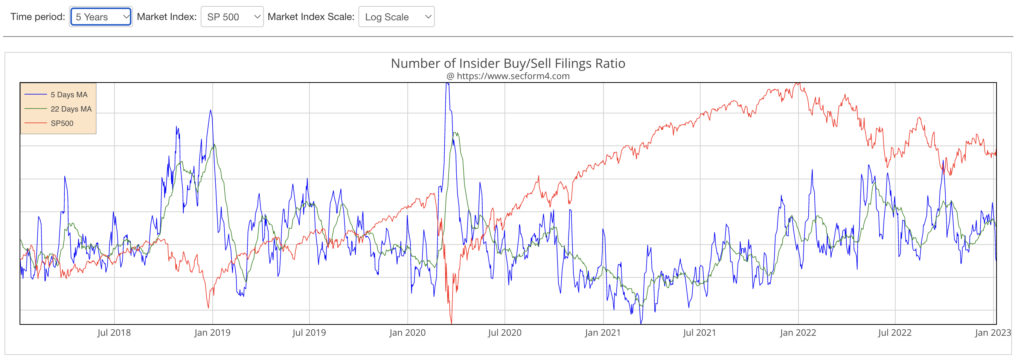

All bear markets end with a crescendo of insider buying. There are a few ways to predict this pivotal event. The most reliable I have found, the ratio of insider buying to selling, can be found at popular subscription services such as secform4.com. I’ve included a few charts from the site to help illustrate this phenomenon of insider buying foretelling the end of the bear market. I wouldn’t expect too much buying at the moment, though, as we’re deep in the throes of the 4th quarter earnings blackout when insiders are restricted from taking advantage of these reduced prices. But since the average bear market lasts 12 months, we’re at that point- start looking for an end to it.

The blue line is a ratio of insider buying over selling. The more buying, the higher the blue line is. The red line is the S&P 500. The big spike in blue around early mid-2020 was, in hindsight, a generational buying opportunity. It was the collapse of the market brought on by the coronavirus Pandemic of 2020. There was another excellent opportunity at the end of 2018. A sizable chunk of that quarter’s losses came during a violent December. The indexes all dropped at least 8.7 percent for the month. The Dow and S&P 500 also recorded their worst December performance since 1931 and their biggest monthly loss since February 2009.

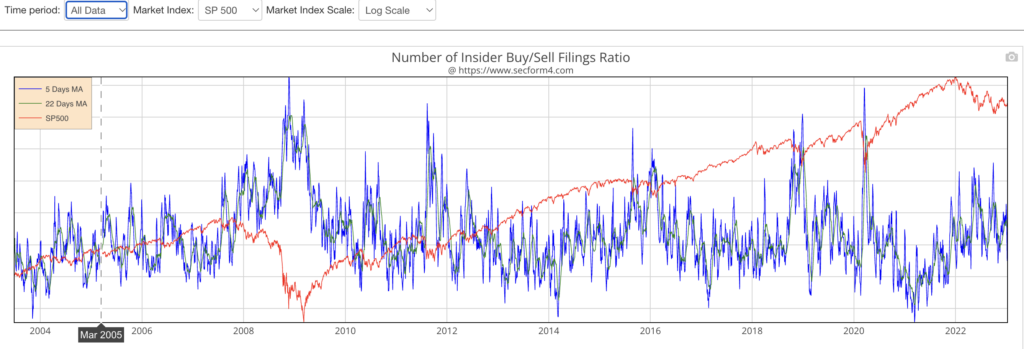

The above chart goes back as far as we have records. The most prominent bear market over this span was the Great Recession of 2008. Insiders hit the ball out of the park this time as well, calling the bottom in the Spring of 2009, once again in 2011, and with precision every significant dip since. Will they do it again? Probably, but they haven’t yet wrung the all-clear bell yet.

There are always outlier insider purchases, but when insiders buy en masse, it’s probably akin to the wisdom of the crowd. There wasn’t much wisdom from the crowds last week as we’re in the heart of the 4th quarter earnings blackout. The most notable buy was Director Austin’s second bit of the CrowdStrike apple.

Name: Roxanne S Austin

Position: Director

Transaction Date: 2023-01-05 Shares Bought: 35,000 Average Price Paid: $96.19 Cost: $3,366,700.00

Company: CrowdStrike Holdings Inc. (CRWD)

CrowdStrike revolutionized cloud-based cybersecurity and altered how consumers obtain and experience cybersecurity. CrowdStrike has founded on the premise that cyberattackers had an asymmetric advantage over older cybersecurity systems that couldn’t keep up with the frequent changes in enemy tactics. This problem is solved in a completely new way by the CrowdStrike Falcon platform, which is the first true cloud-native platform that can use large amounts of security and corporate data to offer highly flexible solutions through a single lightweight agent. Customers are protected from attackers by a new platform strategy that finds and stops threats to stop breaches.

Roxanne S. Austin has been a board of directors member since September 2018. Austin has been the president of Austin Investing Advisors, a private investment and consultancy business, since January 2004. He is also the head of EQT Partners’ U.S. Mid-Market Investment Advisory Committee. Austin presently serves on the boards of directors of Abbott Laboratories, a producer of pharmaceutical, medical equipment, and nutritional products. AbbVie, a biopharmaceutical firm; and Verizon Communications, a telecommunications provider. She was on the boards of Target Corporation, Teledyne Technologies, and LM Ericsson Telephone Company. Austin is a member of the California State Society of Certified Public Accountants and the American Institute of Certified Public Accountants. Ms. Austin has a B.B.A. in Accounting from the University of Texas in San Antonio.

Opinion: CrowdStrike is the gold standard in endpoint protection. Director Roxanne’s first buy was at $99.74. It boosted confidence among investors, and the stock spiked to $106. It didn’t take long, though, for Wall Street analysts that loved Crowstrike 50% higher to downgrade it. Cloud software companies have all been getting repriced over the last year, and $CRWD was no exception. That’s when Roxanne lays another $3.6M onto her initial investment of 25,000 shares at $99.74. Maybe she knows that cuts are coming and that CRWD can make lots of money from its loyal customers and recurring revenue streams.

Name: William D Nash

Position: President & CEO

Transaction Date: 2022-12-30 Shares Bought: 8,220 Average Price Paid: $60.98 Cost: $501,256

Company: Carmax Inc (KMX)

CarMax, Inc. provides an exceptional customer experience by providing a diverse range of excellent used automobiles and associated goods and services at low, no-haggle pricing and via a customer-friendly sales process. CarMax was founded in 1996 under the laws of the Commonwealth of Virginia. CarMax, Inc. is a holding corporation whose activities are carried out via its subsidiaries. The company started operations in 1993 under Circuit City Stores, Inc. (“Circuit City”), establishing the first CarMax location in Richmond, Virginia. The company’s omnichannel platform, which provides the greatest addressable market in the used vehicle business, enables retail consumers to purchase a car on their terms – online, in-store, or a seamless mix of both.

Mr. Nash is the president and CEO of CarMax, the nation’s biggest retailer of used vehicles, with over 30,000 employees working in over 230 retail stores, customer experience centers, corporate offices, and CarMax Auto Finance (CAF). Mr. Nash oversees the company, including strategy, finance, operations, technology, marketing, and human resources. Before joining CarMax, Mr. Nash worked at Circuit City in various capacities, including corporate tax manager. He earned his CPA while working as an accountant for a public accounting company. Mr. Nash graduated from James Madison University with a Bachelor of Business Administration in Accounting.

Opinion: Nash is up 8% since his purchase. Carmax faced fierce competition from new asset-light car sellers and disruptive business models like Carvana. The shakeout of nonprofitable businesses may have given Carmax a whole new lease on life.

Name: Andrew R Heyer

Position: Director

Transaction Date: 2022-12-30 Shares Bought: 38,000 Average Price Paid: $22.28 Cost: $846,770.00

Company: Lovesac Co. (LOVE)

Lovesac Co is a technology-driven business that develops, produces, and distributes one-of-a-kind, high-quality furniture developed from the Meant for Life concept, which results in items made to last a lifetime and are designed to grow in tandem with customers’ lives. The current product line includes modular sofas called Sactionals, luxury foam bean bag chairs named Sacs, and home design accessories. All essential products are covered by a broad portfolio of utility patents, putting innovation at the heart of the design philosophy. The Company advertises and sells its goods via contemporary and efficient showrooms, which are increasingly supplemented by direct-to-consumer touch-points such as newly built mobile concierges and kiosks, shop-in-shops, and online pop-up stores with third-party merchants.

Andrew R. Heyer is the Chairman of the Board of Directors. Mr. Heyer is a financial specialist with over 35 years of experience investing in the consumer and consumer-related goods and services sectors. Mr. Heyer is the Chief Executive Officer and Founder of Mistral Equity Partners, a private equity fund manager launched in 2007 that invests in the consumer business. Mr. Heyer was a Managing Director at Drexel Burnham Lambert Incorporated before joining Argosy, and before that, he was at Shearson/American Express. Mr. Heyer also serves on the boards of directors of many private firms, including Worldwise, a pet accessories company. Mr. Heyer has been a director and President of Haymaker Acquisition Corp. III, a special-purpose acquisition business, since June 2019.

Opinion: Buying a furniture manufacturer in one of the worst housing markets in fifteen years doesn’t seem like a good strategy, but perhaps it’s akin to buying straw hats in the winter.

Name: Jack Hightower

Position: Chief Executive Officer/10% Owner

Transaction Date: 2023-01-04 Shares Bought: 131,539 Average Price Paid: $22.00 Cost: $2,893,858

Company: HighPeak Energy Inc. (HPK)

HighPeak Energy is an independent crude oil and natural gas company focused on acquiring, developing, and producing crude oil, NGLs, and natural gas reserves. It was founded in Delaware on October 29, 2019. The Company’s assets are mainly situated in Howard County, Texas, a part of the Midland Basin’s northeastern region and home to a lot of crude oil. The Signal Peak area is located in the south, and the northern Flat Top area is where the Company has two sizable contiguous land positions focusing on the Howard County region of the Midland Basin, in particular, HighPeak Energy. The Company’s assets include rights, titles, and interests in natural gas and crude oil properties, most of which are situated in Howard County, Texas, a Midland Basin region rich in crude oil.

Mr. Hightower has been running E&P platforms in the oil and gas business for more than 49 years. From 2011 until 2013, Mr. Hightower held the positions of Chairman, President, and CEO of Bluestem Energy Partners, LP. Mr. Hightower held the positions of Chairman, President, and CEO of Celero Energy II, LP, from 2006 to 2009, as well as Celero Energy, LP, from 2004 to 2005, before founding Bluestem. Mr. Hightower started Celero after being chairman, president, and CEO of Pure Resources, Inc., which grew to become the 11th largest independent E&P company in North America that was traded on a public stock exchange. Unocal made a bid for the Pure Resources shares it did not already hold in October 2002.

Opinion: Jack is betting big on crude. And why not? HPK reported Q3 revenue $204.114M vs $47.472M. HighPeak CEO Jack Hightower said, “Looking over our brief history as a public company, we have expanded our development program across the entirety of our acreage position and in several formations, and, as a result, we have delineated significant proven reserves.”

Name: Mark David Jenkins

Position: Director

Transaction Date: 2023-01-06 Shares Bought: 25,523 Average Price Paid: $19.59 Cost: $499,996.00

Company: Carlyle Credit Solutions Inc.

The Carlyle Group Inc. is a private equity company specializing in direct and fund-of-funds investments. Management-led/Leveraged buyouts, privatizations, divestitures, strategic minority equity investments, structured credit, global distressed and corporate opportunities, small and middle market, private equity placements, consolidationcs and buildups, senior debt, mezzanine, and leveraged finance, and venture and growth capital financings, seed/startup, early venture, emerging growth, turnaround, mid venture, late venture, PIPES Corporate Private Equity, Real Assets, Global Market Strategies, and Solutions are the four investment sectors of the business. Typically, the firm invests in industrial, agribusiness, the ecological sector, fintech, airports, parking, Plastics, Rubber, diversified natural resources, minerals, farming, aerospace, defense, automotive, consumer, retail, industrial, infrastructure, energy, power, healthcare, software, software-enabled services, semiconductors, communications infrastructure, financial technology, utilities, gaming, systems, and related supply chain, electronic systems, systems, oil and gas, and systems, oil and gas.

Mark Jenkins is a New York-based Managing Director and Head of Global Credit. He also serves on the Carlyle Leadership Committee. Before joining Carlyle, Mr. Jenkins was a Senior Managing Director at CPPIB, in charge of the firm’s Global Private Investment business. He chaired the Credit Investment Committee and the Private Investments Committee and was in charge of the portfolio value development group. He also oversaw CPPIB’s purchase of Antares Capital and its subsequent growth into middle-market lending. Before joining CPPIB, he worked for Barclays Capital in New York as a Managing Director and Co-Head of Leveraged Finance Origination and Execution. Mr. Jenkins formerly worked for Goldman Sachs & Co. in New York for 11 years in top roles in the Fixed Income and Financing departments. Mr. Jenkins graduated from Queen’s University with a B.Com degree. Wilton Re, Teine Energy, Antares Capital, and Merchant Capital Solutions were among the companies he sat on the boards of.

Opinion: It’s a black box, and maybe Director Jenkins knows what’s in it. You and I certainly don’t.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

Blog Sign UP

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have and we curse aloud, what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full-time to managing my personal investments. Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog, newsletter, and associated social media sites is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax