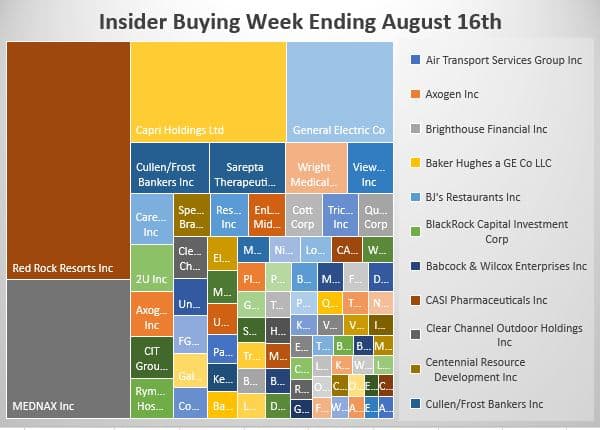

Animal spirits are picking up. This is the most buying we’ve seen since the market sell-off last December. One thing for sure, Insiders buy stocks when they think they are cheap. Highlights are:

- Several insiders bought GE stock immediately prior to and immediately after Harry Markapolis’s interview on CNBC where he alleged fraud.

- Axogen Chairman bought $1 million worth of stock after the company she leads plunged 30% on weaker earnings forecast

- Outdoor billboard leader, Clear Channel newly appointed Chairman bought $913k at $2.28 per share. CCO is loaded with debt.

- Three CIT insiders took advantage of low prices to add to their holdings.

- Insider and CEO John Idol continues to make big bets on Capri Holdings, parent of Versace, Jimmy Choo, and Michael Kors brands.

- COT Director Rosenfield added to his recent large purchase of Canadian beverage company. According to the Washington Service, Rosenfeld two prior buys yielded an average impressive nine-month return of 537.2%.

- Two insiders bought $1.3 million of beleaguered pet care company and home care company, Care.com

- Enlink Midstream Director bought over $1 million of this pipeline company yielding 14.30%! MPLX director bought $513k of this midstream energy infrastructure play yielding 9.8%

- MEDNAX Chairman bought over $10 million of this physician practice management company as it sunk to a twenty-year low.

- Chairman Fertitta bought $18.5 million of Red Rock Resorts as it dips to the lowest price since IPO

- Two insiders bet heavily on this gene therapy Duchenne muscular dystrophy breakthrough biotech Sarepta Therapeutics with the CEO buying $2 million at $123.07.

- Tricida CFO buys $969k at this development stage pharmaceutical tackling metabolic acidosis in chronic kidney disease. The company plans an NDA this quarter. Goldman started ‘potential game-changer’ with a buy and $48 price target on June 27th.

- TWOU education software provider gets a failing grade from Wall Street as stock craters. Two insiders buy over $ 1million worth of stock.

- UAL Director Shapiro reiterates his faith adding $820k to his already aggressive buy history.

- Wright Medical Group pullback brings good entry point says Piper Jaffray analyst Matt O’Brein. Four insiders buy almost $2million worth of stock.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, unintuitive as it may seem, insiders can also be wrong about their Company’s prospects, they can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website.

If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar

#stock #market #money #bitcoin #business #forex #marketing #binaryoptions #wallstreet #cryptocurrency #forextrader #trading #binary #luxurylifestyle #entrepreneur #stockmarket #realestate #billionaire #investor #food #investing #success #iqoption #forexsignals #binaryoptionsignals #usa #invest #workfromhome #forexlifestyle #trader

Great analysis, wow. Thanks for sharing this