For trade, details click on this link to the trades.

For trade, details click on this link to the trades.

I had a dream Friday morning about the stock market. I yelled out in my sleep, “everything is going up.” I woke up and it pretty much did exactly that.

In a good market, almost all trades bounce sharply but the stickiness and real progress from there are what you have to measure. Perhaps deduct 4 or 5 percent from all the posted returns to determine your likely return as getting them at the same price or lower than the insider‘s purchase cost is difficult to do since they almost always jump some in price on the renewed confidence from insider buying,

Name: Dubugras Henrique Vasoncelos

Position: Director

Shares Bought: 845, Average Price Paid: $1,783.32, Cost: $1,506,907

Company: Mercadolibre Inc. (MELI)

Mercado Libre, Inc. (literally “free market” in Spanish, and known as Mercado Livre in Portuguese) is an Argentine company headquartered in Buenos Aires, incorporated in the United States that operates online marketplaces dedicated to e-commerce and online auctions, including mercadolibre.com. As of 2016, Mercado Libre had 174.2 million users in Latin America, making it the region’s most popular e-commerce site by several visitors. MercadoLibre hosts the largest online commerce and payments ecosystem in Latin America. Their efforts are centered on enabling e-commerce and digital and mobile payments on behalf of their customers by delivering a suite of technology solutions across the complete value chain of commerce. They are present in 18 countries, including Argentina, Brazil, Mexico, Colombia, Chile, Venezuela, and Peru. Based on unique visitors and page views, They are market leaders in each major country where they are present. Through their online commerce platform and related services, They provide their users with robust online commerce and payments tools that not only contribute to the development of a large and growing e-commerce community in Latin America (a region with a population of over 635 million people and one of the fastest-growing Internet penetration rates in the world) but also foster entrepreneurship and social mobility. Their main focus is to deliver compelling technological and commercial solutions that address the distinctive cultural and geographic challenges of operating an online commerce and payments platform in Latin America.

Mr. Dubugras is the co-founder & co-CEO of Brex Inc. Brex Inc. is a company reimagining financial systems so every growing company can realize their full potential and take control of their spending and business as they scale. Before that position, Mr. Dubugras co-founded Pagre.me, an online payments company, EduqueMe, an educational crowdfunding company aimed at sponsoring Latin American students in United States colleges and Estudar nos EUA, a company aimed at disseminating information and opportunities related to studying abroad for both undergraduate and graduate-level students.

Opinion: Meli is almost always a winner from where insiders buy it. It’s the eBay of Latin America with much better management. I keep missing it and it pisses me off.

Name: Kewalramani Reshma

Position: CEO

Shares Bought: 10,000, Average Price Paid: $195.65, Cost: $1,956,492

Company: Vertex Pharmaceuticals Inc. (VRTX)

Vertex is a global biotechnology company that invests in scientific innovation to create transformative medicines for people with serious diseases. The company has multiple approved medicines that treat the underlying cause of cystic fibrosis (CF) – a rare, life-threatening genetic disease – and has several ongoing clinical and research programs in CF. Beyond CF, Vertex has a robust pipeline of investigational small molecule medicines in other serious diseases where it has deep insight into causal human biology, including pain, alpha-1 antitrypsin deficiency, and APOL1-mediated kidney diseases. In addition, Vertex has a rapidly expanding pipeline of cell and genetic therapies for diseases such as sickle cell disease, beta-thalassemia, Duchenne muscular dystrophy, and type 1 diabetes mellitus. Founded in 1989 in Cambridge, Massachusetts, their corporate headquarters is now located in Boston’s Innovation District, and their international headquarters is in London, United Kingdom. They currently employ approximately 3,500 people in the United States, Europe, Canada, Australia, and Latin America with nearly two-thirds of their staff dedicated to research and development. Vertex is consistently recognized as one of the industry’s top places to work by Science Magazine, The Boston Globe, Boston Business Journal, and the San Diego Business Journal. Their research and medicines have also received esteemed recognitions, including the Robert J. Beall Therapeutics Development Award, the French Prix Galien, and the British Pharmacological Society awards.

Reshma Kewalramani, M.D., FASN, is the Chief Executive Officer and President at Vertex. Dr. Kewalramani has dedicated her career to improving patients’ lives, including the last 15+ years, through the development of new medicines. She joined Vertex in 2017 and was previously the Chief Medical Officer and Executive Vice President of Global Medicines Development and Medical Affairs. During that time, Vertex made remarkable progress in bringing new medicines to more cystic fibrosis (CF) patients worldwide, including the approval of SYMDEKO/SYMKEVI and the rapid approval of TRIKAFTA to treat up to 90% of all CF patients potentially. Under Dr. Kewalramani’s leadership, Vertex also advanced several programs outside of CF into the clinic, including alpha-1 antitrypsin deficiency, APOL1-mediated kidney diseases, sickle cell disease, and beta-thalassemia.

I wrote this about Vertex on the August 6th post week or two ago. Now the CEO bought $500k. It’s a top three position at the moment.

Opinion: Development biotech companies don’t make money so when they catch on with investor’s imagination, the sky is the limit. When they make that transition to approved products generating revenue, the rules of the game change. Vertex is mature biotech with $1.79 billion in revenues in the latest quarter. The stock price has faltered and Vertex has been dead money for a year and a half. In fact the last time, Sachs bought VRTX on 11-20-20 it was 15,000 shares for $217.36. Vertex was as high as $306 in July of 2020. VanEck Biotech ETF BBH topped out at $178 then and last Friday closed at $214.30 so VRTX has clearly lagged both its own price history plus the biotech group at large. So what gives?

VRTX sold off sharply on June 11th closing $23 lower and 11% from the prior day on news that they had ended the development of a promising liver disease drug VX-864.

Stifel analyst Paul Matteis lowered the firm’s price target on Vertex Pharmaceuticals to $244 from $277 after removing VX-864 from his model following the company announcing it is discontinuing the asset. Given that a first drug was discontinued for safety and this one had a pharmacodynamic effect that was “marginal in the grand scheme of things,” Matteis said he finds it difficult to have the conviction that future AAT molecules will perform materially better. However, he keeps a Buy rating on Vertex shares, which he said looked “cheap” at aftermarket trading levels. He still sees substantial growth and “robust barriers-to-entry” in the core cystic fibrosis franchise and while the rest of the pipeline is “early/risky,” he would argue that other assets are for the-most-part free options at current levels.

Cathie Wood’s ARKK bought 108.3k shares on July 21 the day after it was downgraded to underperform from market perform at SVB Leerink with a $170 price target.

They raised guidance on July 29th to $7-2B to $7.4B from prior guidance at $6.7B-$6.9B and beat Q2 earnings with a $3.11 print versus a consensus of $2.28.

All things are relative when it comes to insider buying. Vertex is what they call value biotech. That’s a tough place to be for investors. Development biotech companies don’t make money so when they catch on with investor’s imagination, the sky is the limit. When they make that transition to approved products generating revenue, the going gets rougher. Dreams become reality and they usually don’t match the lofty expectationss analysts had earlier.

Phase 2 data for VX-147, a drug for glomerulosclerosis is due 2H 2021 but other than that it’s likely going to be how well the cystic fibrosis franchise holds up. According to the Mayo Clinic:

The FDA has approved these medications for treating CF in people with one or more mutations in the CFTR gene:

- The newest combination medication containing elexacaftor, ivacaftor and tezacaftor (Trikafta) is approved for people age 12 years and older and considered a breakthrough by many experts.

- The combination medication containing tezacaftor and ivacaftor (Symdeko) is approved for people age 6 years and older.

- The combination medication containing lumacaftor and ivacaftor (Orkambi) is approved for people who are age 2 years and older.

- Ivacaftor (Kalydeco) has been approved for people who are 6 months and older.

Sachs is not giving up and neither are we. A Phase 3 trial of Trikafta in children with CF ages 2 to 5 is underway. Vertex Pharmaceuticals, the drug’s manufacturer, has not announced when it will release the results of the trial or when it plans to apply to the FDA for approval for this age group. JP Morgan says beyond the solid commercial execution, pipeline updates sounded an optimistic tone but were not needle moving. …..they acknowledge the concentration risk ….however, VRTX is currently trading below the fundamental value of the CF business alone.

Name: Bryant John A

Position: Director

Shares Bought: 3,000, Average Price Paid: $89.08, Cost: $267,246

Company: Ball Corp. (BLL)

Ball Corporation is an American company headquartered in Broomfield, Colorado. It is best known for its early production of glass jars, lids, and related products used for home canning. Since its founding in Buffalo, New York, in 1880, when it was known as the Wooden Jacket Can Company, the Ball company has expanded and diversified into other business ventures, including aerospace technology. It eventually became the world’s largest manufacturer of recyclable metal beverage and food containers. The Ball brothers renamed their business the Ball Brothers Glass Manufacturing Company, incorporated in 1886. Its headquarters, as well as its glass and metal manufacturing operations, were relocated to Muncie, Indiana, by 1889. The business was renamed the Ball Brothers Company in 1922 and the Ball Corporation in 1969. It became a publicly-traded stock company on the New York Stock Exchange in 1973. The ball left the home canning business in 1993 by spinning off a former subsidiary (Alltrista) into a free-standing company, which renamed itself Jarden Corporation. As part of the spin-off, Jarden is licensed to use the Ball registered trademark on its line of home-canning products. Today, the Ball brand mason jars and home canning supplies belong to Newell Brands.

John Bryant was elected to Ball Corporation’s board of directors in September 2018. Mr. Bryant joined Kellogg Company in 1998 and held a variety of roles, including chief financial officer; president, North America; president, international; and chief operating officer before becoming a chief executive officer in January 2011. In addition to his role on Ball’s board, Bryant serves as a Macy’s Inc., Compass PLC, and Coca-Cola European Partners. He has also served as a trustee of the W.K. Kellogg Foundation Trust and on the boards of directors of Catalyst and The Consumer Goods Forum.

Opinion: We also wrote last week. I don’t think much has changed but stock price momentum has waned.

Opinion: What do recycled aluminum cans and aerospace technology have to do with one another? Nothing as far as I can tell but when multiple insiders are buying, investors should pay more attention. None of these recent purchases are particularly large and look more like corporate officers fulfilling some obligation to own company shares than opportunistic backup the truck buys. We’re taking a pass on Ball, especially considering its run from $77.90 to $92.5 in the last two weeks.

Name: Baxter Scott H

Position: CEO

Shares Bought: 10,000, Average Price Paid: $53.24, Cost: $532,400

Company: Kontoor Brands Inc. (KTB)

Kontoor Brands, Inc., a lifestyle apparel company, designs, manufactures, procures, markets, and distributes apparel under the Wrangler and Lee brands in the United States and internationally. The company sells its products primarily through mass and mid-tier retailers, specialty stores, department stores, and retailer-owned and third-party e-commerce sites, as well as through direct-to-consumer channels, including full-price and outlet stores, and its websites. As of January 2, 2021, it operated 86 retail stores across the Americas, Europe, the Middle East, Africa, and the Asia-Pacific regions. Kontoor Brands, Inc. was incorporated in 2018 and is headquartered in Greensboro, North Carolina. Kontoor Brands is built on a foundation of trust that ignites their entrepreneurial spirit and shapes their future. They are sharply focused on driving brand growth and delivering long-term value to their stakeholders while ensuring we make a positive impact on the world. Kontoor Brands is strongly positioned as a leader in the global apparel industry. Their business is founded upon a strategic sourcing model and best-in-class supply chain, with industry-leading sustainability standards. They are focused on leveraging their global platform to drive brand growth and deliver long-term value for all of their stakeholders, including Their consumers, customers, shareholders, and suppliers.

Scott Baxter is the President & Chief Executive Officer of Kontoor Brands, Inc. He is also on the company’s Board of Directors. Baxter was named CEO in August 2018 when VF Corporation announced its intention to separate its Jeanswear organization into an independent, publicly-traded company. Baxter has more than 30 years of experience in retail, operations, marketing, merchandising, sales and manufacturing. Prior to being named CEO of Kontoor Brands, Baxter was Group President, Americas West, for VF Corporation. In this role, he was responsible for overseeing brands such as The North Face® and Vans®.

Opinion: Sometimes I just give up thinking to myself what does that insider see in buying his company’s stock. They usually buy their stock when it’s had some pullback in price on a piece of less than stellar news. The fortunes appear so mediocre, the outlook so ordinary at best and bleak at worst.

I’m usually wrong when I dismiss these purchases out of hand but it could take several painful months to find this to be a smart buy or a misguided one. Maybe it’s as simple as this; earnings will be good. Its well-known apparel sales are taking off with people flush with their Government stimulus and ready to go back out in the world.

Name: Bradford Neil

Position: Director

Shares Bought: 4,450, Average Price Paid: $45.94, Cost:$204,435

Company: Forrester Research Inc (FORR)

Forrester Research creates technology research reports and provides advisory services and technology conferences. The company also provides analysis in technology areas including computing, software, networking, the Internet, and telecommunications. The company’s clients include senior management, business strategists, and information technology professionals. In general, Forrester projects how technology trends will impact businesses, consumers, and society as a whole. Forrester helps business and technology leaders use customer obsession to accelerate growth. That means empowering you to put the customer at the center of everything you do: your leadership, strategy, and operations. Becoming a customer-obsessed organization requires change — it requires being bold. We give business and technology leaders the confidence to put bold into action, shaping and guiding how to navigate today’s unprecedented change in order to succeed. Forrester was founded in July 1983 by George Forrester Colony, now chairman of the board and chief executive officer, in Cambridge, Massachusetts. The company’s first report, “The Professional Automation Report,” was published in November 1983. In November 1996, Forrester announced its initial public offering of 2,300,000 shares. In February 2000, the company announced its secondary public offering of 626,459 shares.

Neil Bradford is the founder and chief executive officer of General Index Limited (GX), a start-up provider of energy and commodity pricing data. GX partners with energy firms to create cost-effective, robust pricing benchmarks for their trading and commercial activities. Neil has 20 years experience of in executive leadership in data and research-focused businesses. Prior to founding GX, Neil led two businesses to successful exits — firstly as CEO of Argus Media, an energy and commodity price reporting agency, and then as CEO of Financial Express Limited (FE), a leading provider of investment data and research to the wealth management industries, which was sold to a private equity firm in 2018. Neil returns to the Forrester board after serving as an executive from 1999 to 2006.

Opinion: That’s it. Forrester is a buy-out candidate with its steady recurring revenue model.

Name: Ruchim Arik W

Position: Director

Shares Bought: 100,000, Average Price Paid: $38.07, Cost: $3,806,788

Name: Spanos Mike

Position: CEO

Shares Bought: 13,200, Average Price Paid: $37.79 Cost: $498,846

Company: Six Flags Entertainment Corp. (SIX)

Six Flags Entertainment Corporation, more commonly known as Six Flags or Six Flags Theme Parks, is an American amusement park corporation headquartered in Arlington, Texas. It has properties in Canada, Mexico, and the United States. Six Flags owns more theme parks, and waterparks combined than any other amusement park company globally and have the seventh-highest attendance in the world. The company operates 27 properties throughout North America, including theme parks, amusement parks, water parks, and a family entertainment center. In 2019, Six Flags properties hosted 32.8 million guests. Six Flags was founded in the 1960s and derived its name from its first property, Six Flags Over Texas. The company maintains a corporate office in Midtown Manhattan, while its headquarters are in Arlington, Texas. On June 13, 2009, the corporation filed for Chapter 11 bankruptcy protection due to crippling debt, which it successfully exited after corporate restructuring on May 3, 2010. The name “Six Flags” originally referred to the flags of the six different nations that have governed Texas: Spain, France, Mexico, the Republic of Texas, the United States (Union), and the Confederate States of America. Six Flags parks are still divided into different themed sections, although many of the original areas from the first three parks have been replaced.

Arik Ruchim has served as a director of the Company since January 2020. Mr. Ruchim is a Partner at H Partners, LP, an investment management firm. Prior to joining H Partners in 2008, Mr. Ruchim was at Creative Artists Agency and Cruise/Wagner Productions. Mr. Ruchim currently serves as a director of Tempur Sealy International, Inc., the world’s largest bedding provider, where he serves as a member of its Nominating and Corporate Governance Committee and its Compensation Committee, and as a member of the University of Michigan’s Tri-State Leadership Council, a group dedicated to enhancing educational opportunities for undergraduate and graduate students. Mr. Ruchim previously served as a director of Remy International, Inc., a global manufacturer of automotive parts, and as a director of Dick Clark Productions, a television production company.

Opinion: Six Flags hasn’t paid a dividend since March 2020 when the Pandemic shut everything down. The stock has tripled in value since then. My guess is that a dividend is imminent that parks are reopening and cash flow is back.

Name: Malafronte Michael W

Position: Director

Shares Bought: 9,000, Average Price Paid: $35.99, Cost: $323,910

Company: Adtalem Global Education Inc. (ATGE)

Adtalem Global Education Inc. is an American corporation that operates several for-profit higher education institutions, including American University of the Caribbean School of Medicine, Association of Certified Anti-Money Laundering Specialists, Chamberlain University, EduPristine, OnCourse Learning, Ross University School of Medicine, Ross University School of Veterinary Medicine, and Walden University. Adtalem Global Education Inc. provides workforce solutions worldwide. It operates through two segments, Medical and Healthcare; and Financial Services. The Medical and Healthcare segment offers degree and non-degree programs in the medical and healthcare postsecondary education industry. This segment operates Chamberlain University, American University of the Caribbean School of Medicine, Ross University School of Medicine, and Ross University School of Veterinary Medicine. The Financial Services segment provides test preparation, certifications, conferences, seminars, memberships, and subscriptions to business professionals in the areas of accounting, anti-money laundering, banking, and mortgage lending. It operates the Association of Certified Anti-Money Laundering Specialists, Becker Professional Education, OnCourse Learning, and EduPristine. The company was formerly known as DeVry Education Group Inc. and changed its name to Adtalem Global Education Inc. in May 2017. Adtalem Global Education Inc. was incorporated in 1987 and is based in Chicago, Illinois.

Mr. Malafronte is a founding partner of International Value Advisers, LLC (IVA) where he serves as managing partner and is responsible for overseeing all aspects of IVA, including developing company strategy and managing resources. Prior to IVA, Mr. Malafronte was a senior vice president at Arnhold and S. Bleichroeder Advisers, LLC where he worked for two years as a senior analyst for the First Eagle Funds. Prior to the First Eagle Funds, Mr. Malafronte was a portfolio manager at Oppenheimer & Close, where he assisted in the launch of a domestic hedge fund and offshore partnership and was responsible for all facets of portfolio management for the investment partnerships, including idea generation, in-depth research and stock selection. Mr. Malafronte currently serves as a director of IVA Fiduciary Trust.

Opinion: Well, Malafronte should know what he is doing. I don’t like it though when the CEO unloads $13,945,611 shares the month before.

Name: Murphy Paul J

Position: CEO

Shares Bought: 10,000, Average Price Paid: $22.57, Cost: $225,700

Name: Schweinfurth Lynn S

Position: CFO

Shares Bought: 5,000, Average Price Paid: $21.75, Cost: $108,750

Company: Red Robin Gourmet Burgers Inc. (RRGB)

Red Robin Gourmet Burgers and Brews, or simply Red Robin, is an American chain of casual dining restaurants founded in September 1969 in Seattle, Washington. In 1979, the first franchised Red Robin restaurant was opened in Yakima, Washington. Red Robin’s headquarters are in Greenwood Village, Colorado. As of August 2020, the company had over 570 restaurants in operation with 90 being operated as a franchise.

Red Robin Gourmet Burgers, Inc., is a casual dining restaurant chain founded in 1969 that operates through its wholly-owned subsidiary, Red Robin International, Inc., and under the trade name, Red Robin Gourmet Burgers and Brews. It believes nothing brings people together like burgers and fun around its table, and no one makes moments of connection over crave-able food more memorable than Red Robin. It serves a variety of burgers and mainstream favorites to Guests of all ages in a casual, playful atmosphere. In addition to its many burger offerings, Red Robin serves a wide array of salads, appetizers, entrees, desserts, signature beverages, and Donatos® pizza at select locations. It’s now easy to enjoy Red Robin anywhere with online ordering available for to-go, delivery, and catering. There are more than 540 Red Robin restaurants across the United States and Canada, including those operating under franchise agreements. Red Robin… YUMMM®!

Paul Murphy is responsible for leading the brand and the executive team in the creation, implementation, and execution of a strategy that delivers positive results for all stakeholders. Before joining Red Robin, Paul served as Executive Chairman of Noodles & Company. He previously worked with Einstein Noah Restaurant Group, Inc. for 12 years, where he served in a variety of roles including President and CEO. During this tenure, Paul gained extensive industry knowledge and honed his management and leadership skills in the quick-service sector. In his time with Del Taco, Paul and his team took the over 50-year old brand to new heights, including leading the transition from a privately held to a publicly-traded company in 2015.

Lynn Schweinfurth is responsible for leading and maximizing the capabilities of all Red Robin financial disciplines including accounting, strategic and financial planning, operations analysis, treasury and investor relations, as well as optimizing the Company’s supply chain function. Lynn joined the Red Robin leadership team in January 2019 and has more than 25 years of experience in corporate finance, with over two decades of experience in the restaurant industry. Prior to joining Red Robin, she served in a variety of senior finance leadership roles for Fiesta Restaurant Group, Inc., Brinker International, Inc., Yum Brands, Inc., and PepsiCo, Inc.

Opinion: Have you been out to eat lately? I’m sure you have. I don’t ever remember restaurants busier than they are now. Maybe its memorable because the service is spotty because getting people to work has been hell. Now that unemployment benefits are tapering, that might get better. We bought this and got the bounce. I think I’ll go back in as well.

Name: Rutherford John R

Position: Director

Shares Bought: 10,000, Average Price Paid: $22.19, Cost:$221,940

Company: Enterprise Products Partners L.P. (EPD)

Enterprise Products Partners L.P. is one of the most significant publicly traded partnerships and a leading North American provider of midstream energy services to producers and consumers of natural gas, NGLs, crude oil, refined products, and petrochemicals. Its services include: natural gas gathering, treating, processing, transportation and storage; NGL transportation, fractionation, storage and export, and import terminals; crude oil gathering, transportation, storage and export, and import terminals; petrochemical and refined products transportation, storage, export and import terminals and related services; and a marine transportation business that operates primarily on the United States inland and Intracoastal Waterway systems. The partnership’s assets include approximately 50,000 miles of pipelines, 260 million barrels of storage capacity for NGLs, crude oil, refined products, and petrochemicals, and 14 billion cubic feet of natural gas storage capacity.

John R. Rutherford serves as Independent Director of the General Partner of the Company. Mr. Rutherford currently serves as a Senior Managing Director of NRI Energy Partners LLC. This firm evaluates and invests in private and public energy companies and provides financial and strategic consulting services to energy companies and investment firms. His career includes over 20 years of investment banking experience as mergers and acquisitions and strategic advisor to public and private energy companies, investment firms, management teams, and boards of directors. Before joining Plains, Mr. Rutherford served as Managing Director of the North American Energy Practice of Lazard Freres & Company from 2007 until 2010. Before joining Lazard, he was a partner at Simmons & Company for over ten years

Opinion: ESG investing is putting a damper on all the pin action for this group. I like a solid 8.1% dividend yield. Natural gas will outlast me in the pipes. After that, they can run hydrogen through them. Founder Duncan bought $15.4 million last March at $22.71, where it is today.

Name: Zwarenstein Barry

Position: Director

Shares Bought: 25,000, Average Price Paid: $20.45, Cost: $511,188

Company: ON24 Inc. (ONTF)

The company was founded in 1998 as a platform for companies to broadcast video press releases. It became a financial news streaming website but suffered financial losses after the early 2000s recession. In August 2002, ON24 closed its news operation but continued to provide third-party content. After downsizing the company, they reformatted their operations to provide streaming services for other companies. ON24 provides a leading cloud-based digital experience platform that makes it easy to create, scale, and personalize engaging experiences to drive measurable business growth. Today, They are helping over 1,900 companies worldwide, including 3 of the five largest global technology companies, 4 of the five largest US banks, 3 of the five largest global healthcare companies, and 3 of the five largest global industrial manufacturing companies, convert millions of prospects to buyers. Through interactive webinars, virtual events, and always-on multimedia experiences, ON24 provides a system of engagement powered by AI, enabling businesses to scale engagement, conversions, and pipelines to drive revenue growth. The ON24 platform supports an average of 4 million professionals a month, totaling over 2.5 billion engagement minutes per year.

Barry Zwarenstein serves as Chief Financial Officer, Secretary of the Company. Mr. Zwarenstein has served as Chief Financial Officer since January 2012 and was our Interim CEO from December 2017 to May 2018. From November 2007 to October 2015, Mr. Zwarenstein served on the board of directors of Dealertrack Technologies, Inc., a provider of subscription-based software for the automotive retail industry that Cox Automotive, Inc. acquired in October 2015. From September 2008 to November 2011, Mr. Zwarenstein served as Senior Vice President and Chief Financial Officer of SMART Modular Technologies, Inc.

Opinion: Not crazy about this business but CFO buys cannot be ignored. They are my favorite insiders to copycat. I’d nibble until I learn more. I talked to a salesperson. They don’t want to waste time on you unless you can spend $25k or more. I am thinking of hiring them to help me boost the circulation of the Insiders Report you are reading. The growth has been anemic at best. On24 fell 29 on a weak earnings report, where they cut their view (13c)-(6c)from (8c)- (2c). Several analysts downgrade the stock and this is where we’re at.

Name: Topper Joseph

Position: Director 10% Owner

Shares Bought: 52,916, Average Price Paid: $18, Cost: $926,997.00

Company: CrossAmerica Partners LP. (CAPL)

CrossAmerica Partners LP engages in the wholesale distribution of motor fuels, operation of convenience stores, and ownership and leasing of real estate used in the retail distribution of motor fuels in the United States. The company operates in two segments, Wholesale and Retail. The Wholesale segment engages in the wholesale distribution of motor fuels to lessee dealers, independent dealers, commission agents, and company-operated retail sites. The Retail segment is involved in selling convenience merchandise items and retail sale of motor fuels at company-operated retail sites and retail sites operated by commission agents. As of March 1, 2021, the company distributed fuel to approximately 1,700 locations; and owned or leased approximately 1,100 sites. CrossAmerica GP LLC operates as the general partner of the company. The company was formerly known as Lehigh Gas Partners LP and changed its name to CrossAmerica Partners LP in October 2014. CrossAmerica Partners (formerly Lehigh Gas Partners) won’t leave motorists running on empty as they drive across America. The company distributes gasoline and diesel fuel to 1,174 gas stations in 16 US states, mostly along the East Coast. CrossAmerica owns or leases about 660 gas stations franchised under various brands, including BP, ExxonMobil, Shell, and Valero; it also distributes branded motor fuel to Gulf and Sunoco gas stations. About 95% of the more than 906.2 million gallons of motor fuels distributed yearly by CrossAmerica is branded (including the Chevron, Sunoco, Valero, Gulf, and CITGO brands).

Joseph V. Topper Jr., CPA, serves as Chairman of the Board of CrossAmerica GP LLC, a General Partner of the Company. He has served as a director on the Board since October 2012 and was elected Chairman of the Board effective November 19, 2019. Mr. Topper has been the President of Dunne Manning Inc. (“DMI”), a diversified portfolio of companies operating in the wholesale and retail gasoline, real estate, and investing industries since 2015. Mr. Topper has over 25 years of management experience in the wholesale and retail fuel distribution business. In 1987, Mr. Topper purchased his family’s retail fuel business. He five years later founded DMI (formerly known as Lehigh Gas Corporation), where he has served as the Chief Executive Officer since 1992.

Opinion: Large dividend yield of 11.20%. Income investors should go for it. Driving is back but when EV obsoletes the combustion engine, the game is over here.

Name: Helm Scott B

Position: Director

Shares Bought: 5,000, Average Price Paid: $17.98, Cost: $89,890

Company: Vistra Corp. (VST)

Vistra (NYSE: VST) is a premier, integrated, Fortune 300 energy company based in Irving, Texas, providing essential resources for customers, commerce, and communities. Vistra combines an innovative, customer-centric approach to retail with safe, reliable, diverse, and efficient power generation. The company brings its products and services to market in 20 states and the District of Columbia, including six of the seven competitive power markets in the U.S. and markets in Canada and Japan, as well. Serving nearly 5 million residential, commercial, and industrial retail customers with electricity and gas, Vistra is the largest competitive residential electricity provider in the country and offers over 40 renewable energy plans. The company is also the largest competitive power generator in the U.S. with a capacity of approximately 39,000 megawatts powered by a diverse portfolio of natural gas, nuclear, solar, and battery energy storage facilities. In addition, the company is a large purchaser of wind power. The company is currently constructing a 400-MW/1,600-MWh energy storage system in Moss Landing, California, which will be the largest of its kind in the world when it comes online. Vistra is guided by four core principles: we do business the right way, we work as a team, we compete to win, and we care about our people, our neighbors, and our stakeholders.

Scott Helm, chairman of the board, has served on the board as Chairman since 2017. Helm is a private investor based out of Baltimore, Maryland. Previously, Helm was a founding partner of Energy Capital Partners, a private equity firm focused on investing in North American energy infrastructure. Prior to joining Energy Capital Partners, he served as Executive Vice President and Chief Financial Officer at Orion Power Holdings, Inc., a publicly-traded company that owned and operated power plants. Helm began his career at Goldman, Sachs & Co.

Opinion: I only mention it because we’ve blogged about it before. It’s one of our largest holdings. This is a small buy but lots of insiders have bought sizeable amounts of stock. It really hasn’t moved much but pays a steady dividend. I like what they are doing with renewables. I think electricity usage is going to explode as the combustion engine automobile finally gets electrified.

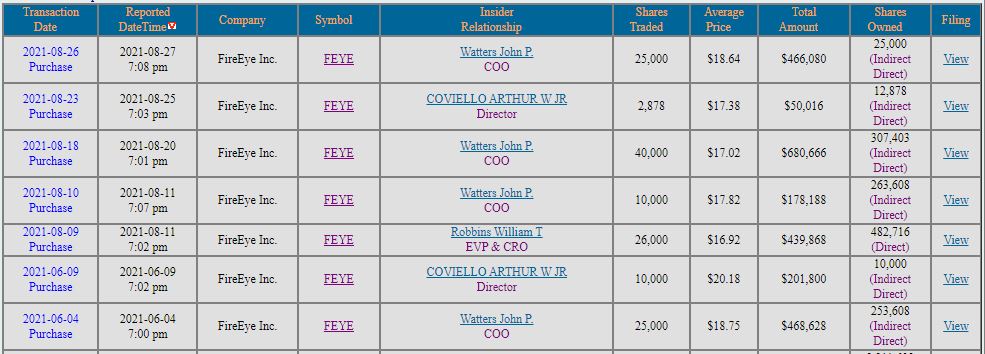

Name: Coviello Arthur W

Position: Director

Shares Bought: 2,878, Average Price Paid: $17.38, Cost: $50,016

Name: Watters John

Position: COO

Shares Bought: 25,000 Average Price Paid: $18.64, Cost: $466,080

Company: FireEye Inc. (FEYE)Company: FireEye Inc. (FEYE)

Every day at FireEye, we see firsthand the impact of cyber-attacks on real people. It inspires us to fulfill our mission to relentlessly protect our customers from the impact and consequences of cyberattacks. They have learned that technology alone isn’t enough to combat cyber attackers. Their fundamental belief is that hands-on frontline expertise and intelligence, combined with innovative technology, provides the best means to protect their customers from cyber threats. FireEye has created a unique learning system. their real-time knowledge of the threat landscape ensures that their offerings provide the best means to protect their customers. Their frontline expertise constantly guides them as we build their products, deliver threat intelligence and arm their services team to prepare for, respond to and prevent breaches. The FireEye Innovation Cycle was created by product teams embracing their world-class frontline threat expertise AND their frontline experts embracing their solutions. They use this innovation cycle to create the most effective cyber defense platform – a seamless, on-demand extension of our customers’ security operations.

Art has served as a member of the board of directors since December 2020. Since 2015 he has been an active investor and advisor in the technology industry, guiding startups both as a private investor and in his roles as a Venture Partner at Rally Ventures, as an advisor to ClearSky Security Fund, and as a Senior Advisor to Blackstone’s Tactical Opportunities Group. Prior to joining Rally Ventures, Art served as Executive Chairman of RSA, the Security Division of EMC. Art joined RSA in 1995 and became CEO in 2000. During his tenure, the company evolved from its roots in authentication and encryption to being a leader in the most important emerging areas of information security, including security analytics, identity, and Governance, Risk & Compliance. Art has been a central figure within the information security industry for more than 25 years.

John serves as FireEye President and Chief Operating Officer. He has served in various roles with the Company since the Company acquired iSIGHT Partners in 2016, including as a consultant from May 2020 to April 2021, as Chairman of the FireEye Advisory Board from April 2020 to April 2021, as Executive Vice President and Chief Strategy Officer from February 2018 to April 2020, as Executive Vice President, Global Services and Intelligence from January 2017 to January 2018, and as President of iSIGHT from March 2016 to January 2017.

Opinion: FireEye Announces Sale of FireEye Products Business to Symphony Technology Group for $1.2 Billion

- All-cash transaction unlocks high-growth Mandiant Solutions business

- Continued partnership after closing supports customers with reseller relationship and shared product telemetry and frontline threat intelligence

- FireEye Board authorizes a share repurchase program of up to $500 million

Insiders are buying with conviction but it’s not been a smooth ride for shareholders. For starters, the day they announced the spinoff, the stock had a musted response, dropping slightly. Was this a good idea or a desperate attempt at fixing the company that had lagged behind its peers for years? Incredible potential as cyber security threats became a way of life but what was FireEye going squandering its headstart while others like CrowdStrike and Palo Alto Networks rained money on their shareholder. Then on December 14, 2020 the Government began disclosing massive cyber-espionage involving numerous government agencies including the National Security Administration. All publicly-traded security companies got a jump in value and attention and have never looked back.

So far so good but on June 2nd they dropped the bombshell that there were changing their well-known, FireEye company name to Mandiant and with it the sale of their products business to P.E firm. Wall Street did not like the news and several analysts questioned the logic and downgraded the company. The stock starts dropping from $22.79 to around $18,85 where COO John Waters bought 25,000 shares at $18,75 arresting the slide in price. Another purchase by a Director seemed to do the trick and FEYE began regaining the ground it lost.

Then it slammed unfortunate shareholders again on August 5th when the Company reported a huge revenue drop and blown earnings. The launch of Mandint Advantage caused a confusing revenue recognition as it moved entirely to the cloud. The remaining Mandiant business will be comprised of subscription software and professional services. Mandiant remains the gold standard for the incident response to the growing number of ransomware and high-profile security stocks. The bottom line- the confusion around all the moving parts and price drop caused JP Morgan analyst to reduce his December 22 price target to $24 from $27.

Since then there have been 5 high conviction insider buys as seen from the chart above. If you think the cyber security is a growing business, which of course it is, FireEye now known as Mandiant is great earningsplay.

Name: Joh. A. Benckiser

Position: 10% Owner

Shares Bought: 438,810, Average Price Paid: $16.97, Cost: $7,448,411

Name: Tattersfield Michael J

Position: CEO

Shares Bought: 10,500, Average Price Paid: $14.30, Cost: $150,149

Name: Goudet Olivier

Position: Chairman

Shares Bought: 60,000, Average Price Paid: $13.21, Cost: $792,660

Company: Krispy Kreme Inc. (DNUT)

Krispy Kreme, Inc., together with its subsidiaries, operates as a branded retailer and wholesaler of doughnuts, coffee, and other complimentary beverages, and treats, and packaged sweets. The company operates through four segments: Company Stores, Domestic Franchise, International Franchise, and KK Supply Chain. It owns and franchises Krispy Kreme stores. As of August 01, 2018, the company operated approximately 1,400 retail shops in 32 countries. It also produces doughnut mixes and doughnut-making equipment. Krispy Kreme, Inc. was formerly known as Krispy Kreme Doughnuts, Inc. and changed its name to Krispy Kreme, Inc. in May 2021. The company was founded in 1937 and is headquartered in Winston-Salem, North Carolina. Krispy Kreme, Inc. operates as a subsidiary of Pret Panera I G.P. Krispy Kreme Doughnut Corporation is a global retailer of premium-quality sweet treats, including its signature Original Glazed ® Doughnut. The Company has offered the highest-quality doughnuts and great-tasting coffee.. Krispy Kreme Doughnuts is proud of its Fundraising program, which has helped non-profit organizations raise millions of dollars in needed funds for decades. Krispy Kreme doughnuts can be found in approximately 12,000 groceries, convenience, and mass merchant stores in the U.S. The Company has nearly 1,400 retail shops in 33 countries.

JAB Holding Company is a privately held global investment company focused on consumer goods and services. In 2012, JAB Holding Company was formed as a partner-led investment firm, with $9bn equity placed under one holding company. JAB Holding Company and JAB Consumer Fund, including co-investors, are together referred to as “JAB” and are now responsible for managing total capital over $50bn. JAB is focused on long-term value creation by investing in companies with premium brands, attractive growth, and strong cash flow and has controlling and anchor stakes in companies.

Michael James Tattersfield is a businessperson who has been at the helm of 6 different companies and presently is President & Chief Executive Officer for Einstein Noah Restaurant Group, Inc., President & Chief Executive Officer of Krispy Kreme Doughnut Corp., and President & Chief Executive Officer at Krispy Kreme Doughnuts, Inc. He is also on the board of Panera Holdings Corp., Insomnia Cookies Holdings LLC, and Krispy Kreme Holding UK Ltd. Mr. Tattersfield previously was President for Yum! Brands, Inc., Chief Operating Officer & Executive Vice President at lululemon Athletica, Inc., Vice President-Store Operations at L Brands, Inc., Chairman at Einstein Bros. Bagels, Inc., and Chief Executive Officer of Caribou Coffee Co., Inc.

Olivier Goudet has served as a member of the Board of Directors since September 2016 and as Chairman since May 2017. Mr. Goudet is currently Managing Partner and Chief Executive Officer of JAB Holding Company (“JAB”), a position he has held since 2012. He is the former Executive Vice President and Chief Financial Officer of Mars, Incorporated (“Mars”) and has served as an independent advisor to the Mars Board of Directors. Mr. Goudet began his career at Mars, serving on the finance team of its French business, and held several senior executive positions at the VALEO Group, including Group Finance Director.

Opinion: I’m leary of JB Holdings after the disastrous Cody investment they made. One of the richest family offices can make mistakes when they have had some big hits, like Keurig.

Name: Newhall Adair

Position: Director

Shares Bought: 48,694, Average Price Paid: $10.34, Cost: $503,324

Company: Bright Health Group Inc. (BHG)

The company was founded by Bob Sheehy, the former CEO of UnitedHealthcare, with partners Kyle Rolfing, Tom Valdivia, and seed investor Flare Capital Partners, upon raising $81.5 million in venture capital in 2016. The company said it would focus on “consumer-centric” technology, facilitating patient experiences through digital interfaces. Bright Health is based in Minneapolis. It first began offering plans in the State of Colorado in a partnership with Centura Health after several large insurers announced they would be pulling out of the state. Their mission of Making healthcare right. Together. It is built upon the belief that by connecting and aligning the best local resources in healthcare delivery with the financing of care, they can drive a superior consumer experience, reduce systemic waste, lower costs, and optimize clinical outcomes. At its core, Bright Health is a healthcare company. They are founded and led by industry veterans all too familiar with the challenges that have plagued U.S. healthcare for decades. They believe that to drive meaningful change, they must leverage technology and bring together the financing and delivery of care to strengthen healthcare’s most critical relationship: that between the consumer and their primary care physician. For too long, U.S. healthcare, primarily designed to cater to employers and large institutions, has failed the consumer through unnecessary complexity, a lack of transparency, and skyrocketing costs. They are making healthcare simple, personal, and affordable.

Adair serves as a director of Bright Health Group, Inc. He is a Partner at Greenspring Associates and is responsible for sourcing and due diligence efforts on the fund, direct and secondary opportunities. Prior to Greenspring Associates, Adair served as a Principal at Domain Associates, LLC from August 2009 until December 2014. Prior to joining Domain Associates, LLC, he worked in the business development group at Esprit Pharma, Inc., where he assisted with multiple product acquisitions and the subsequent sale of the company to Allergan plc. Adair also serves on the board of directors of Crown Laboratories, Inc. and is a board observer at Aetion, Inc. Entrada and Everside Health. In addition, Adair advises five venture advisory boards for venture capital firms and six passive direct healthcare investments (HilleVax, Imago Biosciences, Kallyope, NGM Bio, Phathom Pharma, PowerVision, ScoutBio, and Tenaya Therapeutics).

Opinion: They want to shake up the health care experience. Management has a good pedigree. The Company raised FY21 revenue to $1.6b from $1.5b.Q2 earnings were (7c) versus 1c consensus. They just finished selling 75.3 M shares of common stock for holders so that should take some selling pressure off the stock. It wasn’t a great vote of confencnde

Name: Hernandez Marlow

Position: CEO

Shares Bought: 46,900, Average Price Paid: $10.20, Cost: $478,358

Company: Cano Health Inc. (CANO)

Cano Health operates value-based primary care centers and supports affiliated medical practices that specialize in primary care for seniors in Florida, Texas, Nevada, and Puerto Rico, with additional markets in development. As part of its care coordination strategy, Cano Health provides sophisticated, high-touch population health management programs including telehealth, prescription home delivery, wellness programs, the transition of care, and high-risk and complex care management. Cano Health’s personalized patient care and proactive approach to wellness and preventive care set it apart from competitors. Cano Health has consistently improved clinical outcomes while reducing costs, affording patients the opportunity to lead longer and healthier lives. Cano serves a predominantly minority population (80% of its patients are Latino or African American) and a low-income population (50% of its members are dual-eligible for Medicare and Medicaid

Dr. Marlow Hernandez is the Chief Executive Officer of Cano Health and serves on its Board of Directors. Under Hernandez’s leadership, Cano Health has become one of the fastest-growing and most respected healthcare companies in Florida abiding by cultural attributes, which stand on the principles of always placing the needs of patients above all else; while striving to create a better and sustainable health care model to improve the lives of all Americans. Practicing medicine, running the medical business, while also taking on the task of night and weekend duties at local hospitals, Hernandez became one of the most accomplished medical professionals in the state before reaching the age of 30.

Opinion: Primary care centers are desperately needed but I don’t want to finance them with my own dollars.

Name: Washburne Ray W

Position: Director

Shares Bought: 100,000, Average Price Paid: $8.90, Cost: $889,900

Company: Energy Transfer LP. (ET)

Energy Transfer is a Texas-based company that began in 1995 as a small intrastate natural gas pipeline operator and is now one of the largest and most diversified investment grade master limited partnerships in the United States—growing from roughly 200 miles of natural gas pipelines in 2002 to more than 86,000 miles of natural gas, natural gas liquids (NGLs), refined products, and crude oil pipelines. Today, there are three publicly traded partnerships in the Energy Transfer Family. (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with a strategic footprint in all major domestic production basins. ET is a publicly traded limited partnership with core operations that include complementary natural gas midstream, intrastate, and interstate transportation and storage assets; crude oil, natural gas liquids (NGL) and refined product transportation and terminalling assets; NGL fractionation; and various purchase and marketing assets. Et al. owns Lake Charles LNG Company. (NYSE: SUN) is a master limited partnership that distributes motor fuel to approximately 10,000 convenience stores, independent dealers, commercial customers, and distributors in more than 30 states. SUN’s general partner is Energy Transfer Operating, LP, a subsidiary of Energy Transfer LP (NYSE: ET). For more information, visit Sunoco LP.’s largest independent compression services providers in terms of total compression fleet horsepower. The Partnership partners with a broad customer base composed of producers, processors, gatherers, and natural gas and crude oil transporters. The Partnership focuses on providing compression services to infrastructure applications primarily in high-volume gathering systems, processing facilities, and transportation applications. More information is available at USA Compression.

Mr. Washburne was appointed to the Board of Directors of a general partner in April 2019 and served on the compensation committee. He is currently President and Chief Executive Officer of Charter Holdings, Inc., a Dallas-based investment company involved in real estate, restaurants, and diversified financial investments. In addition, he currently serves on the President’s Intelligence Advisory Board (PIAB). From August 2017 to February 2019, Mr. Washburne served as the President and Chief Executive Officer of the Overseas Private Investment Corporation (OPIC), the United States government’s development finance institution.

Opinion: I like natural gas 26% of the power generated in this country comes from this source. Warren Kelcy, the Chairman. Insiders are big buyers of ET and I would be too. The chart looks ripe for bounce as the stock came down from its May high o $11.60 into the $9.49 area due to its most recent earnings report. There were have been several insiders buying in the last two weeks

Name: Waters Gregory L

Position: Director

Shares Bought: 93,570, Average Price Paid: $8.39, Cost:$785,464

Company: Cyxtera Technologies Inc. (CYXT)

Cyxtera is a global leader in data center colocation and interconnection services. The company operates a footprint of 61 data centers in 29 markets around the world, providing services to more than 2,000 leading enterprises and U.S. federal government agencies. Cyxtera brings proven operational excellence, global scale, flexibility, and customer-focused innovation together to provide a comprehensive portfolio of data center and interconnection services. Cyxtera owns more than 60 data centers around the world. The company was founded in 2017 after a consortium led by BC Partners and including Medina Capital Advisors and Longview Asset Management bought CenturyLink’s colocation business and renamed it Cyxtera. As part of the $2.3 billion deal, the colocation business was combined with Medina Capital’s security and data analytics businesses including Cryptzone, Catbird, Easy Solutions, and Brainspace. Its security unit was later spun out in 2019 as AppGate, Inc. The formation of Cyxtera was orchestrated by private equity firms Medina Capital and BC Partners. One hundred percent of their current equity stakes of Cyxtera will roll into the combined company. This will translate into approximately 58 percent ownership of the combined company for Cyxtera’s owners.

Mr. Gregory L. Waters is an Independent Director at ON Semiconductor Corp., an Independent Director at Sierra Wireless, Inc., and a Lead Independent Director at Cyxtera Technologies, Inc. /New/. He is on the Board of Directors at ON Semiconductor Corp., Mythic, Inc., Sierra Wireless, Inc., Semiconductor Industry Association, Starboard Value Acquisition Corp., and Cyxtera Technologies, Inc. /New/. Mr. Waters was previously employed as a President, Chief Executive Officer & Director by GigPeak, Inc., a President, Chief Executive Officer & Director by Integrated Device Technology, Inc., a Vice President & General Manager by Cellular Systems, an Executive VP & General Manager-Front End Solutions by Skyworks Solutions, Inc., a Senior VP-Strategy & Business Development by Agere Systems, Inc., and a Director-North American Sales by Texas Instruments Incorporated.

Opinion:

Name: McIlwain Matthew S

Position: Director

Shares Bought: 36,970, Average Price Paid: $7.71, Cost: $285,041

Company: Nautilus Biotechnology Inc. (NAUT)

Nautilus (Nasdaq: NAUT) is a company with a vision to revolutionize biomedicine by unlocking the complexity of the human proteome. They are driven to transform the field of proteomics by democratizing access to the proteome and enabling fundamental advancements across biomedical research and drug discovery. They were founded in 2016 on the belief that incremental advancements to existing technologies are inadequate; that a bold scientific leap would be required to radically reinvent proteomics and create a new gold standard in the field. Their mission is to integrate our breakthrough innovations in computer science, engineering, and biochemistry to develop a protein analysis platform of extreme sensitivity and scale. Pursuing that goal is a leadership team with a unique combination of experiences from the fields of technology and life sciences, and a broader team made up of a wide spectrum of disciplines and expertise including protein chemists, chip designers, molecular biologists, data scientists, material scientists, biophysicists, optical engineers, microfluidics engineers, bioinformaticians, and software engineers.

Mr. Matthew S. McIlwain is an Independent Director at Nautilus Biotechnology, Inc. and an Independent Director at Smartsheet, Inc. He is on the Board of Directors at Nautilus Biotechnology, Inc., Qumulo, Inc., Animoto, Inc., Smartsheet, Inc., Mixpo, Inc., Skytap, Inc., 2nd Watch Holding Co., Inc., 2nd Watch, Inc., Amperity, Inc., Appature, Inc., Booster Fuels, Inc., ExtraHop Networks, Inc., Igneous Systems, Inc., Nautilus Biotechnology, Inc. (United States), Suplari, Inc., Terraclear, Inc., Villa Academy, Washington Policy Center, Washington Technology Industry Association and Fred Hutchinson Cancer Research Center. Mr. McIlwain was previously employed as an Independent Director by Apptio, Inc., a Managing Director by Madrona Venture Group LLC, a Vice President-Business Process by Genuine Parts Co.

Opinion: Sexy story but this venture-backed pre-revenue company is too risky for me

Name: Considine Terry

Position: Director

Shares Bought: 450,000, Average Price Paid: $6.53, Cost: $2,940,356

Company: Apartment Investment & Management Co. (AIV)

Aimco is one of the nation’s premier apartment home providers delivering a quality living experience to their residents every day. The key to their success is their people. Their employees care about their residents and it shows. From the first interaction to the last, their people make a world of difference in the lives of our residents. Needless to say, they are passionate about finding the right people and nurturing their growth within Aimco. Aimco is a Real Estate Investment Trust focused on property development, redevelopment, and various other value-creating investment strategies, targeting the U.S. multifamily market. Aimco’s mission is to make real estate investments where outcomes are enhanced through human capital and substantial value is created for investors, teammates, and the communities in which we operate. Aimco is traded on the New York Stock Exchange as AIV. Through thoughtful planning and design, They offer creative and unique solutions for their developments, leading to improved surroundings, first-in-class services, and a major contribution to the vibrancy and economic development of the cities where we do business.

Terry Considine serves as Chairman of the Board of the Company. Mr. Considine has been Chairman of the Board and Chief Executive Officer since July 1994. Mr. Considine also serves on the board of directors of Intrepid Potash, Inc., a publicly held producer of potash. Mr. Considine has over 45 years of experience in real estate and other industries. Among other real estate ventures, in 1975 Mr. Considine founded and subsequently managed the predecessor companies that became Aimco at its initial public offering in 1994.

Opinion: Apartments, apartments, apartments. Developers would rather build apartment buildings with their evergreen revenue than single-family, one and done.

Name: Drachman Jonathan G

Position: CEO

Shares Bought: 150,000, Average Price Paid: $6.22, Cost:$933,550

Company: Neoleukin Therapeutics Inc. (NLTX)

Neoleukin Therapeutics, Inc. is a biopharmaceutical company. The Company is engaged in providing immunotherapies for cancer, inflammation, and autoimmunity using de novo protein design technology. The Company uses computational methods to design proteins that demonstrate specific pharmaceutical properties. Its primary areas of focus are oncology, inflammation, and autoimmunity. Its technology, the Neoleukin platform, uses a set of advanced computational algorithms and methods to design functional de novo proteins. Neoleukin’s lead program, NL-201, is a computationally designed de novo protein therapeutic. NL-201 is designed for use as a single agent or in combination with complementary therapeutic modalities. NL-201 has also shown promise in combination with allogeneic cell therapy to expand and maintain populations of transplanted CAR-T and NK cells. Neoleukin is a biopharmaceutical company creating next-generation immunotherapies for cancer, inflammation, and autoimmunity using de novo protein design technology. Neoleukin uses sophisticated computational methods to design proteins that demonstrate specific pharmaceutical properties that provide potentially superior therapeutic benefit over native proteins. Neoleukin’s lead product candidate, NL-201, is a combined IL-2 and IL-15 agonist designed to improve tolerability and activity by eliminating the alpha receptor binding interface.

Jonathan is a seasoned clinician, researcher, and biopharmaceutical executive who joined Neoleukin at the company’s founding in 2018. For 14 years prior, he was at Seattle Genetics, where he most recently served as Chief Medical Officer and Executive Vice President of Research and Development. From 1998 to 2004, Dr. Drachman was a faculty member of the Division of Hematology at the University of Washington in Seattle, and a Senior Investigator in the Division of Research and Education at Puget Sound Blood Center. He currently serves on the board of directors for Calithera Biosciences and Harpoon Therapeutics.

Opinion:

Name: Fan John

Position: CEO

Shares Bought: 50,000, Average Price Paid: $5.45, Cost: $272,500

Company: Kopin Corp. (KOPN)

Kopin is a leading developer and provider of critical components for wearable headset products. Innovation is in their DNA. For more than three decades, Kopin’s scientists and engineers have created innovative technologies that have enhanced the way people see, hear and communicate. Kopin has developed and commercialized game-changing technologies such as heterojunction bipolar transistors (HBT) which power billions of cellphones, and microdisplays which have brought vivid images to more than 30 million consumer electronics and military night vision devices. Today Kopin is focused on providing critical components and subsystems for wearable computing systems for military, enterprise, industrial, and consumer products. Kopin’s technology portfolio includes ultra-small displays, innovative optics, and low-power ASICs. Kopin has contributed to the development of head-mounted displays for the F-35 Joint Strike Fighter, created the Golden-i, a wearable headset design for enterprise, Solos smart glasses for cyclists and runners, and collaborated on many wearable products with a range of companies including Fujitsu, Google, Motorola, RealWear and Vuzix. Kopin has more than 200 global patents and patents pending in these areas. Kopin is an ISO 9001:2015 certified company in respect to the design, development, and manufacturing of liquid crystal microdisplays and related systems for consumer, industrial, and defense applications.

Dr. Fan is the Founder, Chairman, CEO, and President of Kopin Corporation, a NASDAQ public company since 1992. Kopin, headquartered in Westborough, Massachusetts, is a leading provider of components and technologies for mobile and wearable devices. Kopin has over 300 patents and patents pending in this emerging growth area. Fan began his career at MIT’s Lincoln Laboratory, where he researched semiconductor materials and devices. He was leading the Electronic Materials Group at Lincoln Laboratory when he left MIT in 1985 and founded Kopin CorpoCEO of Kopin. “In our defense business, we remain on track as two development programs have entered low-rate initial production (LRIP) and we expect another program to enter LRIP in the fourth quarter of 2021. Our F-35 Joint Strike Fighter program continues strong as we announced during the quarter an additional order that extends deliveries into the first quarter of 2022. During the second quarter ended June 26, 2021, we reduced shipments of our product for FWS-I thermal weapon sight systems while our customer makes system and production enhancements. We are working closely with them and expect the lower shipment rate to continue during the third fiscal quarter and then to increase in the fourth fiscal quarter of 2021 to make up some of the shortfall. Despite this short-term slow down, the program remains very strong, and we expect a follow-on order in the third quarter of 2021.”ration.

Opinion: Kopin was a big winner last week surging 12.4% last week. CEO of Kopin. “In our defense business, we remain on track as two development programs have entered low-rate initial production (LRIP) and we expect another program to enter LRIP in the fourth quarter of 2021. Our F-35 Joint Strike Fighter program continues strong as we announced during the quarter an additional order that extends deliveries into the first quarter of 2022. During the second quarter ended June 26, 2021, we reduced shipments of our product for FWS-I thermal weapon sight systems while our customer makes system and production enhancements. We are working closely with them and expect the lower shipment rate to continue during the third fiscal quarter and then to increase in the fourth fiscal quarter of 2021 to make up some of the shortfall. Despite this short-term slowdown, the program remains very strong, and we expect a follow-on order in the third quarter of 2021.” This name sounds sexy with all its IP but the results are not impressive.

Name: Stassen Zachary William

Position: CFO

Shares Bought: 40,000, Average Price Paid: $5.32, Cost: $212,800

Company: ViewRay Inc. (VRAY)

ViewRay was founded on the belief that enhanced real-time visualization combined with online adapting and accurate dose recording will significantly improve the safety and efficacy of radiation therapy, leading to better outcomes for patients. MRI-guided radiation therapy was conceived by company founder James F. Dempsey, Ph.D., while he was a member of the radiation oncology faculty at the University of Florida in 2004. And ViewRay holds the exclusive worldwide license for its combination of MRI and radiation therapy technologies. ViewRay, Inc. designs, manufactures and markets radiation therapy systems. The company offers MRIdian, a magnetic resonance image-guided radiation therapy system to image and treat cancer patients. Its MRIdian integrates MRI technology, radiation delivery, and proprietary software to see the soft tissues, shape the dose to accommodate changes in anatomy, and strike the target using real-time targeting throughout the treatment. The company serves university research and teaching hospitals, community hospitals, private practices, government institutions, and freestanding cancer centers. ViewRay, Inc. markets its MRIdian through a direct sales force and distribution network. It has operations in the United States, France, Germany, Taiwan, the United Kingdom, and internationally. The company was founded in 2004 and is headquartered in Oakwood, Ohio.

Zach has more than 20 years of experience in the medical device and healthcare industries. He was most recently the CFO and COO at Bolder Surgical, an innovative, privately-held med-tech company. Prior to Bolder Surgical, Zach held various business development roles at Spectranetics, including Vice President of Finance, prior to its acquisition by Royal Philips. Earlier, he co-founded a device company that was acquired by Cardinal Health. Zach also has experience as a healthcare investment banker on Piper Jaffray’s team.

Opinion: This is an old-line company that has had a product approved for some time. Its been tough sledding for VRAY and I don’t know what catalyst there might be to bring about change.

Name: Knauf Noah

Position: Director

Shares Bought: 167,213, Average Price Paid: $4.37, Cost: $730,721

Name: Feder Eric

Position: Director

Shares Bought: 125,000, Average Price Paid: $4.29, Cost: $536,062

Name: Wijnberg Sandra S

Position: Director

Shares Bought: 117,000, Average Price Paid: $4.28, Cost: $500,374

Name: Ellis Stewart

Position: CFO

Shares Bought: 24,400, Average Price Paid: $4.25, Cost: $103,700

Name: McCathron Richard

Position: President

Shares Bought: 24,100, Average Price Paid: $4.25, Cost: $102,425

Company: Hippo Holdings Inc. (HIPO)

Hippo is an American property insurance company based in Palo Alto, California. Hippo offers homeowner’s insurance that covers the homes and possessions of the insurance holder as well as liability from accidents happening in the insured property. They use AI and big data to aggregate and analyze property information. The company sells insurance policies directly to customers and through independent insurance brokers. Hippo was founded by Assaf Wand, a former Intel Capital investor and McKinsey consultant, and Eyal Navon, an entrepreneur with an extensive background in software engineering and R&D. A serial entrepreneur who had previously founded several companies, Wand’s interest in insurance was inspired by his father’s lengthy career in the “antiquated” insurance industry. In December 2016, to fund product development, Hippo raised $14m in a Series A round of venture capital financing, and in April 2017 Hippo launched in California. At launch, the company’s marketing was centered on the delivery of a 60-second quote for homeowners insurance policies; a transparent, online purchase process; and smart home sensors that could proactively identify and prevent potential damage to policyholder’s homes.

Noah Knauf has served as a member of the board of directors since July 2019. Mr. Knauf focuses on investments in high-growth technology companies, with a particular focus on healthcare, fintech, gaming, and frontier technology. Mr. Knauf co-led Kleiner Perkins’ Digital Growth Fund team, which became BOND in 2019. At Kleiner Perkins, he invested in a range of innovative companies including Better Mortgage, Epic Games, SmileDirectClub, Toss, and UiPath. Mr. Knauf continues to co-lead the three Digital Growth Funds totaling $2.8 billion of committed capital. Before joining Kleiner Perkins, Mr. Knauf served as Managing Director at private equity firm Warburg Pincus where he contributed to almost twenty investments in growth companies over nine years from June 2006 to June 2016.

Eric Feder has served as a member of the board of directors since October 2018. Mr. Feder also serves as the Managing General Partner of LEN X, LLC, since 2019, where he oversees Lennar’s innovation and venture capital investing. Prior to his current role, Mr. Feder was Vice Chairman at Rialto Capital from 2008 until 2018. From October 2004 to October 2008, Mr. Feder owned Cirrus Capital, LLC, a real estate venture.

Sandra Wijnberg has been an independent director of Hippo Enterprises since September 2020 and chairs the audit committee. From 2015 to 2019, she was an executive advisor of Aquiline Capital Partners, a subsidiary of Aquiline Holdings LLC, a registered investment advisory firm and from 2007 to 2014 was a partner and the chief administrative officer of Aquiline Holdings LLC. From 2014 through 2015, served as the Deputy Head of Mission for the Office of the Quartet in Jerusalem, a development project under the auspices of the United Nations. Previously, Ms. Wijnberg served as Senior Vice President and Chief Financial Officer of Marsh & McLennan Companies, Inc.

Stewart Ellis serves as Chief Financial Officer and oversees all financial functions of Hippo. Prior to joining Hippo, Mr. Ellis served as Chief Financial Officer at Activehours (d/b/a Earnin), a mobile fintech company, from April 2017 to February 2019. From July 2012 to April 2017, Mr. Ellis was employed by BloomReach, Inc., an enterprise software company where he served as Chief Financial Officer. Mr. Ellis also served as Vice President, Finance, and other roles, of 23andMe, Inc. where he was employed from September 2008 to July 2012.

Richard McCathron has served as a member of the board of directors and as our President since February 2017. Prior to Hippo, Mr. McCathron held senior executive positions at various insurance companies including First Connect Insurance as its President & Chief Executive Officer from October 2012 to February 2017, Superior Access Insurance as its President & Chief Executive Officer from June 2007 to October 2010, and Mercury Insurance Group as its Regional Vice President from April 2004 to June 2007.

Opinion: Get an insurance quote in two minutes. Like Limonade and others, HIPO is in an active fin tech spot. We would not surprised to get bought out. We have a ton of insider buying on this troubled SPAC merger. Hippo (HIPO) announced a new issuing carrier relationship with Ally Financial Inc. (ALLY) subsidiary, Motors Insurance Corp., which is a 50 state carrier.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund.

[custom-twitter-feeds]

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried many vendors, and SECForm4 is one of the most customer-friendly and responsive I’ve used.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial, so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization, and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years, and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 are horrendously poor. Also, planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001, when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019, 4th Best in November 2020, 4th Best in January 2021 (I kid you not)