For trade, details click on this link to the trades.

Name Sachs Bruce I

Position: Director

Shares Bought: 15,000 Average Price Paid: $197.91, Cost: $2,968,650

Company: Vertex Pharmaceuticals Inc. (VRTX)

Vertex is a global biotechnology company that invests in scientific innovation to create transformative medicines for people with serious diseases. The company has multiple approved medicines that treat the underlying cause of cystic fibrosis (CF) – a rare, life-threatening genetic disease – and has several ongoing clinical and research programs in CF. Beyond CF, Vertex has a robust pipeline of investigational small molecule medicines in other serious diseases where it has deep insight into causal human biology, including pain, alpha-1 antitrypsin deficiency, and APOL1-mediated kidney diseases. In addition, Vertex has a rapidly expanding pipeline of cell and genetic therapies for diseases such as sickle cell disease, beta-thalassemia, Duchenne muscular dystrophy, and type 1 diabetes mellitus. Founded in 1989 in Cambridge, Massachusetts, their corporate headquarters is now located in Boston’s Innovation District, and their international headquarters is in London, United Kingdom. They currently employ approximately 3,500 people in the United States, Europe, Canada, Australia, and Latin America with nearly two-thirds of their staff dedicated to research and development. Vertex is consistently recognized as one of the industry’s top places to work by Science Magazine, The Boston Globe, Boston Business Journal, and the San Diego Business Journal. Their research and medicines have also received esteemed recognitions, including the Robert J. Beall Therapeutics Development Award, the French Prix Galien, and the British Pharmacological Society awards.

Mr. Sachs joined their Board in 1998 and is the Board’s lead independent director. Mr. Sachs is a General Partner at Charles River Ventures, a venture capital firm he joined in 1999. From 1998 to 1999, he served as Executive Vice President and General Manager of Ascend Communications, Inc. From 1997 until 1998, Mr. Sachs served as President and Chief Executive Officer of Stratus Computer, Inc. From 1995 to 1997, he served as Executive Vice President and General Manager of the Internet Telecom Business Group at Bay Networks, Inc. From 1993 to 1995, he served as President and Chief Executive Officer of Xylogics, Inc.

Opinion: Development biotech companies don’t make money so when they catch on with investor’s imagination, the sky is the limit. When they make that transition to approved products generating revenue, the rules of the game change. Vertex is a mature biotech with $1.79 billion in revenues in the latest quarter. The stock price has faltered and Vertex has been dead money for a year and half. In fact the last time, Sachs bought VRTX on 11-20-20 it was 15,000 shares for $217.36. Vertex was as high as $306 in July of 2020. VanEck Biotech ETF BBH topped out at $178 then and last Friday closed at $214.30 so VRTX has clearly lagged both its own price history plus the biotech group at large. So what gives?

VRTX sold off sharply on June 11th closing $23 lower and 11% from the prior day on news that they had ended the development of a promising liver disease drug VX-864.

Stifel analyst Paul Matteis lowered the firm’s price target on Vertex Pharmaceuticals to $244 from $277 after removing VX-864 from his model following the company announcing it is discontinuing the asset. Given that a first drug was discontinued for safety and this one had a pharmacodynamic effect that was “marginal in the grand scheme of things,” Matteis said he finds it difficult to have conviction that future AAT molecules will perform materially better. However, he keeps a Buy rating on Vertex shares, which he said looked “cheap” at aftermarket trading levels. He still sees substantial growth and “robust barriers-to-entry” in the core cystic fibrosis franchise and while the rest of the pipeline is “early/risky,” he would argue that other assets are for the-most-part free options at current levels.

Cathie Wood’s ARKK bought 108.3k shares on July 21 the day after it was downgraded to underperform from market perform at SVB Leerink with a $170 price target.

They raised guidance on July 29th to $7-2B to $7.4B from prior guidance at $6.7B-$6.9B and beat Q2 earnings with a $3.11 print versus a consensus of $2.28.

All things are relative when it comes to insider buying. Vertex is what they call value biotech. That’s a tough place to be for investors. Development biotech companies don’t make money so when they catch on with investor’s imagination, the sky is the limit. When they make that transition to approved products generating revenue. Phase 2 data for VX-147, a drug for glomerulosclerosis is due 2H 2021 but other than that it’s likely going to be how well the cystic fibrosis franchise holds up. According to the Mayo Clinic:

The FDA has approved these medications for treating CF in people with one or more mutations in the CFTR gene:

- The newest combination medication containing elexacaftor, ivacaftor and tezacaftor (Trikafta) is approved for people age 12 years and older and considered a breakthrough by many experts.

- The combination medication containing tezacaftor and ivacaftor (Symdeko) is approved for people age 6 years and older.

- The combination medication containing lumacaftor and ivacaftor (Orkambi) is approved for people who are age 2 years and older.

- Ivacaftor (Kalydeco) has been approved for people who are 6 months and older.

Sachs is not giving up and neither are we. A Phase 3 trial of Trikafta in children with CF ages 2 to 5 is underway. Vertex Pharmaceuticals, the drug’s manufacturer, has not announced when it will release the results of the trial or when it plans to apply to the FDA for approval for this age group. JP Morgan says beyond the solid commercial execution, pipeline updates sounded an optimistic tone but were not needle moving. …..they acknowledge the concentration risk ….however, VRTX is currently trading below the fundamental value of the CF business alone.

Meanwhile, no one mentions the concentration risk of rocket ship Moderna stock but VRTX gets hammered for it. Not to minimize it, there are always real risks from concentration. Gene therapy replacement treatments have failed but that doesn’t mean they always will. In fact, CRISPR and Vertex are working on a gene-editing therapy in a Phase 1/2 trial as a potential one-time therapy for patients suffering from transfusion-dependent beta thalassemia and severe sickle cell disease. CFTR modulators are also promising.

Name: Rankin R Alex

Name: Rankin R Alex

Position: Director

Shares Bought: 500, Average Price Paid: $192.76, Cost: $96,382

Name: Lloyd Karole

Position: Director

Shares Bought: 1,000, Average Price Paid: $187.90, Cost:$187,904

Company: Churchill Downs Inc (CHDN)

Churchill Downs Incorporated is the parent company of Churchill Downs. The Company has evolved from one racetrack in Louisville, Kentucky, to a multi-American-state-wide, publicly-traded company with racetracks, casinos, and America‘s premier leading online wagering company among its portfolio of businesses. Churchill Downs Incorporated is an industry-leading racing, online wagering, and gaming entertainment Company anchored by an iconic flagship event, the Kentucky Derby. The Company owns and operates three pari-mutuel gaming entertainment venues with approximately 3,050 historical racing machines in Kentucky. It also owns and operates TwinSpires, one of the largest and most profitable online wagering platforms for horse racing, sports, and iGaming in the U.S., and it has seven retail sportsbooks. The Company is also a leader in brick-and-mortar casino gaming in eight states with approximately 11,000 slot machines, video lottery terminals, and 200 table games.

Mr. Rankin has been a director since 2008 and serves as Chairman of the Board. He is also the Chairman of the Board of Sterling G. Thompson Company, LLC (a private insurance agency and broker) and the President of Upson Downs Farm, Inc. (a Thoroughbred breeding and racing operation). He is Vice Chairman and Director of Glenview Trust Company and a member of The Jockey Club. Mr. Rankin is a Trustee and former Chairman of the James Graham Brown Foundation (a private, nonprofit foundation that fosters well-being and quality of life. And the image of Louisville and Kentucky by actively supporting and funding projects in civic affairs, economic development, education and health, and general welfare. Since 1954 has been awarded over 2,680 grants totaling over $450 million). Among other exceptional personal and professional attributes, Mr. Rankin’s expertise in the areas of finance and risk management, as well as his experience in the business of Thoroughbred horse racing, qualify him as a member of the Board of Directors.

Mrs. Lloyd has been a director since 2018 and serves on the Nominating & Governance Committee while also serving as Chair of the Audit Committee. In her 37-year career, Mrs. Lloyd served many of EY’s highest-profile clients through mergers, IPOs, acquisitions, and divestitures across numerous industries, including banking, insurance, consumer products, transportation, real estate, manufacturing, and retail. Mrs. Lloyd is active in the Atlanta community, working with the Metro Atlanta Chamber of Commerce and The Rotary Club of Atlanta. She was previously the Chair of the Atlanta Symphony Orchestra Board of Directors. Mrs. Lloyd supports many colleges and universities throughout the Southeast, including serving on the President’s Advisory Council and the Board of Visitors at the University of Alabama. Mrs. Lloyd qualifies as an Audit Committee Financial Expert, which makes her well-suited for her current role as the Chair of the Company’s Audit Committee and as a member of the Board.

Opinion: These are small, what I would say low conviction buys. They are buys none the less and that’s a welcome thing considering the draught of insider buying. The market should not be all about Meme names and SPAC promoters. It’s good to see some regular old gambling even if its an iconic Churchill Downs.

Name: Hess David P

Name: Hess David P

Position: Director

Shares Bought: 4,400 Average Price Paid: $113.77, Cost: $500,588

Company: Woodward Inc. (WWD)

Woodward, Inc. is an American designer, manufacturer, and service provider of control systems and control system components (e.g. fuel pumps, engine controls, actuators, air valves, fuel nozzles, and electronics) for aircraft engines, industrial engines and turbines, power generation and mobile industrial equipment. Woodward, Inc. was founded as The Woodward Governor Company by Amos Woodward in 1870. Initially, the company made controls for waterwheels (first patent No. 103,813), and then moved to hydro turbines. In the 1920s and 1930s, Woodward began designing controls for diesel and other reciprocating engines and for industrial turbines. Also in the 1930s, Woodward developed a governor for variable-pitch aircraft propellers. Woodward parts were notably used in the GE engine on the United States military’s first turbine-powered aircraft. Starting in the 1950s, Woodward began designing electronic controls, first analog and then digital units For 150 years, Woodward has focused its resources and expertise on delivering proven systems that perform under incredible demands. Their customers have come to rely on them to help them address and solve the challenges associated with global efficiency initiatives – from reducing emissions to increasing energy efficiency, to helping them introduce alternative energy sources.

Mr. David Hess most recently served as the CEO of Arconic Corporation. Prior to Arconic, Mr. Hess served in numerous executive leadership roles during his 38-year career at United Technologies Corporation (“UTC”) including Executive Vice President and Chief Customer Officer for UTC Aerospace, President of Pratt & Whitney, as well as President of Hamilton Sundstrand, the UTC business where he began his professional career in 1979. Mr. Hess also brings extensive boardroom experience at public and private aerospace, defense, and industrial companies. Mr. Hess brings a strong background in senior executive leadership roles in the aerospace & defense sectors. He brings deep industry experience, a proven track record, a collaborative style, and a strong technical background to the board.

Opinion: I like this purchase. Hess is a knowledgeable insider in the businesses that Woodward is in. If he is buying $500k worth of Woodward, the aviation turnaround is probably closer than the market is giving it credit for.

Name: Ludwig Edward J

Name: Ludwig Edward J

Position: Director

Shares Bought: 3,000 Average Price Paid: $79.54, Cost: $238,635

Company: Cvs Health Corp. (CVS)

CVS Health Corporation provides health services in the United States. The company’s Pharmacy Services segment offers pharmacy benefit management solutions, including plan design and administration, formulary management, retail pharmacy network management, mail order pharmacy, specialty pharmacy and infusion, clinical, and disease and medical spend management services. It serves employers, insurance companies, unions, government employee groups, health plans, prescription drug plans, Medicaid managed care plans, plans offered on public health insurance and private health insurance exchanges, other sponsors of health benefit plans, and individuals. This segment operates retail specialty pharmacy stores and specialty mail order, mail order dispensing, compounding pharmacies, and branches for infusion and enteral nutrition services. Its Retail/LTC segment sells prescription and over-the-counter drugs, consumer health and beauty products, and personal care products. It provides health care services through its MinuteClinic walk-in medical clinics. This segment distributes prescription drugs and provides related pharmacy consulting and other ancillary services to chronic care facilities and other care settings. As of December 31, 2020, it operated approximately 9,900 retail locations and 1,100 MinuteClinic locations and online retail pharmacy websites, LTC pharmacies, and onsite pharmacies. The company’s Health Care Benefits segment offers traditional, voluntary, and consumer-directed health insurance products and related services. It serves employer groups, individuals, college students, part-time and hourly workers, health plans, providers, governmental units, government-sponsored plans, labor groups, and expatriates. The company was formerly known as CVS Caremark Corporation and changed its name to CVS Health Corporation in September 2014. CVS Health Corporation was founded in 1963 and is headquartered in Woonsocket, Rhode Island.

Edward J. Ludwig has been a director of Boston Scientific since March 2014. Mr. Ludwig is the former chairman of the board of Becton, Dickinson, and Company (BDX), a global medical technology company, having served in that position from February 2002 through June 2012. He also served as BDX’s chief executive officer from January 2000 to September 2011 and as its president from May 1999 to December 2008. Mr. Ludwig joined BDX as a senior financial analyst in 1979. Prior to joining BDX, Mr. Ludwig served as a senior auditor with Coopers and Lybrand (now PricewaterhouseCoopers), where he earned his CPA, and as a financial and strategic analyst at Kidde, Inc. Mr. Ludwig has been a member since 2013 and is now Chairman of the Board of POCARED, a privately held company focused on infectious disease diagnostics. Mr. Ludwig currently serves as a director of CVS Health Corporation. He formerly served as a director of Xylem, Inc. and as vice-chair of the board of trustees of the Hackensack University Medical Center Network.

Opinion: CVS announced CVS Health announced its plans to acquire Aetna, the 3rd largest health insurer on Dec. 3, 2017. The CVS–Aetna deal is the biggest health care merger in U.S. history.oThe combined entity would form a healthcare giant with more than $245 billion in annual revenue

I suppose the logic to this deal was that Amazon was coming for them and they could compete better with Amazon or whatever might be coming down the pike. Based on stock price action, that hasn’t proven to have done much for shareholders. The stock is almost exactly where it was on the date of the announcement almost 4 years later. On Wednesday last week, the Department of Health and Human Services’ Office of Inspector General (HHS-OIG) is putting Aetna’s Medicare Advantage plans under the microscope.

Management could have done a hundred other things instead of merging with Aetna and I don’t see why I would follow Mr. Ludwig down another rabbit hole.

Name: Kissam Luther C Iv

Position: Director

Shares Bought: 5,000, Average Price Paid: $75.94, Cost: $379,687

Company: DuPont de Nemours Inc. (DD)

DuPont de Nemours, Inc., commonly known as DuPont, is an American company formed by Dow Chemical and E. I. du Pont de Nemours and Company on August 31, 2017, and the subsequent spin-offs of Dow Inc. and Corteva. Before the spinoffs, it was the world’s largest chemical company in terms of sales. The merger has been reported to be worth an estimated $130 billion. With a 2018 total revenue of $86 billion, DowDuPont ranked No. 35 on the 2019 Fortune 500 list of the largest United States public corporations. DuPont is headquartered in Wilmington, Delaware, where it has been incorporated since the founding of the old DuPont in 1802. Within 18 months of the merger, the DowDupont was split into three publicly traded companies with focuses on agriculture (Corteva), materials science (Dow Inc.), and specialty products (DuPont).

For more than 200 years, DuPont has been innovating around you while continually reinventing itself to bring technology-driven solutions to our customers. We are now focused on helping customers advance their best ideas and delivering specialized products and solutions to transform industries and everyday life. From helping electric cars charge faster and go farther to meeting life’s essentials for clean water, we’re around the world, working side by side with industry leaders in safety, healthcare, electronics, mobility, and construction, to help you thrive today.

Luke C. Kissam has been appointed as Director of the Company effective 9/1/2020. Kissam is the former chairman, chief executive officer, and president of Albemarle Corporation, a global specialty chemicals company with leading lithium, bromine, and refining catalysts. Before becoming CEO, he held various leadership positions at Albemarle since joining the company in 2003. He also serves on the board of directors of DuPont de Nemours and Albemarle Corporation and has served on several communities and charitable boards and associations.

Opinion: Dupont probably ranks high in banker’s wet dreams. I’m sure all the mergers and spinoffs put some banker’s children through the best schools and allowed them to buy the finest second and third homes in the world. What has it done for shareholders though besides accumulate ungodly fees? I tried to find what long-term shareholders of Dupont or Dow realized with all the mergers and spinoffs but I couldn’t find anything to show the returns. If they’re not bragging about it, it wasn’t so hot. I’m willing to bet big money they would have been better off buying Albermarle and getting a giant foothold in the lithium business than getting its CEO as a board member.

Name: Parker Stuart B

Position: Director

Shares Bought: 25,000, Average Price Paid: $61.62, Cost: $1,540,570

Company: Kemper Corp. (KMPR)

The Kemper family of companies is one of the nation’s leading specialized insurers. With $14.3 billion in assets, Kemper is improving the insurance world by providing affordable and easy-to-use personalized solutions to individuals, families, and businesses through its Auto, Personal Insurance, Life, and Health brands. Kemper serves over 6.2 million policies, is represented by more than 30,000 agents and brokers, and has 9,500 associates dedicated to meeting the ever-changing needs of its customers. Today’s Kemper Corporation was initially founded as Unitrin, Inc. in April 1990, when it was spun off from Henry Singleton’s conglomerate Teledyne. Singleton expected the new venture to duplicate the successful spin-off of the Argo Group, originally a worker’s compensation insurance provider, created in 1986. Argonaut’s original $20 per share stock appreciated 240 percent by 1990. Singleton remained Chairman of Unitrin after it was spun off to shareholders at $31.25 per share, trading on NASDAQ. Unitrin divided its business into three major categories: life and health insurance, property and casualty insurance, and consumer finance, which covered various services, including automobile and industrial loans. In 2002, Unitrin purchased the renewal rights for the homeowners and automobile insurance lines of Kemper Insurance, a long-time Chicago insurance, and financial services firm. In 2010, Unitrin purchased all rights to the Kemper name and began operations as Kemper Corporation on August 25, 2011, trading on the New York Stock Exchange under the KMPR ticker symbol.

Stuart Parker serves as Director of the Company. Parker served as Chief Executive Officer for USAA from 2015 until his retirement in February 2020. He spent more than 21 years with USAA in roles including Chief Operating Officer, Chief Financial Officer, President of the Property & Casualty Insurance Group, and President of Financial Planning Services. Parker was a distinguished graduate of the Air Force ROTC program and served in the U.S. Air Force for nearly 10 years, serving in Operations Desert Shield and Desert Storm.

Opinion: What the heck happened to Kemper? The stock is down 24% from its May high of $84. Management is blaming it on higher automobile accidents from the reopening of the economy. Considering much of this was in Florida where the economy never really shut down, the street doesn’t seem to be buying management’s excuse, ” The pandemic’s re-opening is happening faster than projected, resulting in a significant increase in auto frequency and severity. Although these effects were mostly anticipated, the speed of the re-opening magnified their financial impact in this quarter’s results. In addition, severity was impacted by social inflation creeping into lower-limit policies and Florida personal injury protection court rulings that impacted multiple policy years. As a result, the Specialty P&C segment generated an as adjusted underwriting loss of $60 million and an as adjusted underlying combined ratio of 106%. We believe this to be short-term in nature extending a few quarters while we take appropriate corrective measures. ”

This is Parker’s biggest purchase ever at the Company. So what gives? I don’t see the rationale for pandemic-related causes as auto insurer Allstate sure seems to be doing well in this environment. And it’s not particularly assuring appointing the President and CEO, Lacher, with the additional title of Chairman. On July 29th, they reported:

- Reports Q2 (Jun) loss of $1.54 per share, excluding non-recurring items, $2.91 worse than the S&P Capital IQ Consensus of $1.37; revenues rose 26.3% year/year to $1.46 bln vs the $1.36 bln S&P Capital IQ Consensus.

- Kemper ended the quarter with a book value per share of $67.67, a decrease of 3 percent from $69.74 at the end of 2020.

Perhaps it’s the low ratio of stock price to book value that Kemper is trading at that appears to Parker. There are not many companies out there you can buy for book. I would take a swing at KMPR meaning swing trade. It should be a relatively painless swing back to the 50 day moving average at $70.54. After that, I’d need a better reason to own it not trade it.

Name: Haughie Alan

Name: Haughie Alan

Position: CFO

Shares Bought: 12,470, Average Price Paid: $55.94, Cost: $697,556

Company: Louisiana-pacific Corp (LPX)

Louisiana-Pacific Corporation, commonly known as “LP,” is an American building materials manufacturer. It was founded in 1973 and is currently based in Nashville, Tennessee. LP pioneered the U.S. production of oriented strand board (OSB) panels. Today, LP is the world’s largest producer of OSB and manufactures engineered wood building products.LP products are sold to builders and homeowners through building materials distributors, dealers, and retail home centers. As a proven leader in high-performance building solutions, LP Building Solutions manufactures uniquely engineered, innovative building products that meet the demands and needs of the building industry. Its extensive product portfolio includes durable and dependable exterior siding and trim systems, engineered wood framing and structural panels for single-family homes, multifamily projects, repair & remodel markets, light commercial facilities, and outdoor buildings. LP also provides industry-leading service and warranties to help customers build more innovative, better, and faster. For more information, visit LPCorp.com. Its extensive offerings include innovative and dependable building products and accessories, such as ® SmartSide® Trim & Siding, LP Structural Solutions portfolio (LP WeatherLogic® Air & Water Barrier, LP Legacy® Premium Sub-Flooring, LP® TechShield® Radiant Barrier, LP® FlameBlock® Fire-Rated Sheathing and more), oriented strand board (OSB), LP® TopNotch® Sub-Flooring, LP, LP® Outdoor Building Solutions®, and LP Elements® Performance Fencing. In addition to product solutions, LP provides industry-leading service and warranties. Since its founding in 1972, LP has been Building a Better World™ by helping customers construct beautiful, durable homes. Headquartered in Nashville, Tennessee, LP operates 25 plants across the U.S., Canada, Chile, and Brazil.

Alan J. M. Haughie serves as Chief Financial Officer, Executive Vice President of the Company. From 2013 to 2017, he was Senior Vice President and Chief Financial Officer of ServiceMaster Global Holdings Inc., a Fortune 1000 public company that provides residential and commercial services. From 2010 until 2013, Mr. Haughie served as Senior Vice President and Chief Financial Officer of Federal-Mogul Corporation.

Opinion: The homebuilder ETF XHB hit its high back in May and has been undergoing a 3-month consolidation. Meanwhile, LPX topped out in March. Goldman Sachs analyst Susan Maklari initiated coverage of Louisiana-Pacific around July 15th with a Sell rating and $54 price target. The analyst initiated coverage of building products with a cautious outlook saying wood products face near-term pressures. As capacity ramps and input costs decline, along with near-term moderation in consumer demand, lumber and related commodity prices should adjust lower. Given this operating backdrop, the analyst looks for the stocks that are most commodity-exposed to underperform. Her analysis shows Louisiana-Pacific has historically moved in line with changes in woods prices.

Haughie has been biding his time looking for this pullback in price. CFO stock purchases are my favorite insider buy. The Company on August 3rd reported Q2 revenue of $1.17B, consensus of $1.3B. “All of LPX’s segments overcame tightening supply chains to set records for sales and EBITDA in the second quarter of 2021, resulting in $4.74 in adjusted diluted earnings per share,” said Chairman and CEO Brad Southern. “Siding sales grew by 39% and higher OSB prices resulted in extraordinary cash flow. The Siding capacity expansion project at Houlton is underway and on schedule, and Peace Valley pressed its first OSB board since restarting in late June.” I’m going with the CFO and not Goldman on this call. LPX is a buy.

Name: Taylor David S

Position: Director

Shares Bought: 5,000, Average Price Paid: $39.30, Cost: $196,485

Company: Delta Air Lines Inc. (DAL)

Delta Air Lines, Inc., typically referred to as Delta, is one of the major airlines of the United States and a legacy carrier. It is headquartered in Atlanta, Georgia. The airline, along with its subsidiaries and regional affiliates, including Delta Connection, operates over 5,400 flights daily and serves 325 destinations in 52 countries on six continents. Delta is a founding member of the SkyTeam airline alliance. Delta has nine hubs, with Atlanta being it’s most significant in terms of total passengers and number of departures. It is ranked second among the world’s largest airlines by the number of scheduled passengers carried, passenger-kilometers flown, and fleet size. It is ranked 69th on the Fortune 500. The company slogan is “Keep Climbing.

Delta Air Lines (NYSE: DAL) is the U.S. global airline leader in safety, innovation, reliability, and customer experience. Powered by their employees worldwide, Delta has led the airline industry in operational excellence for a decade while maintaining our reputation for award-winning customer service. Today, nothing is more important than the health and safety of their customers and employees. Since the onset of the COVID-19 pandemic, Delta has moved quickly to transform the industry standard of cleanliness while offering customers more space across the travel journey. These and numerous other layers of protection ensure a safe and comfortable travel experience for our customers and employees. With its mission of connecting the people and cultures of the globe, Delta strives to foster understanding across a diverse world and serve as a force for social good.

Delta Air Lines’ board of directors today announced David Taylor as its newest member. Mr. Taylor is currently Chairman of the Board, President, and Chief Executive Officer of The Procter & Gamble Company. He has been President and CEO since 2015 and was elected Chairman of the Board in 2016. Taylor has held numerous positions of increasing responsibility including, Group President-Global Beauty, Grooming & Health Care, Group President-Global Health & Grooming, Group President-Global Home Care, and President-Global Family Care. Mr. Taylor currently serves as Chair of the Alliance to End Plastic Waste and serves on the Board of Directors of the U.S.-China Business Council, The Consumer Goods Forum, and Catalyst. He is a member of the Business Roundtable and the Board of Visitors at Duke University’s Fuqua School of Business.

Opinion: Small buy but the airlines can make you money. I wouldn’t buy Delta though if I was going to buy an airline. It would be Southwest with its much better balance sheet. I think the airlines were mortally wounded by the US Government bailouts requiring them to fly empty planes if they wanted any money in order to survive the Pandemic. Southwest took the least Federal dole and will come out of this even stronger than they were compared to the other airlines. I’m not buying Delta but we have an order in to buy LUV Monday morning at Friday’s closing price. The Delta variant resurgence of Covid has hammered all the airline stocks and I think we are closer to the end than the market is pricing in now.

Name: Rales Mitchell P

Name: Rales Mitchell P

Position: Director

Shares Bought: 250,200 Average Price Paid: $46.19, Cost:$11,555,995

Company: Colfax CORP. (CFX)

Colfax Corporation is an American corporation manufacturing welding, air and gas handling equipment, and medical devices headquartered in Annapolis Junction, Maryland. Indexed on the NYSE, the company was originally founded as a spinoff from the American conglomerate Danaher Corporation. In 2011, Colfax acquired British Charter International PLC, which in turn owned Swedish ESAB (8,500 employees worldwide, 2012). Both companies have since been wholly owned by Colfax. Further Colfax also acquired Allweiler (2,100 employees worldwide, 2011). The company made its largest acquisition ever in November 2018, buying medical device company DJO Global for $3.15 billion.

Colfax Corporation was started in 1995 by Steven and Mitchell Rales, two brothers who had previously created Danaher Corporation, growing it from a group of discrete manufacturing businesses to a leading science and technology innovator with a market value of more than $100 billion. Embracing the successful Danaher approach, the Colfax team embarked on a journey to build a world-class global enterprise by acquiring good businesses and improving and expanding them to create great businesses. Their first acquisitions, including IMO Industries, Inc. and Allweiler AG, joined together to become a high-performance pumps company called Colfax Fluid Handling.

Mitchell P. Rales is a co-founder of Colfax and has served as a director of the Company since its founding in 1995. He is the Chairman of our Board of Directors. He has been a principal in a number of private business entities with interests in manufacturing companies and publicly traded securities for over 25 years. Mr. Rales was instrumental in the founding of our Company and has played a key leadership role on our Board since that time. He helped create the Danaher Business System, on which the Colfax Business System is modeled, and has provided critical strategic guidance to the Company during its development and growth.

Opinion: Rales brothers are the financial geniuses behind Danaher. It’s stupid not to bet with them when they give you an opportunity. I’m all in on Colfax.

Name: Michaels Steven A

Name: Michaels Steven A

Position: CEO

Shares Bought: 7,500 Average Price Paid: $42.91, Cost: $321,825

Company: PROG Holdings Inc. (PRG)

PROG Holdings, Inc. (NYSE: PRG) is a financial technology holding company based in Salt Lake City, Utah with three business segments: Progressive Leasing, which offers lease-to-own transactions primarily to credit-challenged consumers through e-commerce and point-of-sale retail partners, via online, mobile, and in-store solutions; Vive Financial, which provides consumers who may not qualify for traditional prime lending with a variety of second-look, revolving credit products through private label and branded credit cards; and Four Technologies, which provides consumers of all credit backgrounds Buy Now, Pay Later (BNPL) options through four interest-free installments via its platform, Four.

Progressive Leasing provides consumers with lease-purchase solutions for merchandise, including furniture, appliances, electronics, jewelry, mobile phones and accessories, mattresses, and automobile electronics and accessories from leading traditional and e-commerce retailers (whom we refer to as our point-of-sale partners or “POS partners”). Progressive Leasing purchases from its POS partners the merchandise desired by customers and, in turn, leases the merchandise to the customers through a lease-to-own transaction. Progressive Leasing’s technology-based, proprietary decisioning platform offers prompt lease decisioning at the point-of-sale and is integrated with both traditional and e-commerce POS partners. Progressive Leasing provides customers with transparent and competitive lease payment options along with flexible terms, intended to help customers achieve merchandise ownership, including through low initial payments and early buyout options. The lease-to-own transactions also benefit Progressive Leasing’s POS partners by generating incremental sales with credit-challenged consumers who typically would not have qualified for financing offers traditionally provided by these retailers. Progressive Leasing has funded over 10 million leases since its inception in 1999.

Steve Micheals Was Named Chief Executive Officer Of Prog Holdings, Inc. In December 2020, And President Of The Company In April 2021. Mr.Michaels, Who is Also A Member Of Prog Holdings Board Of Directors, Previously Served As Ceo Of The Company’s Progressive Leasing Segment, And As Chief Financial Officer And President Of Strategic Operation, Vice President Of Strategic Planning & Business Development, And Vice President Of Finance At Aaron’S Inc.

Opinion: Salt Lake City has spawned several fintech companies and lease to own seems to be an area of interest for diverse set of tech giants from Apple to Square. Square just announced its plans to acquire Afterpay for $29 billion in stock. Galileo Financial Technologies was acquired by SoFi for $1.2 billion.

Apple Inc. is working on a new service with Goldman that will let consumers pay for any Apple Pay purchase in installments over time, rivaling the “buy now, pay later” offerings popularized by services from Affirm Holdings Inc. and PayPal Holdings Inc.

So if this area is so hot, why is PRG Holdings a dud? It’s obvious that PRG is being viewed as a company that takes on the credit risk from its subprime customer base and not a classic fintech. That’s certainly understandable as its basically a spin-off from Aaron’s, the Atlanta-based furniture lease to own company that pioneered the whole concept.

On July 29, 2020, Aaron’s Holdings Company, Inc. (NYSE: AAN, $61.36, Market Capitalization: $4.1 billion) a leading omni-channel provider of lease-purchase solutions, announced its intention to separate into two independent, publicly-traded companies: PROG Holdings, Inc (Progressive PGR +1.6% Leasing and Vive Financial) and The Aaron’s Company, Inc. (Aaron’s Business segment). On November 17, 2020, Aaron’s Holdings Company, Inc. announced additional details of the separation. Post spin-off, Aaron’s Holdings will be renamed as PROG Holdings, Inc., while the spun-off unit that will hold the Aaron’s business segment will be named as The Aaron’s Company, Inc. Both the entities will trade on NYSE under the symbols “PRG” and “AAN”, respectively. Headquartered in Draper, UT, PROG Holdings, Inc will comprise of the company’s current Progressive business segment and Vive Financial. On the other hand, The Aaron’s Company, headquartered in Atlanta, GA, will comprise of ~1,400 company-operated and franchised stores in 47 US states and Canada, the e-commerce platform Aarons.com and Woodhaven Furniture Industries.

I don’t like complicated stories and neither does the street. We’ll pass on this for now.

Name: Smith Douglas Irvine

Name: Smith Douglas Irvine

Position: Director

Shares Bought: 10,117, Average Price Paid: $38.46, Cost: $389,100

Name: Michel John

Position: CFO

Shares Bought: 8,000, Average Price Paid: $37.75, Cost: $302,000

Name: Patterson Mark Robert

Position: Director

Shares Bought: 2,000 Average Price Paid: $37.50, Cost: $75,000

Company: HomeStreet Inc. (HMST)

HomeStreet, Inc. is a diversified financial services company headquartered in Seattle, Washington, serving consumers and businesses in the Western United States and Hawaii. The Company is principally engaged in real estate lending, including mortgage banking activities, and commercial and consumer banking. Its principal subsidiaries are HomeStreet Bank and HomeStreet Capital Corporation. HomeStreet Bank is a member of the FDIC and an Equal Housing Lender. HomeStreet Bank is one of the largest community banks in Northwest, California, and Hawaii. Since they began in 1921, they’ve stayed focused on what they believe is most important: building long-term relationships with their customers and providing ongoing support to their communities. They offer a full range of financial services including commercial banking, commercial lending, consumer banking, mortgage lending, residential construction financing, commercial real estate financing, and insurance services. Their primary area of community focus is housing and homes. HomeStreet also supports organizations where their employees have an integral involvement. HomeStreet is an Equal Housing Lender and makes mortgage loans without regard to race, color, religion, national origin, sex, handicap, or familial status. Member FDIC

Douglas I. Smith is an Independent Director of HomeStreet Inc. r. Smith is a director of and has worked for Miller and Smith Inc., a privately held residential land development and home building company in metropolitan Washington, D.C. since 1992, and has served as its president since 2002. He is also the managing member of Miller and Smith LLC, and Silent Tree Partners LLC, both of which invest in real estate development and management of those development projects. He has also been a board member of HomeAid Northern Virginia since 2001.

John M. Michel serves as Chief Financial Officer, Executive Vice President of the Company. He has been the Executive Vice President and Chief Financial officer of First Foundation, Inc. and its banking subsidiary First Foundation Bank since September 2007, and oversaw that company’s initial public offering and significant growth in assets. Mr. Michel has also served as Chief Financial Officer of First Foundation Advisors since January 2009. He was Chief Financial Officer of Sunwest Bank from February 2005 to October 2006 and was Chief Financial Officer of Bank Plus Corporation and its subsidiary Fidelity Federal Bank from September 1998 to December 2001. Mr. Michel started his career as a certified public accountant (inactive) at Deloitte & Touche from 1981 to 1989.

Mark Robert Patterson serves as Independent Director of the Company. Mr. Patterson served as Managing Director and Equity Analyst of NWQ Investment Management Co., LLC, an investment management company, from 1997 until his retirement in 2014. At NWQ, he conducted fundamental research and valuation analysis of public companies within the financial services sector. He also performed detailed valuation and capital planning financial analysis that informed the company’s strategic direction. Before that position, Mr. Patterson served as a financial analyst in the U.S. Bank’s Financial Consulting Division/Planning & Forecasting Department. He is a Chartered Financial Analyst and holds an MBA from The Anderson School at UCLA and a bachelor’s degree in business & mathematics from Linfield College.

Opinion: I love it when there are cluster insider buys. I can see them all sitting around their desks and virtual Zoom meetings bemoaning the stock price. HomeStreet was up 6% for the week leading this last group of insider buys. It just goes to show you what a little conviction can do to reassure fickle shareholders. Bank stocks also had a nice day on last Friday’s employment report.

Name: Rady Ernest S

Position:CEO Chairman 10% Owner

Shares Bought: 19,940 Average Price Paid: $37.62, Cost: $750,127

Company: American Assets Trust Inc. (AAT)

American Assets Trust, Inc. is a full-service, vertically integrated, and self-administered real estate investment trust, or REIT, headquartered in San Diego, California. The Company has over 50 years of acquiring, improving, developing, and managing premier office, retail and residential properties throughout the United States in some of the nation’s most dynamic, high-barrier-to-entry markets primarily in Southern California, Northern California, Oregon, Washington, and Hawaii. The Company’s office portfolio comprises approximately 3.4 million square feet, and its retail portfolio comprises approximately 3.1 million rentable square feet. In addition, the Company owns one mixed-use property (including approximately 97,000 rentable square feet of retail space and a 369-room all-suite hotel) and 2,112 multifamily units. In 2011, the Company was formed to succeed the real estate business of American Assets, Inc., a privately held corporation founded in 1967 and, as such, has significant experience, long-standing relationships, and extensive knowledge of its core markets, submarkets, and asset classes.

Mr. Rady has served as Chairman of their Board of Directors and Chief Executive Officer since September 2015. From their initial public offering in January 2011 to September 2015, Mr. Rady served as their Executive Chairman of their Board of Directors. Mr. Rady has over 40 years of experience in real estate management and development. Mr. Rady founded American Assets, Inc. in 1967 and currently serves as president and chairman of the board of directors of American Assets, Inc. In 1971, he also founded Insurance Company of the West and Westcorp, a financial services holding company. From 1973 until 2006, Mr. Rady served as chairman and chief executive officer of Westcorp. He served as chairman of Western Financial Bank from 1982 until 2006 and chief executive officer of Western Financial from 1994 until 1996 and from 1998 until 2006.

Opinion: Rady buys his company’s stock just about every month. It’s not on the 10b5-1 preplanned buying program either. It’s hard to make much sense of this. Why doesn’t he just get it over with and buy the company?

Name: Richards Christine P

Position: Director

Shares Bought: 5,000 Average Price Paid: $27.24, Cost:$136,200

Company: Spirit Airlines Inc. (SAVE)

Spirit Airlines, Inc. (stylized as spirit) is an American ultra-low-cost carrier headquartered in Miramar, Florida, in the Miami metropolitan area. Spirit operates scheduled flights throughout the United States and in the Caribbean and Latin America. Spirit Airlines is committed to delivering the best value in the sky. The company is the leader in providing customizable travel options starting with an unbundled fare. It allows its Guests to pay only for the options they choose – like bags, seat assignments, and refreshments – something Spirit Airlines calls Á La Smart. The company makes it possible for its Guests to venture further and discover more than ever before. Its Fit Fleet® is one of the youngest and most fuel-efficient in the U.S. Spirit Airlines serves destinations throughout the U.S., Latin America, and the Caribbean and is dedicated to giving back and improving those communities.

Christine P. Richards is on Spirit Airlines, Inc.; Christine P. Richards’s career spanned 33 years with FedEx Corporation in various roles, including Executive Vice President, General Counsel, and Secretary from 2005 until she retired from FedEx in 2017. Before that position, Ms. Richards had responsibility in diverse areas, including strategic transactions, fleet and supply chain, customer support, and government and regulatory matters. Before joining FedEx, Ms. Richards was in private law practice. She serves on several non-profit boards, including the Tennessee State Collaborative on Reforming Education and the Fuqua School of Business Board of Visitors at Duke University.

Opinion: Spirit is canceling flights faster than any airline in recent memory. “This is not our proudest moment, ” Spirit Airlines CEO said. Small buy but when all the airlines have retreated I’d pick up LUV before Spirit.

Name: Mckeon Brian P

Name: Mckeon Brian P

Position: Director

Shares Bought: 10,000 Average Price Paid: $26.43, Cost: $264,269

Company: Alkermes plc. (ALKS)

Alkermes focuses on the development of innovative medicines that seek to address the unmet needs of people living with serious mental illness, addiction, and cancer. As a fully integrated, global biopharmaceutical company, they apply their scientific expertise and proprietary technologies to develop products that are designed to make a meaningful difference in the way patients manage their disease. They are inspired by some of the most pressing public health challenges of their time to help advance innovation with the potential to improve treatment options and outcomes for patients. Beyond their important mission of developing medicines, they believe it is their responsibility to take a holistic approach as they seek to support patients, caregivers, and broader impacted communities. In this context, they also work to help support and enhance the systems through which these complex diseases are treated. They are committed to patient engagement, disease education and awareness, and advocacy for important policies that support equitable access to quality treatment. Headquartered in Dublin, Ireland, we have an R&D center in Waltham, Massachusetts; a research and manufacturing facility in Athlone, Ireland; and a manufacturing facility in Wilmington, Ohio.

Mr. McKeon serves as the Executive Vice President, Chief Financial Officer, and Treasurer of IDEXX Laboratories, Inc. (“IDEXX”), a public multinational corporation. He leads IDEXX’s Finance, Corporate Development, and Strategy, and Investor Relations functions and oversees IDEXX’s livestock, water, and human diagnostics businesses. Mr. McKeon served on the Board of Directors of IDEXX from 2003 to 2013. Prior to joining IDEXX, Mr. McKeon served as Executive Vice President and Chief Financial Officer of Iron Mountain Incorporated from 2007 to 2013 and as Executive Vice President and Chief Financial Officer at the Timberland Company from 2000 to 2007. Prior to these roles, he held several finances and strategic planning roles at PepsiCo Inc., serving most recently as Vice President, Finance, at Pepsi-Cola, North America. Mr. McKeon previously served as a Director of Athena Health, Inc. from September 2017 to February 2019.

Opinion: ALKS moved up sharply on this insider buy. Mizuho analyst Vamil Divan keeps a Buy rating on Alkermes with a $33 price target after the company’s oncology asset nemvaleukin alfa was granted FDA Fast Track designation for the treatment of mucosal melanoma. The designation highlights the FDA’s view that the drug has the potential to treat a serious condition and address an area where there is an unmet medical need, Divan tells investors in a research note. Alkermes shares have done well, but there is room for additional upside as nemvaleukin proceeds through registrational trials and investors give the rest of the story “proper credit,” says the analyst.

I would not chase it, nor would I buy it with better opportunities like VRTX.

Name: De Schutter Richard U

Name: De Schutter Richard U

Position: Director

Shares Bought: 10,000, Average Price Paid: $25.01, Cost: $250,123

Company: Bausch Health Companies Inc. (BHC)

Bausch Health Companies Inc. (formerly Valeant Pharmaceuticals) is a multinational specialty pharmaceutical company based in Laval, Quebec, Canada. It develops, manufactures, and markets pharmaceutical products and branded generic drugs, primarily for skin diseases, gastrointestinal disorders, eye health, and neurology. Bausch Health owns Bausch & Lomb, a supplier of eye health products. Bausch Health Companies Inc. (NYSE/TSX: BHC) is a global company that develops, manufactures, and markets a range of pharmaceutical, medical device, and over-the-counter products, primarily in the therapeutic areas of eye health, gastroenterology, and dermatology. They are delivering on their commitments as they build an innovative company dedicated to advancing global health. Approximately 22,000 employees are united around their mission of improving people’s lives with their health care products. They manufacture and market health care products directly or indirectly in approximately 100 countries. Five pillars, or guiding principles, represent the foundation on which they realize their mission as an organization: People, Quality Health Care Outcomes, Customer Focus, Innovation, and Efficiency.

Mr. De Schutter has served on the Board since January 2017. He is the owner of asset management firm L.B. Gemini, Inc., serving as President and director since 2000. He previously served as the Chairman and CEO of DuPont Pharmaceuticals Company from July 2000 until its acquisition by Bristol-Myers Squibb in October 2001. Mr. De Schutter was also a director and Chief Administrative Officer of Pharmacia Corporation, created through the merger of Monsanto Company and Pharmacia & Upjohn in 2000. Before this merger, he was a director, Vice Chairman, and Chief Administrative Officer for Monsanto. From 1995 to 1999, he served as Chairman and CEO of G.D. Searle & Co., Monsanto’s wholly-owned pharmaceutical subsidiary.

Opinion: Some stocks are just bound to disappoint and I put BHC in that camp. Its long and storied history is just too much for me to regurgitate on a long Summer weekend. Try this Forbes article for an Ackman McKinsey & Company scandal and bruising stock market losses.

by

Name: Rutherford John R

Name: Rutherford John R

Position: Director

Shares Bought: 6,000, Average Price Paid: $22.73, Cost:$136,375

Company: Enterprise Products Partners. (EPD)

Enterprise Products Partners L.P. is one of the most significant publicly traded partnerships and a leading North American provider of midstream energy services to producers and consumers of natural gas, NGLs, crude oil, refined products, and petrochemicals. Its services include: natural gas gathering, treating, processing, transportation and storage; NGL transportation, fractionation, storage and export, and import terminals; crude oil gathering, transportation, storage and export, and import terminals; petrochemical and refined products transportation, storage, export and import terminals and related services; and a marine transportation business that operates primarily on the United States inland and Intracoastal Waterway systems. The partnership’s assets include approximately 50,000 miles of pipelines, 260 million barrels of storage capacity for NGLs, crude oil, refined products, and petrochemicals, and 14 billion cubic feet of natural gas storage capacity. Enterprise Products Partners L.P. has grown significantly since its IPO in July 1998, increasing its asset base from $715 million to $64 billion on December 31, 2020. This phenomenal growth is a result of expansions from organic growth opportunities, as well as acquisitions.

John R. Rutherford serves as Independent Director of the General Partner of the Company. Mr. Rutherford currently serves as a Senior Managing Director of NRI Energy Partners LLC. This firm evaluates and invests in private and public energy companies and provides financial and strategic consulting services to energy companies and investment firms. His career includes over 20 years of investment banking experience as mergers and acquisitions and strategic advisor to public and private energy companies, investment firms, management teams, and boards of directors. Before joining Plains, Mr. Rutherford served as Managing Director of the North American Energy Practice of Lazard Freres & Company from 2007 until 2010. Before joining Lazard, he was a partner at Simmons & Company for over ten years.

Opinion: Small and not meaningful to me. I prefer electric utilities to MLP pipelines.

Name: Green William C

Position: Director

Shares Bought: 4,139 Average Price Paid: $17.83, Cost:$73,800

Company: Arbor Realty Trust Inc. (ABR)

Arbor Realty Trust, Inc. is a nationwide real estate investment trust and direct lender, providing loan origination and servicing for multifamily, seniors housing, healthcare, and other diverse commercial real estate assets. Headquartered in New York, Arbor is a Fannie Mae DUS®lender and Freddie Mac OptigoSeller/Servicer. Arbor’s product platform also included CMBS, bridge, mezzanine, and preferred equity lending. Rated by Standard and Poor’s and Fitch Ratings, Arbor is committed to building on its reputation for service, quality, and customized solutions with an unparalleled dedication to providing its clients excellence over the entire life of a loan. Arbor manages a multibillion-dollar servicing portfolio, specializing in Fannie Mae, Freddie Mac, and other government-sponsored enterprises, as well as CMBS, bridge, mezzanine, and preferred equity lending. For over 20 years, Arbor has been helping multifamily and commercial real estate clients achieve their financial goals by focusing on growing long-term relationships. They value their clients to such an extent that they’re more comfortable calling them partners, and their relationships with Arbor are the foundation of their business. Founded by Chairman and CEO Ivan Kaufman, Arbor Realty Trust, Inc. is a Top 10 Fannie Mae DUS® Multifamily Lender by volume and a Top Fannie Mae Small Loan Lender, a Top Freddie Mac Small Balance Loan Lender, a Fannie Mae and Freddie Mac Seniors Housing Lender, an FHA Multifamily Lender, a HUD-approved LIHTC Lender as well as a CMBS, Bridge, Mezzanine and Preferred Equity Lender. With a multibillion-dollar servicing portfolio, Arbor is a primary commercial loan servicer and special servicer rated by Standard & Poors and Fitch.

William C. (Bill) Green is the Lead Independent Director of the Company. Since March 2013. Mr. Green has served as one of their directors since February 2012. Mr. Green currently serves as the Chief Financial Officer and a principal of Ginkgo Investment Company and Ginkgo Residential, a multifamily property investing and operating company and its affiliates. Additionally, Mr. Green is the Co-Chief Executive Officer of Ginkgo REIT, Inc. Mr. Green was appointed to serve as Lead Director. Mr. Green’s leadership experience at several organizations provides him with insight and expertise on the real estate, banking, and financial services industries in general, which led the Board of Directors to conclude that he should serve as their director.

Opinion: I’d like to buy RKT again one day. Someone, please let me know when the squeeze begins anew.

Name: Paul George L

Name: Paul George L

Position: Director

Shares Bought: 25,000, Average Price Paid: $14.65, Cost: $366,250

Company: Cornerstone Building Brands Inc. (CNR)

NCI Building Systems, Inc. merged with Ply Gem Parent, LLC in November 2018. In April 2019, the newly-formed company announced that it would officially operate as Cornerstone Building Brands, headquartered in Cary, North Carolina. Cornerstone Building Brands is the largest manufacturer of exterior building products in North America, servicing the commercial, residential, and repair & remodel markets. Before the merger, NCI Building Systems Inc. was one of the largest metal products manufacturers for the non-residential construction industry in North America. The company provided a broad range of products for repair, retrofit, and new construction activities. It operated within three primary business segments: metal coil coating, metal components, and engineered building systems. Their comprehensive portfolio spans the breadth of the residential and commercial markets, while their expansive footprint enables them to serve customers and communities across North America.

Their relentless focus on excellence combined with their ongoing commitment to innovation and R&D has driven them to become the #1 manufacturer of windows, vinyl siding, insulated metal panels, metal roofing, wall systems, and metal accessories. They believe every building they create and every part of that building positively contributes to communities where people live, work, and play.

Stuart Parker serves as Director of the Company. Parker served as Chief Executive Officer for USAA from 2015 until his retirement in February 2020. He spent more than 21 years with USAA in roles including Chief Operating Officer, Chief Financial Officer, President of the Property & Casualty Insurance Group, and President of Financial Planning Services.Parker was a distinguished graduate of the Air Force ROTC program and served in the U.S. Air Force for nearly 10 years, serving in Operations Desert Shield and Desert Storm.

Opinion: Cornerstone’s chart pattern looks a lot like Louisiana-Pacific. Since I’m buying LPX I won’t have the firepower to take on two names in this sector. Besides I’m buying with a CFO on LPX and a director on CNR. You’re always better betting with the man.

Name: Chazen Stephen I

Position: CEO Chairman

Shares Bought: 50,000 Average Price Paid: $14.12, Cost: $706,150

Company: Magnolia Oil & Gas Corp. (MGY)

Magnolia Oil & Gas Corp. is engaged in the oil and gas exploration and production business. It operates assets located in the Eagle Ford Shale and Austin Chalk formations in South Texas. The company was founded on July 31, 2018, and is headquartered in Houston, TX. they’re a publicly traded oil and gas exploration and production company with operations primarily in South Texas in the core of the Eagle Ford Shale and Austin Chalk formations. They create value for their investors by growing their premier asset platform, generating substantial free cash flow, maintaining financial flexibility, and ensuring thoughtful capital allocation. At Magnolia, they’re well-positioned to deliver sustained value for their investors while operating their business in a safe and environmentally responsible manner. They recognize they have a responsibility to share information about their business and their priorities in the areas of health and safety, environmental stewardship, workforce diversity, community outreach, and corporate governance.

Stephen I. “Steve” Chazen is Chairman, President, and Chief Executive Officer of Magnolia Oil and Gas Corporation. Mr. Chazen was elected as Chairman of the Board of Occidental Petroleum in March 2020. Mr. Chazen retired as Chief Executive Officer of Occidental in April 2016. He began his career at Occidental in 1994 as Executive Vice President of Corporate Development. He was named Chief Financial Officer in 1999 and served as Chief Financial Officer until 2010. Mr. Chazen was appointed President of Occidental in 2007. He was then named Chief Operating Officer in 2010 before being appointed Chief Executive Officer in May 2011. He was elected to the Board of Directors in 2010. Before joining Occidental, Mr. Chazen was Managing Director in Corporate Finance and Mergers and Acquisitions at Merrill Lynch.

Opinion: I’ve had enough of Steven Chazen. He was the CEO of Occidental Petroleum and has been a director on a few different oil and gas names.

Name: Immelt Jeffrey R

Name: Immelt Jeffrey R

Position: Director

Shares Bought: 114,000, Average Price Paid: $8.80, Cost: $1,003,428

Name: Kadre Manuel

Position: Director

Shares Bought: 50,000, Average Price Paid: $8.65, Cost: $432,500

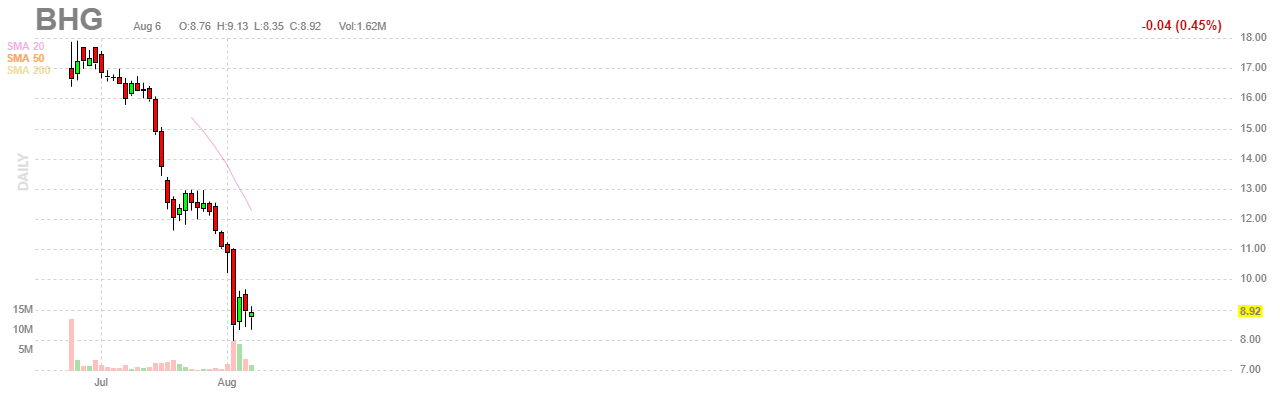

Company: Bright Health Group Inc. (BHG)

The company was founded by Bob Sheehy, the former CEO of UnitedHealthcare, with partners Kyle Rolfing, Tom Valdivia, and seed investor Flare Capital Partners, upon raising $81.5 million in venture capital in 2016. The company said it would focus on “consumer-centric” technology, facilitating patient experiences through digital interfaces. Bright Health is based in Minneapolis. It first began offering plans in the State of Colorado in a partnership with Centura Health after several large insurers announced they would be pulling out of the state. Their mission of Making healthcare right. Together. It is built upon the belief that by connecting and aligning the best local resources in healthcare delivery with the financing of care, they can drive a superior consumer experience, reduce systemic waste, lower costs, and optimize clinical outcomes. At its core, Bright Health is a healthcare company. They are founded and led by industry veterans all too familiar with the challenges that have plagued U.S. healthcare for decades. They believe that to drive meaningful change, they must leverage technology and bring together the financing and delivery of care to strengthen healthcare’s most critical relationship: that between the consumer and their primary care physician. For too long, U.S. healthcare, primarily designed to cater to employers and large institutions, has failed the consumer through unnecessary complexity, a lack of transparency, and skyrocketing costs. They are making healthcare simple, personal, and affordable.

Immelt served as CEO of GE for 16 years, from 2001 to 2017. According to Bright Health’s statement, Immelt “transformed GE’s employee health care program during his tenure, creating a company-wide, value-based model that reduced health care costs by 20 percent.” Mr. Jeffrey R. Immelt is a Lead Independent Director at Hennessy Capital Investment Corp. V, an Independent Director at Desktop Metal, Inc., an Independent Director at Bloom Energy Corp., an Independent Director at Twilio, Inc., an Independent Director at Sila Nanotechnologies, Inc., a Venture Partner at NEA Management Co. LLC, a Chairman at GE Europe GmbH, a Chairman at GE Franchise Finance Corp., a Chairman at GE Transportation, a Member at American Academy of Arts & Sciences, and a Member at The Business Council. He is on the Board of Directors at Tuya, Inc., Hennessy Capital Investment Corp. V, Desktop Metal, Inc., Bright Health, Inc.

Manuel Kadre is the Independent Chairman of the Board of Republic Services Inc. Mr. Kadre has been Chief Executive Officer of MBB Auto, LLC, since 2012. He served as Chief Executive Officer of Gold Coast Caribbean Importers, from 2005 to 2014. He was President, Vice President, General Counsel, and Secretary of CC1 Companies, (1995 – 2009). He has served as Lead Independent Director at Mednax, Inc., since 2007. He is the Director of The Home Depot, Inc., since 2018. He is on the Board of Trustees.

Opinion: It’s hard to find a worse insider to follow than the former dufus that led GE, Jeffrey Immelt. But when a stock prices its IPO on June 24th at $18 per share and just two months later is trading for less than half of that, what the heck?

August 4th-Morgan Stanley analyst Ricky Goldwasser upgraded Bright Health (BHG) to Overweight from Equal Weight with a price target of $12, down from $18. While Bright Health remains a “show-me” story and the call “could be early,” Goldwasser notes that the stock is down over 50% since the company’s IPO. Following this “meaningful underperformance,” the stock trades at a traditional managed care multiple, but that multiple could expand to one more similar to Oscar Health’s (OSCR) if there are signs that Bright’s integrated offering is beginning to take hold, Goldwasser tells investors in a research note following the company’s first earnings report since coming public.

August 3rd- According to The Fly on the Wall-Piper Sandler analyst Jeff Garro recommends buying shares of Bright Health Group on today’s post-earnings weakness. The shares are under because the revenue and EBITDA beats were partially attributable to an unexpected $59M investment income gain, Q2 medical cost ratio was above estimates, and the fiscal 2021 MCR guidance was above projections, Garro tells investors in a research note. However, Bright Health’s MCR performance should be judged on a “growth- and COVID-adjusted curve,” says the analyst. He believes Bright Health has “strong visibility” into 160% organic revenue growth in fiscal 2021 and high 30% revenue growth thereafter. Garro reiterates an Overweight rating on the stock with a $24 price target.

Name: Litchman Manuel MD

Position: CEO

Shares Bought: 86,206 Average Price Paid: $2.91, Cost: $250,859

Company: Mustang Bio Inc. (MBIO)

Mustang Bio, Inc. (“Mustang”) is a clinical-stage biopharmaceutical company focused on translating today’s medical breakthroughs in cell and gene therapies into potential cures for hematologic cancers, solid tumors, and rare genetic diseases. Mustang aims to acquire rights to these technologies by licensing or otherwise acquiring an ownership interest, to fund research and development, and to out-license or bring the technologies to market. Mustang has partnered with top medical institutions to advance the development of CAR T therapies across multiple cancers, as well as lentiviral gene therapy for XSCID. Mustang is registered under the Securities Exchange Act of 1934, as amended, and files periodic reports with the U.S. Securities and Exchange Commission

Mustang Bio was founded in 2015 and in the same year became a partner company of Fortress Biotech. In April 2017, Manuel Litchman took over as CEO of Mustang Bio, and in October of the same year, the company signed a lease with the University of Massachusetts Medicine Science Park in Worcester, MA, for a manufacturing facility to support the clinical development and commercialization of CAR-T products for glioblastoma and acute myeloid leukemia. Until 2018, the company’s studies focused mainly on cancer-fighting therapies and cell therapies. After licensing a gene therapy for X-SCID from St Jude Children’s Research Hospital, Mustang Bio expanded its efforts to immunodeficiency treatments. In April 2019, it was announced that the gene therapy developed by St. Jude’s showed positive results in a trial involving eight infants suffering from X-SCID. Mustang Bio expects to fully take over the trial from St Jude by 2020. In May 2019, Mustang Bio raised $32 million in an underwritten public offering to fund its continued development of products for the treatment of blood cancers, solid tumors, and rare genetic diseases. The corporation was founded in 1963 and is headquartered in Woonsocket, Rhode Island.

Opinion: Litchman keeps the faith. This is one of his many buys in this beleaguered biotech name. As long as he keeps buying, we’ll keep holding. Development biotech investment can be very painful to shareholders in the absence of a steady stream of good news.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund.

[custom-twitter-feeds]

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried many vendors, and SECForm4 is one of the most customer-friendly and responsive I’ve used.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial, so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization, and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years, and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 are horrendously poor. Also, planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019, 4th Best in November 2020, 4th Best in January 2021 (I kid you not)

[…] wrote this about Vertex on the August 6th post week or two ago. Now the CEO bought $500k. It’s a top three position at the […]