It was a beautiful long weekend in Montreal. I tried to enjoy it as much as possible getting out of the house every chance I got. Even went out with some buddies of mine on Saturday night and came back in the wee hours of the morning. Haven’t stayed up that late in a long time and of course, paid the price on Sunday as I was in a zombie state pretty much all day. One thing about turning 40, you can’t party like your 20 anymore, which is something my trainer reminded me of tonight as he trained me hard and screamed “TO STAY LEAN AND MEAN, NO ALCOHOL!!!”

It was a beautiful long weekend in Montreal. I tried to enjoy it as much as possible getting out of the house every chance I got. Even went out with some buddies of mine on Saturday night and came back in the wee hours of the morning. Haven’t stayed up that late in a long time and of course, paid the price on Sunday as I was in a zombie state pretty much all day. One thing about turning 40, you can’t party like your 20 anymore, which is something my trainer reminded me of tonight as he trained me hard and screamed “TO STAY LEAN AND MEAN, NO ALCOHOL!!!” I promised a follow-up on a few comments I started over the last two weekends, a brief intro to secrets of elite funds and keep on dancing till the world ends. This week, we’re going to delve deeper into this mysterious, secret world of elite funds as we analyze some of their recently released 13-F quarterly filings for Q1 2011. After reading this comment, and the follow-up in Part 2, you’ll be in a better position to understand what elite funds are buying and selling, and more importantly, how to use this information to your advantage.

Let me state flat out, my goal is to educate many investors, not spoonfeed them stocks to buy. Never, ever under any circumstance buy a stock blindly, even if elite funds are loading up on it. All major banks and institutions analyze 13F filings and quite often, these stocks are targeted by naked short sellers, large hedge funds and big bank prop desks which love to manipulate them up and down.

Moreover, as you will see in my follow-up comment in Part 2, I’m a heavy risk-taker. That’s me. I have no risk manager breathing down my neck and do whatever the hell I want with my money. I will ask other people’s advice, but at the end of the day, the buck stops with me and nobody else, just the way I like it (even elite funds have constraints on the positions they take on any one stock) I’ve been beaten, battered, bruised and enjoyed ups and downs, but that’s part of the game when you take inordinate risk in a very concentrated portfolio. I do this because I truly believe that over the long-term this is the way elite funds consistently beat the indexes.

Having said this, just because I am taking huge risk with my money, doesn’t mean I’m always right. I can stomach large swings in my personal portfolio and would never manage an institutional portfolio the same way or advocate that others do the same. For me, sitting in front of a computer all day trading was an extremely humbling and “real world” educational experience. Lots of senior pension fund managers have never traded for a living and they don’t understand the ins and out of trading or managing money. For them, it’s all about theory and the Efficient-Market Hypothesis (EMH). Worse still, some senior managers blindly believe in their risk models and leave no room for Black Swan events (which are occurring more frequently; instead of once every 100 years, it’s once every five years).

Only when you trade stocks, bonds, currencies, commodities and derivatives do you realize how irrelevant EMH is in the real world. The stock market in particular is heavily manipulated by big banks and their big hedge funds clients using multi-million dollar high-frequency trading platforms. Don’t for a second think it’s all clean — there is huge information asymmetry. That’s why I urge all retail investors to go back and carefully read my comment on the big secret where I offer practical advice for most investors to follow.

Also, there a lot of doomsayers who believe the world is about to end. In fact, some preacher made a prediction that it was going to happen yesterday (nothing happened, what a shocker!). Then there are those who blindly believe in “sell in May and go away”. They’re going to be proven wrong too, but for now, it seems like there are plenty of jittery investors worried about the next shoe to fall (just look at the headlines above; click on image to enlarge).

After that long preamble, let’s get to business analyzing the holdings of elite funds. Macro news is just noise; we want to focus on what elite funds are actually buying and selling. Actions speak louder than words.

Let me begin with an article that lifted my spirits up this weekend (no pun intended). UPI reports that Viagra reduces MS symptoms in animals:

Multiple sclerosis symptoms in animals with the disease were drastically reduced by the sexual dysfunction drug Viagra, researchers in Spain say.The study, published in Acta Neuropathologica, showed a practically complete recovery occurred in 50 percent of the animals after eight days of treatment of the drug normally used in the treatment of erectile dysfunction.

Drs. Agustina Garci and Juan Hidalgo of the Universitat Autonoma de Barcelona studied the effects of a treatment using sildenafil — sold under the brand name Viagra — in an animal model of multiple sclerosis.

If given shortly after disease onset, the scientists say they observed the drug reduced the infiltration of inflammatory cells into the white matter of the spinal cord, reducing damage to the nerve cell’s axon and facilitating myelin repair.

Before you dismiss these findings, I already discussed them with my doctor friends and it turns out there is a plausible theory behind this. Viagra is a vasodilator which helps erectile dysfunction (ED) and why it may indeed help MS. Go back to read my comment on the road to liberation to understand the connection and please educate yourself on the benefits of vitamin D as it is quickly becoming linked to all sorts of conditions (check out Google news articles on Vitamin D; best in the form of D-drops in a glass of water, first thing every morning).

What does Viagra have to do with the holdings of elite funds? Why do I still have hard-on for stocks two and half years after I wrote my comment on post-deleveraging blues? Because institutions are stillhorny for hedge funds and still shoving billions into them, allowing them to grow larger and larger. More money flowing into directional hedge funds (L/S equity, global macro, CTA) means you will see wild gyrations in all risk assets, including high beta stocks.

I sent that Viagra article to a friend of mine and think he got a bigger hard-on than me. He owns a boatload of Pfizer stock (PFE) which has done quite well over the last year, going from $14 to nearly $21. Now, look at the top institutional holders as of March 31st, 2011 by clicking in the image below (data is free on Yahoo finance for every stock):

I note that the the world’s largest asset managers own it, Blackrock, Vanguard, Fidelity (FMR), Wellington, but I also noticed Dodge & Cox, one of the best fund managers in the world with a long-term stellar track record. They invest their own money alongside their investors and were out of technology long before the bubble burst in 2001 (it cost them some clients but they all came back).

I note that the the world’s largest asset managers own it, Blackrock, Vanguard, Fidelity (FMR), Wellington, but I also noticed Dodge & Cox, one of the best fund managers in the world with a long-term stellar track record. They invest their own money alongside their investors and were out of technology long before the bubble burst in 2001 (it cost them some clients but they all came back).

So let’s dig deeper in Pfizer. The above just gives you a snapshot; it doesn’t tell you whether Dodge and Cox and other funds were adding to their Pfizer position during Q1 2011. In order to get this information, you go on the NASDAQ website and type in Pfizer’s stock symbol (PFE) at the top, hit enter, which brings you to this page. Scroll down the right hand side and under holdings, click on detailed institutional holdings, which will bring you to this page.

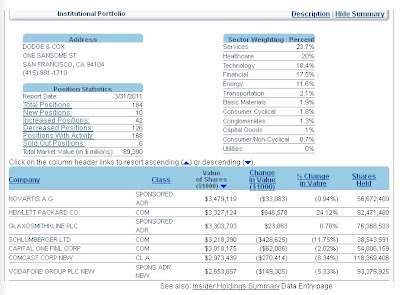

You will find the same funds listed above, along with all the other institutions that hold Pfizer shares, except now you can click on the funds and have a lot more details on all their holdings. I clicked on Dodge and Cox, which is on page 2 of the link above, and it brings me to a page that looks like this (click on image to enlarge):

I then scroll down to Pfizer and can see that they own 104,764,233 shares at the end of Q1 2011 (March 31st, 2011). Moreover, their position was unchanged. The cool thing about the NASDAQ site is that you can click on the headers at the top of each column to get even more information. For example, if you click on shares held, you will see their top holdings in terms of number of shares (click on image to enlarge):

You’ll notice that Dodge and Cox’s top holdings as of March 31st, 2011 are: Sprint Nextel, News Corp, General Electric, Boston Scientific, Comcast, Xerox, Pfizer, Vodafone, Hewlett Packard, Wells Fargo, Aegon, GlaxoSmithKline, Cemex SAB, Merck, Symantec, Time Warner, etc.

You’ll notice that Dodge and Cox’s top holdings as of March 31st, 2011 are: Sprint Nextel, News Corp, General Electric, Boston Scientific, Comcast, Xerox, Pfizer, Vodafone, Hewlett Packard, Wells Fargo, Aegon, GlaxoSmithKline, Cemex SAB, Merck, Symantec, Time Warner, etc.

So what? This shows me that they’re heavy into big pharma now, positioning their portfolio into more defensive names (healthcare is 20% of their holdings) but they also take selective bets in banks (Wells Fargo) and technology (Symantec).

Once you have this information, you can look at the charts, see if price is above the 50-day and 200 day moving average, start tracking these companies and notice whether each dip is being bought and whether the stock keeps making news highs. Again, do not buy any stock blindly, even if elite funds are buying it, but use this publicly available information to start tracking what the elite funds are buying and to help you select a diversified portfolio of companies in all sectors. Or, if you’re a risk-taker like me, you can take more concentrated bets on a few companies.

Think I will end Part 1 here and delve into what other elite funds are buying and selling in my follow-up comment. If you enjoy these stock comments, please show your appreciation by clicking on the PayPal button which says “donate” under the pig at the top of my blog site. I welcome all financial support, large or small (PayPal calls it donation but I’m not a charity, just a blogger who writes on pensions, markets and health).

Finally, if you’re an institution, broker or family office looking to get a lot more detailed breakdown on what each top fund I track closely is buying and selling and which sectors they’re focusing on, then please contact me by email (LKolivakis@gmail.com) and I will be glad to offer you my services for a reasonable fee. I truly believe if you use this information wisely, adding some basic technical and fundamental analysis and money management principles, it will help you gain the advantage you’re looking for.