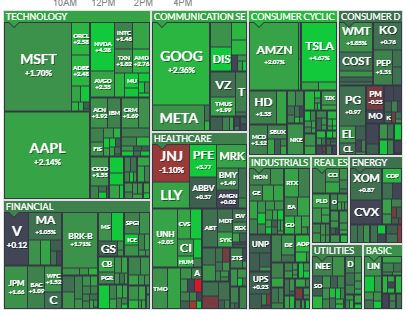

The S&P 500 has been on a tear. It tacked on another 3% on top of last week’s, 4% gain. There was almost nothing that went down. Last Friday it was hard to find something that was not green on your screen. Check out Finviz’s Map of the Market below. It was a full-on stampede to buy stocks. Apple is approaching its all-time high. The money on the sidelines is pouring in.

Slightly better CPI prints were the trigger, but inflation is not so easily tamed. For starters, don’t expect much help from lower energy prices. I just attended Denver EnerCom and heard from a lot of energy producers. Capital is still restrained, while most companies are more interested in financial discipline, returning money to shareholders, and paying off debt than CapEx. Even if they wanted to ramp up drilling, vital supplies, like fracking sand, are in short supply. Oil has retreated some, but natural gas is within spitting distance of decades high price. Dramatic increases in utility bills are on the way but this may take a year or even two to filter down from the public utility commissions that have to approve them. It isn’t easy taming the dislocations from the Pandemic. Supply chain disruptions will gradually ease but going green and made in America will be expensive. No mistake about it.

Enjoy the ride while on it, but the next Fed meeting in September will give investors plenty to worry about. You can be certain that Powell will not want to be enshrined as the Fed Chairman that let the inflation genie out of the bottle. A ripping stock market will not help him navigate a soft landing.

This week, the only opinions I’m sharing are the ones I’m buying or seriously considering. I just don’t have the time to comment on all the insider buying as the company-imposed blackout periods recede.

Name: Gray Brian Gerald John

Position: Director

Transaction Date: 2022-08-10 Shares Bought: 7,500 Average Price Paid: $130.62 Cost: $979,650.00

Company: RenaissanceRe Holdings Ltd (RNR)

RenaissanceRe Holdings Ltd. offers reinsurance, insurance, and associated services to a variety of customers. Property, casualty, and specialty reinsurance, as well as some insurance products, are among the products offered by the company. It operates in two divisions: Property, Casualty, and Specialty. Property reinsurance and insurance are written on behalf of its operating subsidiaries, joint ventures, and managed funds from the Property business. Casualty and Specialty reinsurance and insurance are written on behalf of its operating subsidiaries, joint ventures, and managed funds from the Casualty and Specialty segment. It writes catastrophe reinsurance and insurance coverage to protect against natural disasters such as earthquakes, hurricanes, typhoons, and tsunamis, as well as claims resulting from other natural and man-made disasters such as winter storms and terrorist attacks, among others.

RenaissanceRe Holdings Ltd’s Independent Director is Brian G. J. Gray. Mr. Gray served as Group Chief Underwriting Officer of Swiss Reinsurance Company Ltd. (“Swiss Re”) from 2008 until his retirement in 2012. He was also a member of Swiss Re’s Group Executive Committee. From 2005 until 2008, he was a member of Swiss Re’s Group Executive Board, where he was in charge of underwriting Property and Specialty Product Lines on a worldwide scale. Mr. Gray joined Swiss Re in Canada (“Swiss Re Canada”) in 1985 and has held a number of positions, including President and Chief Executive Officer from 2001 to 2005 and Senior Vice President from 1997 to 2001.

Opinion: A large buy like this draws my attention. Add to it that insiders were buying RNR since last October at the $144 range. The Company blew out 2nd quarter’s earnings yet there was little evidence of that in the stock action.

Name: Brown Jeffrey J

Position: Director

Transaction Date: 2022-08-09 Shares Bought: 3,940 Average Price Paid: $126.54 Cost: $498,549.00

Company: MEDIFAST INC (MED)

Medifast, Inc. distributes a range of weight reduction, weight management, and healthy living products under the OPTAVIA, Optimal Health by Taking Shape for Life, and Flavors of Home brands, all of which are based on its proprietary formulae. The Company’s product selection includes, but is not limited to, bars, bits, pretzels, puffs, cereal crunch, beverages, hearty alternatives, oatmeal, pancakes, pudding, soft serve, shakes, smoothies, soft bakes, and soups. Ingredients are used in the formulation of the Company’s nutritious goods. The Food and Drug Administration (FDA), the Federal Trade Commission (FTC), the Consumer Product Safety Commission, the United States Department of Agriculture, and the United States Environmental Protection Agency all regulate the processing, formulation, packaging, labeling, and advertising of the Company’s products.

Mr. Jeffrey J. Brown is a Medifast, Inc. Lead Independent Director, Brown Equity Partners LLC Chief Executive Officer, Forrest Binkley & Brown Co-Founder & Partner, and Golden State Vintners, Inc. Chairman. He serves on the boards of Rent-A-Center, Medifast, Fieldstone Utah Investors LLC, M Financial Holdings, Inc., and Tail Activewear, Inc. Mr. Brown has previously served as an Independent Director for Outerwall, Inc., RCS Capital Corp., Nordion, Inc., a Non-Executive Director for Midatech Pharma Plc, and an Independent Director for Steadfast Income REIT, Inc. He was also a director at Engaged Capital LLC and GlasPro, Inc.

Opinion:

Name: Buffett Warren E

Position: 10% Owner

Transaction Date: 2022-08-04 Shares Bought: 6,681,669 Average Price Paid: $58.48 Cost: $390,719,454.00

Company: Occidental Petroleum Corp (OXY)

Occidental Petroleum Corporation is an energy company. The Company conducts oil and gas exploration and production activities in the United States, the Middle East, and Africa. Within the United States, it has operations in Texas, New Mexico, and Colorado, as well as offshore operations in the Gulf of Mexico. The Company’s business segments include Oil and Gas, chemicals, Midstream, and Marketing. The Oil and Gas segment explores, develops, and produces oil and condensate, natural gas liquids (NGL), and natural gas. The Chemical segment manufactures and markets basic chemicals and vinyls. The Midstream and Marketing segment purchases, markets, gathers, processes, transports, and stores oil, condensate, NGL, natural gas, carbon dioxide (CO2), and power. It also trades around its assets, including transportation and storage capacity, and invests in entities that conduct similar activities. The Midstream and Marketing segment purchases, markets, gathers, processes, transports, and stores oil, condensate, NGL, natural gas, carbon dioxide (CO2), and power. It also trades around its assets, including transportation and storage capacity, and invests in entities that conduct similar activities.

Warren Buffett, the full name Warren Edward Buffett, is an American businessman and philanthropist who was born on August 30, 1930, in Omaha, Nebraska, United States. He is widely regarded as the most successful investor of the twentieth and early twenty-first centuries, having defied prevailing investment trends to amass a personal fortune of more than $100 billion. Buffett, also known as the “Oracle of Omaha,” was the son of Nebraska Congressman Howard Homan Buffett. He studied with Benjamin Graham at the Columbia University School of Business after graduating from the University of Nebraska with a B.S. in 1950. (M.S., 1951). Buffett returned to Omaha in 1956 and, in 1965, acquired a majority stake in textile maker Berkshire Hathaway Inc., which he used as his primary investment vehicle.

Opinion: I think Buffett buys the whole company, but why bother when he can pick it off in the open market? There’s probably a Buffett premium already in the stock, but it’s hard to ascertain what a tender for the whole company would bring. Are they buyers besides Buffett that would bid for the whole show?

Name: Morrison Scott C

Position: CFO

Transaction Date: 2022-08-08 Shares Bought: 17,500 Average Price Paid: $57.59 Cost: $1,007,762.00

Company: BALL Corp. (BLL)

Name: Baker Charles E

Position: VP

Transaction Date: 2022-08-08 Shares Bought: 10,000 Average Price Paid: $57.46 Cost: $574,627.00

Company: BALL Corp. (BLL)

Ball Corporation is an American company headquartered in Broomfield, Colorado. It is best known for its early production of glass jars, lids, and related products used for home canning. Since its founding in Buffalo, New York, in 1880, when it was known as the Wooden Jacket Can Company, the Ball company has expanded and diversified into other business ventures, including aerospace technology. It eventually became the world’s largest manufacturer of recyclable metal beverage and food containers. The Ball brothers renamed their business the Ball Brothers Glass Manufacturing Company, incorporated in 1886. Its headquarters, as well as its glass and metal manufacturing operations, were relocated to Muncie, Indiana, by 1889. The business was renamed the Ball Brothers Company in 1922 and the Ball Corporation in 1969. It became a publicly traded stock company on the New York Stock Exchange in 1973. Ball left the home canning business in 1993 by spinning off a former subsidiary (Alltrista) into a free-standing company, which renamed itself Jarden Corporation.

Scott Ball Corporation’s Chief Financial Officer and Senior Vice President is Charles Morrison. Mr. Morrison also serves on the boards of Sensient Technologies Corp., Rexam Ltd., the National Association of Manufacturers, the Jefferson Economic Council, the Denver Chapter of the Kelley School of Business, and the Treasury Management Association. Mr. Morrison formerly held the positions of Managing Director-Corporate Banking at Bank One, First Vice President-Corporate Banking at First Chicago Bancorp, Vice President at NBD Bank NA, and Chairman of the National Association of Corporate Treasurers. Mr. Morrison holds an MBA from Wayne State University in Michigan and a bachelor’s degree from Indiana University.

Mr. Charles E. Baker has served as Ball Corporation’s Vice President and General Counsel since 2004 and April 2004, respectively, and as its Company Secretary since July 27, 2011. From April 2004 through July 2011, Mr. Baker worked as an Assistant Secretary at Ball Corporation. From 1999 to April 2004, he was Ball Corporation’s Associate General Counsel. He was Senior Director of Business Development at Ball Corporation from 1995 to 1999, Director of Corporate Compliance from 1994 to 1997, and Director of Business Development from 1993 to 1995. After ten years at the Toronto legal firm Fraser & Beatty, he joined Ball Corporation in 1993. Mr. Baker was a Partner with Fraser & Beatty from 1988 to 1993 and an Associate from 1983 to 1988. He has been the General Counsel and Vice President of QinetiQ Consulting Pty Ltd. since April 2004 and April 27, 2005, respectively. From April 2004 until 2011, he was the Assistant Secretary of QinetiQ Consulting Pty Ltd., and he is now the Executive Director.

Opinion: At a minimum, splitting the giant aluminum can business off from the high-tech space and aeronautics business would make IR’s life easier telling the investment story. Management has been buying this stock all year despite the lackluster business performance. This smells like an LBO with private equity or activist investors accumulating shares. I’d bet money on it. Insiders want to get far ahead either to avoid the appearance of trading on inside information.

Name: Cohler Matt

Position: Director

Transaction Date: 2022-08-08 Shares Bought: 18,710 Average Price Paid: $52.99 Cost: $991,485.00

Company: KKR & Co. Inc. (KKR)

Kohlberg Kravis Roberts is a global investment business that manages a variety of alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and hedge funds, which it manages through strategic partners. Through a diligent and disciplined investment approach, employing world-class people, and driving growth and value creation with KKR portfolio companies, the company creates strong investment returns for its fund investors. Through its capital markets operation, the corporation invests its own money alongside the money it manages for fund investors and provides financing and investment options.

Matt Cohler is a former General Partner at Benchmark Ventures, where he oversaw early-stage investments in Internet and software startups for over a decade. He is currently a director and member of the Asana nominating and governance committee, a director and member of the 1stdibs audit committee, and a director of many privately owned firms. He previously worked at Domo as a director, member of the audit committee, and member of the nominating and governance committee, as well as at Uber as a director and member of the audit committee, and as a director at privately owned firms such as Duo Security, Instagram, and Tinder. Matt was formerly Vice President at Facebook, where he was the company’s seventh employee, and Vice President at LinkedIn, where he was part of the company’s founding team.

Opinion: When you read Cohler’s bio, consider he’s buying KKR and not the tech boards he sits on like Asana, Quora, ResearchGate, and 1stdibs. Sometimes I get on my soap box and rail against private equity but the real destroyer of investor wealth lately are the VCs and investment banks that have hyped such insane valuations for unprofitable tech stocks.

Name: Lance Howard L

Position: Director

Transaction Date: 2022-08-05 Shares Bought: 5,000 Average Price Paid: $50.59 Cost: $252,963.00

Company: Mercury Systems Inc. (MRCY)

A technological business called Mercury Systems, Inc. manufactures and sells parts, items, modules, and subsystems to the aerospace and military sectors in the Americas, Europe, and Asia-Pacific. About 300 programs with 25 clients in commercial aviation and the military industry are using the company’s goods and solutions. It provides parts such as switches, oscillators, filters, equalizers, digital and analog converters, chips, monolithic microwave integrated circuits, memory, and storage units; modules and sub-assemblies such as embedded processing modules and boards, switch fabric boards, digital receiver boards, multi-chip modules, integrated radio frequency and microwave multi-function assemblies, tuners, and transceivers; and graphics. In addition, the business creates and designs digital radio frequency memory units for a range of contemporary electronic warfare applications, radar environment simulation, and test systems for defense and intelligence using signals intelligence payloads and EO/IR technologies for small UAV platforms, as well as onboard UAV processor systems for real-time wide-area motion imagery.

Between 2016 and 2019, Mr. Lance served as the president and chief executive officer of Maxar Technologies, a renowned supplier of space technology solutions, including satellites, robots, geospatial images, and services. From 2012 until 2016, he served as the Blackstone Group’s executive advisor for private equity. From 2003 through 2012, he held these positions at Harris Corporation (now L3Harris), a top provider of communications and IT hardware, software, systems, and services to the public sector, the military, and private industry. From 2001 to 2002, he served as NCR Corporation’s Co-President and Chief Operating Officer of the Retail and Financial Group. He previously worked for Emerson Electric Company for 17 years, holding positions such as Executive Vice President of the Electronics and Telecom businesses, Group President of the Climate Technologies businesses, and Chief Executive Officer of Astec PLC, a Hong Kong-based subsidiary that is listed on the London Stock Exchange.

Opinion: On July 26th, short seller Glasshouse issued a report claiming that there was something fishy about the company’s accounting. I want to own more defense stocks. This one is on my radar. I’d like to see more insiders stepping up.

Name: Parker Stuart B.

Position: Director

Transaction Date: 2022-08-04 Shares Bought: 5,000 Average Price Paid: $42.55 Cost: $212,750.00

Company: Kemper Corp. (KMPR)

Property and casualty, life, and health insurance are all offered in the United States by Kemper Corporation, a diversified insurance holding firm. Specialty Property & Casualty Insurance, Preferred Property & Casualty Insurance, and Life & Health Insurance make up the company’s three business segments. In addition to offering commercial vehicle insurance to businesses, it also offers auto, homes, renters, fire, umbrella, general liability, and numerous other property and casualty insurance to people. The company also provides supplemental accident and health insurance products, Medicare supplement insurance, fixed hospital indemnity, home health care, specified disease, and accident-only plans to people in rural, suburban, and urban areas. These products include permanent and term life insurance. It uses independent agents and brokers to distribute its goods.

From 2015 until his retirement in February 2020, Parker led USAA as its CEO. He worked with USAA for almost 21 years, holding positions such as chief operating officer, chief financial officer, president of the property and casualty insurance group, and president of financial planning services. He holds an MBA from St. Mary’s University and a bachelor’s degree in business administration from Valdosta State University. Parker, a renowned Air Force ROTC programme alumnus, spent over ten years in the U.S. Air Force, including in Operations Desert Shield and Desert Storm. Stuart is a useful addition to our board because of his expertise as the CEO of the insurance sector and his lengthy record of success as a leader, according to Board Chairman Robert J. Joyce. We anticipate the operational insight and viewpoint he will bring to Kemper. According to Joseph P. Lacher, Jr., President and CEO, “Stuart’s high level of competence and profound understanding of the insurance sector will be a significant benefit to our board.” Kemper’s growth plan will be greatly aided by his effectiveness in advancing strategy through transformative customer service, accelerated product development, and digital innovation.

Opinion:

Name: Ferguson Thomas E.

Position: CEO

Transaction Date: 2022-08-10 Shares Bought: 5,000 Average Price Paid: $42.49 Cost: $212,435.00

Company: AZZ INC. (AZZ)

The power generation, transmission, distribution, refining, and industrial industries in the US and abroad are served by AZZ Inc.’s galvanizing and metal coating solutions, welding solutions, specialty electrical equipment, and engineering services. The business is divided into the Infrastructure Solutions and Metal Coatings sectors. The Metal Coatings division provides steel fabrication and other industries with metal finishing solutions for corrosion protection, such as hot-dip galvanizing, spin galvanizing, powder coating, anodizing, and plating. It benefits original equipment manufacturers as well as fabricators or manufacturers that offer services to the electrical and telecommunications, bridge and highway, petrochemical, and general industrial industries. Products and services are offered by the Infrastructure Solutions category to serve electrical and industrial applications.

Thomas E. Ferguson is now the president, chief executive officer, and non-independent director of AZZ, Inc. and the CEO of Nuclear Logistics LLC. He serves on the Lionheart Children’s Academy board as well. Mr. Ferguson formerly held the positions of Senior Vice President at Flowserve Corp. and Chief Executive Officer of Flexsteel Pipeline Technologies, Inc.

Opinion:

Name: Ball George L.

Position: CFO

Transaction Date: 2022-08-05 Shares Bought: 70,000 Average Price Paid: $41.50 Cost: $2,905,000.00

Company: Parsons Corp. (PSN)

In North America, the Middle East, and other parts of the world, Parsons Corporation offers integrated solutions and services in the defense, intelligence, and critical infrastructure sectors. Critical Infrastructure and Federal Solutions make up its two operating segments. To the U.S. Department of Defense and the American intelligence community, the company provides cyber security and intelligence services, as well as offensive and defensive cybersecurity platforms, tools, and operations. It also provides space and geospatial solutions, including geospatial intelligence, threat analytics, space situational awareness, small satellite launch and integration, satellite ground systems, fight dynamics, and command and control solutions to the National Geospatial-Intelligence Agency.

It also offers the Defense Intelligence Agency and the U.S. Department of Defense missile defense and C5ISR solutions, including integrated air and missile defense, data fusion and analytics, platform system integration, directed energy, joint all-domain operations, and command and control systems; technology services for energy production systems, aviation, healthcare, and bio-surveillance systems, environmental systems and related infrastructure, as well as nuclear.

Ball started working at Parsons in 1995, and since then, he has held a number of financial and operational jobs until acquiring his present role in 2008. He is a member of the boards of directors for Cornerstone Building Brands, Inc., and Wells Fargo Real Estate Investment Corporation in addition to his duties at Parsons. As a member of the Advisory Board of the Ronald McDonald House Charities of Southern California and the Board of Trustees of the Los Angeles County Arboretum Foundation, he is also engaged in a number of Pasadena, California, community groups.

Opinion: Insiders buying at the top of a price range are unusual. My favorite insider to pay attention to is the CFO. This one is at the top of my list to follow up on.

Name: Barbas Paul M

Position: Director

Transaction Date: 2022-08-10 Shares Bought: 8,000 Average Price Paid: $24.90 Cost: $199,174.00

Company: Vistra Corp (VST)

Vistra Corp. acts as an integrated retail electricity and power generation corporation through its subsidiaries. Retail, Texas, East, West, Sunset, and Asset Closure are the company’s six segments. It provides residential, commercial, and industrial clients with electricity and natural gas in 20 states and the District of Columbia. Electricity generating, wholesale energy purchases and sales, commodities risk management, fuel production, and fuel logistics management are among the company’s other activities. With a portfolio of natural gas, nuclear, coal, solar, and battery energy storage plants, it serves over 4.3 million consumers with a generation capacity of around 38,700 megawatts. Vistra Energy Corp. was the previous name of the corporation, which was changed to Vistra Corp. in July 2020. Vistra Corp., situated in Irving, Texas, was formed in 1882.

Paul M. Barbas has been a member of the board since 2018. He is the chair of the nominating and governance committee. Barbas formerly served on the board of Dynegy Inc. and was appointed to the Board as part of the Company’s purchase of Dynegy. Barbas formerly served as president and CEO of DPL Inc. and its primary subsidiary, The Dayton Power and Light Company (DP&L), as well as on the boards of DPL Inc. and DP&L. He previously held the positions of executive vice president and chief operating officer of Chesapeake Utilities Corporation, a diversified utility company engaged in natural gas distribution, transmission, and marketing, propane gas distribution and wholesale marketing, and other related services, as well as executive vice president of Allegheny Power. Barbas was also a member of the boards of directors of Pepco Holdings, Inc. and El Paso Electric, Inc. Barbas also volunteers at Scorton Creek Game Farm, where she helps to maintain trails and conservation areas managed by the Massachusetts Division of Fisheries and Wildlife.

Opinion: Electricity is the energy driver of the future. Utilities are the growth engine of the new economy. Safety, growth, and yield- what’s not to like?

Name: Crawford Edward F

Position: Director

Transaction Date: 2022-08-05 Shares Bought: 50,000 Average Price Paid: $19.38 Cost: $969,116.00

Company: Park Ohio Holdings Corp. (PKOH)

In the US, Europe, Asia, Mexico, Canada, and other countries, Park-Ohio Holdings Corp. offers capital equipment, manufactured components, and supply chain management outsourcing services. Supply Technologies, Assembly Components, and Engineered Products make up its three operating segments. The Supply Technologies segment provides Total Supply Management solutions, which include engineering and design support, part usage and cost analysis, supplier selection, quality assurance, barcoding, product packaging and tracking, just-in-time and point-of-use delivery, and electronic billing, and ongoing technical support services. It also offers spare parts and aftermarket products, as well as production components like valves, fuel hose assemblies, and electro-mechanical hard. In addition, it designs and produces locknuts, SPAC nuts, SPAC bolts, and wheel hardware, among other goods, using precision cold-formed and cold-extruded fasteners.

Since 1992, Mr. Edward F. Crawford has served as the company’s chairman. From 1997 to 2003, he served as president. Since 1964, he has served as chairman and CEO of The Crawford Group, a venture capital and management firm for a collection of industrial firms. After serving the company for more than 18 years as a director and senior officer, Mr. Edward Crawford has accumulated a comprehensive understanding of the company’s strategy and operations. He also contributes to the Board his 40+ years of management expertise in a range of private businesses. Mr. Crawford is a member of Resilience Capital Partners LLC’s board of advisors.

Opinion: Supply chain management must be a hot button at all companies, particularly those looking to move manufacturing to friendlier shores. According to the CEO, “supply chain, inflation and labor challenges took a toll on our ability to perform as we expected, especially within our Assembly Components segment. Many operational and expense reduction initiatives completed in 2021 were offset by these costs, but we expect to see meaningful impact to our results in the first half of 2022 and anticipate near record revenue and solid profits during 2022 as a whole.

If you take a leap of faith and assume management will adjust to the inflationary cost pressures, this might be a great opportunity for investors to bet on this secular momentum.

Name: DeFranco James

Position: Director

Transaction Date: 2022-08-09 Shares Bought: 35,620 Average Price Paid: $18.66 Cost: $664,669.00

Company: DISH Network CORP (DISH)

DISH Network Corporation is a conglomerate. Its subsidiaries are involved in two major business segments: Pay-TV and Wireless. Its Wireless business section is divided into two divisions: Retail Wireless and 5G Network Deployment. The Pay-TV section provides pay-TV services under the DISH and SLING brands. The DISH branded pay-TV service includes DBS and FSS spectrum, owned and leased satellites, broadcast operations, customer service centers, a leased fiber optic network, and in-home service. Multichannel, live-linear streaming over-the-top (OTT) Internet-based domestic, foreign, and Latino video programming services are available under the SLING brand of pay-TV services. Under the Boost Mobile and Ting Mobile brands, the Cellular-Retail division provides countrywide prepaid and postpaid retail wireless services to subscribers. The Wireless-5G Network Deployment unit has made an investment in order to get specific wireless spectrum licenses.

James DeFranco is the Company’s Executive Vice President and Director. Mr. DeFranco is one of our Executive Vice Presidents and has served as a vice president and member of our Board of Directors since the company’s inception. James DeFranco is the Company’s Executive Vice President and Director. Mr. DeFranco is one of our Executive Vice Presidents and has served as a vice president and member of our Board of Directors since the company’s inception. He has held numerous executive officer and director positions with DISH Network and our companies over the last five years. Mr. DeFranco co-founded DISH Network with Charles W. Ergen and Cantey M. Ergen in 1980. The Board determined that Mr. DeFranco should remain on the Board owing to his experience of DISH Network from its inception, notably in sales and marketing.

Opinion: At some price Dish and it’s spectrum might be a good buy. I just don’t know what that is. If SpaceX wanted to operate as a traditional ISP at some point, this could be a good combination- but that might be far off. Amazon has been rumored to be interested in the spectrum Dish has for a 5G run. Google is already in the broadband business but it would be a tough sell for either of them with anti-trust issues.

Name: Robotti Robert

Position: Director

Transaction Date: 2022-08-10 Shares Bought: 560,224 Average Price Paid: $17.85 Cost: $9,999,998.00

Company: Tidewater Inc. (TDW)

Tidewater Inc. and its subsidiaries operate a global fleet of marine service boats that provide offshore marine support and transportation services to the offshore energy sector. It provides services in support of offshore oil and gas exploration, field development, and production, as well as wind farm development and maintenance, including towing and anchor handling for mobile offshore drilling units; transporting supplies and personnel required to sustain drilling, workover, and production activities; offshore construction, seismic, and subsea support; geotechnical survey support for wind farm construction; and various specialized services. Deepwater vessels, such as platform supply and horsepower anchor handling tug supply vessels for transporting supplies and equipment from shore bases to deepwater and intermediate water depth offshore drilling rigs and production platforms; towing-supply vessels for use in intermediate and shallow waters.

Robert Edward Robotti is the founder of Robotti & Co. Advisors LLC, Robotti & Co., Inc., and Robotti Securities LLC, as well as Chairman and Chief Executive Officer of Pulse Seismic, Inc., President of Robotti Securities LLC, and President & Chief Investment Officer of Robotti & Co. Advisors LLC (both are subsidiaries of Robotti & Co., Inc.). He is also a board member of AMREP Corp., Tidewater, Inc., PrairieSky Royalty Ltd., and the Catholic Medical Mission Board, Inc., as well as a General Partner of Ravenswood Investments III LP, Member of The New York Society of Security Analysts, Inc., General Partner of Ravenswood Investment Co. LP, Managing Director of Ravenswood Management Co. LLC, and Managing Member of Ravenswood Investment Co. LLC. He formerly worked with G.research LLC as Vice President, PaineWebber, Inc. as a Principal, and Robotti Global Fund LLC as a Portfolio Manager.

Opinion: I’m buying this stock Monday. Join me?

Name: Roush Lukas M.

Position: Director

Transaction Date: 2022-08-08 Shares Bought: 10,000 Average Price Paid: $16.25 Cost: $162,500.00

Company: Bandwidth Inc. (BAND)

Bandwidth Inc. operates in the United States as a cloud-based software-powered communications platform-as-a-service (CPaaS) provider. The firm is divided into two segments: CPaaS and Other. Its platform enables businesses to build, grow, and run voice and messaging communications services across a variety of mobile applications or linked devices. In addition, the firm offers SIP trunking, data reselling and hosted voice-over-Internet protocol services. It caters to major corporations, communications service providers, conferencing providers, contact centers, small and medium-sized organizations, developing technology startups, and a variety of other industries. Bandwidth Inc. was established in 2000 and is based in Raleigh, North Carolina.

Luke Roush co-founded Sovereign’s Capital in 2012 and served as the firm’s Managing Partner. From 2013 to 2016, he established the firm’s Asian operations in Kuala Lumpur and Jakarta. Luke is largely responsible for the firm’s investments in healthcare and consumer products. Luke has twelve years of expertise in worldwide commercialization and business development at venture-backed and Fortune 500 firms before joining Sovereign’s Capital. He formerly served as Vice President of Sales, Marketing, and Business Development at TransEnterix (NYSE:TRXC), a medical device firm that developed and marketed a minimally invasive surgical system in the United States, Europe, and Asia. Prior to joining TransEnterix, he was Chief Operating Officer of Liquidia Technologies (NASDAQ:LQDA), a biopharmaceutical nanotechnology firm. Luke formerly worked at Boston Scientific as the worldwide marketing manager for the neurovascular stroke division (NYSE:BSX). He also co-founded 410 Medical, a medical device firm specializing in fluid infusion in pediatric and adult emergency care.

Opinion: We own Bandwidth and have been adding to it on the way down.

Name: McGough Patrick

Position: VP

Transaction Date: 2022-08-08 Shares Bought: 28,800 Average Price Paid: $14.86 Cost: $427,968.00

Company: Comstock Resources Inc (CRK)

Comstock Resources, Inc. is an independent energy company that predominantly operates in North Louisiana and East Texas, where it acquires, explores, develops, and produces oil and natural gas. The business has proven reserves totaling 6.1 trillion cubic feet, or the equivalent of natural gas, as of December 31, 2021. Additionally, it holds stakes in 2,557 active oil and gas wells. The business was founded in 1919, and it has its headquarters in Frisco, Texas.

Following the acquisition of Covey Park, Patrick H. McGough was appointed as vice president of operations in July 2019. He joined Covey Park in August 2018 as the Vice President of Operations, where he was in charge of the operations and engineering for drilling, completion, and production. Patrick had major positions as a Drilling, Completion, and Production engineer with Brammer Engineering prior to working at Covey Park. Mr. McGough engaged in both unconventional and traditional plays at this time in a number of basins (Arkla-Tex, South Texas, West Texas, Mississippi, Oklahoma, and South Louisiana). He earned an MBA from Centenary College of Louisiana and a Bachelor of Science in Chemical Engineering from Louisiana Tech University.

Opinion:

I met with management of Comstock Resources at the recent Denver Enercom. Here was your consummate Texas good ‘ole boy. He was quick to share that he was on the phone with Jerry Jones every day, hours at at time sometimes. Jerry Jones is the owner of the Dallas Cowboys. He talked and looked like someone Jerry would pal around with. He said Jerry felt this was the best investment he ever made, even better than the Cowboys bet. Jerry Jones was just on CNBC touting his investment in Comstock.

If it’s so great, why aren’t you buying the stock ,I asked its team. He said he had bought a bunch of it. The following day it was announced that VP McGough had purchased 28,800 shares at $14.86. We bought some then. I went back and looked up the trading. Management was buying it in May of 2020 when you couldn’t give it away at $4.75 per share. Its more than tripled since then.

Name: Merchant Fazal F

Position: Director

Transaction Date: 2022-08-08 Shares Bought: 35,000 Average Price Paid: $14.13 Cost: $494,550.00

Company: Warner Bros. Discovery Inc. (WBD)

Name: Wiedenfels Gunnar

Position: CFO

Transaction Date: 2022-08-08 Shares Bought: 35,460 Average Price Paid: $14.09 Cost: $499,743.00

Company: Warner Bros. Discovery Inc. (WBD)

Warner Bros. Discovery, Inc., a media corporation, distributes content in about 50 languages globally through different distribution methods. It also produces, develops, and distributes feature films, television, gaming, and other content in physical and digital media via basic networks, direct-to-consumer or theatrical distribution, TV programming, and game licensing. The Discovery Channel, HGTV, Food Network, TLC, Animal Planet, Investigation Discovery, Travel Channel, Science, MotorTrend, Discovery en Espaol, Discovery Familia, Eurosport, TVN, Discovery Kids, Discovery Family, American Heroes Channel, Destination America, Discovery Life, Magnolia Network, Cooking Channel, ID, the Oprah Winfrey Network, Eurosport, DMAX, and Discovery Home & Health brands, among others, are owned and operated by the company. Survival, natural history, exploration, sports, general entertainment, home, cuisine, travel, heroes, adventure, crime and investigation, health, and children are among the genres covered.

Mr. Fazal F. Merchant now serves as an Independent Director at Warner Bros. Discovery, Inc., Meritor, Inc., and Ryman Hospitality Properties, Inc. He serves on the boards of Warner Bros. Discovery, Meritor, Ryman Hospitality Properties, Inc., and Tanium, Inc. Mr. Merchant previously worked for DreamWorks Animation SKG, Inc. as Chief Financial Officer, DIRECTV Latin America LLC as Chief Financial Officer, Treasurer, and Senior VP, The Royal Bank of Scotland Plc (Invt Mgmt) as Managing Director & Group Head, Barclays Capital, Inc. as Managing Director-Investment Banking Division, and Ford Motor Co. as Purchasing Controller. He earned his bachelor’s degree at The University of Texas in Austin and his MBA at Indiana University.

Dr. Gunnar Wiedenfels is the Chief Financial Officer of Warner Bros. Discovery, Inc. and an Independent Member-Supervisory Board of SAP SE. He serves on the boards of SAP SE, Motor Trend Group LLC, and OWN LLC. Dr. Wiedenfels formerly worked for Discovery, Inc. as Chief Financial Officer, ProSiebenSat.1 Media SE as Chief Financial Officer, and McKinsey & Co., Inc. as an Engagement Manager. He was also a member of the Scripps Networks Interactive, Inc. board of directors. RWTH Aachen University awarded him his Ph.D.

Opinion:

Name: Jacobsmeyer Barbara Ann

Position: CEO

Transaction Date: 2022-08-09 Shares Bought: 30,000 Average Price Paid: $13.78 Cost: $413,400.00

Company: Enhabit Inc. (EHAB)

In the United States, Enhabit, Inc. offers home health and hospice care. Its home health services include patient education, pain management, wound care and dressing changes, cardiac rehabilitation, infusion therapy, pharmaceutical administration, and skilled observation and assessment; practices to treat chronic diseases and conditions such as diabetes, hypertension, arthritis, Alzheimer’s disease, low vision, spinal stenosis, Parkinson’s disease, osteoporosis, complex wound care, and chronic pain, as well as disease-specific plans. To meet the individual physical, emotional, spiritual, and psychosocial needs of terminally ill patients and their families, the company also provides hospice services such as pain and symptom management, palliative and dietary counseling, social worker visits, spiritual counseling, and bereavement counseling.

Barbara A. Jacobsmeyer is now the President, Chief Executive Officer, and Director of Enhabit, Inc. Ms. Jacobsmeyer also serves as Encompass Health Corp.’s Chief Executive Officer-Home Health & Hospice. She formerly served as the Chief Executive Officer of The Rehabilitation Institute of St. Louis LLC and the Chief Operating Officer of Healthcare Network DPH, Inc. Ms. Jacobsmeyer has a bachelor’s degree from St. Louis University and a master’s degree from Webster University.

Opinion: The spin off of 100% of Enhabit (EHAB), its home health and hospice business. Enhabit is now an independent public company. Encompass Health will continue to trade on the New York Stock Exchange under the symbol “EHC” and, effective July 1, Enhabit will begin “regular-way” trading on the NYSE under the symbol “EHAB.”

Name: Warren Kelcy L

Position: Chairman

Transaction Date: 2022-08-08 Shares Bought: 1,158,908 Average Price Paid: $10.93 Cost: $12,666,864.00

Company: Energy Transfer LP. (ET)

Energy Transfer is a Texas-based company that began in 1995 as a small intrastate natural gas pipeline operator and is now one of the largest and most diversified investment grade master limited partnerships in the United States—growing from roughly 200 miles of natural gas pipelines in 2002 to more than 86,000 miles of natural gas, natural gas liquids (NGLs), refined products, and crude oil pipelines. Today, there are three publicly traded partnerships in the Energy Transfer Family. (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with a strategic footprint in all major domestic production basins.

Kelcy L. Warren is Executive Chairman of the Board of Directors of Energy Transfer LP, and has been a leader in the energy industry for nearly 40 years. Mr. Warren co-founded Energy Transfer in 1996, which began as a small intrastate natural gas pipeline operator and is now one of the largest and most diversified publicly traded energy companies in the industry. Today, the Energy Transfer family of partnerships includes Energy Transfer LP, Sunoco LP, and USA Compression Partners, LP.

Opinion: Buy. This is a core infrastructure play for natural gas transmission lines along with KMI and EPD.

Name: Ungerleider Howard I

Position: Director

Transaction Date: 2022-08-05 Shares Bought: 20,000 Average Price Paid: $10.59 Cost: $211,752.00

Company: Kyndryl Holdings Inc. (KD)

Kyndryl Holdings, Inc. is a global technology service firm and provider of IT infrastructure services. Cloud services, core enterprise and cloud services, application, data, and artificial intelligence services, digital workplace services, security and resiliency services, and network and edge services are all available from the organization. Financial, telecommunications, retail, car, and transportation businesses are also served. The firm was founded in the year 2020 and is based in New York, New York.

In accordance with the IBM Spin-Off, Mr. Ungerleider was named to the board. Since April 2019, Mr. Ungerleider has held the positions of President and Chief Financial Officer of Dow Inc. He started working at The Dow Chemical Company in 1990, and he has held a number of posts since then, including Chief Financial Officer from 2014 to 2015. After The Dow Chemical Company and E.I. du Pont de Nemours and Company merged in 2016, he was named Chief Financial Officer of DowDuPont.From 2017 to April 2019, when Dow Inc. split from DowDuPont, Mr. Ungerleider held this position. In addition to serving on the boards of directors of FCLTGlobal, the Michigan Israel Business Bridge, and Keep America Beautiful, Mr. Ungerleider is the chairman of the Dow Company Foundation. Mr. Ungerleider serves on the Executive Committees of the Michigan Climate Executive Advisory Group and Business Leaders for Michigan. He additionally held the position of director for Wolverine Bancorp, Inc. for the previous five years. Mr. Ungerleider earned his BBA from The University of Texas in Austin and his MBA from UCLA. Mr. Ungerleider is a competent member of our Board due to his experience in international business, leadership, and finance.

Opinion:

Name: Pittman Robert W

Position: CEO/Chairman

Transaction Date: 2022-08-10 Shares Bought: 54,112 Average Price Paid: $9.31 Cost: $503,739.00

Company: iHeartMedia Inc. (IHRT)

iHeartMedia, Inc. is a global media and entertainment corporation. It is organized into three divisions: Multiplatform Group, Digital Audio Group, and Audio & Media Services Group. The Multiplatform Group section operates Premiere Networks, a nationwide radio network that produces, distributes, or represents around 120 syndicated radio programs and services to roughly 6,400 radio station affiliates. It also provides real-time traffic and event information, as well as weather updates, sports, and news, via about 2,100 radio stations, 170 television affiliates, and Internet and mobile partnerships. This division owns 863 radio stations as of December 31, 2021, including 249 AM and 614 FM radio stations. Podcasting, digital sites, newsletters, digital services, and programs are offered by the Digital Audio Group sector, as is iHeartRadio, a mobile app and web-based service for radio stations, digital-only stations, bespoke artist stations, and podcasts.

Robert W. Pittman is a media inventor who has had a big influence in a variety of sectors and enterprises. He is a founding member of Pilot Group, LLC, a New York private investment firm. He co-founded the MTV network, was instrumental in bringing America Online into the mainstream consumer market, and revitalized stagnating businesses such as Six Flags Theme Parks and Century 21 Real Estate. He has previously held the positions of CEO of MTV Networks, AOL Networks, Six Flags Theme Parks, Quantum Media, Century 21 Real Estate, and Time Warner Enterprises. He was also the Chief Operating Officer of America Online, Inc. and AOL Time Warner. Pittman began his career as a radio broadcaster in his home Mississippi at the age of 15 and later programmed his own radio station in Pittsburgh, which became the market’s number one rock FM station. He enjoyed comparable success as the program director of NBC-owned AM and FM stations in Chicago and then as the program director of NBC Radio’s flagship station, WNBC in New York.

Opinion:

Name: Farner Jay

Position: CEO

Transaction Date: 2022-08-09 Shares Bought: 40,500 Average Price Paid: $9.87 Cost: $399,771.00

Company: Rocket Companies Inc. (RKT)

Rocket Companies, Inc. operates in the United States and Canada in the tech-driven real estate, mortgage, and e-Commerce industries. It works in two divisions: Direct to Consumer and Partner Network. Rocket Mortgage is a mortgage lender; Amrock provides title insurance, property valuation, and settlement services; Rocket Homes is a home search platform and real estate agent referral network that offers technology-enabled services to support the home buying and selling experience; Rocket Auto is an automotive retail marketplace that provides centralized and virtual car sales support to online car purchasing platforms; and Rocket Loans is a mortgage lender.It also provides Core Digital Media, a digital social and display advertiser in the mortgage, insurance, and education sectors.

Rocket Companies’ Chief Executive Officer and Director is Jay Farner. He joined Quicken Loans in 1996 and has held top leadership positions since 1999. Jay was President and Chief Marketing Officer prior to his ascension to CEO in 2017. He is also the Chief Executive Officer and Director of RHI and certain of its subsidiaries. Jay is a member of the boards of Detroit Labs, Community Solutions, StockX, Bedrock Manufacturing, the Metropolitan Detroit YMCA, Bizdom Fund, and Rocket Giving Fund. Jay graduated from Michigan State University with a bachelor’s degree in finance.

Opinion: This is a 10B5-1 plan so I can’t read much into it other than RKT is cheap and the housing sell-of may be near a bottom.

Name: Coxon Robert

Position: Director

Transaction Date: 2022-08-04 Shares Bought: 25,000 Average Price Paid: $8.90 Cost: $222,532.00

Company: Ecovyst Inc. (ECVT)

Name: Bitting Kurt

Position: CEO/Director

Transaction Date: 2022-08-05 Shares Bought: 10,750 Average Price Paid: $8.85 Cost: $95,162.00

Company: Ecovyst Inc. (ECVT)

Name: Schneberger Thomas

Position: President

Transaction Date: 2022-08-04 Shares Bought: 11,390 Average Price Paid: $8.78 Cost: $100,000.00

Company: Ecovyst Inc. (ECVT)

Name: Feehan Michael

Position: Chief Financial Officer

Transaction Date: 2022-08-04 Shares Bought: 11,425 Average Price Paid: $8.77 Cost: $100,161.00

Company: Ecovyst Inc. (ECVT)

Name: Vann Kyle D

Position: Director

Transaction Date: 2022-08-04 Shares Bought: 10,000 Average Price Paid: $8.77 Cost: $87,696.00

Company: Ecovyst Inc. (ECVT)

Ecovyst Inc. manufactures and sells specialty catalysts in the United States, the Netherlands, the United Kingdom, and other countries. Eco Services and Catalyst Technologies are the company’s two segments. Sulfuric acid recycling services for the manufacturing of alkylate for refineries are provided by the Eco services sector, as well as virgin sulfuric acid for mining, water treatment, and industrial applications. Catalyst Technologies provides polyethylene and methyl methacrylate producers and licensors with tailored catalyst products and process solutions. Its catalyst helps to make polymers for packaging films, bottles, containers, and other molded applications. This business sector also sells zeolite-based pollution control catalysts, which remove nitrogen oxides from diesel engine emissions and sulphur dioxide from fuels during the refining process. PQ Group Holdings Inc. was the company’s previous name until August 2021, when it changed to Ecovyst Inc. Ecovyst Inc. is based in Malvern, Pennsylvania, and was formed in 1831.

Senior Advisor for Carlyle’s Europe Buyout team is Robert Coxon. Mr. Coxon helps Carlyle with strategy development and investment sourcing for the chemicals and process industries. In addition to serving as a Senior Advisor for Carlyle, Mr. Coxon serves as Chairman of the multinational polymer and resin business Scott Bader and as a Non-Executive Director of AZ Electronic Materials, Stahl Holdings BV, and Meretec. He serves as the chairman of the United Kingdom Center for Process Innovation, a global hub for supercritical fluid, electronic materials, and bioprocessing research. He serves as the University of Durham’s deputy chancellor, the NE Process Industry Cluster’s chairman, which represents over 300 process firms, and a non-executive director of The Whitehall & Industry Group. Mr. Coxon served as Synetix’s CEO and ICI’s senior vice president, two of the top catalyst companies in the world, before joining Carlyle. Mr. Coxon holds an M.B.A. from Cranfield University and a Brunel University engineering degree.

In April 2022, Mr. Bitting was appointed Chief Executive Officer and a Director of Ecovyst. In 2006, he joined Rhodia’s Eco services division, where he worked as vice president, business director, and sulphur products manager. Mr. Bitting was instrumental in Ecoservices’ separation from Solvay and subsequent merger with PQ Corp. He oversaw transformational development across all of the company’s product lines. Mr. Bitting previously worked in managerial roles at Sprint Corporation and Kinder Morgan, Inc. before joining Eco services. Mr. Bitting served as a Company Commander in the 10th Mountain Division of the US Army as a Captain. He graduated from Rider University with a Master of Business Administration and Villanova University with a Bachelor of Science in Business Administration.

In April 2022, Mr. Schneberger was chosen to lead Ecovyst. He started working at PQ Corporation in December 2019 and is now in charge of strategy and business development. He was crucial in developing PQ into a catalyst and associated services firm with rapid growth. Prior to joining PQ, Mr. Schneberger held the positions of Global Business Director for FMC, Alkali Chemicals, and Chief Operating Officer for FMC, Lithium, both of which were publicly traded as Livent. He oversaw the development and execution of FMC’s acclaimed sustainability program during his time there as well. He experienced a variety of leadership and management positions before joining FMC at Rhône Poulenc, Rhodia, Safety Compliance Management, and General Chemical. Lehigh University awarded him a Bachelor of Science in Chemical Engineering, and the University of California at Berkeley awarded him a Master of Business Administration. He presently serves on the board of Habitat for Humanity Philadelphia.

Since May 2016, Mr. Feehan has held the position of Vice President of Finance and Treasurer at PQ Corporation, which he joined in December 2006. He held the position of Corporate Controller from 2008 until 2016. Mr. Feehan started his career in public accounting with Arthur Andersen and KPMG before working for Radnor Holdings Corporation as director of finance and corporate controller before joining PQ. He graduated from the University of Notre Dame with a Bachelor of Business Administration in Accounting and Computer Applications and from Villanova University with a Master of Business Administration.

In addition to Legacy Reserves LP, Kyle D. Vann serves on the boards of 8 additional businesses. Mr. Vann formerly served as the CEO of Entergy-Koch LP, Senior Vice President of Koch Industries, Inc., Advisor at Haddington Ventures LLC, and Refinery Engineer at The Humble Oil & Refining Co. The University of Kansas conferred an undergraduate degree to Mr. Vann.

Opinion:

Name: Walt David R

Position: Director

Transaction Date: 2022-08-10 Shares Bought: 150,000 Average Price Paid: $8.62 Cost: $1,293,495.00

Company: Quanterix Corp. (QTRX)

Name: Madaus Martin D

Position: Director

Transaction Date: 2022-08-10 Shares Bought: 89,667 Average Price Paid: $8.43 Cost: $755,543.00

Company: Quanterix Corp. (QTRX)

Quanterix Corporation is a life sciences firm that develops and markets digital immunoassay systems for life sciences research and diagnostics in North America, Europe, the Middle East, Africa, and the Asia Pacific area. It provides the HD-X instrument, which is a sensitive automated multiplex protein detection platform, as well as the SR-X instrument, which allows researchers to use Simoa detection technology in a variety of applications, including direct detection of nucleic acids. The firm also offers the SP-X instrument, which is based on Simoa planar array technology and is used to test multiplex chemiluminescent immunoassays. The company’s main areas of focus include neurology, cancer, cardiology, infectious illnesses, and inflammation. Through a direct sales force, support organizations, and distributors or sales agents, it sells its products for the life science research sector primarily to laboratories associated with academic and governmental research institutions, as well as pharmaceutical, biotechnology, and contract research companies.

David R. Walt is a member of the Harvard Medical School faculty in the Department of Pathology at Brigham and Women’s Hospital, a Wyss Institute Member, and a Howard Hughes Medical Institute Professor. He was previously a University Professor at Tufts University. Dr. Walt is the Scientific Founder of Illumina Inc. and Quanterix Corp., as well as the Scientific Founder of numerous additional life sciences firms, including Ultivue, Inc. and Arbor Biotechnologies. For his basic and applied work in optical microwell arrays and single molecules, he has garnered several national and international prizes and distinctions. He is a member of the National Academies of Engineering and Medicine, as well as a Fellow of the American Academy of Arts and Sciences, the American Institute for Medical and Biological Engineering, and the National Academy of Inventors. He earned a B.S. in chemistry from the University of Michigan, a Ph.D. in chemical biology from the State University of New York at Stony Brook, and completed postdoctoral research at MIT.

Martin D. Madaus is a businessman who has led eight separate enterprises. He is now the Executive Chairman of Emulate, Inc. and the Chief Operations Officer of Sherlock Biosciences, Inc. Dr. Madaus also serves on the boards of seven additional firms. Martin D. Madaus has previously served as General Manager of Boehringer Mannheim Corp. (California), Chairman, President, and Chief Executive Officer of EMD Millipore Corp., Chairman and Chief Executive Officer of Ortho-Clinical Diagnostics, Inc., Chairman, President, and Chief Executive Officer of Millipore SA, Chairman and Chief Executive Officer of Ortho-Clinical Diagnostics, President and Chief Executive Officer of Roche Diagnostics Corp., and Vice President-Business Development.Dr. Madaus holds doctorates from both Ludwig-Maximilians-Universität München and The University of Veterinary Medicine Hanover.

Opinion: This stock popped 20% plus from these insiders buy. That won’t help shareholders down 80%/

Name: Ho John

Position: CEO

Transaction Date: 2022-08-09 Shares Bought: 29,924 Average Price Paid: $6.88 Cost: $205,949.00

Company: Landsea Homes Corp (LSEA)

Landsea Houses Corporation (Nasdaq: LSEA) is a publicly listed residential homebuilder based in Newport Beach, California that designs and constructs best-in-class homes and sustainable master-planned communities in some of the country’s most coveted markets. The firm has built houses and communities in New York, Boston, New Jersey, Arizona, Florida, Texas, Silicon Valley, Los Angeles, and Orange County in California. An award-winning homebuilder that builds suburban, single-family detached and attached homes, mid-and high-rise properties, and master-planned communities, Landsea Homes is known for creating inspired places that reflect modern living and provide homebuyers the opportunity to “Live in Your Element. People can live where they want, how they want in a home that has been designed specifically for them. Landsea Homes’ High-Performance Homes are carefully built to take advantage of the newest developments in home automation technology supported by Apple® and are driven by a pioneering commitment to sustainability. Homes have features that make life easier and provide energy savings, allowing for more comfortable living at a cheaper cost, as well as sustainability features that contribute to a healthier lifestyle for both homeowners and the environment.

Since 2013, John Ho has been the Chief Executive Officer and Director of Landsea Homes. He spent ten years in real estate investment and development with Colliers International and Jones Lang LaSalle before founding Landsea Homes. He served as Director at Jones Lang LaSalle from 2011 to 2013, leading the firm in cross-border business development and delivering transactional, consultancy, and other integrated real estate services to outbound Chinese businesses investing overseas. Ho graduated from the University of Southern California with a bachelor’s degree and an MBA from the UCLA Anderson School of Management.

Opinion:

Name: Fernandez Andre J

Position: CFO

Transaction Date: 2022-08-10 Shares Bought: 40,000 Average Price Paid: $5.01 Cost: $196,500.00

Company: WeWork Inc. (WE)

Name: Mathrani Sandeep

Position: CEO

Transaction Date: 2022-08-10 Shares Bought: 50,000 Average Price Paid: $4.98 Cost: $200,500.00

Company: WeWork Inc. (WE)

WeWork Inc., formerly BowX Acquisition Corp., is engaged in providing flexible space and workplace management solutions. For entrepreneurs and businesses, the company creates real and virtual shared spaces as well as office services. Standard offices, office suites, and full-floor offices are among the options available under the private workspace. WeWork All Access, WeWork On Demand, and Dedicated Desk are some of the open workspace options offered by the company. WeWork All Access, a monthly membership program offered by the company, allows access to hot desks, conference rooms, and private offices throughout the world. WeWork On Demand, the company’s pay-as-you-go offering, gives users access to the shared workplace and conference rooms. A dedicated Workstation allows customers to have their own desk in one area while also having access to meeting rooms.

Fernandez brings over thirty years of expertise in finance and senior leadership roles to WeWork. Fernandez was most recently Executive Vice President and Chief Financial Officer of NCR Corporation, a global $8 billion leader in business software, services, and hardware for the banking, retail, and hospitality industries. Previous to joining NCR Corporation, he served as President and Chief Executive Officer of CBS Radio, President and Chief Operating Officer of Journal Communications, and prior to that, CFO of Journal Communications, as well as a range of global financial leadership roles at General Electric. Mr. Fernandez now serves on the boards of Giving with Sachem Acquisition Corp. and Bankroll Club LLC and formerly served as Vice Chairman of the Board of Froedtert Health, as well as Buffalo Wild Wings Inc. and the National Association of Broadcasters. Mr. Fernandez graduated from Harvard University with a Bachelor of Arts in Economics.

WeWork’s Chief Executive Officer, Sandeep Mathrani, has been CEO and a director since February 2020 and Chairman of the Board since March 2022. From 2018 until 2020, Mr. Mathrani was Chief Executive Officer of Brookfield Properties Retail Group and Vice-Chairman of Brookfield Properties. Prior to that, he was CEO of GGP Inc. for eight years, during which time the firm was recapitalized in November 2010, saw eight years of growth, and was sold to Brookfield Property Partners in August 2018. Prior to joining GGP in 2010, Mr. Mathrani was President of Retail at Vornado Realty Trust, where he handled the firm’s retail real estate segment in the United States as well as its operations in India, which mostly consisted of office assets. Prior to that, he spent eight years as Executive Vice President at Forest City Ratner, where he was responsible for establishing and expanding a new platform of retail assets across New York City’s five boroughs. Mr. Mathrani now serves on the boards of directors of Dick’s Sporting Goods, Tanger Factory Outlet Centers, Inc., and Bowlero Corporation, as well as the WeWork Capital Advisors LLC Management Committee.

Opinion: WeWork offices are nearly full around the country. I’d be a buyer but that means getting in bed with Matsu Sun. I don’t have enough transparency about the debt and real estate behind it but hyrbrid workplace is the new buzz word. In reality there is nothing proprietary about WeWork. Shared office space can be developed anywhere by just about anyone.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data so I like people that eat what they kill.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have and we curse aloud, what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019

[…] Insiders nailed this stock and we highlighted a while ago in this blog post on 8/12/22. Its interesting to see what insiders were buying before the Federal Reserve set out on the fastest […]