehicle charging stations, or the next innovation around the corner, they’re dedicated to empowering a better future. It generates electricity through coal, hydroelectric, landfill gas, uranium, natural gas, oil sources, and solar, wind, and other renewable sources. The company has approximately 10,100 circuit miles of transmission lines, 39,800 circuit miles of overhead distribution lines, and 13,000 circuit miles of underground distribution lines. It serves approximately 1,620,400 customers, including residences, commercial firms, industrials, municipalities, and other electric utilities.

As executive vice president and chief financial officer for Evergy, Kirk Andrews has management responsibility for all corporate financial functions, including treasury, accounting, planning, tax, capital allocation, and investor relations. Mr. Andrews will also oversee the company’s performance management, corporate development, and renewable energy development activities. Mr. Andrews previously served as Executive Vice President and Chief Financial Officer of NRG Energy, Inc. from 2011-2021 where he led NRG’s corporate financial functions. He also played an instrumental role in formulating and executing NRG’s capital allocation strategies and in financing the company’s repowering initiatives. Before Mr. Andrews joined NRG, he enjoyed a successful 15-year career in investment banking.

David Campbell is president and chief executive officer of Evergy. Prior to his selection as president and chief executive officer of Evergy, Campbell served as executive vice president and chief financial officer of Vistra Corporation from 2019 through 2020. From 2014 through 2019, Campbell served as chief executive officer of InfraREIT, Inc., expanding his responsibilities in late 2016 to become chief executive officer of Sharyland Utilities. From 2013 through 2014, Mr. Campbell served as president and chief operating officer of Bluescape Resources, an independent investment company, where he oversaw field and business operations. From 2004 to 2013, Campbell worked at TXU Corp., and its successor, Energy Future Holdings in various senior leadership roles. Prior to joining TXU Corp., Campbell was a partner at McKinsey & Company where he led the corporate finance and strategy practice in Texas.

Opinion: Electricity consumption is a growth industry as certain as the sun will rise and set. The utility index has pulled back since August representing a good time to revisit names here. We are buyers of all-electric utilities with insider buying. Last week we blogged about a very informed insider buying AES. Now we have the top two officers buying $1 million of EVRG stock.

We are buyers of all regulated electric utility stocks with large insider buying. This is one of the least understood and appreciated opportunities in the market. We love asynchronous bets. The sector has long been associated with little old lady investing; slow, boring, and safe. The radical changes being brought by the need to address climate change and the ever-increasing electricity demands of the digital lifestyle are going to launch this sector into the biggest spurt of growth since Thomas Edison and the light bulb. We want to be on board.

Another benefit in a rising cost environment, utility companies have the legislative right to pass through their rising costs with rate hikes. Growth and insulation from an inflationary environment make a unique investment opportunity. It will take a while for the market to come around to this view so be patient. Stocks have a way of moving in spurts and laying dead for some time testing our patience. At least in this sector, you get paid to wait with their healthy dividend payouts.

Name: Agwunobi John O

Position: CEO Chairman

Transaction Date: 2021-09-17 Shares Bought: 5,000 Average Price Paid: $44.90 Cost: $224,517

Company: Herbalife Nutrition Ltd (HLF)

Herbalife Nutrition is a global multi-level marketing (MLM) corporation that develops and sells dietary supplements. Mark Hughes founded the company in 1980, and it employs an estimated 8,900 people worldwide. The business is incorporated in the Cayman Islands, with its corporate headquarters located in Los Angeles, California. The company operates in 94 countries through a network of approximately 4.5 million independent distributors and members. The company has been criticized by, among others, hedge fund manager Bill Ackman of Pershing Square Capital, who claimed in 2012 that Herbalife operates a “sophisticated pyramid scheme” after taking a $1 billion short position in Herbalife stock. Herbalife agreed to “fundamentally restructure” its business in the U.S. but not worldwide and pay a $200 million fine as part of a 2016 settlement with the U.S. Federal Trade Commission (FTC) following accusations of it being a pyramid scheme. In November 2017, Ackman’s hedge fund closed out its short position in Herbalife.

John Agwunobi is CEO and Chairman of Herbalife Nutrition, a premier global nutrition company that serves customers in 95 markets. Agwunobi is a passionate proponent of Herbalife Nutrition’s mission to improve the nutrition habits of people worldwide, strengthening our communities and providing entrepreneurs a proven business opportunity to earn a part- or full-time income. As chief executive officer, he sets the strategy for Herbalife Nutrition, overseeing all aspects of the Company’s growth and ensuring that the Company continues to be recognized worldwide as a leading nutrition company, with a keen focus on initiatives that can positively impact issues affecting global society, including obesity, healthy aging, health care costs, and entrepreneurship.

Opinion: The company’s 20% collapse in price after their investor day is not a buying opportunity. I take issue with the Citi analyst that says it is. Normally a CEO stepping up to buy some shares will slow the sell-off if not reverse it. With Icahn selling his holdings, there is no more bang for the buck and finally, Ackman’s short if he still is short looks like it could pay off nicely.

Unfortunately for Herbalife bulls(if there are any), it won’t matter what HLF does in the short term. It will always be colored by the battle of the Wall Street titans, Icahn and Ackman, that transfixed the popular imagination before Gamestop and AMC and the whole subReddit Wall Street Bets phenomenon. Add to the fact that Icahn is unloading his stock, I’d say this is a short free throw zone. Sell away.

Name: Abrahamson James R

Position: Director

Transaction Date: 2021-09-17 Shares Bought: 7,750 Average Price Paid: $29.50 Cost: $228,625

Company: Vici Properties Inc. (VICI)

Vici Properties is a real estate investment trust (REIT) specializing in casino properties, based in New York City. It was formed in 2017 as a spin-off from Caesars Entertainment Corporation as part of its subsidiaries’ bankruptcy plan. It owns 29 casinos, hotels, and racetracks, and 4 golf courses throughout the United States. VICI Properties Inc. is an experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality, and entertainment destinations, including the world-renowned Caesars Palace. VICI Properties’ national, geographically diverse portfolio consists of 28 gaming facilities comprising 47 million square feet and features approximately 17,800 hotel rooms and more than 200 restaurants, bars, nightclubs, and sportsbooks. Its properties are leased to industry-leading gaming and hospitality operators, including Caesars Entertainment, Inc., Century Casinos, Inc., Hard Rock International Inc., JACK Entertainment LLC, and Penn National Gaming, Inc. VICI Properties also has an investment in the Chelsea Piers, New York facility and owns four championship golf courses and 34 acres of undeveloped land adjacent to the Las Vegas Strip. VICI Properties aims to deliver sustained income and value growth through its strategy of creating the highest quality and most productive experiential asset portfolio in American real estate investment management.

James R. Abrahamson has been a member of the Board since August 2015. Mr. Abrahamson was Chairman of Interstate Hotels & Resorts, a leading U.S.-based global hotel management company comprising over 500 hotels, until its sale to Aimbridge Hospitality in October 2019. He previously served as Interstate’s Chief Executive Officer (“CEO”) from December 2011 to March 2017; he was named to the additional position of Chairman in October 2016. Mr. Abrahamson has served as Chairman of the Board for VICI Properties Inc. (NYSE: VICI), a REIT valued at over $14 billion in market capitalization, since its launch in 2017. Mr. Abrahamson served as an independent director at La Quinta Holdings Inc. (NYSE: LQ) from November 2015 until the sale of the company in May 2018 and has served as an independent director of CorePoint Lodging Inc. (NYSE: CPLG), a REIT comprising over 200 hotels since it was spun out of La Quinta in May 2018. Prior to joining Interstate in 2011,

Opinion: REITs have defensive characteristics in a low-interest inflationary backdrop. VICI’s outsized dividend of 4.8% should provide support for the stock if interest rates rise moderately due to an improving economy. Other than that VICI doesn’t do anything for me.

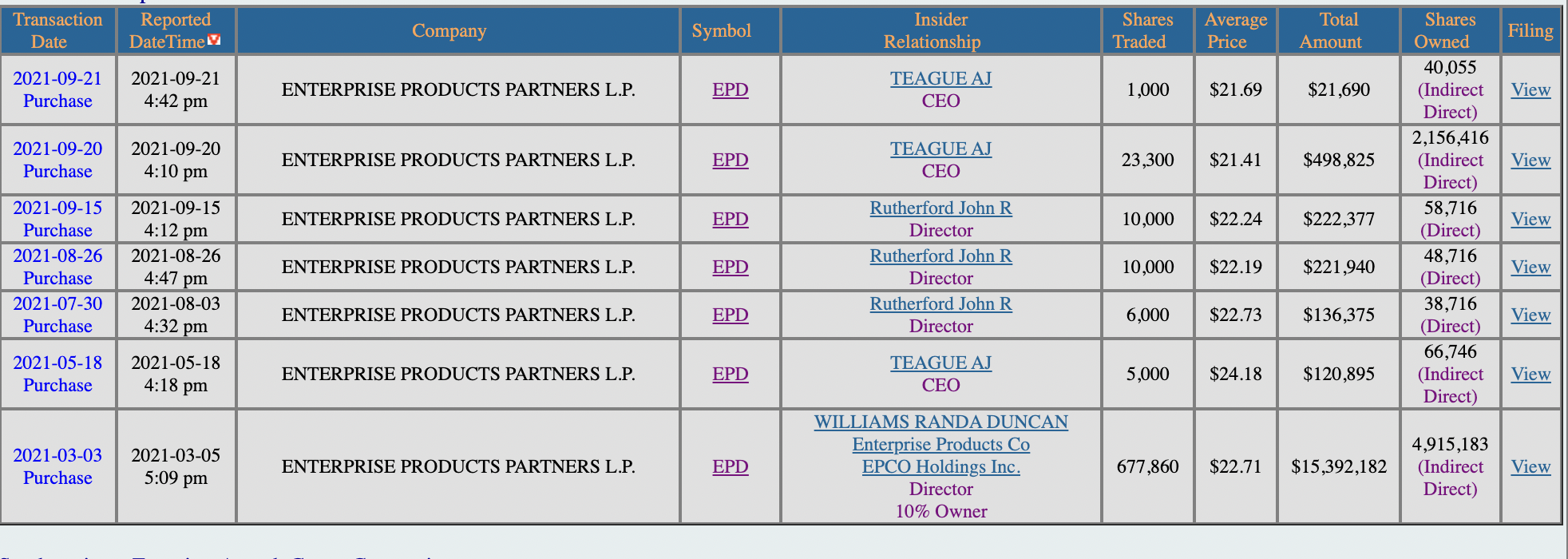

Name: Teague Aj

Position: CEO

Transaction Date: 2021-09-20 Shares Bought: 23,300 Average Price Paid: $21.41 Cost: $498,825

Company: Enterprise Products Partners L.P. (EPD)

Enterprise Products Partners L.P. provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products. The company operates through four segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services, and Petrochemical & Refined Products Services. The NGL Pipelines & Services segment offers natural gas processing and related NGL marketing services. It operates 21 natural gas processing facilities in Colorado, Louisiana, Mississippi, New Mexico, Texas, and Wyoming; NGL pipelines; NGL fractionation facilities; NGL and related product storage facilities; and NGL marine terminals. The Crude Oil Pipelines & Services segment operates crude oil pipelines; and crude oil storage and marine terminals, including a fleet of 310 tractor-trailer tank trucks used to transport liquefied petroleum gas. It also engages in crude oil marketing activities. The Natural Gas Pipelines & Services segment operates natural gas pipeline systems to gather, treat, and transport natural gas. It leases underground salt dome natural gas storage facilities in Napoleonville, Louisiana; owns an underground salt dome storage cavern in Wharton County, Texas; and markets natural gas. The Petrochemical & Refined Products Services segment operates propylene fractionation and related marketing activities; butane isomerization complex and related deisobutanizer units; and octane enhancement and high purity isobutylene production facilities. It also operates refined products pipelines and terminals; and ethylene export terminals, and provides refined products marketing and marine transportation services. The company was founded in 1968 and is headquartered in Houston, Texas.

Mr. Teague has served as Co-Chief Executive Officer since January 2020 and has been a director of Enterprise GP since November 2010. He also serves as Co-Chairman of the Capital Projects Committee. Mr. Teague previously served as Chief Executive Officer of Enterprise GP from January 2016 to January 2020, Chief Operating Officer of Enterprise GP from November 2010 to December 2015, and Executive Vice President of Enterprise GP from November 2010 until February 2013. He served as Executive Vice President of EPGP from November 1999 to November 2010 and additionally as a director from July 2008 to November 2010 and as Chief Operating Officer from September 2010 to November 2010. In addition, he served as EPGP’s Chief Commercial Officer from July 2008 until September 2010. He served as Executive Vice President and Chief Commercial Officer of DEP GP from July 2008 to September 2011.

Opinion: It’s safe to say Teague knows this business inside and out. Insiders have been buyers all year of Enterprise Products Partners yet the stock has gone nowhere other than paying its enormous 8.2% dividend. The current Wall Street groupthink that fossil fuels are for dinosaurs has created the greatest cognitive dissonance in years. The fossil fuel energy sector now represents the smallest slice of the S&P 500 in history. Ironically, it’s the best performing sector of the market, up 34% YTD and over 67% during the last 12 months.

This likely has more to do with the reversion to the mean rather than the beginning of a new trend. The energy sector was the worst-performing sector in 2020, losing 34%. I always caution people chasing the best-performing funds. They’re likely to do better investing in the worst-performing ones rather than herd following. ARKK Innovation ETF run by Cathie Woods is a perfect case in point, another notable laggard in 2021 after putting in a stellar 2020 performance.

ARKK has zero fossil fuel stocks yet multiple investments in an improbable future devoid of hydrocarbons. Climate change is real and it is cataclysmic but It will be far more difficult, perhaps impossible to wean off of hydrocarbons. When the world realizes that it will get serious about living with fossil fuels and redouble its efforts toward carbon capture and sequestration. Chevron and Enterprise Products have already started. Chevron and Enterprise explore carbon storage.

Energy is the best performing sector this year but can it continue? Not all names are participating in the rally, though. Enterprise Products is a noticeable laggard. I’m sure the insiders at EPD are scratching their heads wondering why their stock is going nowhere.

This is a macro argument that your opinion or my opinion probably has as much weight as the expert climatologist, geologists, and futurists. I totally buy into climate change caused by the usage of hydrocarbons. Bill Gates explains it the best in his book How to Avoid a Climate Disaster. Global warming is no longer a credible debate topic. It’s a fact.

The disconnect between stock prices and reality is that it will take far more political will than I see available to wean us off the fossil fuel tit. Just look around you. All the major car manufacturers are talking about a world where they don’t make combustion engine vehicles any longer. Sure EV transportation is growing but do you see vastly fewer combustion engine cars on the road? It’s much harder to do this than Wall Street would you lead to believe. Look at the prices of EVs. Yeah, they’re supposed to be coming down. How long have we heard this?

In past blog posts, I’ve mentioned Norway sells more EV vehicles than combustion engines, more than any nation on the planet yet fossil fuel consumption is still on the rise there. I’m getting tired of making the argument. We are not getting off fossil fuels anytime soon. In fact, consumption may very well increase as bottlenecks in solar, lithium, copper, supply chain challenges are all making the decarbonization of the planet look much harder than academics would lead you to believe. I’ve attached the University of Michigan Center for Sustainable Systems report that shows renewables growing from 12.5% today to 17% by 2050. Thirty years from now 76% of U.S. energy still comes from fossil fuels.

By current DOE estimates, 76% of U.S. energy will come from fossil fuels in 2050, which is widely inconsistent with IPCC carbon reduction goals.

We like asynchronous bets. Unless you expect the U.S to willingly go back to the energy consumption of a caveman, we are going to keep Enterprise Products’ vast investments in the hydrocarbon economy viable and the 8% plus dividend is safe and likely growing.

Name: Bauer Jerry M

Position: Director

Transaction Date: 2021-09-20 Shares Bought: 15,000 Average Price Paid: $15.07 Cost: $226,050

Company: Marten Transport Ltd. (MRTN)

Marten Transport, Ltd. operates as a temperature-sensitive truckload carrier for shippers in the United States, Canada, and Mexico. It operates through four segments: Truckload, Dedicated, Intermodal, and Brokerage. The Truckload segment transports food and other consumer packaged goods that require a temperature-controlled or insulated environment. The Dedicated segment offers customized transportation solutions for individual customers’ requirements using temperature-controlled trailers, dry vans, and other specialized equipment. The Intermodal segment transports customers’ freight utilizing its temperature-controlled trailers on railroad flatcars for portions of trips, as well as using tractors and contracted carriers. The Brokerage segment develops contractual relationships with and arranges for third-party carriers to transport freight for customers in temperature-controlled trailers and dry vans. As of December 31, 2020, the company operated a fleet of 3,331 tractors, including 3,188 company-owned tractors and 143 tractors supplied by independent contractors. Marten Transport, Ltd. was founded in 1946 and is headquartered in Mondovi, Wisconsin. Roger Marten founded Marten Transport, Ltd. at the age of 17, delivering milk and other dairy products. His routes at that time were primarily in the Modena, Wisconsin area where Roger was born and raised. Driving for the Modena Co-op Creamery, The Roger Marten Community Center was built in Mondovi, WI. The facility was dedicated to his memory in 1996.

Jerry is a Principal and Board Member at Heartland Equity Partners. Jerry also serves as Chairman and CEO of Bauer Built, Inc., a family-owned business now in its 3rd generation. From 1976 to 2013, Jerry served as President of Bauer Built before turning over day-to-day operations to his son. The company has been in the family for over 70 years and has become one of the largest independent tire dealers and retread manufacturers in North America. Bauer Built is also a distributor of new and retreaded tires and related products and services throughout the Midwest and a distributor of petroleum products in west-central Wisconsin. In addition to his work at Bauer Built, Jerry has been on the Board of Directors of Security Financial Services Corporation / Security Financial Bank of Durand since 1992 and is currently its Chairman.

Opinion: It’s hard to get excited about Marten Transport. Marten has a strong financial profile but people believe truckload capacity will likely increase in the back half of 2022 and the price hikes of recent days are unsustainable as supply-demand gets into equilibrium.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund.

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried many vendors, and SECForm4 is one of the most customer-friendly and responsive I’ve used.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial, so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization, and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years, and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 are horrendously poor. Also, planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019, 4th Best in November 2020, 4th Best in January 2021 (I kid you not)