Wright Medical Group (WMGI) is working with financial advisers to explore a sale, Nabila Ahmed and Ed Hammond of Bloomberg reported last night, citing people familiar with the matter. The ankle joint implant maker rose 11% in after-hours trading Friday night to $24.45. The company has made no final decision and could still opt against a potential sale, sources told Bloomberg. Potential acquirers in the space include Stryker (SYK), Johnson & Johnson (JNJ) and Smith & Nephew (SNN), Ahmed and Hammond reported.

I was reviewing our portfolio holdings after the market close on Friday, (embarrassingly counting the money on a very strong day) when I noticed that a position we had a loss in was now soundly profitable. This is when I discovered this late-breaking news after the market close on Friday. I was particularly pleased that we had added to the position earlier in the day as the chart and volume looked technically strong. WMGI represents a healthy 5% weighting in The Insiders Fund.

A little bit about WMGI. From their 10K-“

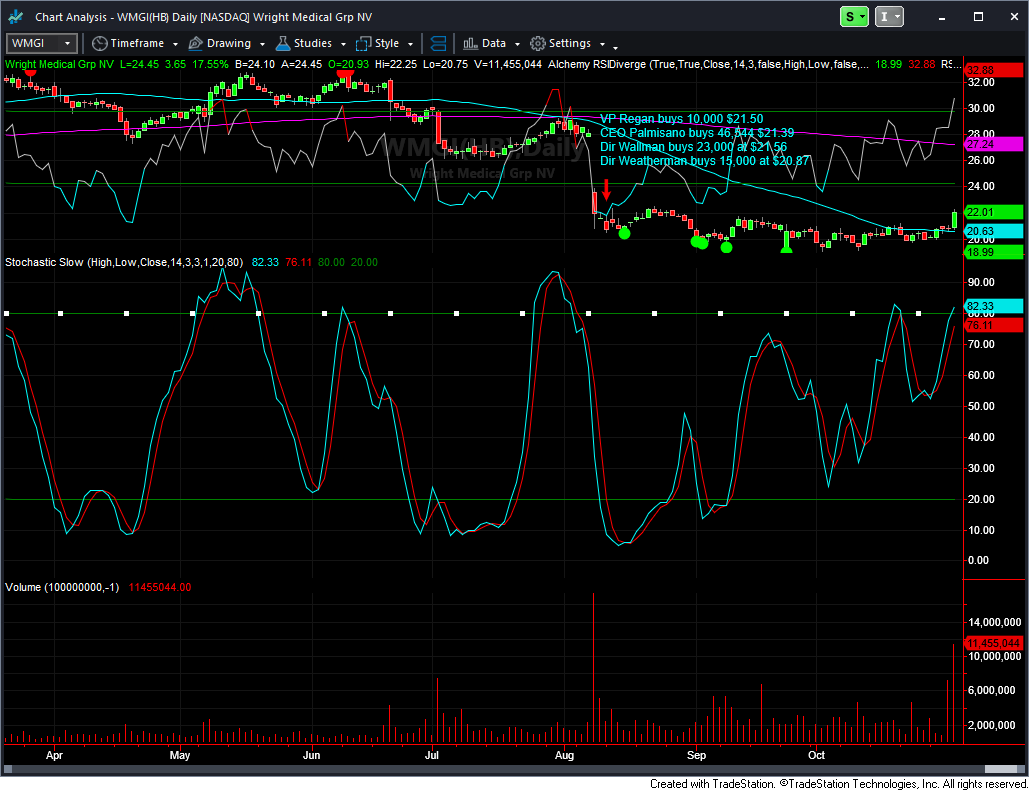

After a disastrous outing on August 8th, 2019 Wright Medical stock plunged 21.6%, to 22, on massive volume. Shares touched their lowest point since May 2018. Meanwhile, the medical devices outlet blamed light quarterly sales on distributor sales of an implant called Cartiva. Cartiva treats arthritis in the big toe. During the quarter, distributors pulled resources away from selling Cartiva, the company said. As a result, Cartiva sales lagged by $2 million. Further, the company’s core U.S. foot and ankle business suffered higher-than-usual turnover, Chief Executive Robert Palmisano said during the company’s conference call with analysts. He described some of the issues facing Wright Medical Group as a “knife fight.”

Four insiders stepped up and bought shares, the largest being the CEO, Palmisano who bought $1 million worth at $21.39 on August 12th. Back in December of 2018, Director Wallman purchased 20,000 shares at $26.83. This kind of buying lends credibility to the Bloomberg article that the company has put itself up for sale. Bloomberg is a reliable source and the citing of two writer’s names lends even more credibility to the headline. One of the things investors have to gauge for themselves is the reliability of the information. One of our core rules of investing is don’t chase hot ideas and rumors. WMGI is definitely a worthwhile speculation, and if the shares don’t spike too much on Monday or in the following days we may add to our already sizeable position.

Bear in mind, they report their 3rd quarter earnings after the close Wednesday, November 6th. This is now a very big event. Management may discredit the Bloomberg report or more likely not comment on it. Either way, analysts will grill them heavily on this news item. Wednesday after the close is going to a very nervous time for Wright Medical investors. Our paper profits may disappear or turn into larger profits depending on this one-day event.

Below are some of the headlines from The Fly on the Wall we have observed. Please note we are doing our own analysis of the value which we will not share to our readers as this would not be fair to the partners in the Fund. To find out more about WMGI, here is a link to their most current investor presentation http://ir.wright.com/static-files/3705283e-1246-40ba-bd83-64170c953d66. I’d also recommend listening to their last recorded earnings presentation. http://ir.wright.com/events/event-details/q2-2019-wright-medical-group-nv-earnings-conference-call

In summary, the analyst community once rated WMGI as high as $36 but like lemmings they all locked stop lowered estimates AFTER the price fall. Now the consensus seems to be about $24. Where do you think the takeout price would be? What if anything is in the pipeline there that would make it special? What is the reasoning behind a potential buyer’s interest? What are the bankers trying to get? Why would management consider a sale at a 52 week low in price? The stock recently traded as high as $32.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, unintuitive as it may seem, insiders can also be wrong about their Company’s prospects, they can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website.

If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar

#insomnicahedgefundguy #stock #market #money #bitcoin #business #forex #marketing #binaryoptions #wallstreet #cryptocurrency #forextrader #trading #binary #luxurylifestyle #entrepreneur #stockmarket #realestate #billionaire #investor #food #investing #success #iqoption #forexsignals #binaryoptionsignals #usa #invest #workfromhome #forexlifestyle #trader #investment #wealthmanagement