Curious how well insiders are doing with their buys? Scroll the significant buys of the last year.

Normally we try to focus on insider buying which gives us a granular peek inside the corporate veil and thus some edge at this game. We stay away from the global macro where we don’t have a perceived edge. That’s foolhardy to do right now as we are witness to a titanic struggle between autocracy and democracy being waged on a global stage with generational economic implications.

The market has acted like it didn’t have a care in the world with two back-to-back weekly advances, notching a solid 3.87% MTD gain. The yearly loss on the S&P 500 is now just 4.68%. Are we out of the woods?

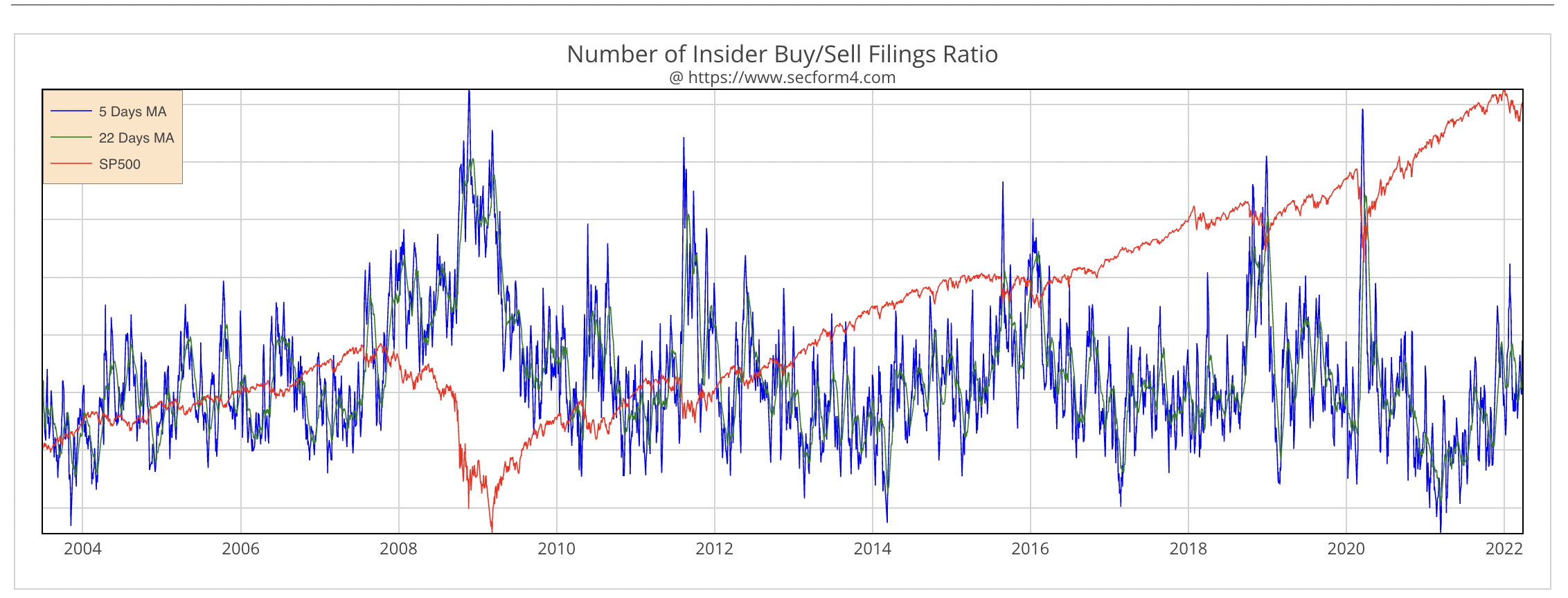

As you can see in this chart above from SecForm4.com insiders are not buying this market at a level that has defined market bottoms in the past. This week insider buying dropped off precipitously. The most obvious explanation for this is that we are in the earnings blackout period before 1st quarter results.

The other takeaway offered to explain the sanguine behavior of the market is that inflation can be kept under wraps by the newly awakened and now vigilant Fed. I have zero confidence in this explanation. I don’t believe the Fed can actually impact inflation with their tools or apply them in a manner that properly addresses the problem. For instance, most of the recent inflation has occurred from the following circumstances.

- Supply Constraints and disruptions caused by the Pandemic

- The rise in the price of oil caused by the war in Ukraine

- The lack of preparation to transition from a carbon-based economy to a renewable energy one

- Bringing offshore manufacturing back to the United States

- Generational shift of Millenials moving to 1st time home buyers

Raising interest rates will not fix any of the above and can actually exacerbate the problem causing a weakening and recessionary economy. The 2 yr 10 yr flattening of the yield curve explains the bond’s market belief that the Fed will cause an economic slowdown by raising rates. The housing market is beginning to show signs of slowing down which could have unintended consequences of raising rents as homeownership becomes less affordable.

The last thing I wanted to say is that market seems to be forecasting an outcome in the war in Ukraine that is favorable to the United States market economy and unfavorable to Russia and its Chinese supporter. The S&P 500 has now regained all the ground lost since the start of the war and the Chinese market as shown in the FXI has lost more than 15%. The Russian was briefly re-opened last week with severe restrictions and artificial market measures such as a ban on sales by foreigners and short selling. For all practical purposes, it has been closed since the start of the war.

This implied favorable outcome prediction could be premature and easily changed overnight with something like a tactical nuclear weapon being used by the Russians that catapults this war into a broader confrontation. The war seems far from over and the ultimate outcome unknowable. It’s a war that the West seems united in the belief that it cannot afford to lose and at the same time, Putin and his power clique cannot afford to lose. It’s also one that China has staked its credibility on with its declaration of friendship with Russia just days before the invasion.

This now seems like a tactical blunder of enormous consequence to the Chinese communist party. This puts the Chinese in a place where they cannot win. The West will never accept a complete victory by Russia after the heroic fighting of the Ukrainian people and the unlimited financial and vast military support the U.S and EU are providing to Ukraine. Markets are smarter than the most talented talking heads and the S&P 500 is now virtually unchanged from where it was on February 24th, the date of the Russian invasion of Ukraine while the FXI ( the ETF of large-cap Chinese ADRs) is down 15.34%

Name: Borninkhof K. Michelle

Position: CIO

Transaction Date: 2022-03-17 Shares Bought: 259 Average Price Paid: $1,944.66 Cost: $503,668.00

Company: AutoZone Inc (AZO)

AutoZone, Inc. (AutoZone) is a retailer and distributor of automotive replacement parts and accessories in the United States. The Company operates through the Auto Parts Locations segment. The Auto Parts Locations segment is a retailer and distributor of automotive parts and accessories through the Company’s locations in the United States, Mexico, and Brazil. AutoZone operates approximately 5,975 stores in the United States, 635 stores in Mexico, and 47 stores in Brazil. The Company’s stores carry product lines for cars, sport utility vehicles, vans, and light trucks, including new and remanufactured automotive hard parts, maintenance items, accessories, and non-automotive products. AutoZone also sells the ALLDATA brand diagnostic and repair software. They have vast opportunities in our stores, distribution centers, field offices, specialty business units, and Store Support Center and embrace diverse experiences, backgrounds, knowledge, and ideas to strengthen their teams and business. The team is connected by a deep commitment to Pledge and Values, principles established more than thirty years ago that reinforce the priorities and team culture.

Michelle Borninkhof works as a Chief Information Officer at AutoZone, which is an Automobile Parts Stores company with an estimated 100 K employees; and founded in 1979. They are a member of the C-Suite Department’s Information Technology Executive team, and their management level is C-Level. Michelle is currently based in Memphis, Tennessee, after graduating from Kansas State University. She previously worked at McDonald’s Corp. as Chief Information Officer and Vice President of US Technology.

Opinion: This is the 2nd material insider buy in AutoZone so this would merit closer attention except for the fact that there is an equal amount of option exercised selling during the same period

Name: Attal Alain

Position: Director

Transaction Date: 2022-03-24 Shares Bought: 1,500 Average Price Paid: $129.91 Cost: $194,865.00

Company: GameStop Corp. (GME)

Name: Cohen Ryan

Position: Director 10% Owner

Transaction Date: 2022-03-22 Shares Bought: 10,000 Average Price Paid: $101.76 Cost: $10,176,342.00

Company: GameStop Corp. (GME)

Name: Cheng Lawrence

Position: Director

Transaction Date: 2022-03-21 Shares Bought: 4,000 Average Price Paid: $95.84 Cost: $383,355.00

Company: GameStop Corp. (GME)

GameStop Corp. is a multichannel video game retailer that also sells consumer products and telecom services. It is divided into four segments: the United States, Canada, Australia, and Europe. The retail operations and electronic commerce websites www.gamestop.com and www.thinkgeek.com, as well as Game Informer magazine and Kongregate, are all part of the US sector. The retail and e-commerce businesses are part of the Canadian sector. The retail and e-commerce operations in Australia and New Zealand are referred to as the Australian sector. The retail and e-commerce businesses in European countries are included in the Europe division. Daniel A. DeMatteo created the company in 1996, and it is based in Grapevine, Texas.

Alan Attal is an entrepreneur and e-commerce executive with over two decades of experience establishing and managing enterprises. Mr. Attal was the Chief Marketing Officer of Chewy Inc. from 2017 to 2018, where he was in charge of broadcast, direct mail, and digital advertising and engagement activities. He was the company’s Chief Operating Officer from 2011 to early 2017, overseeing its growth from three personnel to more than 10,000.

Ryan Cohen is the managing partner of RC Ventures and a major shareholder in GameStop. Mr. Cohen previously developed and led Chewy Inc. (NYSE: CHWY), where he was responsible for the company’s growth and elevation to market leadership in the pet business. Before leaving in 2018, Mr. Cohen guided the company through its successful sale to PetSmart Inc. Mr. Cohen has substantial retail, IT, and e-commerce experience.

Lawrence Cheng is Co-Founder and Managing Partner of Volition Capital, a leading growth equity investment firm based in Boston, Massachusetts, and the first investor in Chewy Inc. He has more than two decades of venture capital and growth equity investing experience based on his time at Volition Capital, Fidelity Ventures, Battery Ventures, and Bessemer Venture Partners. He is currently the head of Volition Capital’s Online and Consumer team, concentrating on innovative firms in e-commerce, internet services, consumer brands, digital media, and gaming. He majored in Psychology at Harvard College, where he obtained his bachelor’s degree.

Opinion: This one caught everyone by surprise and apparently engendered an epic short squeeze with GameStop soaring 50% since Cohen’s purchase. Very few people believe GameStop can be a viable competitor in the video game industry that is dominated by a handful of large cap companies that has completely transitioned from a retail store model to a downloadable online economy. Netflix led the transition from the DVD player model to a streaming one. It’s hard to see where GameStop with its retail driven model can successfully make that transition.

Name: McIlwain Matthew S

Position: Director

Transaction Date: 2022-03-18 Shares Bought: 10,000 Average Price Paid: $49.62 Cost: $496,218.00

Company: Smartsheet Inc (SMAR)

Smartsheet Inc. provides a cloud-based platform for the execution of work. It enables teams and organizations to plan, capture, manage, automate, and report on work. The company offers Dashboards that provide real-time visibility into the status of work to align individuals, managers, and executives; Portals to easily locate and access from any device the resources available for a project without IT assistance; Cardview to organize, share, and act on workflows; and Grid to keep teams on task by easily tracking multiple moving parts. It also includes Projects, which provide an interface with capabilities that promote the team and organizational collaboration to improve job execution. Calendar that connects deadlines to workflows to bring teams and organizations together; Forms that allow business users to collect data in a logical and consistent manner; Integrations that enable businesses and teams to connect, sync, and extend their existing enterprise apps across their workflows to create job execution; and Automated actions that automate repetitive operations.

Mr. Matthew S. McIlwain is an Independent Director at Nautilus Biotechnology, Inc. and an Independent Director at Smartsheet, Inc. He serves on the boards of directors of Nautilus Biotechnology, Inc., Qumulo, Inc., Animoto, Inc., Smartsheet, Inc., Mixpo, Inc., Skytap, Inc., 2nd Watch Holding Co., Inc., 2nd Watch, Inc., Amperity, Inc., Appature, Inc., Booster Fuels, Inc., ExtraHop Networks, Inc., Igneous Systems, Inc., Nautilus Subs Mr. McIlwain formerly worked for Apptio, Inc. as an Independent Director, Madrona Venture Group LLC as a Managing Director, Genuine Parts Co. as a Vice President-Business Process, McKinsey & Co., Inc. as an Engagement Manager, and Credit Suisse First Boston USA, Inc. as a Principal.

Opinion: SmartSheet has grown revenues consistently but has yet to break into the black. It seems inevitable that a cloud-based software business growing this fast will certainly rapidly grow the bottom line yet the latest quarter showed no hint of that trend. Perhaps Director McIlwain anticipates this quarter is better?

Name: Owen Rebecca L

Position: Director

Transaction Date: 2022-03-18 Shares Bought: 5,250 Average Price Paid: $38.43 Cost: $201,285.00

Company: WillScot Mobile Mini Holdings Corp. (WSC)

Now that WillScot and Mobile Mini have joined forces, they’re better equipped than ever to do what we do best – make life easier for customers. As North America’s leader in the innovative flexible workspace and portable storage solutions, They are the only provider on the continent that can deliver everything customers need. Space. Storage. Furnishings. Services. Everything. With one order from them, they’re Ready to Work. Every facet of their company is geared toward providing this value. Their strong team of service-focused experts. Their vast fleet of quality portable units. Their turnkey solutions with limitless add-on options. The expansive network lets them deliver anywhere fast. The whole company is built to serve customer needs. When customers call them, it’s the only call they need to make – because we’re the only company that can service their entire site. No other company in our industry has the resources, acumen, or service commitment to fully deliver on this approach. They have combined the best of WillScot and Mobile Mini. The best practices. The best industry knowledge.

Ms. Owen has formerly served on the boards of directors of WillScot Corporation, Jernigan Capital Corporation, and Columbia Equity Trust Corporation. Since 2013, Ms. Owen has served on the board of directors of Carr Properties, a private real estate investment trust, and the Real Estate Investment Advisory Committee of ASB Capital Management, LLC, an institutional real estate investment firm. From 2006 until 2020, Ms. Owen served on the Horizons National Student Enrichment Program Inc. and the Boys & Girls Club of Greater Washington boards of directors.

Opinion: On March 2nd, Barclays analyst Manav Patnaik upgraded WillScot Mobile Mini to Overweight from Equal Weight with a price target of $50, up from $40. The company looks well-positioned to beat its recently set three- and five-year financial targets, Patnaik tells investors in a research note. The analyst sees “many potentially positive catalysts” for the shares, including upside driven from multiple expansion, earnings beats and a continued stream of acquisitions. WillScot is “still in the early-to-middle innings of a perception change,” says Patnaik.

Name: Myers Franklin

Position: Director

Transaction Date: 2022-03-18 Shares Bought: 7,500 Average Price Paid: $35.78 Cost: $268,350.00

Company: HF Sinclair Corp (DINO)

HollyFrontier Corp. and Holly Energy Partners, with interests and assets in Oklahoma, have established HF Sinclair Corp. as their new parent holding company after acquiring Sinclair Oil Corp. and Sinclair Transportation from The Sinclair Companies. HF Sinclair will continue to operate refineries in Oklahoma, Kansas, New Mexico, Wyoming, Washington, and Utah, with refined products distributed in 19 states. It will also sell fuel to more than 1,300 Sinclair-branded stations across the country and license the Sinclair brand to more than 300 locations. In Oklahoma and other states, the corporation will also provide petroleum product and crude oil transportation, storage, and throughput services to the petroleum industry.

Currently, Franklin Myers is Chairman of Comfort Systems USA, Inc., Chairman for HollyFrontier Corp. and Senior Advisor at Quantum Energy Partners LLC. Mr. Myers is also on the board of Input and HF Sinclair Corp. He previously worked as an Executive Advisor at The CapStreet Group LLC, an Operating Advisor at Paine Schwartz Partners LLC, Senior Vice President and General Counsel for Baker Hughes Co. and Senior Vice President and General Counsel of Baker Hughes Holdings LLC, Chief Financial Officer and Senior Vice President for Cameron International Corp., Chief Financial Officer and Senior Vice President of Cooper Energy Services, and a Partner at Fulbright & Jaworski LLP.

Opinion: Holly was the largest independent refiner in the U.S. Add Sinclair to the mix and they are even bigger . Sinclair was one of the most valuable privately owned businesses in America. Holly figured the value was $2.6 billion for the oil assets. Sinclair appears o remain the owners of popular ski resorts popular ski resorts of SnowBasin and Squaw Valley, both existentially threatened by global warming. The owners of Sinclair requested customary registration rights on the full 60 million shares offered to them in the new company they own 26% of. It seems the family is selling at a good time with oil assets perhaps unsustainably high in price right now although this deal started in the Summer of last year, before the recent runup in the price of gasoline.

There are just too many unknowns for me on this one and I’m sitting out.

Name: Botha Roelof

Position: Director

Transaction Date: 2022-03-18 Shares Bought: 153,000 Average Price Paid: $32.72 Cost: $5,005,411

Company: Natera Inc (NTRA)

Natera, Inc., a diagnostics company, develops and commercializes molecular testing services worldwide. Panorama is a non-invasive prenatal test that uses a blood sample from the mother to screen for chromosomal abnormalities in the foetus, as well as zygosity in twin pregnancies; Vistara is a single-gene mutation screening test; Horizon carrier screening to determine carrier status for various genetic diseases, and Spectrum is a test that detects chromosomal anomalies or inherited genetic conditions during an in vitro fertilization cycle. Anora miscarriage test products study foetal chromosomes to detect the reason for miscarriage, and non-invasive paternity testing tools employ blood draw from the expectant mother and claimed father to determine paternity by gestation. The company sells its products both directly and through a network of about 100 laboratories and distributors.

Roelof F. Botha has served as a member of our board of directors since 2007. Mr. Botha has been with Sequoia Capital, a venture capital firm, since 2003, and has been a Managing Member of Sequoia Capital Operations, LLC since 2007. Mr. Botha worked for PayPal, Inc. from 2000 to 2003 in a variety of capacities, the most recent of which was Chief Financial Officer. Mr. Botha worked as a management consultant for McKinsey & Company, a management consulting firm, from 1996 to 1998. Mr. Botha currently serves on the boards of directors of Square, Inc., a payments, financial, and marketing services provider; MongoDB, Inc., a document-oriented database program developer; Eventbrite, Inc., event management and ticketing platform; Unity, Inc., a 3D and VR content development platform; and several private companies.

Opinion: Personalized medicine holds enormous importance and with it promise of riches. Natera already has drugs on the market. Although not yet profitable, NTRA did show impressive year-over-year revenue growth of $567.1M for Q4 2021 versus the previous year 2020 of $367.1M.

These look like personal investment buys and not as his role of designated board seat from super prominent VC Sequoia Capital. This is an enormously important fact when weighing insider conviction.

NTRA just was found guilty on March 23rd of false advertising as a jury found that Natera intentionally and recklessly misled the transplant community by deliberately engaging in false advertising in the promotion and marketing of its Prospera kidney transplant rejection assessment test. CareDx was awarded monetary damages totaling $44.9M: $21.2M in compensatory damages and $23.7M in punitive damages. Overwhelming evidence emerged at the trial that demonstrated that Natera made false statements that its senior executives knew were based on unscientific, unreliable, and inappropriate conclusions to market Prospera. The trial underscored the value of AlloSure’s clinical excellence as the only donor-derived cell-free DNA test that has prospective, multicenter validation published. The jury did not find CareDx liable for false advertising under the Delaware Deceptive Trade Practices Act, or intentional and willful false advertising or unfair competition. Notably, the jury rejected all of Natera’s challenges to AlloSure performance claims.

On March 16th Natera announced that Roelof Botha, lead independent director of Natera’s board of directors and partner at Sequoia Capital, has invested $5M to purchase shares of Natera’s stock on the open market. In addition, Natera executives and non-employee directors have elected to exchange their cash compensation for Natera equity for the remainder of 2022.

This purchase would have looked a lot better had it been made after the jury trial. So much for the smart money that Sequoia is supposed to represent. I’m assuming that Botha knew a verdict was imminent in the jury trial and this may all be immaterial but it certainly sows doubt in my mind, especially so with the recently published Hindenberg short-sell report.

Name: Walsh Patrick D

Position: Director

Transaction Date: 2022-03-21 Shares Bought: 5,000 Average Price Paid: $27.76 Cost: $138,794.00

Company: ANI Pharmaceuticals Inc (ANIP)

Name: Lalwani Nikhil

Position: CEO

Transaction Date: 2022-03-21 Shares Bought: 7,224 Average Price Paid: $27.69 Cost: $199,997.00

Company: ANI Pharmaceuticals Inc (ANIP)

Name: Shanmugam Muthusamy

Position: COO

Transaction Date: 2022-03-17 Shares Bought: 10,000 Average Price Paid: $27.65 Cost: $276,503.00

Company: ANI Pharmaceuticals Inc (ANIP)

Name: Gassert Chad

Position: VP

Transaction Date: 2022-03-18 Shares Bought: 10,000 Average Price Paid: $27.51 Cost: $275,087.00

Company: ANI Pharmaceuticals Inc (ANIP)

ANI Pharmaceuticals, Inc. is an integrated specialty pharmaceutical company. The Company is focused on developing, manufacturing, and marketing branded and generic prescription pharmaceuticals. Controlled chemicals, oncology treatments (anti-cancer), hormones and steroids, and complicated formulations are some of the areas where the company specializes. Pharmaceuticals, both branded and generic, are among the company’s offerings. Aspirin and Extended-Release Dipyridamole, Bretylium Tosylate Injection USP, cholestyramine, Etodolac, Fluvoxamine, Indapamide, Nilutamide, Vancomycin, and other generics are among the company’s offerings. Arimidex (anastrozole) tablets, Atacand HCT Tablets, Atacand Tablets, Casodex, Cortenema, Cortrophin gel, Cortrophin-Zinc, Inderal LA, Inderal XL, InnoPran XL, Lithobid, Reglan, and Vancocin are some of the company’s branded goods. It operates out of three pharmaceutical manufacturing sites, two of which are in Baudette, Minnesota, and one in Oakville, Ontario.

Mr. Walsh has served as a director since May 2018 and has been Chairman of the Board since June 2020. He also served as interim Chief Executive Officer of ANI from May 2020 to September 2020. Mr. Walsh was named Chairman and Chief Executive Officer of Alcami, global contract development, and manufacturing firm, in March 2021. From May 2019 to April 2020, Mr. Walsh worked as the Chief Executive Officer of TriPharm Services, an injectable manufacturing company that was bought by Alcami. Mr. Walsh was the CEO of Avista Pharma, a private equity-backed global provider of contract manufacturing, research, and analytical testing services that were bought by Cambrex, from 2015 until February 2019.

Mr. Lalwani is the President and Chief Executive Officer of ANI, as well as a member of the Board of Directors. From May 2012 until August 2020, Mr. Lalwani worked at Cipla Ltd, a worldwide pharmaceutical corporation, where he held roles of increasing responsibility, including CEO of Cipla USA, CEO of InvaGen, Head of US Strategy, M&A, and Integration, and Head of Cipla’s Global Respiratory business. As Cipla entered the specialty pharmaceutical industry, Mr. Lalwani devised and implemented multi-year strategic growth strategies for key products, as well as facilitated successful acquisitions. Mr. Lalwani previously worked as an associate partner at McKinsey & Company, where he advised pharmaceutical and healthcare organizations around the world, and as an engineer at Medtronic.

Shanmugam Muthusamy, the founder of Novitium Pharma LLC, is currently Director and Head-Research & Development at ANI Pharmaceuticals, Inc. and President of Novitium Pharma LLC (a subsidiary of ANI Pharmaceuticals, Inc.). Mr. Muthusamy is also a member of the Nuray Chemicals Pvt Ltd board of directors. Mr. Muthusamy graduated from the Tamil Nadu Dr. M.G.R. Medical University with a master’s degree.

Chad Gassert, the founder of Novitium Pharma LLC, is the Senior Vice President-Business Development of Endo Generics Holdings, Inc., the Senior Vice President-Corporate Development & Strategy of ANI Pharmaceuticals, Inc., and the Senior Vice President-Business Development of Par Pharmaceutical, Inc. Chad Gassert previously served as the Chief Executive Officer of Novitium Pharma LLC. Mr. Gassert graduated from the University of Delaware with a bachelor’s degree and a master’s degree from the New Jersey Institute of Technology.

Opinion: On March 16th Raymond James analyst Elliot Wilbur lowered the firm’s price target on ANI Pharmaceuticals to $47 from $65 and kept an outperform rating on the shares. ANI Pharmaceuticals’ Q4 results were “mixed” as higher revenue was offset by increased costs to lead to a softer profit number, Wilbur tells investors in a research note.

The generic drug company, ANIP, may have something going for it as in November last year they received the approval of Cortrophin Ge. According to the Company, “physicians now have a much-needed treatment option for patients with acute exacerbations of multiple sclerosis and rheumatoid arthritis, as well as nephrotic syndrome, who can benefit from corticotropin. We have built an experienced rare disease leadership team to drive a full-scale commercial launch early in the first quarter of 2022,” said Nikhil Lalwani, President and CEO of ANI.

Name: Johnny Brokken

Position: Director

Transaction Date: 2022-03-17 Shares Bought:714,284 Average Price Paid: $7 Cost: $4,999,988.00

Company: PureCycle Technologies Inc. (PCT)

Name: Otworth Michael

Position: CEO/Chairman

Transaction Date: 2022-03-17 Shares Bought: 142,856 Average Price Paid: $7 Cost: $999,992.00

Company: PureCycle Technologies Inc. (PCT)

PureCycle Technologies is the only company that sells recycled polypropylene that has the same qualities as virgin polypropylene. Its recycling service turns waste plastic into virgin-like plastic, completely closing the loop on recycled plastic usage and making recycled polypropylene more available at scale to businesses looking for a sustainable, recycled resin. Its headquarters are in Ironton, Ohio, where it was created in 2015.

Jeffrey Fieler is a member of the board of directors of the Combined Company. Mr. Fieler is also a member of the audit committee and chairs the nominating and corporate governance committee. Mr. Fieler was the Founder and Portfolio Manager of Sylebra Capital Management, a global investment manager, from June 2010 to March 2018, where he oversaw an active portfolio in the global technology, media, and telecommunications sectors. Fieler worked at Coatue Management, a global investment manager, as a Senior Partner and Partner (from May 2003 to January 2007), where he oversaw investment research and portfolio positions in the internet, media, and telecom industries.

PureCycle Technologies’ Chairman and Chief Executive Officer are Mike Otworth. Mike is also the Co-Founder and Chairman of the Board of Directors of Innventure, PureCycle’s parent company. Mike was the President and Founding Partner of Green Ocean Innovation for six years prior to joining Innventure. Green Ocean provides Lilly/Elanco Animal Health with technology sourcing and innovation strategy and development services, with a focus on medicines, diagnostics, and other medical devices. Mike formerly worked at XL TechGroup as Vice President and Founding CEO of various start-ups, where he started, capitalized, and moved firms to late-stage investment.

Opinion:

https://finviz.com/published_idea.ashx?t=CANO&f=041122&i=CANOd180799649i

Name: Gold Lewis

Position: Director

Transaction Date: 2022-03-17 Shares Bought: 300,000 Average Price Paid: $6.81 Cost: $2,043,000.00 These securities are owned directly by EGGE, LLC and indirectly by the Reporting Person.

Company: Cano Health Inc. (CANO)

Cano Health, Inc. provides primary care medical services to its members in the United States and Puerto Rico. It owns and operates medical centers enabled by CanoPanorama, a proprietary population health management technology-powered platform that provides the healthcare providers at its medical centers with a 360-degree view of their members with actionable insights to improve care decisions and member engagement. The company also operates pharmacies, as well as provides dental services in its medical centers. As of July 2, 2021, it operated 106 owned medical centers and approximately 800 affiliate providers serving approximately 197,000 members. The company was founded in 2009 and is based in Miami, Florida. Their mission is to improve patient health by delivering superior primary care medical services while forging a life-long bond with their members. Their vision is to become the national leader in primary care by improving the health, wellness, and quality of life of the communities we serve while reducing health care costs.

Dr. Gold is Co-Founder and Chairman of the Board at Advanced Recovery Systems, an integrated behavioral health company specializing in the treatment of substance abuse, eating disorders, and associated mental health issues. He also serves on the boards of Urology Management Associates and Siromed as a non-executive chairman. Dr. Gold previously co-founded Sheridan Healthcare in 1994 and served on its Board of Directors as Executive Vice Chairman. Sheridan Healthcare developed from a single local clinic to a national enterprise with 23 locations under his direction.

Opinion: We’ve written in the past about Cano. Recent activist investor Dan Loeb announced he had acquired a stake and wanted the Company to sell itself as it was fatally wounded by its SPAC IPO process. This seemed like a strange argument but I am comforted to know that Dan Loeb was buying. Cano and its founder Dr. Hernandez is a future star but it seems it got out of the gates with an unsupportable value.

https://finviz.com/published_idea.ashx?t=CANO&f=041122&i=CANOd180799649i

Name: Mathrani Sandeep

Position: CEO

Transaction Date: 2022-03-22 Shares Bought: 30,000 Average Price Paid: $6.55 Cost: $196,500.00

Company: WeWork Inc. (WE)

WeWork Inc., formerly BowX Acquisition Corp., is engaged in providing flexible space and workplace management solutions. For entrepreneurs and businesses, the company creates real and virtual shared spaces as well as office services. Standard offices, office suites, and full-floor offices are among the options available under the private workspace. WeWork All Access, WeWork On Demand, and Dedicated Desk are some of the open workspace options offered by the company. WeWork All Access, a monthly membership program offered by the company, allows access to hot desks, conference rooms, and private offices throughout the world. WeWork On Demand, the company’s pay-as-you-go offering, gives users access to the shared workplace and conference rooms. A dedicated Workstation allows customers to have their own desk in one area while also having access to meeting rooms.

WeWork’s CEO and previous CEO of Brookfield Properties’ retail group, Vice Chairman of Brookfield Properties, and Nareit Chair for 2019. Serves on the board of directors of Host Hotels & Resorts, Inc. and on the executive board and board of trustees of the International Council of Shopping Centers (ICSC).

Opinion: Watch the Apple TV release We Crashed. Then do the financials. Not much has changed.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data so I like people that eat what they kill.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health. It’s just one piece of the investor’s due diligence. The Insiders Fund blog informs you of the purchases that count. As a rule, we only look at material amounts of money as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong about, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have and we curse aloud, what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts comment, and whatever else could be moving the stock. Dow Jones news service is an essential tool but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019