For trade details click on this link to the trades

Selecta Biosciences up 23.20%

Carnival Corp up 9.32%

Del Taco Restaurants up 8.61%

CITIGROUP up -0.32%

Director Timothy Springer has been on a buying binge with Selecta Biosciences. This past week alone, Springer purchased 1,887,696 shares at an average price of $2.30 and 3,644,692 shares at $2.62 per share. Between these two buys he shelled out $13.89 Million. That’s on top of the $6 million he spent the prior week buying shares between $1.77-$1.99 a piece. So he more than doubled down on this buy and paid as much as 47% more for the stock. That’s a lot of confidence. So what the heck is going on with Selecta Biosciences? This is a name we have done a lot of work on it and made a lot of money trading it before. All the more remarkable since this stock collapsed in price after we sold it.

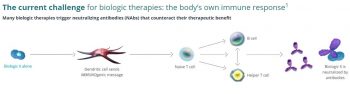

SELB has been pioneering a platform technology they label ImmTor Technology. Its basically a way to deliver biologic therapies and and counter the body’s rejection of these new drugs by neutralizing the antibodies that counteract the therapeutic benefit. The company was featured in the January 2018 issue of Scientific America.

Although the article addressed broad ranges of potential therapy with this approach, Selecta had advanced a treatment for Gout as its primary near term financial objective. Advancing drugs through the phases of drug discovery cost hundreds of millions of dollars and takes years to accomplish. Investors can lose patience and the data behind the trials can disappoint. This is exactly what appears to have happened to Selecta’s main drug, pegasricase, a treatment for chronic refractory gout. This is a debilitating disease that affects approximately 160,000 people in the United States.

SELB had traded as high as $21 per share on the promise of this technology but Selecta Biosciences (SELB) patch to commercial success with pegasricase has been rocky. Several analysts seem to have thrown in the towel with recent downgrades. On October 1 it was downgraded to Neutral from Buy at Mizuho with analyst Difei Yang saying the COMPARE Phase 2 trial data failed to meet its primary endpoint of demonstrating superiority versus competitor Krystexxa with a $2.50 target. Stifel said they see “no reason to buy it here.”

On October 20, Selecta Biosciences, Inc. (NASDAQ: SELB) and Asklepios BioPharmaceutical, Inc. (AskBio) announced that the U.S. Food and Drug Administration (FDA) has granted Rare Pediatric Disease Designation to MMA-101 for the treatment of isolated methylmalonic acidemia (MMA) due to methylmalonyl-CoA mutase (MMUT) gene mutations. The FDA grants Rare Pediatric Disease Designation to incentivize development of new treatments for serious and life-threatening diseases that primarily affect children ages 18 years or younger with fewer than 200,000 people affected in the U.S. The Rare Pediatric Disease designation program allows for a Sponsor who receives an approval for a product to potentially qualify for a voucher that can be redeemed to receive a priority review of a subsequent marketing application for a different product.

So we are left to reading the tea leaves of insider buying. So just who is Timothy Springer? According to SEBL website, “Timothy A. Springer, Ph.D., has served as a member of our board of directors since June 2016 and as a scientific advisor to us since December 2008. Dr. Springer has most recently served as the Latham Family Professor at Harvard Medical School. Dr. Springer was the founder of LeukoSite, a biotechnology company acquired by Millennium Pharmaceuticals in 1999. Dr. Springer is a member of the National Academy of Sciences and his honors include the Crafoord Prize, the American Association of Immunologists Meritorious Career Award, the Stratton Medal from the American Society of Hematology, and the Basic Research Prize from the American Heart Association. Dr. Springer received his Ph.D. from Harvard University.”

Selecta Biosciences may be staging a remarkable comeback although Springer has not always been a great insider to follow. He purchased $6 million worth back in June of 2017 at $17.71. One thing for certain though, the 23.2% gain he notched this latest week is something most investors would like.

Carnival Cruise Lines Director Richard Glasier bought 10,000 shares at $14.05. This was an easy trade up 9.3%. We all know the story here. Cruise lines have been shut down to Covid-19. Carnival is the world’s largest. I think its safe to say there is huge pent up demand and if a vaccine is approved, this group will all have a knee jerk rally. We’d be a buyer of CCL and RCL on an price dips near where insider have been paying up. It’s just a race between a vaccine and bankruptcy at this point.

Del Taco director Ari Levy bought 67,400 shares at $7.49. TACO reported third quarter revenue of $120.8M which met consensus. Comps were up 4.1%. They reported $.16 versus $.10 per consensus. I just tried one of their value meals of fresh Guacamole and Crispy Chicken. It was good but there is a lot of competition in this space. If they can maintain their margins, grow the business some, the stock could be significantly undervalued.

It’s been hard to make money buying bank stocks this year but in recent days, the regional banks have moved nicely. The big banks might not be far behind. Director Jack Lew bought 10,000 shares of CITIGROUP at $44.09. C pays a 4.6% dividend yield so patient investors are earning a lot more than they could in the bank. I’d be a buyer of this name.

Follow us on Twitter for real time insider buying alerts at https://twitter.com/theinsidersfund

[custom-twitter-feeds]

Insiders sell stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer friendly and responsive I’ve used. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believe they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001, when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019

[…] wrote about Selecta last week so we won’t go into it other than to say we traded out of most of the position for a handsome […]