A follow-up to my last comment on spying on elite funds. We begin with an article by Naked Value on Seeking Alpha, Paulson & Co.’s Biggest Buy, Biggest Sell and Top Holdings. You’ll notice that unlike Dodge and Cox, Paulson & Co sold all their Pfizer shares, and initiated a new position in Hewlett-Packard Company (HPQ).

A follow-up to my last comment on spying on elite funds. We begin with an article by Naked Value on Seeking Alpha, Paulson & Co.’s Biggest Buy, Biggest Sell and Top Holdings. You’ll notice that unlike Dodge and Cox, Paulson & Co sold all their Pfizer shares, and initiated a new position in Hewlett-Packard Company (HPQ).Unlike Soros, Paulson & Co is still betting big on gold, owning a significant stake in SPDR Gold Trust (GLD) and expects a continued recovery, and as such it thinks banks like Citigroup (C) will continue to benefit. The fund also owns Anadarko Petroleum Corp (APC) and Transocean Limited (RIG), which is the company Ontario Teachers’ bet on and made a bundle on.

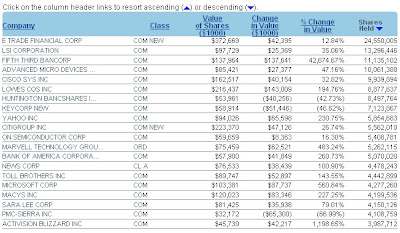

Are you confused? Don’t be. You should be using the tools on the NASDAQ website to slice and dice the portfolios of these elite funds. For example, clicking on the % change in value header at the top of the fourth column will show you Paulson & Co’s new holdings (click on image to enlarge):

Note that apart from Hewlett-Packard mentioned above, Paulson & Co made a significant new investment in Weyerhaeuser (WY), buying up 31,700,200 shares during Q1 2011. Share prices for both companies are well off their highs, and if the fund did their homework, these could yield excellent returns going forward.

Note that apart from Hewlett-Packard mentioned above, Paulson & Co made a significant new investment in Weyerhaeuser (WY), buying up 31,700,200 shares during Q1 2011. Share prices for both companies are well off their highs, and if the fund did their homework, these could yield excellent returns going forward.

When analyzing 13F quarterly filings, it’s important to look at new holdings, not just top holdings. For example, looking at new holdings for Dodge and Cox which I neglected to do in my last comment, you’ll notice that they bought a significant stake in Motorola Mobility (MMI) and Microsoft (MSFT) during Q1 2011 (click on image to enlarge):

Let’s move on to Soros Fund Management. First, start from tickerspy’s hedge funds and click on Soros Fund Management which will bring you to this page. I noticed a significant new holding in Adecoagro (AGRO), a company which engages in the agricultural and agro-industrial businesses in South America. I went on the NASDAQ website, typed in AGRO at the top and then went to detailed institutional holdings which you’ll find on the left-hand side of the blue box. From there, I found Soros Fund Management and looked into their top holdings (click on image to enlarge).

Apart from Adecoagro, which is their top holding reported in Q1 2011, you’ll notice a big increase in their holdings of Motorola Solutions (MSI) and Wells Fargo (WFC).

Apart from Adecoagro, which is their top holding reported in Q1 2011, you’ll notice a big increase in their holdings of Motorola Solutions (MSI) and Wells Fargo (WFC).

Which other company from the list above caught my attention? Dendreon (DNDN) because another well known hedge fund which is in hot water lately, SAC Capital Advisors, owns the most shares of this biotech firm which offers active cellular immunotherapy and small molecule product candidates to treat various cancers.

Which other elite funds own shares of this biotech firm? Montreal’s Sectoral Asset Management, one of the top healthcare funds in the world, as well as Orbimed Advisors, another leading healthcare fund. I also noticed Citadel Advisors who along with SAC and Farallon Capital, is among the best multi-strategy hedge funds. I like seeing this cross-activity among elite funds.

Have a look at the top holdings of SAC Capital Advisors for Q1 2011 (click on image to enlarge):

And here are the top holdings of Citadel Advisors for Q1 2011 (click on image to enlarge):

And here are the top holdings of Citadel Advisors for Q1 2011 (click on image to enlarge):

Pay attention to common holdings among these funds and common sector themes. For example, in semis, Soros is invested in RF Microdevices (RFMD), SAC Capital in Micron Technology (MU) and Citadel Advisors in Advanced Microdevices (AMD). In networking, Soros has a big stake in Extreme Networks (EXTR), SAC Capital in Lucent-Alcatel (LU), and Citadel in LSI Corporation (LSI) and Cisco Systems (CSCO). Also noticed Citadel’s stake in Toll Brothers (TOL), the largest homebuilder (betting on a recovery in housing?).

Pay attention to common holdings among these funds and common sector themes. For example, in semis, Soros is invested in RF Microdevices (RFMD), SAC Capital in Micron Technology (MU) and Citadel Advisors in Advanced Microdevices (AMD). In networking, Soros has a big stake in Extreme Networks (EXTR), SAC Capital in Lucent-Alcatel (LU), and Citadel in LSI Corporation (LSI) and Cisco Systems (CSCO). Also noticed Citadel’s stake in Toll Brothers (TOL), the largest homebuilder (betting on a recovery in housing?).

There are other common themes like software, healthcare, medical devices, financials, business services, energy and one of my favorites, alternative energy. But lately alternative energy has been getting pounded. Just check out this chart of one of my holdings, LDK Solar:

Yuck! But I know the big hedgies are accumulating positions in this and other solars which is why I tell investors to do the same: use these insane selloffs in solar shares to accumulate or initiate positions and hold on for the ride of your life! (IGNORE Jim Chanos’ dire predictions on China and Chinese ADRs!!! Jim has become the claptrap for big hedgies looking to spook investors. Made a great call on Enron, will eat his shorts on China and Chinese solars.)

Yuck! But I know the big hedgies are accumulating positions in this and other solars which is why I tell investors to do the same: use these insane selloffs in solar shares to accumulate or initiate positions and hold on for the ride of your life! (IGNORE Jim Chanos’ dire predictions on China and Chinese ADRs!!! Jim has become the claptrap for big hedgies looking to spook investors. Made a great call on Enron, will eat his shorts on China and Chinese solars.)

I’m running out of gas so let me end by looking at the top holdings of another great fund, Baupost Group, run by the legendary value investor, Seth Klarman. If you want to see a concentrated portfolio, just look at the holdings of this fund (click on image to enlarge):

One of the stocks, PDL Biopharma (PDLI) caught my attention a couple of months ago as I noticed another elite fund, Renaissance Technologies, among the top institutional holders (click on image to enlarge):

One of the stocks, PDL Biopharma (PDLI) caught my attention a couple of months ago as I noticed another elite fund, Renaissance Technologies, among the top institutional holders (click on image to enlarge):

There are many other elite funds that I’ve listed in the past which are not discussed here. Increasingly, there are sector specialists and other funds that specialize in niche strategies. The point of the last two commentaries was to give you the tools to analyze the holdings of these elite funds and allow you to invest more wisely by leveraging off this information. The information is lagged, but when elite funds are increasing their holdings of companies or initiating new positions, it’s typically because they see more upside ahead.

There are many other elite funds that I’ve listed in the past which are not discussed here. Increasingly, there are sector specialists and other funds that specialize in niche strategies. The point of the last two commentaries was to give you the tools to analyze the holdings of these elite funds and allow you to invest more wisely by leveraging off this information. The information is lagged, but when elite funds are increasing their holdings of companies or initiating new positions, it’s typically because they see more upside ahead.

if you want more detailed analysis, just contact me at LKolivakis@gmail.com.

ByLKolivakis