Curious how well insiders are doing with their buys? Scroll through the significant buys of the last year.

Only oil and gas stocks escaped the payback carnage on Friday. We are getting closer and closer to the dreaded blackout period. A period where corporate insiders are prohibited from trading in their own stock. The one thing that buoys investor sentiment in a bear market is when insiders step up and purchase their own company’s stock. There will be less and less of this to report and short-sellers know this. They delight in capitulation and if there was ever a market in recent decades that begged for throwing in the towel, it’s this one. Both stock, bonds, and now real estate are all in decline. There really is no place to hide. And now we begin to lose the little confidence we have as the blackout window starts to close. Yet two well known retailers look like bargain basement buys.

Name: Colombo William J

Position: Director

Transaction Date: 2022-05-31 Shares Bought: 5,000 Average Price Paid: $80.99 Cost: $404,950.00

Company: Dick’s Sporting Goods Inc (DKS)

DICK’S Sports Goods, Inc. and its subsidiaries operate predominantly in the eastern United States as a sporting goods store. Hardlines, such as sports goods equipment, fitness equipment, golf equipment, hunting and fishing gear; clothes; and footwear and accessories are among the company’s offerings. Sporting Goods, Golf Galaxy, Field & Stream, Public Lands, Going Going Gone!, and other specialty concept stores are also owned and operated by the company, as are DICK’S House of Sports and Golf Galaxy Performance Center, as well as GameChanger, a youth sports mobile application for video streaming, scorekeeping, scheduling, and communications. E-commerce websites and mobile applications are used to sell the company’s products.

Mr. Colombo has been a member of the board since 2002, and after resigning as President and Chief Operating Officer of the Company in 2002, he became our Vice Chairman of the Board in February 2008. He also served as our interim Chief Marketing Officer from September 2010 to February 2011.Mr. Colombo was President of dsports.com LLC, our then eCommerce affiliate, from 1998 to 2000. From 1995 to 1998, Mr. Colombo also served as our Chief Operating Officer and Executive Vice President. Mr. Colombo has been with us since 1988. From 1977 through 1988, he worked at J.C. Penney Company, Inc., a New York Stock Exchange-listed retailer, in different field and district roles. From 2003 until 2016, Mr. Colombo was a member of the board of directors of Gibraltar Industries, a significant manufacturer, processor, and distributor of construction and industrial goods listed on Nasdaq.

Opinion: I like the sporting goods business as it has recessionary resistant attributes. As inflation bites consumer spending, sports and video entertainment streaming provide good sources of relatively inexpensive entertainment. Sports even provide anxiety relief from opening your statements. More than the business, though, I like the price at 6.24 P.E with a DCF valuation of $145 at a modest revenue growth rate of 5% per annum is a screaming buy.

So what makes the stock go up? With discretionary consumer spending expected to be severely challenged and inflation lowering margins Dicks management guided revenue and profits lower On May 25th management gave guidance of FY22 SSS growth view to (8%)-(2%) from (4%)-flat. Updates full-year 2022 outlook to reflect the impact of evolving macroeconomic conditions. Dick’s Sporting cut FY22 adjusted EPS view to $9.15-11.70 from $11.70-$13.10.

The stock dipped to $65 and closed higher on the day, a clear bottoming signal. Dick’s increased investment in private-label offerings speaks to a broader industry shift in the relationship between retailers and wholesale brands. As larger brands like Nike switch gears to sell directly to consumers, retailers like Dick’s, Target, and Walmart are beefing up their own brand selection to stay competitive. With private-label products, retailers see higher margins on products that customers can’t buy elsewhere.

There has been massive consolidation and bankruptcy in this industry as Amazon and other online merchants have attached the retail store model. Dicks is a well-managed company and a survivor. They bet on their omni channel strategy and it has worked. From the 10K “Our stores remain at the core of our omni-channel platform. We believe our store base gives us a competitive advantage over our online-only competitors, as our physical presence allows us to better serve our athletes by creating strong engagement through interactive in-store elements, offering the convenience of accepting in-store returns or exchanges and expediting fulfillment of eCommerce orders, the ability to place online orders in our stores if we are out of stock in the retail store, buy-online, pick-up in store or curbside capabilities, and giving direct, live access to well-trained and knowledgeable teammates. In fiscal 2021, approximately 70% of online sales were fulfilled directly by our stores, which serve as localized points of distribution, and they enabled 90% of total sales through online fulfillment and in-person sales.

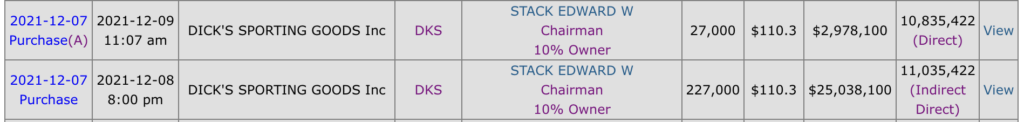

The bottom line is that CEO Stack and his family have a controlling interest in the company. Edward W. Stack is their Executive Chairman. From 1984 to January 2021, Mr. Stack served as our Chairman and Chief Executive Officer taking over the operation of the Company after his father and their founder, Richard “Dick” Stack, retired from our then two-store chain. Lauren R. Hobart became our President and Chief Executive Officer effective February 1, 2021 and has served as our President since May 2017

If they want to sell there will be ample private equity companies interested in the brand. In January 2015 Dicks talked to several private equity companies about a buyout. During that time DKS had 90 million shares or so outstanding with a price of around $53 per share giving it a market cap of approximately $4.7 billion. Today DKS has 83 million or so shares outstanding at a price of $81 per share giving it a market cap of $11.69 Billion

Recent purchases by Edward Stack may reveal his thinking a bit on the valuation of his company’s shares.

Name: Schulze Richard M

Position: Chairman 10% Owner

Transaction Date: 2022-05-25 Shares Bought: 250,000 Average Price Paid: $79.60 Cost: $19,900,738.00

Company: Best Buy Co Inc (BBY)

In the United States and Canada, Best Buy Co., Inc. sells technology. Domestic and International are the two segments in which the firm works. Computing products, such as desktops, notebooks, and peripherals; mobile phones, including related mobile network carrier commissions; networking products; tablets, including e-readers; smartwatches; and consumer electronics, including digital imaging, health and fitness, home theater, portable audio, including headphones and portable speakers, and smart home products are all available through its stores. Appliances, such as dishwashers, laundry, ovens, refrigerators, blenders, coffee makers, and vacuum cleaners; entertainment products, such as drones, peripherals, movies, music, and toys, as well as gaming hardware and software, virtual reality, and other software products; and other products, such as baby, food and beverage, luggage, outdoor living, and sporting goods are all available in the company’s stores. It also offers advice, delivery, design, health-related services, installation, memberships, repair, set-up, technical support, and warranty services.

The Richard M. Schulze Family Foundation was founded by Richard M. “Dick” Schulze, who is also the founder and chairman emeritus of Best Buy Co., Inc., the world’s biggest multi-channel consumer electronics store. Schulze, who was born and raised in St. Paul, Minnesota, is the epitome of the American dream. He and a hand-picked team developed a retailing empire in the Twin Cities from humble beginnings. In both his professional and personal lives, he remained true to his lifelong ideals of integrity, humility, honesty, and respect. Schulze aspires to leave a personal legacy of three key contributions to business, entrepreneurship education, and philanthropy in the years to come.

Opinion: A lot of what I wrote about Dicks is financially the exact same story for Best Buy. Founders with massive holdings buying large dollar amounts of stock instead of unloading them like in the tech world. Like Dicks, there was a lot of pull forward demand from the Pandemic and the company will likely post negative comp-store sales for a while which usually doesn’t excite investors. Massive insider buying with a below market P.E, EV/EBIT and other metrics like it’s outsized dividend yield of 4.38% below or near 5 Yr extremes. This view is not universally shared. According to Fly on the Wall, Citi analyst Steven Zaccone lowered the firm’s price target on Best Buy to $65 from $80 and keeps a Sell rating on the shares. The analyst continues to see “significant risk” to second half of 2022 estimates and the company’s multi-year earnings power amid worsening economic conditions. Best Buy is facing a spending shift away from electronics, a worsening macro backdrop and tougher promotional environment, Zaccone tells investors in a research note. Best Buy’s model is “not built for a recession,” he writes.

The dividend is attractive 4.38% with a 28% coverage ratio so its not likely to be cut by moderate reduced sales.

Name: Silagy Eric E

Position: CEO , Chairman

Transaction Date: 2022-06-02 Shares Bought: 13,128 Average Price Paid: $76.45 Cost: $1,003,636

Company: Nextera Energy Inc (NEE)

NextEra Energy, Inc. generates, transmits, distributes, and sells electric power to retail and wholesale clients in North America through its subsidiaries. Wind, solar, nuclear, coal, and natural gas plants are used to create electricity for the corporation. It also owns, develops, constructs manages, and operates electric generation facilities in wholesale energy markets, as well as sells energy commodities and develops, constructs, manages, and operates clean energy solutions such as renewable generation facilities, battery storage projects, and electric transmission facilities.

Florida Power & Light Company (FPL), a subsidiary of NextEra Energy, Inc. and the biggest vertically integrated rate-regulated electric utility in the United States, is led by Eric Silagy as chairman, president, and CEO. In December 2011, he was named president, then in May 2014, he was named CEO, and in March 2022, he was named chairman. Mr. Silagy has approximately two decades of experience with NextEra Energy firms. He managed all generation development, including solar, natural gas, and nuclear energy projects, for FPL as senior vice president of regulatory and state governmental affairs and chief development officer. Mr. Silagy was vice president and general manager of the Southern area at NextEra Energy Resources, as well as vice president of business development.

Opinion: Utilities and Oil and Gas sector are the only two groups that are positive for the year to date. We’ve traded in and out of this name but don’t own it currently. Utilities should be interest-rate sensitive and as the Fed raises rates, they would normally be under pressure. Two different dynamics are at play here, though. First, there is a generally held sentiment that the Fed’s attempt to raise rates and reduce their balance sheet combined with record inflation will push the economy into recession. Second, electricity consumption due to EV vehicle adaption, clean energy, and the digital age will cause record usage. We like this name and will be buyers again.

Name: Moore Meridee

Position: Director

Transaction Date: 2022-05-31 Shares Bought: 12,000 Average Price Paid: $41.26 Cost: $495,149

Company: Rayonier Inc (RYN)

Rayonier Inc (Rayonier) is a US-based forest products company engaged in activities related to forest management and real estate sales and entitlement. They own and manage several acres of forest area in North America and New Zealand. They are also involved in hunting, mineral extraction, and cell tower rentals. Rayonier also sells real estate, including the sale of land. This includes improved development, no improved development, rural areas, and non-strategic and forested areas. The trade logos from markets in Australia, New Zealand, and the Pacific Rim. The company operates primarily in the United States and New Zealand. Rayonier is headquartered in Yuri, Florida, USA.

Meridee A. Moore is a Director of BlackRock Capital Investment Corporation. In 2002, Ms. Moore founded Watershed Asset Management, LLC (“Watershed”). Ms. Moore is currently the Senior Managing Member of Watershed. Prior to founding Watershed in 2002, Ms. Moore was Partner and Portfolio Manager of Farallon Capital Management, L.L.C. Ms. Moore has over 25 years of principal investing experience and serves on the boards of Rayonier, Inc. Moore previously served on the boards of PG & E Corporation, Pacific Gas and Electric Company, its utilities, NextGen Climate America, and Inc. Moore received her B.A. from the University of Colorado and her J.D. Yale Law School.

Opinion: I don’t understand how RYN is valued. The end markets are strong but without any guide posts, insider buying is not conclusive enough either.

Name: Cummins Wes

Position: Director

Transaction Date: 2022-05-31 Shares Bought: 15,000 Average Price Paid: $30.49 Cost: $457,350.00

Company: Vishay Precision Group Inc. (VPG)

In the United States, Israel, the United Kingdom, the rest of Europe, Asia, and Canada, Vishay Precision Group, Inc. designs, manufactures, and distributes specialized sensors, weighing solutions, and measuring systems. Sensors, Weighing Solutions, and Measurement Systems are its three segments. Precision resistors, strain gauges, load cells, onboard weighing systems, and process weighing solutions are among the company’s offerings. Data acquisition systems for avionics, steel production measurement systems, material testing, and simulation systems, and data acquisition systems for vehicle safety testing are all available from the firm. Industrial, test and measurement, transportation, steel, medical, agriculture, avionics, military and space, and consumer product sectors all employ the company’s products.

B. Riley Asset Management LLC was created by Wesley Carl Cummins. Mr. Cummins is the Chairman and CEO of Applied Blockchain, Inc., as well as the Chief Investment Officer of B. Riley Asset Management LLC. Sequans Communications SA and Vishay Precision Group, Inc. are also on his board of directors.

He has worked as an analyst at Harvey Partners LLC, an analyst at Kennedy Capital Management, Inc., a research analyst at Nokomis Capital LLC, a president at Riley Investment Management LLC, a research director and head of capital markets at B. Riley & Co. LLC, an analyst at Needham & Co. LLC, and a director at B. Riley Securities, Inc. He graduated from Washington University in St. Louis with a bachelor’s degree.

Opinion: Cummins has been a consistent buyer of VPG at ever-lower prices. We’ve blogged on this before.

Name: Breaux Paul W.

Position: Vice President

Transaction Date: 2022-05-31 Shares Bought: 14,000 Average Price Paid: $31.09 Cost: $435,260.00

Company: Carvana Co (CVNA)

Carvana Co. is a holding business that operates an e-commerce platform for the purchase of secondhand automobiles. Consumers can use the Company’s platform to research and locate a vehicle, inspect it utilizing 360-degree vehicle image technology, acquire finance and warranty coverage, purchase the vehicle, and schedule delivery or pick-up, all from the comfort of their own home or office. Customers can acquire financing, complete a purchase, and schedule delivery or pick-up online using the Company’s transaction technologies and web platform. Customers in select markets can also choose to pick up their automobile from a vending machine. Over 266 metropolitan markets are served by its in-house distribution network.

Paul Breaux is the Company’s Vice President, General Counsel, and Secretary. From 2008 through 2015, Mr. Breaux worked as an attorney with Andrews Kurth LLP (now Hunton Andrews Kurth LLP) in Houston, Texas. Mr. Breaux’s representative expertise at Andrews Kurth included a wide range of general commercial transaction matters. Mr. Breaux has a Harvard Law School J.D., a University of Texas at Austin B.A. in Plan II Honors, and a University of Texas at Austin B.B.A. in finance.

Opinion: Insiders continue to buy this short seller favorite. The fall is ignominious. The Garcia father and son duo founders bought $560 million on the secondary at $80 in April. Now they can buy all they want for less than $30. CVNA if it works may be of the biggest winners from this level. We blogged on this one as well just a week ago.

Name: Flatley Jay T

Position: Director

Transaction Date: 2022-05-26 Shares Bought: 40,000 Average Price Paid: $29.31 Cost: $1,172,400

Company: Rivian Automotive Inc. (RIVN)

Rivian Automotive, Inc. is an electric car and accessory company that designs, develops, produces, and distributes them. Five passenger pickup trucks and sport utility vehicles are available from the firm. It collaborates with Amazon.com to deliver the Rivian Commercial Vehicle platform for electric Delivery Vans. In both the consumer and business segments, the corporation offers its products directly to clients. Rivian Automotive, Inc. is situated in San Jose, California, and was formed in 2009.

Since July 5, 2016, Jay T. Flatley has served as Executive Chairman of the Board of Illumina, Inc. Illumina, Inc.’s Chief Executive Officer and Director. From 1994 until its sale to Amersham Pharmacia Biotech Inc. in 1998, Mr. Flatley was co-founder, President, Chief Executive Officer, and director of Molecular Dynamics, Inc., a NASDAQ-listed life sciences firm focusing on genetic discovery and analysis. From 1987 through 1994, he worked for Molecular Dynamics in a variety of jobs with increasing responsibilities. Mr. Flatley worked for Plexus Computers, a UNIX computer business, from 1985 to 1987 as Vice President of Engineering and Vice President of Strategic Planning. Mr. Flatley is also a director of Coherent, Inc., a NASDAQ-listed company that provides photonics-based solutions to the commercial and scientific research industries. Mr. Flatley graduated from Claremont McKenna College with a B.A. in Economics and Stanford University with a B.S. and M.S. in Industrial Engineering.

Opinion :Another insider buying Rivian is a good sign. We blogged on this one as well.

Name: Crawford Edward F

Position: Director 10% Owner

Transaction Date: 2022-05-01 Shares Bought: 38,462 Average Price Paid: $26.00 Cost: $1,000,012.00

Company: Crawford United Corp (CRAWA)

Crawford United Corp. is a holding company that develops and manufactures products for firms involved in the transportation and emissions testing industries. Aerospace Components, Commercial Air Handling, and Industrial Hose are the company’s three segments. Aerospace Components offers complete engineering, machining, grinding, welding, brazing, heat treatment, and assembly services. The Commercial Air Handling section specializes in designing and implementing specialized air handling systems for large-scale commercial, institutional, and industrial applications. The Industrial Hose section includes the manufacture and marketing of flexible interlocking metal hoses as well as silicone hoses. Robert D. Hickok, Sr. created the corporation on May 14, 1910, and it is based in Cleveland, Ohio.

Edward F. Crawford is an entrepreneur who created Cleveland Steel Container Corp. and has led six separate businesses. Mr. Crawford is currently the Chairman of Crawford United Corp., the CEO of Beech Technology Systems LLC, and the President of First Francis Co., Inc. He formerly served as President and Director of Park-Ohio Holdings Corp. and Park-Ohio Industries, Inc. (a subsidiary of Park-Ohio Holdings Corp.), Advisor at Resilience Capital Partners LLC, and Chairman, President, and Chief Executive Officer of The Crawford Group, Inc.

Opinion: There is not enough trading here to be liquid to buy.

Name: Abu-Ghazaleh Mohammad

Position: CEO, Chairman, 10% Owner

Transaction Date: 2022-05-26 Shares Bought: 20,000 Average Price Paid: $25.29 Cost: $505,751.00

Company: Fresh Del Monte Produce Inc (FDP)

Fresh Del Monte Produce Inc. manufactures, markets, and distributes fresh and fresh-cut fruits and vegetables throughout North America, Europe, the Middle East, Africa, Asia, and other parts of the world through its subsidiaries. Fresh and Value-Added Products, Banana, and Other Products and Services are its three segments. It sells pineapples, fresh-cut fruit, fresh-cut vegetables, melons, and vegetables; non-tropical fruits like grapes, apples, citrus, blueberries, strawberries, pears, peaches, plums, nectarines, cherries, and kiwis; other fruit and vegetables, and avocados; and prepared fruit and vegetables, juices, and other beverages, as well as meals and snacks. The company also sells poultry and meat products, as well as provides third-party freight services. It also makes and sells plastic and cardboard items including bins, trays, bags, and boxes.

According to CEO magazine, when Abu-Ghazaleh took over Fresh Del Monte in 1996, the firm had limited product lines and was heavily in debt. He has, however, led a comeback at the firm, which manufactures, markets, and distributes fresh and fresh-cut fruit and vegetables, prepared fruit and vegetables, drinks, and snacks all over the world. Abu-Ghazaleh studied business administration at the American University in Cairo and was president and CEO of United Trading from 1986 until he purchased Fresh Del Monte. His father was a fruit importer in the Middle East in the 1950s. In 1997, he went public with the firm.

Opinion: Another thinly traded stock with limited liquidity.

Name: Caldwell Lisa J

Position: Director

Transaction Date: 2022-05-27 Shares Bought: 9,920 Average Price Paid: $23.63 Cost: $234,410.00

Company: Old Republic International Corp (ORI)

Old Republic International Corporation operates in the insurance underwriting and associated services sector principally in the United States and Canada through its subsidiaries. General Insurance, Title Insurance, and the Republic Financial Indemnity Group Run-off Business are the company’s three segments. Automobile extended warranty, aviation, commercial automobile, commercial multi-peril, commercial property, general liability, home warranty, inland marine, travel accident, and workers’ compensation insurance products are available through the General Insurance segment, as well as financial indemnity products for specialty coverages such as errors and omissions, fidelity, guaranteed asset protection, and surety. The Title Insurance sector provides real estate buyers and investors with lender and owner title insurance coverage based on public records searches.

RAI Services Co.’s Director, Chief Human Resources Officer, and EVP are Lisa Jeffries Caldwell. She is also a member of Delta Sigma Theta Sorority, Inc., The Links, Inc., and The Moles, Inc., and serves on the boards of Old Republic International Corp., Winston-Salem State University, and Triad Business Bank. She previously worked as an attorney at Womble Bond Dickinson (US) LLP, as Executive Vice President-Human Resources at R.J. Reynolds Tobacco Holdings, Inc., as Chief Human Resources Officer and EVP at Reynolds American, Inc., as Chief Human Resources Officer and Executive VP of R.J. Reynolds Tobacco Co., and as Chairman at Winston-Salem Chamber of Commerce. Lisa Jeffries Caldwell graduated from the University of North Carolina at Chapel Hill with a bachelor’s degree and the Wake Forest University School of Law with a master’s degree.

Opinion: Price to book of 1.04 and price to free cash flow of 12.51 makes ORI a reasonable acquisition candidate but there is not enough insider buying to make that a viable thesis.

Name: Gibbs David W

Position: Director

Transaction Date: 2022-05-31 Shares Bought: 50,000 Average Price Paid: $9.50 Cost: $474,818.00

Company: Under Armour Inc. (UA)

Under Armour, Inc., together with its subsidiaries, engages in the development, marketing, and distribution of performance apparel, footwear, and accessories for men, women, and youth. The company offers its apparel in compression, fitted, and loose fit types. It also provides footwear products for running, training, basketball, cleated sports, recovery, and outdoor applications. In addition, the company offers accessories, which include gloves, bags, headwear, and sports masks; and digital subscription and advertising services under the MapMyRun and MapMyRide platforms. It primarily offers its products under the UNDER ARMOUR, UA, HEATGEAR, COLD GEAR, HOVR, PROTECT THIS HOUSE, I WILL, UA Logo, ARMOUR FLEECE, and ARMOUR BRA brands. We sell our products through wholesale channels including national and regional sporting goods chains, independent and specialty retailers, department store chains, Under Armor mono-brand retailers, institutional athletic departments and leagues and teams, and independent distributors. increase. Deliver directly to consumers through a network of 422 brands and factory stores and e-commerce websites.

Under Armour, Inc. (NYSE: UA, UAA) today announced in September 2021 that David Gibbs had been appointed to its Board of Directors effective Sept. 1, 2021. As Chief Executive Officer (CEO) of Yum! Brands, Inc. (NYSE: YUM), Gibbs, 58, leads the company’s overarching strategies, structure, people development, and culture to drive global growth and sales and profitability for more than 51,000 KFC, Pizza Hut, Taco Bell and The Habit Burger Grill restaurants in over 150 countries and territories, with approximately 2,000 franchisees and 1.5 million franchise system employees globally.

Opinion: Turmoil in the C-suite of Under Amour after years of balls to walls unstainable growth by its hard charging founder, Kevin Plank. Under Armour CEO Patrik Frisk to step down, Colin Browne named interim CEO. May 25th. Under Armour announced that Patrik Frisk will step down as President and CEO and as a member of the Board of Directors, effective June 1. The board has initiated a comprehensive internal and external search process to identify a permanent President and CEO. Until a successor is named, the board has appointed Colin Browne, the company’s COO, as interim President and CEO, effective June 1. To support the transition, Frisk will remain with Under Armour as an advisor through September 1. Since joining the company in 2016, Browne modernized Under Armour’s digital go-to-market strategy and direct-to-consumer model and transformed its supply chain organization, leading to significant margin improvement and operating efficiency.

With many well run retailers trading at deeply discounted P.E.s like Crox, BBY, and DKS, you don’t need to look hard for value. Why bother with UA? I don’t see it.

Name: Treadway Charles L.

Position: CEO

Transaction Date: 2022-06-02 Shares Bought: 59,927 Average Price Paid: $8.34 Cost: $499,941.00

Company: CommScope Holding Company Inc. (COMM)

CommScope Inc. is an American global network infrastructure provider company based in Hickory, North Carolina. CommScope employs over 30,000 employees worldwide. With customers in over 130 countries. The company joined the NASDAQ stock exchange on October 25, 2013. CommScope designs and manufactures a variety of network infrastructure products. It has four business segments: Home Networks, Broadband Networks, Venue, Campus Networks, and Outdoor Wireless Networks. At CommScope, they push the boundaries of communications technology to create the world’s most advanced networks. They design, manufacture, install and support the hardware infrastructure and software intelligence that enables their digital society to interact and thrive. Working with customers, they advance broadband, enterprise, and wireless networks to power progress and create lasting connections. Across the globe, their people and solutions are redefining connectivity, solving today’s challenges, and driving the innovation that will meet the needs of what’s next.

Charles L. Treadway is a successful businessman who has led six separate businesses. Mr. Treadway is President, Chief Executive Officer, and Director of CommScope Holding Co., Inc. and President, Chief Executive Officer, and Director of CommScope, Inc. at the moment. He was previously President and Chief Executive Officer of Custom Sensors & Technologies, Inc., Chief Executive Officer of Accudyne Industries LLC, President and Chief Executive Officer of ABB Installation Products, Inc., President and Chief Executive Officer of Prettl International, Inc., and Region Division Manager-Low Voltage Products at ABB, Inc.

Opinion: I’ve blogged about COMM before and I don’t think my logic has changed. I just don’t see how the mountain of debt goes away.

Name: Mcpeak Merrill A

Position: Director

Transaction Date: 2022-05-31 Shares Bought: 20,000 Average Price Paid: $6.82 Cost: $136,400.00

Company: Iovance Biotherapeutics Inc (IOVA)

Name: Weiser Michae

Position: Director

Transaction Date: 2022-05-31 Shares Bought: 10,000 Average Price Paid: $6.80 Cost: $67,978.00

Company: Iovance Biotherapeutics Inc (IOVA)

Name: Maynard Ryan D

Position: Director

Transaction Date: 2022-05-31 Shares Bought: 7,500 Average Price Paid: $6.75 Cost: $50,588.00

Company: Iovance Biotherapeutics Inc (IOVA)

Name: Rothbaum Wayne P

Position: Director

Transaction Date: 2022-05-31 Shares Bought: 1,000,000 Average Price Paid: $6.60 Cost: $6,600,050.00

Company: Iovance Biotherapeutics Inc (IOVA)

Iovance Biotherapeutics, Inc. is a clinical-stage biotechnology business that focuses on developing and commercialising cancer immunotherapy medicines that employ a patient’s immune system to kill cancer cells.It is currently enrolling patients in six phase 2 clinical trials, including C-144-01, which is testing its lead product candidate, lifileucel, for metastatic melanoma; C-145-04, which is testing its product candidate lifileucel for recurrent, metastatic, or persistent cervical cancer; and C-145-03, which is testing its product candidate LN-145 for recurrent and/or metastatic head and neck squamous cell carcinoma. H. Lee Moffitt Cancer Center, M.D. Anderson Cancer Center, Ohio State University, Centre hospitalier de l’Université de Montreal, Cellectis S.A., and Novartis Pharma AG are all partners and licensees of Iovance Biotherapeutics, Inc. Lion Biotechnologies, Inc. was the company’s previous name until June 2017, when it was renamed Iovance Biotherapeutics, Inc. Iovance Biotherapeutics, Inc. is based in San Carlos, California, and was founded in 2007.

General (Ret.) McPeak has substantial leadership experience as a member of public and private firm boards of directors, as well as in the military. He became a member of the Iovance Board of Directors in July 2011 and served as the company’s interim Chief Executive Officer from January to July 2013. McPeak and Associates, a consultancy firm he formed in 1995, is currently led by General McPeak. General McPeak previously served on the boards of directors of Tektronix, Inc., Trans World Airlines, Inc., and ECC International Corp., where he was chairman of the board for many years. Research Solutions, Inc., Aerojet Rocketdyne, Lilis Energy, Valence Surface Technologies, and Navex Global all have General McPeak on their board of directors.

Dr. Weiser founded Actin Biomed LLC, a healthcare investment organisation focusing on the discovery and development of innovative medicines for unmet medical needs, and is currently its co-CEO. Dr. Weiser was the Director of Research at Paramount BioCapital, pharmaceutical development, and healthcare investment organization, prior to joining Actin Biomed. Dr. Weiser is currently on the board of directors of Ziopharm Oncology, Inc., a publicly traded biopharmaceutical business focused on oncology immunotherapies, as well as Emisphere Technologies, Inc., a pharmaceutical and drug delivery firm. Dr. Weiser previously sat on the board of directors of Chelsea Therapeutics International, Ltd., a pharmaceutical development firm that was bought by H. Lundbeck A/S in 2014.

Mr. Maynard is the Chief Financial Officer of Paulus Holdings Ltd., d/b/a LetsGetChecked, at the moment. Mr. Maynard was the Chief Financial Officer of Blade Therapeutics, Inc., a privately held biotechnology firm, prior. Mr. Maynard has spent eleven years as the Chief Financial Officer of Rigel Pharmaceuticals, Inc., a publicly traded commercial-stage drug development firm. Prior to joining Rigel, Mr. Maynard worked for Personify, Inc., an e-commerce software firm, as Corporate Controller and Director of Finance and Accounting, and for General Magic, Inc. as Controller. Mr. Maynard has worked with Siliconix, Inc. in a variety of capacities, including Senior Finance Manager. Previously, Mr. Maynard worked for Ernst & Young LLP. Mr. Maynard graduated from Santa Clara University with a B.S. in Commerce – Accounting.

Mr. Rothbaum is the President of Quogue Capital LLC, a biosciences investment fund that he established in 2001. Mr. Rothbaum co-founded and was the main investor in Acerta Pharma, B.V., a Dutch biotech focused on developing selective, covalent small molecules to treat cancer and inflammation, beginning in 2012.AstraZeneca purchased Acerta Pharma in February 2016. Mr. Rothbaum was the executive chairman of Acerta Pharma from February 2013 until its sale in February 2016. Mr. Rothbaum oversaw the biotechnology practice at the strategic consulting firm The Carson Group from 1993 until 2001. Mr. Rothbaum earned a Phi Beta Kappa degree in political science and psychology from Binghamton University in 1990, and a Master’s degree in international economics from The George Washington University.

Opinion: Several analysts lowered their values but defended Iovance on less than stellar results of an interim trial cohort. Dir Rothbaum knows what he’s doing but lot of this money could be OPM, other people’s money. I don’t see the real employees buying much at all.

Name: Ely James S. III

Position: Director

Transaction Date: 2022-05-31 Shares Bought: 50,000 Average Price Paid: $5.08 Cost: $253,810.00

Company: Community Health Systems Inc (CYH)

The largest publicly owned hospital operator in the United States is Community Health Systems Inc. Over 83 hospitals in nonurban and urban sectors are owned or leased by the firm. In addition to owning four home health firms, the company also provides administrative and consulting services to independent hospitals. The company makes money by providing a wide range of general and specialty inpatient and outpatient healthcare services.

Since May 2009, James S. Ely III has served on the Board of Directors. Mr. Ely launched PriCap Advisors, LLC, an investment management firm, in 2009 and has served as its CEO since then. He was a Managing Director in JPMorgan Chase & Co.’s Leveraged Finance Group from 1995 to 2008, where he was in charge of structuring and arranging syndicated loans and high yield issues in the healthcare, aerospace, defense, and other industries. Mr. Ely began his career with JPMorgan’s predecessor institutions in 1987. He is a member of the board of directors of Select Medical Corporation, a long-term hospitalization services provider, where he chairs the audit and compliance and nominating and corporate governance committees.

Opinion: This smells like opportunity. Ely knows how to trade this stock. The last time he bought 100,000 shares on 9-5-20 for $3.20 he sold 20,000 of them for $35.02!

Name: Martin William C

Position: Chief Strategy Officer

Transaction Date: 2022-05-27 Shares Bought: 60,000 Average Price Paid: $5.70 Cost: $341,955.00

Company: Immersion Corp (IMMR)

Immersion Corporation, together with its subsidiaries, develops, scales, and licenses haptic technologies that enable people in North America, Europe, and Asia to interact with and experience diverse digital goods using their sense of touch. Technology, patent, and mixed licensing are all available through the firm. It also offers software development kits (SDKs) that include tools, integration software, and effect libraries for designing, encoding, and playing back tactile effects in the video. In addition, the firm provides reference designs and reference technologies, as well as engineering and integration services, as well as software and firmware services.

Indie Research LLC, Princeton Equity Group, LLC, and Raging Bull, Inc. are among the five firms he founded. William Charles Martin is the Chairman and Chief Investment Officer of Raging Capital Management LLC (which he formed in 2006) and the Director and Chief Strategy Officer of Immersion Corp., both of which he founded. Mr. Martin’s past positions include Chairman of the Jumpstart New Jersey Angel Network LLC, Principal of Indie Research LLC (which he started in 2010), and Partner of Princeton Equity Group, LLC (he founded the company in 2013).

Opinion: Patent troll. No thanks

Name: Styslinger William C III

Position: Director

Transaction Date: 2022-05-19 Shares Bought: 128,923 Average Price Paid: $4.14 Cost: $533,301.00

Company: Casa Systems Inc (CASA)

Casa Systems, Inc., a communications technology business, offers next-generation physical, virtualized, and cloud-native designs for cable, fixed-line broadband, and wireless networks throughout North America, Latin America, Asia-Pacific, Europe, and the Middle East, and Africa. It sells converged cable access platforms, as well as wireless network core products like virtual evolved packet and 5G core products, small cell solutions, the axyom element management system, and fixed wireless access devices, as well as virtual, centralized, and distributed deployment and bandwidth capacity expansion systems. Optical access solutions, virtualized broadband network gateway router and multiservice router, fiber extension, and residential broadband gateways, as well as machine-to-machine and industrial internet of things routers, are all available from the firm. The business was founded in 2003 and is based in Andover, Massachusetts.

Since 2012, Bill Styslinger has been on our board of directors. From its start in July 1993 until his departure in November 2011, Mr. Styslinger served as chairman, president, and chief executive officer of SeaChange International, a provider of multi-screen video software and services. Mr. Styslinger has also been on the board of directors of Omtool, a company that provides enterprise client/server facsimile software. Mr. Styslinger graduated from the State University of New York at Buffalo with a B.S. in Engineering Science.

Opinion:

Name: Merris John

Position: CEO

Transaction Date: 2022-05-27 Shares Bought: 90,000 Average Price Paid: $4.89 Cost: $439,800.00

Company: Solo Brands Inc (DTC)

Solo Brands, Inc. offers a DirectToConsumer (DTC) platform. We own and operate a full-fledged lifestyle brand that offers products, markets, and delivery through our platform. The company operates four outdoor lifestyle brands, including Solo Stove, Oru Kayak (Oru), ISLE Paddle Boards (ISLE), and Chubbies apparel. Our brand develops products and sells them directly to customers, primarily through e-commerce channels. The company’s product categories include stoves, fire pits, cooking, leisure, storage, lifestyle, consumables, and accessories. The company offers products such as Lite, Titan, and Campfire under the stove. Firepit’s product range includes rangers, bonfires, and eucons. Cookware includes grills and stoves. Lifestyle apparel products include swim trunks, casual shorts, sports, polo shirts + shirts, and lounges. We also provide consumables such as charcoal and firewood, and under accessories, we provide shields, roasting rods, tools, paddles, and pumps.

Mr. Melis has been President and Chief Executive Officer since October 2018 and has been a member of the Board of Directors since March 2021. Prior to joining the company, she was Chief Revenue Officer and Director of Clarus Glassboards LLC, a glass writing maker from October 2015 to October 2018, and from August 2012 to Multiview, an inter-company media company. I was the Vice President. Until October 2015. Melis is also a board member of Fostering Hearts, a non-profit corporation. In 2020, Melis was recognized as the regional winner of the EY Entrepreneur of the Year. Melis holds a degree in Political Science and Business Administration from B.A. Brigham Young University and an MBA. She is from the University of Texas at Austin.

Opinion: Forget it.

Name: Williams Gregg

Position: Director, 10% Owner

Transaction Date: 2022-05-31 Shares Bought: 312,493 Average Price Paid: $2.30 Cost: $719,451.00

Company: Second Sight Medical Products Inc (EYES)

Second Sight Medical Products, Inc. creates, manufactures, and distributes implantable visual prosthesis that provides blind people with artificial eyesight. It creates technologies to help those who are blind or partially sighted. The Orion Visual Cortex Prosthesis System is an implanted cortical stimulation device designed to provide useful artificial vision to those who are blind owing to glaucoma, diabetic retinopathy, optic nerve injury or disease, and eye injury, among other things. The company is based in Sylmar, California, and was created in 1998.

Gregg G. Williams has been on the Board of Directors of Second Sight Medical Products since June 2009 and was elected Chairman of the Board in March of 2018. Mr. Williams is the majority shareholder in SSMP. Williams International Co., LLC is currently led by Mr. Williams, who serves as Chairman, President, and Chief Executive Officer (www.williams-int.com). Mr. Williams held numerous significant management positions within the organisation prior to his present appointment, including President & Chief Operating Officer, Vice President, Advanced Technology, Director, Program Management, and Director, Engineering.

He owns multiple patents pertaining to gas turbine engines, turbo machinery, and control systems, as well as a Bachelor of Science degree in mechanical engineering from the University of Utah. Mr. Williams is also a board member of the General Aviation Manufacturers Association and a former member of the Young Presidents Organization and the board of trustees of Henry Ford Health System. He is a multiengine, instrument, and seaplane pilot in active service. Mr. Williams’ executive and managerial expertise, as well as his leadership skills, have convinced our board that he is well equipped to serve as one of our directors.

Opinion: They will have to raise money. Just hope we don’t own it when they do.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

[custom-twitter-feeds]

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data so I like people that eat what they kill.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

qThe bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.q

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong about, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have and we curse aloud, what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019