Insiders tend to be value investors. Defining value investors is another phrase for buying low. It’s hard to say what value is. After all, beauty is in the eye of the beholder. Does value mean intrinsic value, using common methods of measuring a company’s discounted cash flow value, or does it mean low P.E. or above-average yield, regular dividends? Lots of books have been written on it, and famous investors, like Warren Buffett and his mentor, Benjamin Graham, have largely defined the category. A value investor more or less believes they are buying a stock for less than its intrinsic value and hoping that the market eventually realizes its true value through its price discovery mechanism or even a buy-out or sale.

I was surprised to learn that academics consider value investing higher up on the risk scale. Value stocks, stocks that are often depressed in value, are usually cheap for a reason. Disappointing revenue or earnings growth, actual losses, a change in management, or any number of negative events can cause price declines, making the stock higher beta and with it higher risk. Beta is often thought of as risk, but that’s for a whole lot longer blog post explaining why I think the theory of modern portfolio investing is completely wrong. For now, let’s evaluate stocks that have fallen enough in price to provoke an insider buying response.

Listen to the podcast here

Listen to our The Insiders Fund Not So Daily Podcast and Follow us on Twitter for real-time commentary and insider buying alerts at https://twitter.com/theinsidersfund

If you are a QUALIFIED INVESTOR and are interested in learning how you can be part of the Insiders Fund, schedule some time with me here.

This blog is solely for educational purposes and the author’s own amusement. IT IS NOT INVESTMENT ADVICE. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor.

Name: Gregory Hayes

Position: Director

Transaction Date: 08-11-2025 Shares Bought: 5,250 shares an Average Price Paid of $191.57 for Cost: $1,005,743

Company: Becton Dickinson & Co. (BDX):

Becton, Dickinson and Company, founded in 1897 and incorporated in New Jersey in 1906, is a global medical technology leader that designs, manufactures, and sells medical devices, laboratory equipment, diagnostic products, and supplies. Serving healthcare providers, researchers, laboratories, pharmaceutical companies, and consumers worldwide, BD’s innovations focus on advancing medication management, infection prevention, surgical and interventional care, drug delivery, anesthesia, and diagnostics, as well as enabling breakthroughs in cellular and cancer research.

Gregory J. Hayes joined the Board of Directors of Becton, Dickinson and Company on March 26, 2025. He brings extensive senior leadership expertise, having served as Senior Chairman of RTX Corporation and as Chairman and CEO of United Technologies Corporation, where he led significant mergers and strategic initiatives. Mr. Hayes holds a bachelor’s degree in economics from Purdue University and is a certified public accountant.

Opinion: Even though a $1 million stock purchase still buy’s you something, I am discounting this purchase simply because Director Hayes is a newly appointed director. Directors are almost always required to own some Company stock. Besides Hayes is a pretty rich dude after all. But I do like this buy and I like owning it a little cheaper even more. Becton Dickinson is one of the first stocks I ever owned. My dad, a great man and a physician, gave me some stocks for my Bar Mitzvah. BDX was one of them.

Becton Dickinson (BDX) commands a fortified position in medical tech through diversified segments, recurring revenue, and smart acquisitions such as Edwards’ Critical Care group. Management under CEO Tom Polen is pivoting toward AI-enabled, connected care tools. Insider activity is restrained—with just one anonymous $350k purchase amid heavy insider selling—suggesting guarded confidence. A complex de-merger pairing its biosciences unit with Waters underscores strategic reshaping but also introduces integration risks. Short interest is minimal, reflecting BD’s defensive qualities and institutional backing. A DCF at moderate growth and discount rates gives an intrinsic value slightly above current levels, implying limited upside but a margin of safety. The company’s strengths lie in its scale, recurring revenue, and diversified customer base; its weaknesses reside in modest organic growth and integration complexity. In sum, BDX remains a steady healthcare stalwart—appealing for stable, value-aware investors—but with muted growth allure.

Name: Gregory Hayes

Position: Director

Transaction Date: 08-14-2025 Shares Bought: 8,350 shares an Average Price Paid of $119.90 for Cost: $1,001,165

Company: Phillips 66 (PSX):

Phillips 66 is a multinational energy manufacturing and logistics company headquartered in Houston, Texas, with operations in the United States, the United Kingdom, and Germany. Its diversified business spans five segments: Midstream, Chemicals, Refining, Marketing and Specialties, and Renewable Fuels. The company transports crude oil and refined products, processes natural gas and NGLs, manufactures petrochemicals and specialty chemicals, and refines crude into gasoline, distillates, and jet fuel. Its Marketing and Specialties division provides petroleum products, lubricants, and base oils, while the Renewable Fuels segment converts feedstocks into renewable diesel, jet fuel, and other low-carbon solutions. Founded in 1875, Phillips 66 combines long-standing expertise with a focus on advancing sustainable energy solutions.

Gregory J. Hayes has served as an independent director of Phillips 66 since July 2022. He is Chair of the Nominating and Governance Committee and a member of the Human Resources and Compensation, Public Policy and Sustainability, and Executive Committees. Hayes is a certified public accountant and holds a bachelor’s degree in economics from Purdue University.

Opinion: Phillips 66 (PSX) benefits from a diversified, vertically integrated energy model spanning refining, midstream, chemicals, and branded marketing. Its competitive moat is built on scale, logistics infrastructure, and steady shareholder returns via dividends and buybacks. While five-year revenue growth metrics and net retention data aren’t reported for the sector, activism from Elliott Management spotlights underperformance versus peers. Insider activity is limited—one small director buy contrasts significant insider selling. Short interest has dropped recently, signaling reduced bearish sentiment. A rough DCF using modest growth and cost-savings scenarios suggests a fair value near $135–$145, versus a current price around $129. Phillips 66 stands to benefit from midstream expansion, renewable-fuels investments, and efficiency gains. Yet it faces cyclical refining volatility, chemical margin pressure, regulatory risk, and governance scrutiny amplified by Elliott’s push for structural change. Its broad customer base keeps concentration low. Overall, PSX is a defensive-industrial energy name with modest upside potential but strategic uncertainties that hinge on activist-led reforms and execution.

Name: Wajid Ali

Position: Director

Transaction Date: 08-18-2025 Shares Bought: 10,000 shares an Average Price Paid of $41.32 for Cost: $413,209

Company: TTM Technologies Inc. (TTMI):

TTM Technologies Inc. is a global leader in advanced technology solutions, specializing in mission systems, radio frequency components, RF microwave/microelectronic assemblies, and sophisticated printed circuit boards. Operating 23 specialized facilities across North America and Asia, TTM provides end-to-end design, engineering, and manufacturing services, enabling both rapid time-to-market and high-volume production. The company serves approximately 1,400 customers worldwide, including OEMs, EMS providers, ODMs, distributors, and government agencies.

Wajid Ali joined the Board of Directors of TTM Technologies as an Independent Director in May 2024. He brings nearly 20 years of financial and technology industry expertise, currently serving as Chief Financial Officer at Lumentum Holdings. Previously, he held CFO roles at Synaptics, Teledyne Technologies, and DALSA Corp., and senior financial leadership positions at AMD and ATI. Mr. Ali holds both a Bachelor’s and Master’s degree in Economics from York University, an MBA from the Schulich School of Business at York University, and is a CPA and CMA certified professional accountant in Ontario, Canada.

Opinion: One director is buying while an Executive VP and Sector President is selling. I call this dealer’s choice. TTM Technologies (TTMI) stands as a dominant PCB manufacturer with global scale, diversified sector exposure, and critical defense and aerospace clientele. While lacking recurring-revenue metrics, recent Q2 2025 results—$730 million in sales and ~$0.41 EPS—demonstrate strong execution and market demand. Strategic capacity expansion underscores confidence in growth drivers like AI-enabled data center demand and defense sector strength. Insider sentiment leans cautious: notable insider selling, but a key buy by the CFO signals some internal belief in near-term trajectory. Short interest data is limited. A conservative DCF value in the $45–$50 range sits around current price, implying restrained upside but a valuation that reflects fundamentals. TTMI’s strengths—scale, multi-industry footprint, and tech edge—are balanced by capital intensity and cycle sensitivity. The company is well-positioned to ride secular tailwinds in electronics, yet macro and competitive pressures remain. Overall, TTMI is a high-conviction manufacturing play with moderate valuation comfort—best suited to investors valuing execution and niche MOS but wary of cyclical swings.

Name: Jonathan S. Sobel

Position: Hilltop Securities Chairman

Transaction Date: 08-14-2025 Shares Bought: 30,000 shares an Average Price Paid of $32.35 for Cost: $970,400

Company: Hilltop Holdings Inc. (HTH):

Hilltop Holdings Inc., headquartered in Texas, is a financial holding company operating under the Bank Holding Company Act of 1956. It delivers commercial and consumer banking services across Texas, complemented by broker-dealer and mortgage origination businesses. Hilltop drives growth through organic expansion and strategic acquisitions, supported by strong liquidity and capital resources, while focusing on building a robust and diversified financial services platform.

Jonathan S. Sobel has served on Hilltop Holdings Inc.’s Board of Directors since July 2019 and is Chairman of its subsidiary, Hilltop Securities. He previously spent more than 20 years at Goldman Sachs, where he was Partner and Managing Director and held senior leadership roles including Global Head of the Mortgage Department and Chief Risk Officer for Goldman Sachs Asset Management. He is also Managing Member of DTF Holdings and a Partner at Ford Financial Fund. Mr. Sobel earned his B.A. in Economics from Columbia University.

Opinion: Hilltop Holdings (HTH) operates a diversified financial services model—comprising banking, lending, and securities—with strong roots in the Texas market. The company generates stable profitability, supported by solid free cash flow (~$406M) and balanced capital structure. Recent insider activity shows renewed confidence: Chairman Jonathan Sobel’s acquisition of 10,000 shares—and moderate acquisitions by other executives—signals alignment with shareholder value. Short interest is modest at ~3.1% of shares, indicating only mild bearish pressure. Valuation ratios (P/E, P/B, P/FCF) are attractive for the sector, and a simple FCF-based valuation framework suggests fair value lies modestly above current levels. The company’s strengths lie in its diversified portfolio and regional foothold; however, it remains exposed to macro and rate cycles, with potential competition from larger or digital-first players. Overall, Hilltop is a value-leaning financial holding that offers defensive cash flow and insider conviction, making it suitable for value-focused investors rewarded with a margin of safety.

Name: Duncan Hawkesby

Position: Director

Transaction Date: 08-20-2025 Shares Bought: 71,586 shares an Average Price Paid of $23.05 for Cost: $1,649,873

Company: Reynolds Consumer Products Inc. (REYN):

Reynolds Consumer Products Inc. is a leading provider of household essentials, offering a wide range of cooking, waste management, and tableware products in the United States and internationally. Operating through four segments—Reynolds Cooking & Baking, Hefty Waste & Storage, Hefty Tableware, and Presto Products—the company’s portfolio includes well-known brands such as Reynolds, Hefty, ALCAN, Diamond, and EZ Foil. Its products, including aluminum foil, parchment paper, food storage bags, trash bags, disposable tableware, and reusable containers, are distributed through grocery stores, mass merchants, warehouse clubs, dollar stores, drugstores, home improvement retailers, military outlets, and eCommerce platforms. Founded in 1947 and headquartered in Lake Forest, Illinois, Reynolds Consumer Products operates as a subsidiary of Packaging Finance Limited.

Duncan Hawkesby was elected as a Class II Director of Reynolds Consumer Products Inc., with his tenure beginning on July 23, 2025. He has been the Managing Director of Hawkesby Management Limited since 2018 and brings extensive board experience across Graeme Hart–affiliated companies, including Graham Packaging and Building Supplies Group. Hawkesby has also served as a director of Pactiv Evergreen Inc., TaxGift Limited, and a UPS-Fliway joint venture. He holds a Bachelor of Commerce degree from the University of Otago.

Opinion: Its another new director but still $1.6 M is more than a mandator buy. Reynolds Consumer Products (REYN) is a stalwart consumer staples player with strong brand equity and essential product lines across cooking, storage, and waste solutions. FY 2024 performance was solid: ~$3.7B in revenue, $678M EBITDA, and $369M free cash flow, enabling meaningful debt reduction. However, headwinds like a “Made in USA” class-action suit and raw material inflation cloud near-term visibility.

Insider activity has been overwhelmingly positive. Director Rolf Stangl accumulated over $560K in company shares during share-price weakness, and VP/CAO Chris Mayrhofer added further purchases—demonstrating conviction in long-term value. The business pays a healthy ~4% dividend, supported by modest payout ratios and strong FCF.

Investors focused on dependable cash flow, brand resilience, and underappreciated value would find REYN appealing—provided they’re comfortable with raw material exposure and litigation cadence.

Name: Kelcy L. Warren

Position: Director

Transaction Date: 08-19-2025 Shares Bought: 2,000,000 shares an Average Price Paid of $17.34 for Cost: $34,681,000

Company: Energy Transfer LP (ET):

Energy Transfer LP founded in 1996 and headquartered in Dallas, Texas, Energy Transfer LP is a Delaware limited partnership with its common units traded on the New York Stock Exchange under the ticker “ET.” The company’s assets include ownership interests in two publicly traded master limited partnerships, Sunoco LP and USA Compression Partners. Energy Transfer generates cash flow primarily through distributions received from these subsidiaries, with payout levels determined by their operating earnings and available funds. The partnership’s primary financial obligations include partner distributions, general and administrative expenses, and debt service. After meeting these commitments, remaining cash is distributed to unitholders on a quarterly basis.

Kelcy L. Warren has served on the Board of Directors of Energy Transfer LP since 1996, the year he co-founded the company, and currently holds the role of Executive Chairman. With nearly four decades of experience in the energy sector, he previously served as President and Chief Operating Officer of Cornerstone Natural Gas and as a Director of Crosstex Energy. Under his leadership, Energy Transfer has grown into one of the largest and most diversified energy infrastructure companies in the United States. Mr. Warren earned a Bachelor of Science in Civil Engineering from the University of Texas at Arlington in 1978.

Opinion: Energy Transfer LP (ET) is a high-scale energy infrastructure operator with a vast pipeline network and stable, cash-generative business. Its strong moat derives from decades of regulatory approvals and sprawling operations across key U.S. energy corridors. Management’s substantial insider buying—especially by Executive Chairman Kelcy Warren—signals deep alignment with shareholders.

ET benefits from legal victories such as the $667 million defamation ruling against Greenpeace, enhancing its risk profile. While short interest data is limited, the company’s high-yield profile (~8%+) and defensive infrastructure typically appeal to income-oriented investors. Valuation analysis via FCF-based DCF models suggests a potentially undervalued opportunity, though earnings-based models are more skeptical. The company’s strengths lie in dividend yield, infrastructure scale, and constrained competition, balanced against cyclical energy markets, regulatory headwinds, and capital intensity.

Emerging demand from data center infrastructure presents a promising growth tailwind. Overall, ET offers strong income potential with a margin of safety, positioning it as a compelling pick for value and yield-focused investors who can tolerate macro volatility.

Name: Charles Ray Wesley IV

Position: Director

Transaction Date: 08-19-2025 Shares Bought: 20,000 shares an Average Price Paid of $15.27 for Cost: $305,404

Company: Hallador Energy Co. (HNRG):

Hallador Energy Company is an Indiana-based energy firm engaged in producing steam coal for the electric power generation industry. Through its subsidiaries, the company operates underground and surface mines, including Oaktown Fuels 1 & 2, the Freelandville mine, and the Prosperity mine in the Illinois Basin. Founded in 1949, Hallador is headquartered in Terre Haute, Indiana.

Charles R. Wesley, IV has served as a Director of Hallador Energy Company since November 2023 and chairs the Compensation Committee. He is President and CEO of Thoroughbred Resources LP, bringing extensive experience across the legal, finance, and energy sectors. Previously, he held senior finance and legal roles at Lumen Technologies and practiced international energy law at leading firms. A former mining engineer, Wesley holds a B.S. in Mining Engineering from Virginia Tech and a J.D. from the University of Kentucky College of Law.

Opinion: Hallador Energy (HNRG) is a niche coal miner and generator in the Midwest with deep customer ties via long-term utility contracts. Despite a sizable FY2024 net loss (~$226M), the company produced $65.9M in free cash flow, revealing underlying operational resilience. Q2 2025 revenue fell ~21% YoY, but managed a slight EPS beat, confirming stabilization. Insider buying—especially by Directors Wesley IV and Gray—signals management’s bullish stance, although Director Hardie’s stake sales complicate the narrative. Short interest has climbed to ~6.6% with elevated days-to-cover, reflecting increased skepticism. Analysts remain optimistic, targeting $16–$17, indicating ~40% upside from the current ~$16 price point.

Hallador’s strengths include stable contracts, regional infrastructure, and cash generation; weaknesses are its coal dependency, geographic concentration, and structural industry decline. Opportunities lie in limited diversification—like the Merom power asset—while threats stem from regulatory pressure, reduced coal demand, and ESG headwinds. Overall, HNRG appears as a high-risk, speculative deep-value play with insider alignment and potential upside, best suited for investors betting on coal’s resilience and modest recovery, but hanging by a thin margin.

Name: William Z. Wyatt

Position: Director

Transaction Date: 08-14-2025 Shares Bought: 693,962 shares an Average Price Paid of $14.41 for Cost: $9,999,992

Company: Turtle Beach Corp (TBCH):

Turtle Beach Corporation, founded in 1975 and headquartered in San Diego, California, is a leading global audio technology company. Operating across North America, Europe, the Middle East, and Asia-Pacific, the company designs, markets, and sells innovative gaming headsets for consoles, PCs, tablets, and mobile devices under the Turtle Beach brand. Beyond headsets, its product portfolio includes keyboards, mice, microphones for broadcasters and content creators, game controllers, and specialized aviation and racing simulation equipment.

William Z. Wyatt has served on the Board of Directors of Turtle Beach Corporation since May 2023. He currently chairs the Compensation Committee and is a member of the Value Enhancement Committee. Mr. Wyatt is the Founder and Managing Partner of The Donerail Group, an investment management firm he established in 2018. He previously held senior roles in investment management, including Head of Event-Driven Investments at Starboard Value, and positions at Magnetar Capital, Empyrean Capital, and Goldman Sachs. He earned his undergraduate degree from Tulane University.

Opinion: This smells like the beginning of a leveraged buyout by the Donerali Group .Turtle Beach (TBCH) remains a hallmark in gaming audio, leveraging 14 years at the top of headset market share and growing its portfolio via PDP acquisition. While not a recurring-revenue business, recent Q2 results beat expectations—with rising adjusted EBITDA and raised guidance—highlighting healthy momentum within a competitive field. A blockbuster insider purchase (~$10M) underscores confidence at the board level, though broader insider ownership remains modest and short interest relatively high (~12%) reveals skepticism. Institutional ownership (~65%) anchors stability. Valuation sits at a moderate premium, supported by analyst optimism (average target ~$16.17) and backing through share repurchases. Strengths include brand equity and a diversified product lineup; weaknesses center on dependency on gaming trends, limited market breadth, and operational issues. Growth opportunities lie in innovation, synergies from PDP, and improved e-commerce. Risks include competitive pressure from giants like Logitech and Corsair, tech obsolescence, and integration challenges. Overall, TBCH is a compelling small-cap value-growth story—offering upside and insider alignment—but with key execution and integration hurdles that merit an investor’s attention.

Name: Steven D. Gray

Position: Director

Transaction Date: 08-20-2025 Shares Bought: 50,000 shares an Average Price Paid of $13.79 for Cost: $689,578

Company: Infinity Natural Resources Inc. (INR):

Infinity Natural Resources Inc. is a growth-focused independent energy company dedicated to the acquisition, development, and production of hydrocarbons in the Appalachian Basin. The company targets low-risk, high-value oil and natural gas assets, with operations across eastern Ohio’s volatile Utica Shale, southwestern Pennsylvania’s dry Utica Shale, and the Marcellus Shale in Pennsylvania. Its portfolio includes a wide range of stacked drilling prospects supported by proprietary midstream infrastructure. With control of approximately 93,000 net surface acres in core areas, Infinity maintains a balanced and flexible portfolio designed to adapt to shifting commodity markets.

Steven D. Gray serves as a Director at Infinity Natural Resources Inc. He is the co-founder of RSP Permian, Inc., where he was Director and CEO from 2010 until its merger with Concho Resources in 2018, after which he joined Concho’s Board of Directors until its acquisition by ConocoPhillips in 2021. Earlier in his career, Mr. Gray co-founded several successful oil and gas ventures in partnership with Natural Gas Partners, following eleven years of experience as a petroleum engineer. He currently chairs the Board of Permian Resources Corporation and serves on the Texas Tech Foundation’s advisory board. Mr. Gray holds a bachelor’s degree from Texas Tech University.

Opinion: Pure play on natural gas powered AI data centers. Infinity Natural Resources (INR) is a newly public Appalachian Basin producer with a compelling growth trajectory. Though Q4 2024 saw a modest revenue decline and net loss, the company dramatically transformed its balance sheet. The Q1 2025 IPO infused sufficient capital to reduce net debt by well over $225 million, lifting liquidity above $340 million. In Q2 2025, production surged 25% to 33.1 MBOE/day, driving EBITDA to ~$49.6 million and lowering unit operating costs. Analyst sentiment is bullish: Raymond James set a $29 target (Strong Buy), and SWS initiated at $23 (Buy). Rich reserves and efficient operations provide a structural moat, though risks include earnings volatility, governance issues, and commodity sensitivity. Overall, INR emerges as a high-conviction growth hydrocarbons story with peer-leading execution, offering upside to disciplined value investors comfortable with energy cyclicality.

Name: Gregory L. Summe

Position: Director

Transaction Date: 08-21-2025 Shares Bought: 100,000 shares an Average Price Paid of $12.56 for Cost: $1,256,000

Company: Avantor Inc. (AVTR):

Avantor, Inc. Founded in 1904 and headquartered in Radnor, Pennsylvania, Avantor, Inc. is a global supplier of mission-critical products and services serving the biopharma, healthcare, education, government, advanced technologies, and applied materials sectors. Operating across the Americas, Europe, Asia, the Middle East, and Africa, the company’s extensive portfolio includes high-purity chemicals and reagents, laboratory supplies, formulated silicone materials, custom excipients, single-use assemblies, chromatography resins and columns, analytical sample preparation kits, microbiology and educational tools, clinical trial kits, and fluid handling components. Avantor supports innovation and efficiency across research, development, and production environments worldwide.

Mr. Summe has served on Avantor, Inc.’s Board of Directors since May 2020, where he chairs the Nominating and Governance Committee and is a member of the Compensation and Human Resources Committees. He is the Managing Partner at Glen Capital Partners, an investment fund, and previously held senior leadership roles including Managing Director and Vice Chairman of Global Buyouts at The Carlyle Group and Senior Advisor at Goldman Sachs Capital Partners. Mr. Summe holds an MBA with distinction from The Wharton School of the University of Pennsylvania, a master’s degree in electrical engineering from the University of Cincinnati, and a bachelor’s degree in electrical engineering from the University of Kentucky, where he was inducted into the Hall of Distinction.

Opinion: Strong contrarian buy. Life sciences has been a significant underperformer this year due to the vagaries of Government research financing in biotech and RFK’s perceived anti science approach to healthcare. The sector has recently started to show a pulse. Summe has been an enthusiastic insider buying stock.

Avantor Inc. (AVTR) is a global materials and services supplier to the life sciences ecosystem, with a scale-driven moat and deep embeddedness in regulated lab supply chains. While Q1 2025 revenue fell ~5.9% YoY—missing estimates—the company boasts strong recurring-like revenues and significant cost-cutting initiatives totaling $400M to restore margins to 20%. This has yielded an attractive valuation: ~12x P/E and ~8.5x EV/EBITDA, with analyst expectations pointing to ~$25–$26 fair value.

Insider confidence is particularly notable: four directors have collectively purchased over $1M in shares in a concentrated buying push, especially after the stock’s steep decline.

Avantor is best suited for investors who value deep institutional alignment, high recurring cash flow, and margin recovery potential, while remaining mindful of cyclical exposure and execution risk. If the cost-savings plan holds and lab market demand rebounds, the stock may offer meaningful upside from current levels.

Name: Thomas L. Carter Jr.

Position: CEO, President, and Chairman

Transaction Date: 08-19-2025 Shares Bought: 41,000 shares an Average Price Paid of $12.00 for Cost: $491,950

Company: Black Stone Minerals L.P. (BSM):

Black Stone Minerals L.P. is one of the largest owners and managers of oil and natural gas mineral assets in the United States, with significant holdings across multiple producing basins. The partnership generates revenue primarily by leasing its mineral interests to exploration and production companies and collecting royalty payments from the resulting oil and gas production.

Thomas L. Carter Jr. has served as Chairman and Chief Executive Officer of the General Partner of Black Stone Minerals L.P. since November 2014, and previously as President until his leave of absence from June 2018 to February 2023. He founded the company’s predecessor in 1998 as well as the original Black Stone Energy Company in 1980. Mr. Carter began his career as a loan officer in the Energy Department of Texas Commerce Bank from 1978 to 1980. He holds both a B.B.A. and an M.B.A. from the University of Texas at Austin.

Opinion: Black Stone Minerals (BSM) stands out as a capital-light, royalty-focused energy play with a massive land portfolio spanning key U.S. basins. While reporting no traditional recurring revenue or retention metrics, its passive royalty model delivers consistent, high-margin cash flows. Q3 2024 earnings showed revenue declines alongside a strong EPS beat, demonstrating cost discipline and acquisition synergy. Insider buying by CEO Thomas L. Carter Jr. and others—between ~$14 and ~$18—signals long-term confidence in value realization. Short interest is minimal (1.3–1.6%), and days to cover hover around 4–6 days, implying subdued bearish sentiment.

Valuation multiples are compelling: a forward P/E below 9x with a dividend yield over 12%. A cautious DCF suggests fair value in the $14–$15 range, offering limited upside relative to current sub-$12 levels. Strengths include scale, durability of royalties, and strategic acquisitions; risks stem from commodity cycles, payout sustainability, and long-term energy transitions. Overall, BSM appeals to value-oriented, yield-seeking investors comfortable with cyclical oil & gas exposure and minimal downside near a solid yield floor.

Name: Vincent J. Intrieri

Position: Director

Transaction Date: 08-18-2025 Shares Bought: 25,000 shares an Average Price Paid of $10.96 for Cost: $274,048

Company: Sandridge Energy Inc. (SD):

SandRidge Energy, Inc., founded in 2006 and headquartered in Oklahoma City, Oklahoma, is an oil and gas company focused on acquiring, developing, and producing oil, natural gas, and natural gas liquids across the U.S. Mid-Continent region.

Vincent J. Intrieri will assume the role of Chairman of the Board of SandRidge Energy, Inc. on October 1, 2024. He is the founder and CEO of VDA Capital Management LLC and previously spent nearly two decades in senior investment leadership positions with Carl C. Icahn–affiliated firms from 1998 to 2016. A graduate of Pennsylvania State University’s Behrend College, Intrieri earned his Bachelor of Science in Accounting with distinction.

Opinion: SandRidge Energy (SD) is a lean, Mid-Continent oil & gas producer distinguished by its debt-free balance sheet, strong free-cash-flow generation, and substantial tax loss carryforwards (~$1.6 billion). Director Vincent Intrieri’s purchase of 25,000 shares at ~$10.96 reflects insider confidence in the stock’s undervaluation. Short interest remains modest (~2.8% of float, ~2.9 days to cover), suggesting low speculative pressure. With a low P/E (~5.2x), a 4.5% dividend yield, and analyst targets near $16 (implying ~50% upside), SandRidge presents a compelling value proposition. Its strengths lie in cost efficiency, cash generation, and shareholder-aligned governance; its risks include commodity cycles and energy transition uncertainties. For value-investors comfortable with cyclical energy names, SD offers a contrarian entry at attractive levels, backed by both fundamentals and insider alignment.

Name: William J. Chase

Position: Director

Transaction Date: 08-20-2025 Shares Bought: 100,000 shares an Average Price Paid of $10.03 for Cost: $1,003,000

Company: Intellia Therapeutics Inc. (NTLA):

Intellia Therapeutics, Inc. is a clinical-stage biotechnology company pioneering the development of CRISPR/Cas9-based therapies. The company focuses on creating first-in-class, transformative medicines that address significant unmet medical needs by harnessing its robust scientific, technological, and clinical expertise. Through innovative gene-editing and delivery approaches, Intellia is setting the standard for a new class of medicine and advancing the promise of CRISPR to expand treatment options for patients worldwide.

William J. (Bill) Chase has served as an Independent Director of Intellia Therapeutics, Inc. since April 2023, bringing more than 30 years of strategic finance leadership in the health sciences industry. Prior to joining Intellia, he was Executive Vice President, Finance and Administration, and Chief Financial Officer of AbbVie, both before and after its spin-off from Abbott Laboratories. Over nearly 25 years at Abbott, he advanced through senior roles, ultimately serving as Corporate Vice President of Licensing and Acquisitions. Mr. Chase earned a bachelor’s degree in finance from the University of Illinois and an MBA from the University of Chicago Booth School of Business.

Opinion: Intellia Therapeutics (NTLA) is a front-runner in in vivo CRISPR gene editing, deploying lipid nanoparticle delivery to directly edit genes within the body. Although it’s pre-commercial, the company benefits from deep partnerships (e.g., with Regeneron), a multi-program pipeline targeting ATTR-CM and HAE, and a robust cash buffer (~$945M) that extends liquidity into late 2026 despite ongoing R&D burn.

Its early-stage trials—showing dramatic TTR reductions—signal potential breakthroughs, but investor optimism is tempered by recent safety concerns and the prolonged timelines inherent in gene therapy development. Analysts remain optimistic, with price targets ranging from $26 up to $67 or more, indicating substantial upside if clinical milestones are met.

NTLA presents a high-risk, high-reward investment: its technologies could create paradigm-shifting one-time therapies, yet regulatory delays, long timelines, and trial uncertainty remain serious threats. For investors aligned with transformative biotech stories rooted in platform innovation, Intellia may offer a compelling asymmetric opportunity—just be prepared for the long haul.

Name: Howard W. Lutnick

Position: Cantor EP Holdings IV LLC, Cantor Fitzgerald L. P., Cf Group Management Inc, 10% Owner

Transaction Date: 08-22-2025 Shares Bought: 900,000 shares an Average Price Paid of $10.00 for Cost: $9,000,000

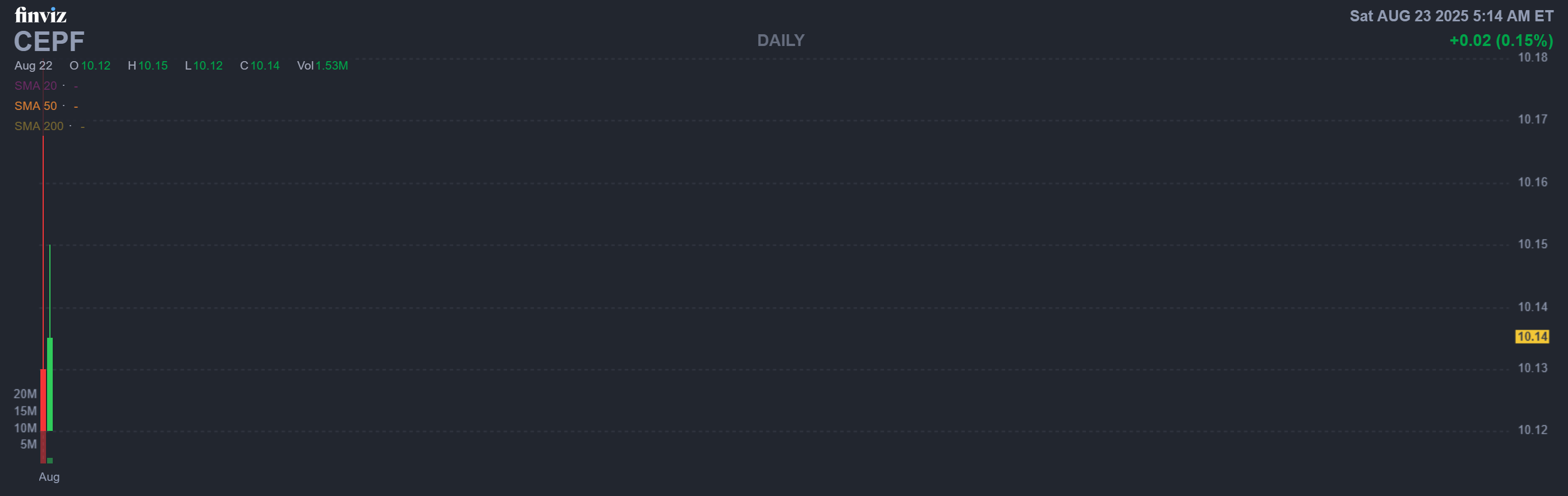

Company: Cantor Equity Partners IV Inc. (CEPF):

Cantor Equity Partners IV, Inc. Founded in 2021 and headquartered in New York, NY, Cantor Equity Partners IV, Inc. is a special purpose acquisition company (SPAC) focused on identifying and executing strategic transactions. Its activities include mergers, share exchanges, asset acquisitions, share purchases, reorganizations, and similar corporate combinations with one or more businesses.

Howard W. Lutnick serves as Director, Chairman, CEO, and 10% beneficial owner of Cantor Equity Partners IV, Inc. and its sponsor, Cantor EP Holdings IV LLC, jointly owned by Cantor Fitzgerald L.P. and CF Group Management Inc. He began his career with Cantor Fitzgerald in 1983, rising rapidly through leadership roles to become President and CEO in 1991 and Chairman in 1996. Lutnick holds a Bachelor of Arts in Economics from Haverford College, earned in 1983.

Opinion: Really incredulous conflict of interest. A SPAC introduced by the current Secretary of Commerce sets a record for potential self dealing by an elected official. We’ve come to expect that with Trump but why not members of his cabinet? At least the public has an opportunity to participate in shady government insider behavior!

Cantor Equity Partners IV Inc. (CEPF) is a newly listed SPAC—backed by Cantor Fitzgerald—raising $400 million through its IPO at $10. The vehicle has no operating business and exists solely to seek a merger or acquisition in industries like tech, healthcare, or digital assets. Trading commenced on August 21, 2025. As of now, it carries no short interest or revenue, and valuation remains at IPO level. Its potential lies entirely in what target it acquires and whether that merger creates value. For investors, CEPF is a high-risk, high-reward proxy tied to SPAC dynamics and execution credibility. If a strong target emerges, upside exists—but otherwise, it may simply revert toward redemption value.

Name: Brady Stewart

Position: Director

Transaction Date: 08-15-2025 Shares Bought: 30,000 shares an Average Price Paid of $6.82 for Cost: $204,486

Company: Evolus Inc. (EOLS):

Evolus Inc. is a global performance beauty company focused on the cash-pay aesthetics market. Serving only licensed practitioners, it offers non-reimbursed aesthetic products, enabling regulatory flexibility and consumer-driven growth. The company drives adoption through loyalty programs, co-branded marketing, special events, and strategic pricing.

Brady Stewart has served as an Independent Director on the Evolus Inc. Board since January 2022. She brings deep expertise in digital innovation and beauty industry leadership, having held senior roles including Chief Commercial Officer at Forma Brands and head of U.S. Direct-to-Consumer operations at Levi Strauss & Co. Earlier in her career, she worked in management consulting and investment at McKinsey & Company and WR Hambrecht & Co. Mrs. Stewart holds a Bachelor’s degree in Comparative Literature from Princeton University and an MBA in Strategy and Operations from Harvard Business School.

Opinion: Evolus (EOLS) is carving its niche in aesthetic neuromodulators with Jeuveau, combining strong unit growth, high reorder rates (~70%), and deep brand engagement via its Evolus Rewards program. Financial health is mixed, with profitability reached in Q2 2024 but balance sheet trends showing declining cash and equity at risk. Insider activity is split: a director made a meaningful buy, yet widespread insider selling suggests caution or personal liquidity. Analysts, by contrast, are highly optimistic, setting price targets as high as $27—implying >2× upside from the current ~$7.6 price. The path forward hinges on scaling operations, managing burn, and expanding product offerings beyond Jeuveau into broader aesthetics. As a speculative play, it suits investors attracted to high-growth beauty trends, but those concerned with cash runway and leadership conviction should tread carefully.

Name: Sajal Srivastava

Position: President and CIO

Transaction Date: 08-20-2025 Shares Bought: 70,567 shares an Average Price Paid of $6.24 for Cost: $440,572

Name: James Labe

Position: Chief Executive Officer

Transaction Date: 08-20-2025 Shares Bought: 70,567 shares an Average Price Paid of $6.24 for Cost: $440,572

Company: TriplePoint Venture Growth BDC Corp. (TPVG):

TriplePoint Venture Growth BDC Corp. is a business development company that provides debt financing and equity investments to venture-backed growth-stage firms. Its financing solutions include growth capital loans, secured and customized loans, equipment financing, revolving loans, and direct equity investments. The company focuses on high-growth industries such as technology, life sciences, and entertainment, with particular emphasis on software, cloud computing, data storage, networking, semiconductors, biotechnology, diagnostics, medical devices, and pharmaceuticals. By offering secured loans, credit facilities, and warrants, TriplePoint supports the growth and expansion of innovative enterprises across diverse sectors.

Sajal Srivastava is the President and Chief Investment Officer of TriplePoint Venture Growth BDC Corp., a role he has held since the company’s founding in 2013 following the IPO of its consulting arm. He co-founded the firm, bringing extensive experience in venture lending and growth financing built during his tenure at Comdisco Ventures and in technology investment banking with Prudential Securities. Mr. Srivastava holds a B.A. in Economics and an M.S. in Engineering Economic Systems and Operations Research from Stanford University.

James P. Labe is the Chief Executive Officer and Chairman of the Board of TriplePoint Venture Growth BDC Corp., a position he has held since the company’s founding in 2013. Widely recognized as a pioneer in venture capital lending and leasing, Mr. Labe previously founded and led Comdisco Ventures, where he managed billions of dollars in lease and loan transactions supporting hundreds of venture-backed companies over a 15-year period. Earlier in his career, he worked at Equitec Financial Group, where he played a key role in shaping the concept of venture leasing. Mr. Labe holds a B.A. from Middlebury College and an Executive MBA from the University of Chicago.

Opinion:

TPVG is a venture debt-focused BDC delivering high yields (~14–15%) by financing growth-stage, VC-backed companies through structured debt instruments often with warrants. Its first-quarter 2025 results underline a stable income stream—$0.27/share net investment income, $0.30/share dividend, and strong NAV ($8.62/share) and liquidity. Insiders, especially President Sajal Srivastava, have been confident, increasing ownership notably.

Nonetheless, sustainability is a concern: the payout ratio exceeds 115%, NAV has been declining since 2021, and short interest is elevated—points to watch if investment returns falter. Valuation at ~6x earnings and 0.7x book suggests potential value upside, provided the firm navigates market headwinds and maintains portfolio quality.

TPVG fits investors seeking income with venture exposure—but they must accept BDC-specific risks, credit cycles, and execution uncertainty. A prudent upside-leaning pick with high yield but significant risk.

Name: Mohamed El-Erian

Position: Director

Transaction Date: 08-18-2025 Shares Bought: 100,000 shares an Average Price Paid of $5.20 for Cost: $519,960

Company: Under Armour Inc.(UA)

Under Armour, Inc. Founded in 1996 and headquartered in Baltimore, Maryland, Under Armour, Inc. is a global leader in performance apparel, footwear, and accessories for men, women, and children. Its product portfolio spans compression, fitted, and loose-fit athletic wear, footwear designed for running, training, basketball, cleated sports, recovery, outdoor, and lifestyle use, as well as accessories including gloves, bags, caps, and socks. Beyond its core product lines, the company drives growth through brand licensing, digital subscriptions, and strategic advertising campaigns. Under Armour reaches consumers worldwide through wholesale distribution, independent partners, institutional sports programs, branded retail stores, and e-commerce platforms across North America, EMEA, Asia-Pacific, and Latin America.

Mohamed A. El-Erian has served on Under Armour, Inc.’s Board of Directors since October 2018, initially as an independent director and later as Lead Director, before being appointed non-executive Chair of the Board in March 2024. A globally respected economist and financial specialist, Dr. El-Erian previously held senior leadership roles as CEO and Co-Chief Investment Officer of PIMCO and currently serves as Chief Economic Advisor at Allianz. He earned a bachelor’s degree in economics from the University of Cambridge, followed by an MPhil and PhD in economics from the University of Oxford.

Opinion:

Under Armour (UAA) is a struggling but iconic sportswear brand undergoing a strategic reset. Revenue slid 9% in FY2025 to ~$5.16 billion, extending a multi-year growth drought (~1% CAGR over five years). The company remains unprofitable, posting a net loss of ~$201 million, although gross margins improved to 47.9%. Management’s turnaround plan involves aggressive SG&A cuts (~40%) and brand refocusing—particularly behind its Curry-brand footwear.

Several board-level insiders recently bought shares (~$5), signaling renewed internal confidence, while short interest remains elevated, reflecting skepticism. A multi-year legal and accounting cloud still hangs overhead despite a $434 M settlement, and the brand continues to battle for relevance against entrenched players. Yet structure and talent persist, and a leaner cost base may pave the way back to profitability.

From a valuation standpoint, Under Armour remains deeply discounted; a cautious DCF suggests fair value in the $7–$9 area—upside exists but depends on execution. Overall, UAA is a high-risk turnaround story—appealing to value investors betting on brand rebound and cost discipline, but investors must be comfortable with cyclicality and historical turbulence.

Listen to our The Insiders Fund Not So Daily Podcast and Follow us on Twitter for real-time commentary and insider buying alerts at https://twitter.com/theinsidersfund

If you are a QUALIFIED INVESTOR and are interested in learning how you can be part of the Insiders Fund, schedule some time with me here.

This blog is solely for educational purposes and the author’s own amusement. IT IS NOT INVESTMENT ADVICE. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

The Insiders Fund and its blogs and posts are not affiliated with, endorsed by, or sponsored by any of the companies mentioned herein. All company names, logos, and trademarks belong to their respective owners. The use of company logos is solely for descriptive and illustrative purposes under fair use. Any information provided is based on publicly available data and should not be considered financial, investment, or legal advice. Readers should conduct their own research or consult with a professional before making any investment decisions. “The hedge fund insomniac guy” is a moniker Harvey Sax, the portfolio manager for The Insiders Fund” has used from time to time on email, blog ,and social media posts. To be clear, The Insomniac Hedge Fund Guy or the Insomniac Hedge Fund” has no explicit or implied financial or any other type of connection to Alpha Wealth Funds beyond the personal branding of its owner, Harvey Sax.

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data, so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified as soon as practically possible. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does. When I have time, over the weekend, I’ll add some preliminary analysis to the Opinion at the end. Sometimes I won’t update this for a couple of weeks or more. A good way to use this blog is as I do, it’s a reference point and filing cabinet for various stocks with notable insider buying. It’s one of many tools I use. I regularly live on Chat GPT, Gemini, Claude, and occasionally Microsoft Copilot. I find the footnotes research very helpful in eliminating errors from AI hallucinations but these opinions are likely to contain inaccuracies due to the nature of the LLM’s.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,