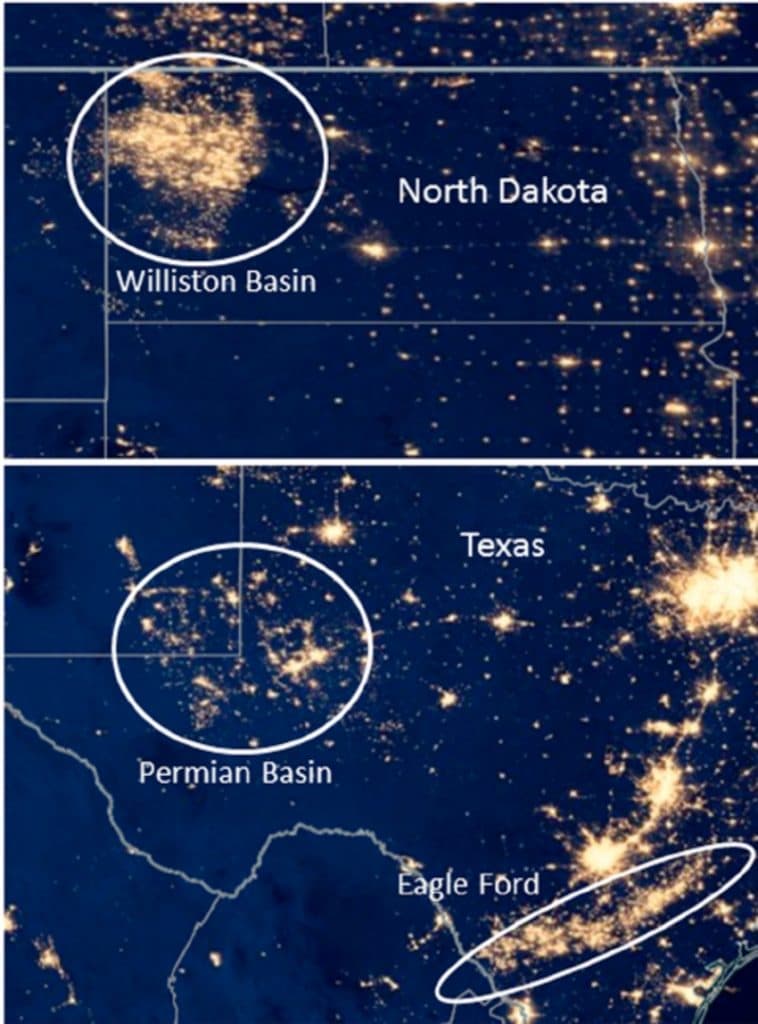

Keynote Day 2 was an unconventional presentation from the unconventional wildcatter Harold Hamm and Tom Petrie, storied oil analyst. Never been more pressure to cut production Harold Hamms said. I think I got that right but that’s a bold statement, cause he survived the Saudi led shale-price busting/collapsing raid in 2016. Petrie remarked that he was surprised at this year’s robust attendance when stock prices were so depressed. My conclusion was miserly loves company combined with a healthy dose of bottom fishing. Hamm sounded a pessimistic note that when he said he heard companies’ promoting investment returns even if oil dropped in the $40s. He scoffed and said that you can’t make money in the $40s, or even $50s. I think that might have been the wake-up call the industry needed to hear. When asked where he would drill for gas, he said he wouldn’t drill at all. It may be thinking about all the nat gas that is flared off in the Permian. That it even had a negative value if you have to pay someone to haul it off. I looked up these satellite photos of nat gas getting flared off. You can really see the enormous magnitude of it. That can’t be good for global warming.

It may also signal the price bottom since rapid U.S unconventional oil exploration has reached the end of the capital markets appetite to risk money on building reserves. It’s all about free cash flow now in the minds of the CEO’s. That was the buzzword and promoted by almost every company CEO or COO presenter. And the reality is that I saw very few that are free cash flow now. It’s all about living within your means and it doesn’t sound like many of them can or will if the price goes much lower. Maybe that’s the kind of message that the Saudis will catch wind of. They would if they read this blog. w It sounds like we’ve reached an equilibrium of maximum pain inflicted upon one another.

Harold Hamm is funny. I wish I head more from him. He wrote the biggest divorce check before Bezos. He’s a showman and a force to be reckoned with no doubt. A kind of quiet redneck with a big stick. I wish I got to ask him a question. He’s bought a ton of stock and I haven’t ever seen any of those buys make money. I’d like to ask him where he gets the money. It’s all in the sales. His one-year average return on his buys was 7% versus 150% on his sales. Why does he bother with the buys? Like I said I wish I heard more from him. He’s a big Trump fan but you can hardly be surprised by that. I think most of the attendees there were in Trump’s corner. Loyal Trump supporters, oil and steel both have negative returns in a year with market returns are in the teens. How long can that last? I wonder if the Democrats get in and punish the oil companies for flaring off all this natural gas in the atmosphere, do you think prices would go up or down. Added costs would have to drive the price up as no one is buying it for kicks.

The Wells Fargo economist predicted the price of oil would be about $50-55 for the next few years. Most oil CEO will refuse to tell you in public where they think the price of oil is. Too many supplies and geopolitical things to consider.

OXY which is very levered and claims to be very shareholder-friendly returning virtually all of its earnings back to the shareholders and claims to be free cash flow but in the footnotes it says at WTI $60 which means that they are not FCF since WTI is below $60. That’s on their powerpoint in the footnotes.

Carl Icahn who has a big position in the stock doesn’t think the Company has been shareholder-friendly at all. That the company is irresponsible to its shareholders by evidence of the lousy stock performance and the deal they gave Warren Buffet for financing money for the Anadarko takeover. Buffett took a risk the banks weren’t willing to take. Taking $8 billion in an 8% preferred is not something the banks were willing to do as OXY’s average bank debt is less than half that rate.

Carl Icahn says an idiot is running Occidental and attacks the female CEO. He says she’s incompetent for paying too much for Anadarko and that the only reason she did it was to save management‘s jobs as Occidental itself was a potential takeover target. You’d never know that from the stock price. It’s been going steadily down, especially so after this deal was announced. There’s a saying from Warren Buffett, invest in a company any idiot can run because eventually, one will. Well here’s one that Warren has invested in and Carl thinks an idiot is running.

I want to research Northern Oil and Gas

My take away line- How come every private family in oil is a billionaire but all the public companies stock prices are stuck where they were 20 yrs ago?

Hope you enjoyed this piece. If you want to keep it coming, send to a friend to keep the author’s morale up. It was a tough conference.